San Diego California Term Sheet — Series Seed Preferred Share for Company is a legal document outlining the key terms and conditions of an investment agreement between a startup company based in San Diego, California, and potential investors for a seed round of funding. This term sheet serves as a framework for negotiating the terms of investment and acts as a precursor to a formal agreement. Keywords: San Diego California, Term Sheet, Series Seed Preferred Share, Company, investment, startup, funding, legal document, negotiations, agreement. There are various types of San Diego California Term Sheet — Series Seed Preferred Share for Company, each with its own specific terms and conditions. Some common variations are: 1. Valuation: The term sheet will define the pre-money valuation of the company, which determines the ownership percentage the investors will acquire for their investment. This valuation can have a significant impact on the terms and future funding rounds. 2. Investment Amount: The term sheet specifies the amount of funding the company is seeking from potential investors. It outlines how the investment will be structured, whether through a single investor or multiple investors, and their respective investment amounts. 3. Liquidation Preference: This provision determines the order in which investors are repaid during a liquidation event, such as the sale or acquisition of the company. Different series seed preferred shares may have different liquidation preferences, which affect the priority of distributions. 4. Conversion Rights: The term sheet details the conversion rights of preferred shares into common shares. It may include provisions such as automatic conversion upon an IPO or voluntary conversion at a specified date or price. 5. Voting Rights: The term sheet identifies the voting rights associated with the preferred shares. This may include voting on matters like the appointment of board members or major corporate decisions. 6. Anti-dilution Protection: Some term sheets include anti-dilution provisions, which protect investors from a significant decrease in the value of their shares in the event of a subsequent funding round at a lower valuation. 7. Board Representation: The term sheet may specify the right of investors to appoint a representative to the company's board of directors. This allows investors to actively participate in key decision-making processes. 8. Shareholder Rights: The term sheet outlines the rights and privileges afforded to shareholders, such as information rights, access to financial statements, and right of first refusal on future investment opportunities. 9. Founder Vesting: In some cases, the term sheet includes vesting requirements for the founders' equity. This incentivizes founders to stay with the company and aligns their interests with the investors. It is important to note that each San Diego California Term Sheet — Series Seed Preferred Share for Company may have unique terms and conditions based on the specific needs and preferences of the company and the investors involved.

San Diego California Term Sheet - Series Seed Preferred Share for Company

Description

How to fill out San Diego California Term Sheet - Series Seed Preferred Share For Company?

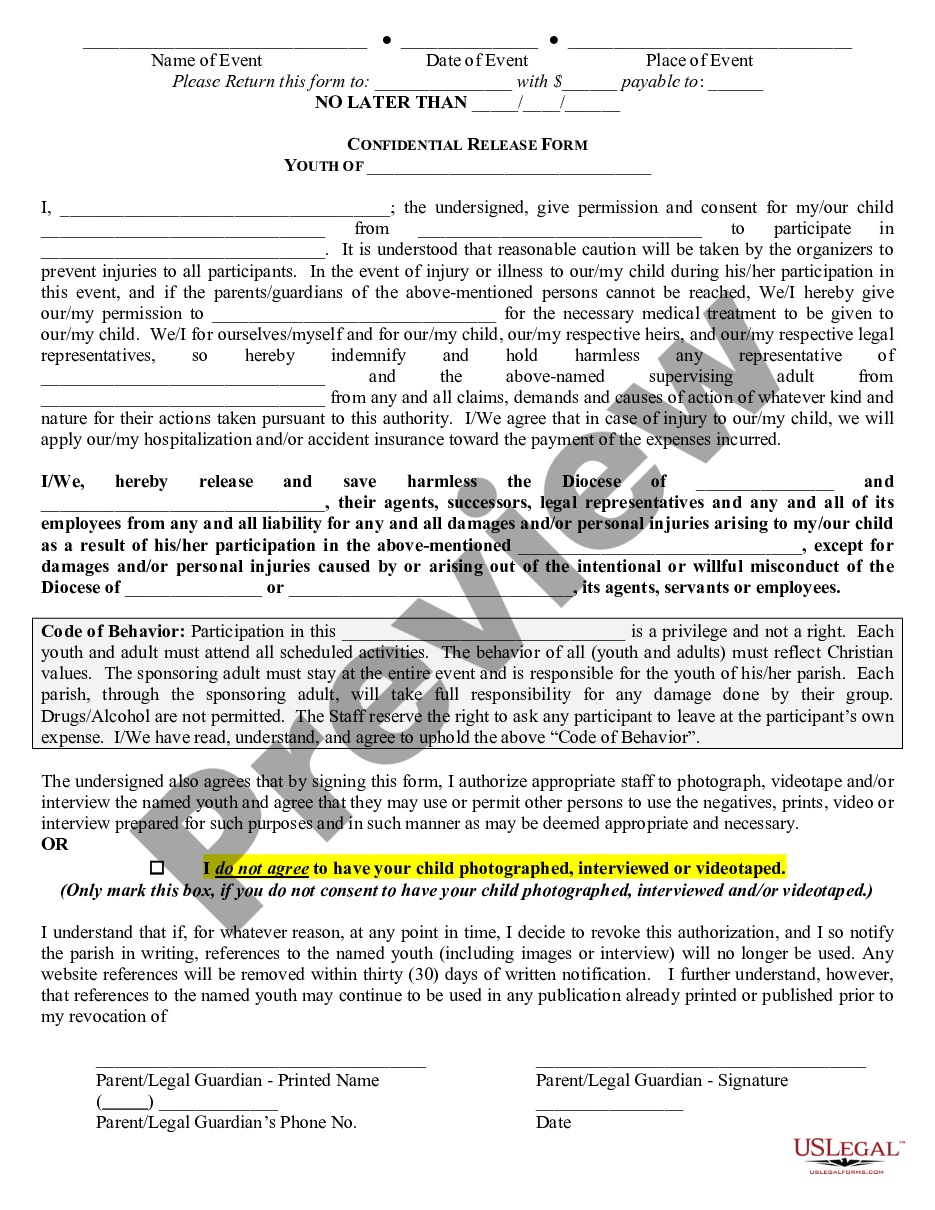

Are you looking to quickly draft a legally-binding San Diego Term Sheet - Series Seed Preferred Share for Company or probably any other document to take control of your personal or business matters? You can select one of the two options: contact a professional to write a legal paper for you or create it completely on your own. Thankfully, there's another solution - US Legal Forms. It will help you receive professionally written legal paperwork without paying unreasonable fees for legal services.

US Legal Forms provides a rich catalog of more than 85,000 state-specific document templates, including San Diego Term Sheet - Series Seed Preferred Share for Company and form packages. We offer documents for an array of life circumstances: from divorce paperwork to real estate documents. We've been out there for over 25 years and got a spotless reputation among our clients. Here's how you can become one of them and obtain the necessary document without extra troubles.

- To start with, carefully verify if the San Diego Term Sheet - Series Seed Preferred Share for Company is tailored to your state's or county's laws.

- If the form includes a desciption, make sure to check what it's intended for.

- Start the searching process over if the template isn’t what you were hoping to find by utilizing the search bar in the header.

- Choose the subscription that is best suited for your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the San Diego Term Sheet - Series Seed Preferred Share for Company template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Moreover, the paperwork we provide are updated by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!