Nassau New York Executive Summary Investment-Grade Bond Optional Redemption is a financial instrument that allows investors to invest in the municipal bonds issued by the Nassau County, New York. These bonds are considered investment-grade, meaning they have a high credit rating indicating low risk of default. The optional redemption feature allows the issuer to redeem the bonds before their maturity date if certain conditions are met. Nassau County, located on Long Island, is known for its vibrant communities, economic growth, and commitment to providing essential public services. To fund various infrastructure projects, the county issues investment-grade bonds that offer attractive investment opportunities for individuals, institutions, and organizations looking for stable and secure investment options. The executive summary of Nassau New York Executive Summary Investment-Grade Bond Optional Redemption provides a concise overview of the bond offering, highlighting key features, benefits, and risks associated with the investment. It outlines the terms and conditions of the bond issuance, including the interest rate, maturity date, and the option for early redemption. Investors considering these bonds can expect competitive interest rates, regular interest payments, and the potential for capital appreciation upon maturity. The optional redemption feature adds a layer of flexibility for the issuer, enabling them to take advantage of favorable market conditions and potentially reduce debt earlier than anticipated. It is worth noting that there may be different types of Nassau New York Executive Summary Investment-Grade Bond Optional Redemption available, each with its own specific terms and conditions. These may include variations in interest rates, maturity periods, and redemption criteria. It is advisable for prospective investors to carefully review the offering documents and consult with financial advisors to select the bond type that best aligns with their investment goals and risk appetite. In conclusion, Nassau New York Executive Summary Investment-Grade Bond Optional Redemption offers investors an opportunity to support the development and growth of Nassau County while benefiting from stable returns. These investment-grade bonds ensure security and can be a suitable addition to investment portfolios seeking stability, income, and potential capital gains over the agreed investment horizon.

Nassau New York Executive Summary Investment-Grade Bond Optional Redemption

Description

How to fill out Nassau New York Executive Summary Investment-Grade Bond Optional Redemption?

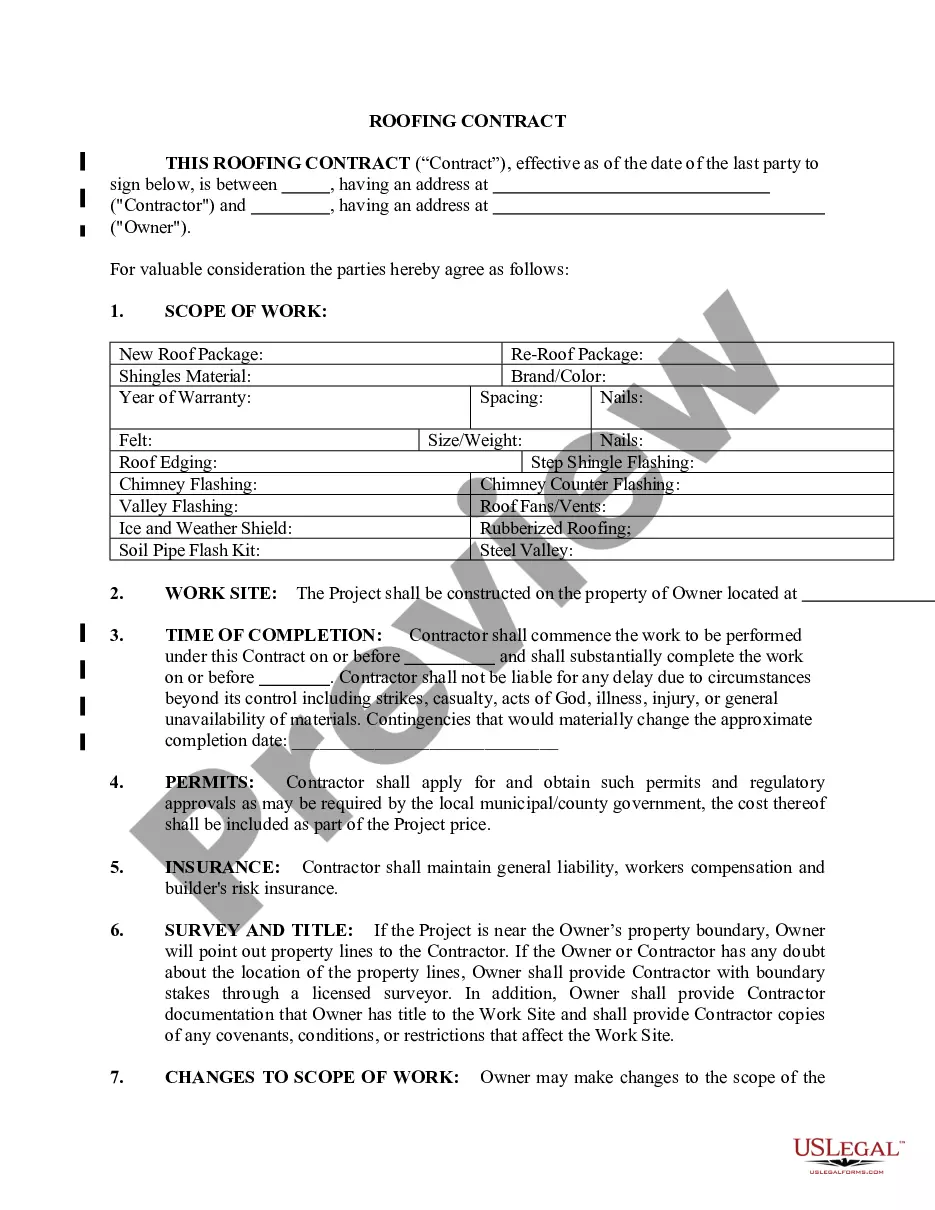

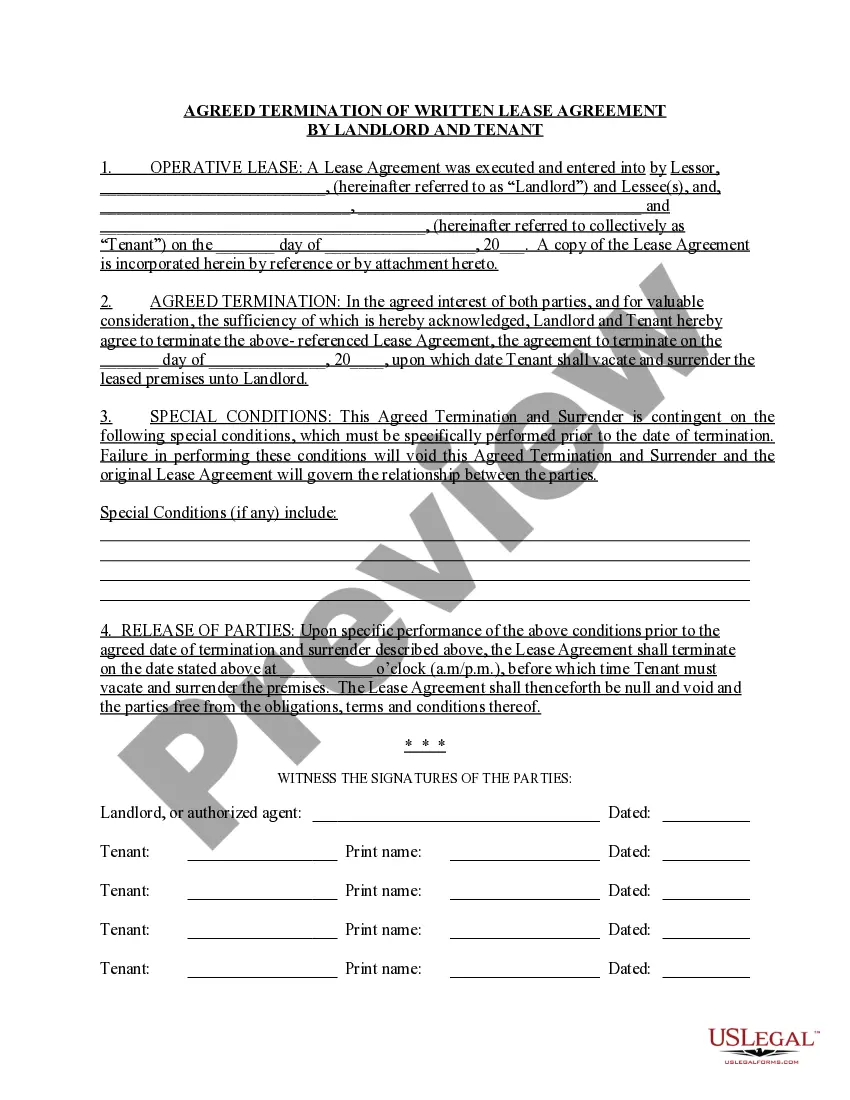

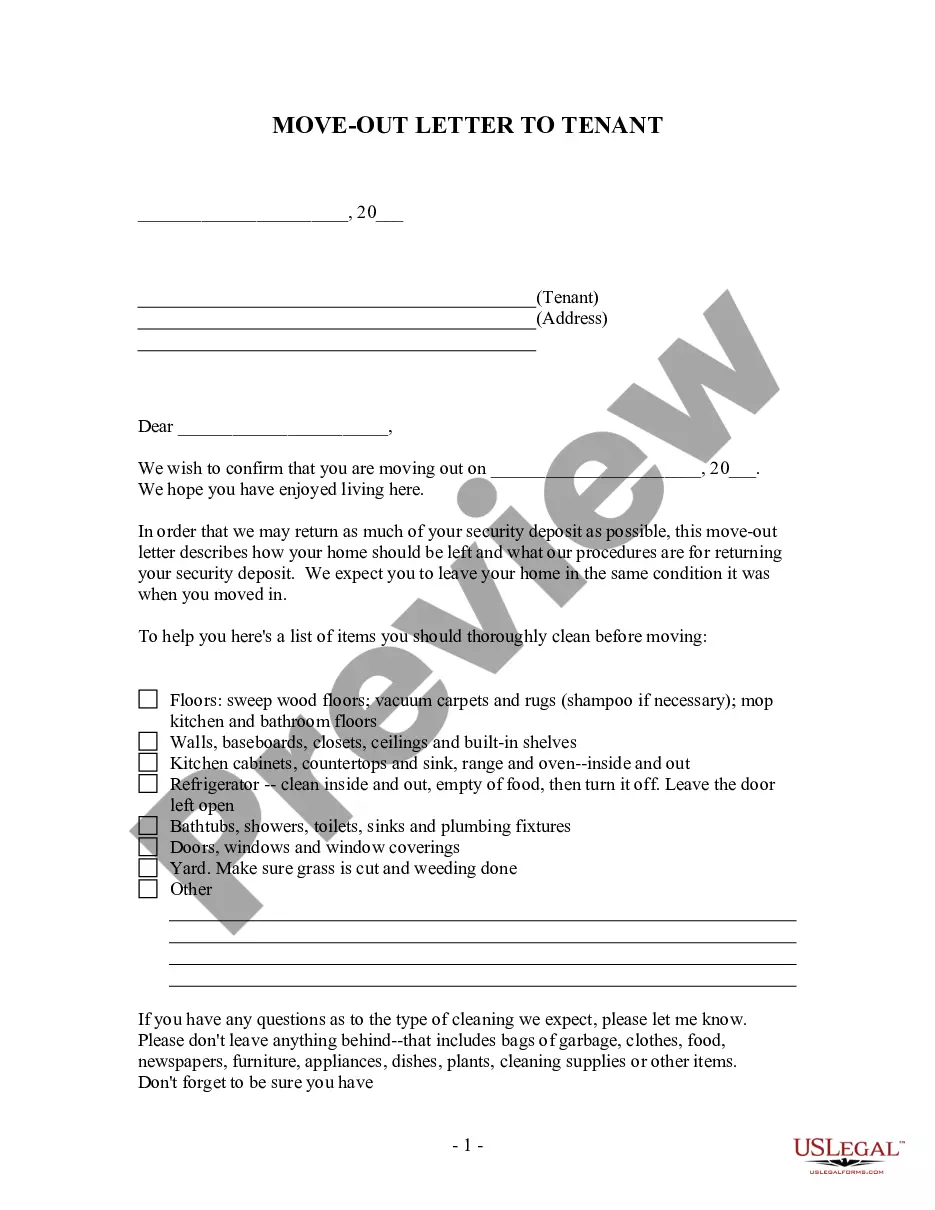

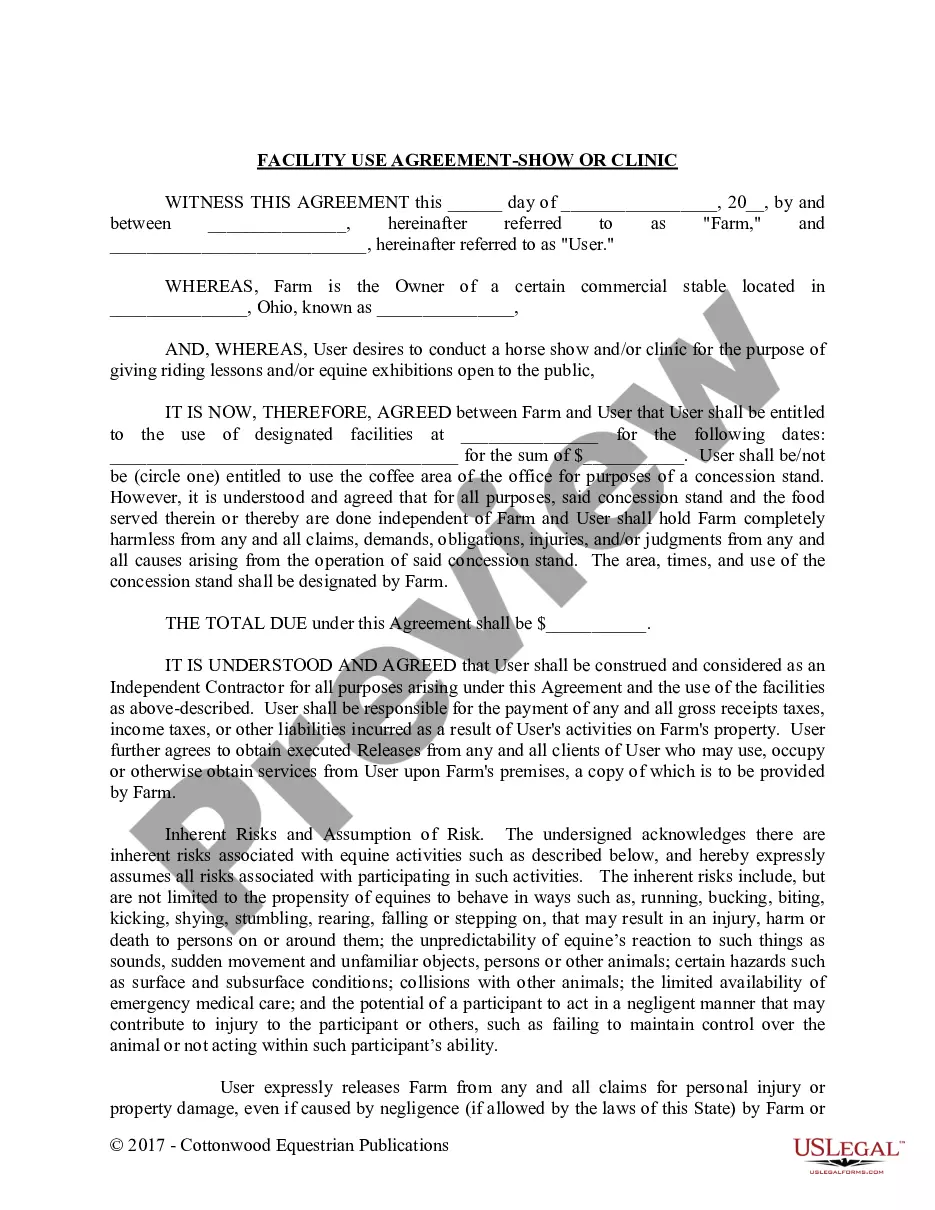

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a legal professional to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Nassau Executive Summary Investment-Grade Bond Optional Redemption, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Consequently, if you need the current version of the Nassau Executive Summary Investment-Grade Bond Optional Redemption, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Nassau Executive Summary Investment-Grade Bond Optional Redemption:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Nassau Executive Summary Investment-Grade Bond Optional Redemption and save it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!