Houston, Texas is a bustling city known for its vibrant business landscape and favorable investment opportunities. For entrepreneurs seeking capital to fuel their startup growth, the topic of private placement of series seed preferred stock becomes crucial. In this article, we will explore the Houston Texas terms applicable for such private placements and shed light on the essential keywords associated with this topic. 1. Series Seed Preferred Stock: Series Seed Preferred Stock refers to a specific class of equity investment offered by startups to venture capitalists and angel investors. This stock class holds various rights and privileges that differentiate it from common stock, providing investors with preferential treatment in the event of a liquidation or exit. 2. Private Placement: Private placement is a fundraising method wherein securities, such as preferred stock, are sold directly to a selected group of accredited investors without the need for a public offering. This allows startups to raise capital without going through the time-consuming process of registering with regulatory bodies. 3. Accredited Investors: Accredited investors are individuals who meet specific criteria set by the U.S. Securities and Exchange Commission (SEC). These criteria typically include having a high net worth or substantial income, making them eligible to participate in private placements. 4. Term Sheet: A term sheet is a document outlining the key terms and conditions of an investment. In the context of private placements of series seed preferred stock, this document includes details such as the valuation of the company, the rights associated with the preferred stock, and the liquidation preferences. 5. Valuation: Valuation refers to the process of determining the worth or monetary value of a startup. This assessment plays a crucial role in private placements as it helps investors determine how much equity they are willing to acquire in exchange for their investment. 6. Liquidation Preference: Liquidation preference refers to the priority given to preferred stockholders when a company faces liquidation or an exit event. It outlines the order in which investors receive their returns from the proceeds of the sale or liquidation of the company. Different variations of liquidation preferences include non-participating, participating, and multiple liquidation preferences. 7. Non-Participating Preferred Stock: Non-participating preferred stock refers to a type of preferred stock where investors have the option to either receive their liquidation preference or convert their shares to common stock and participate pro rata in the distribution of remaining proceeds. 8. Participating Preferred Stock: Participating preferred stock provides investors with both a liquidation preference and the ability to convert their shares to common stock and participate pro rata in the distribution of remaining proceeds. This allows investors to potentially receive returns above their initial liquidation preference. 9. Multiple Liquidation Preferences: Multiple liquidation preferences refer to the situation where preferred stockholders are entitled to receive a multiple of their original investment before common stockholders receive any proceeds. Understanding the nuances and intricacies of Houston Texas terms for private placement of series seed preferred stock is integral for entrepreneurs and investors alike.

Houston Texas Terms for Private Placement of Series Seed Preferred Stock

Description

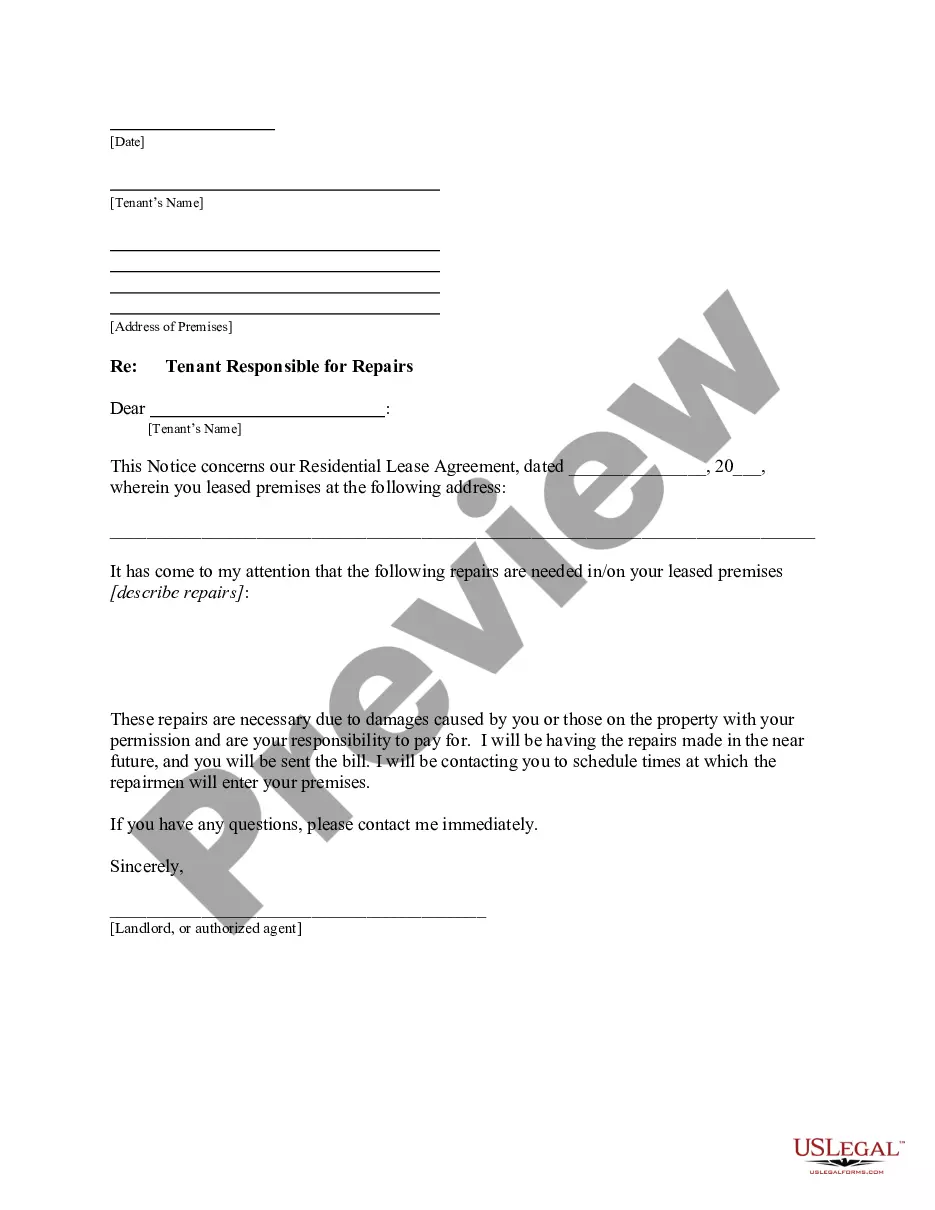

How to fill out Houston Texas Terms For Private Placement Of Series Seed Preferred Stock?

Do you need to quickly draft a legally-binding Houston Terms for Private Placement of Series Seed Preferred Stock or maybe any other form to take control of your personal or corporate affairs? You can select one of the two options: hire a legal advisor to draft a legal paper for you or draft it completely on your own. Thankfully, there's another solution - US Legal Forms. It will help you receive professionally written legal papers without paying sky-high prices for legal services.

US Legal Forms offers a rich collection of more than 85,000 state-specific form templates, including Houston Terms for Private Placement of Series Seed Preferred Stock and form packages. We provide templates for an array of use cases: from divorce papers to real estate document templates. We've been out there for more than 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and get the needed document without extra troubles.

- To start with, carefully verify if the Houston Terms for Private Placement of Series Seed Preferred Stock is tailored to your state's or county's regulations.

- If the document includes a desciption, make sure to verify what it's intended for.

- Start the searching process over if the document isn’t what you were hoping to find by using the search box in the header.

- Choose the subscription that best suits your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Houston Terms for Private Placement of Series Seed Preferred Stock template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. Moreover, the paperwork we offer are updated by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!