Kings New York Executive Summary Investment-Grade Bond Optional Redemption is a financial instrument offered by Kings New York, a reputable financial institution based in New York City. This investment-grade bond offers investors an opportunity to gain steady income and potentially high returns by lending money to the company for a specified period. The Investment-Grade Bond is designed as a relatively low-risk investment option with a high credit rating, making it an attractive choice for conservative investors seeking stable returns. The bond has been thoroughly evaluated by trusted credit rating agencies, confirming its strong financial position and making it suitable for risk-averse investors looking for stable income. The term "Optional Redemption" refers to the feature that allows the issuer (Kings New York) to redeem or repay the bond before its maturity date. This provides flexibility to the issuer in case they want to refinance the bond at a potentially lower interest rate. However, it is important to note that the decision to exercise the optional redemption lies solely with the issuer and not the bondholder. Kings New York may offer different types of Investment-Grade Bond Optional Redemption to cater to the varied needs and preferences of different investors. These types may include: 1. Fixed-Rate Investment-Grade Bond Optional Redemption: This type of bond offers a fixed interest rate for the duration of the bond. Investors can expect a predictable income stream throughout the bond's life, making it suitable for individuals looking for stability and consistency in their investment. 2. Floating-Rate Investment-Grade Bond Optional Redemption: Unlike fixed-rate bonds, floating-rate bonds have interest rates that fluctuate based on a benchmark rate such as LIBOR (London Interbank Offered Rate) or the U.S. Treasury bill rate. This type of bond is ideal for investors who want their returns to adjust with changing market conditions. 3. Callable Investment-Grade Bond Optional Redemption: With this type of bond, the issuer has the right to redeem or buy back the bond from the bondholder before the predetermined maturity date. This feature allows the issuer to take advantage of lower interest rates in the future, but it introduces some uncertainty for investors who may receive their principal earlier than expected. In summary, Kings New York Executive Summary Investment-Grade Bond Optional Redemption provides investors with a low-risk opportunity to earn steady income. With various types available, investors can choose the bond that best aligns with their investment goals and risk tolerance. It is advisable to consult with a financial advisor or research thoroughly before investing in any bond offering.

Kings New York Executive Summary Investment-Grade Bond Optional Redemption

Description

How to fill out Kings New York Executive Summary Investment-Grade Bond Optional Redemption?

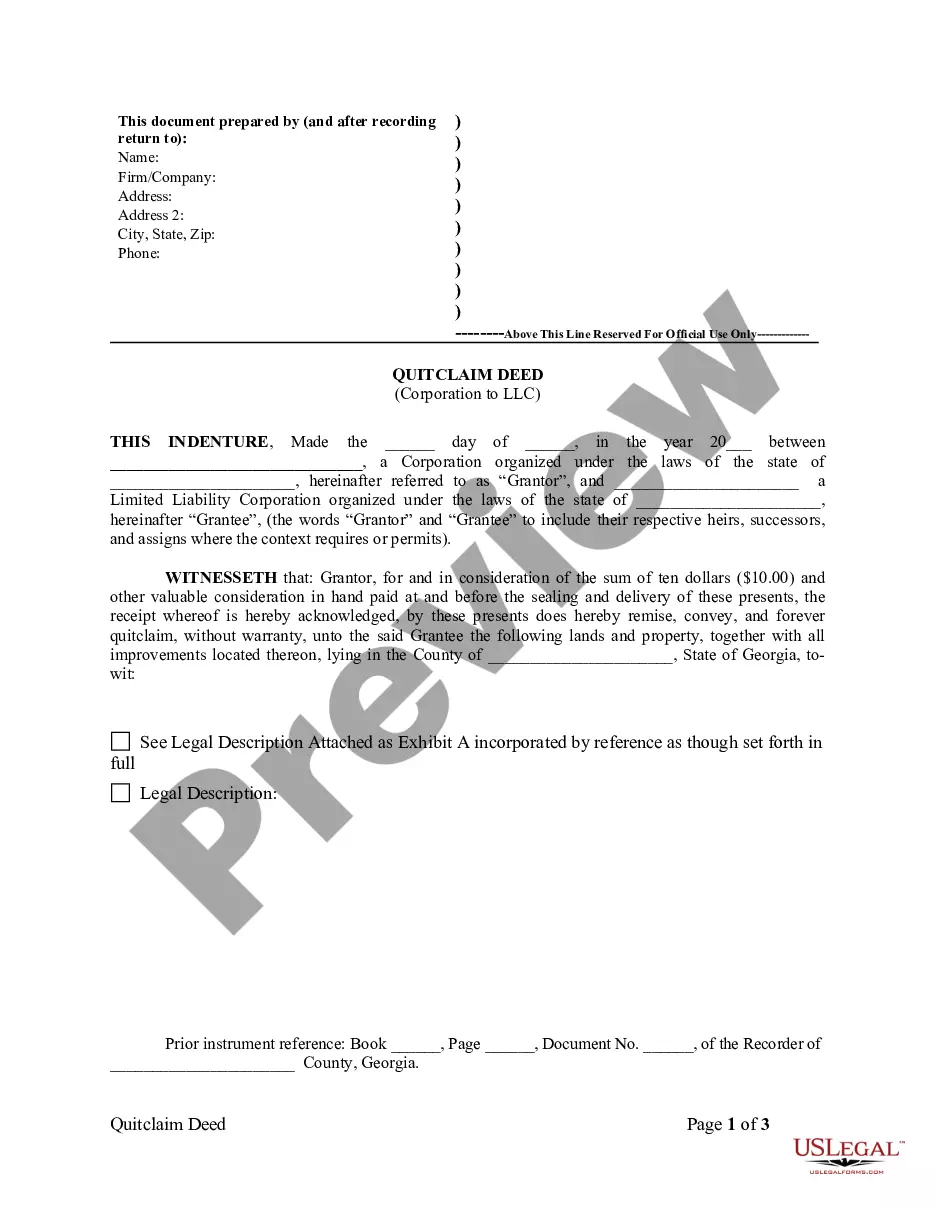

Do you need to quickly create a legally-binding Kings Executive Summary Investment-Grade Bond Optional Redemption or probably any other form to take control of your personal or business matters? You can go with two options: hire a legal advisor to draft a legal paper for you or draft it completely on your own. Thankfully, there's another solution - US Legal Forms. It will help you get professionally written legal papers without paying sky-high fees for legal services.

US Legal Forms provides a rich catalog of over 85,000 state-compliant form templates, including Kings Executive Summary Investment-Grade Bond Optional Redemption and form packages. We offer documents for an array of use cases: from divorce papers to real estate document templates. We've been out there for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra hassles.

- To start with, carefully verify if the Kings Executive Summary Investment-Grade Bond Optional Redemption is adapted to your state's or county's regulations.

- If the document includes a desciption, make sure to verify what it's suitable for.

- Start the search again if the form isn’t what you were looking for by utilizing the search box in the header.

- Select the subscription that best suits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Kings Executive Summary Investment-Grade Bond Optional Redemption template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Additionally, the documents we offer are reviewed by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!