Orange California Executive Summary Investment-Grade Bond Optional Redemption is a financial instrument that allows investors to purchase bonds issued by the city of Orange, California. This investment-grade bond option provides investors with a high level of creditworthiness, as the bonds are backed by the government entity of Orange, a well-established city in Southern California. Investment-grade bonds are considered to be low-risk investments due to the reliable income stream generated from the bond interest payments. The Orange California Executive Summary Investment-Grade Bond Optional Redemption offers investors the flexibility to choose whether to redeem their bonds at a specified optional redemption date or to hold them until maturity. This flexibility allows investors to strategize their investment portfolios based on their financial objectives. There are different types of Orange California Executive Summary Investment-Grade Bond Optional Redemption available, including: 1. General Obligation Bonds: These bonds are secured by the full faith and credit of the city of Orange. They are backed by the city's ability to levy taxes and other revenue sources, making them one of the safest options available. 2. Revenue Bonds: These bonds are backed by specific revenue sources such as tolls, fees, or other income generated by infrastructure projects in Orange, California. Revenue bonds provide investors with a slightly higher yield compared to general obligation bonds but still maintain a high level of creditworthiness. 3. Tax Allocation Bonds: These bonds are backed by tax increment revenues generated from designated redevelopment areas within Orange, California. The funds generated from these bonds are used to finance various redevelopment projects and improvements in the designated areas. Investors considering Orange California Executive Summary Investment-Grade Bond Optional Redemption should analyze their investment objectives, risk tolerance, and the specific terms and conditions of each bond offering before making any investment decisions. It is advisable to consult with a financial advisor or bond specialist to ensure that the investment aligns with their individual financial goals and objectives.

Orange California Executive Summary Investment-Grade Bond Optional Redemption

Description

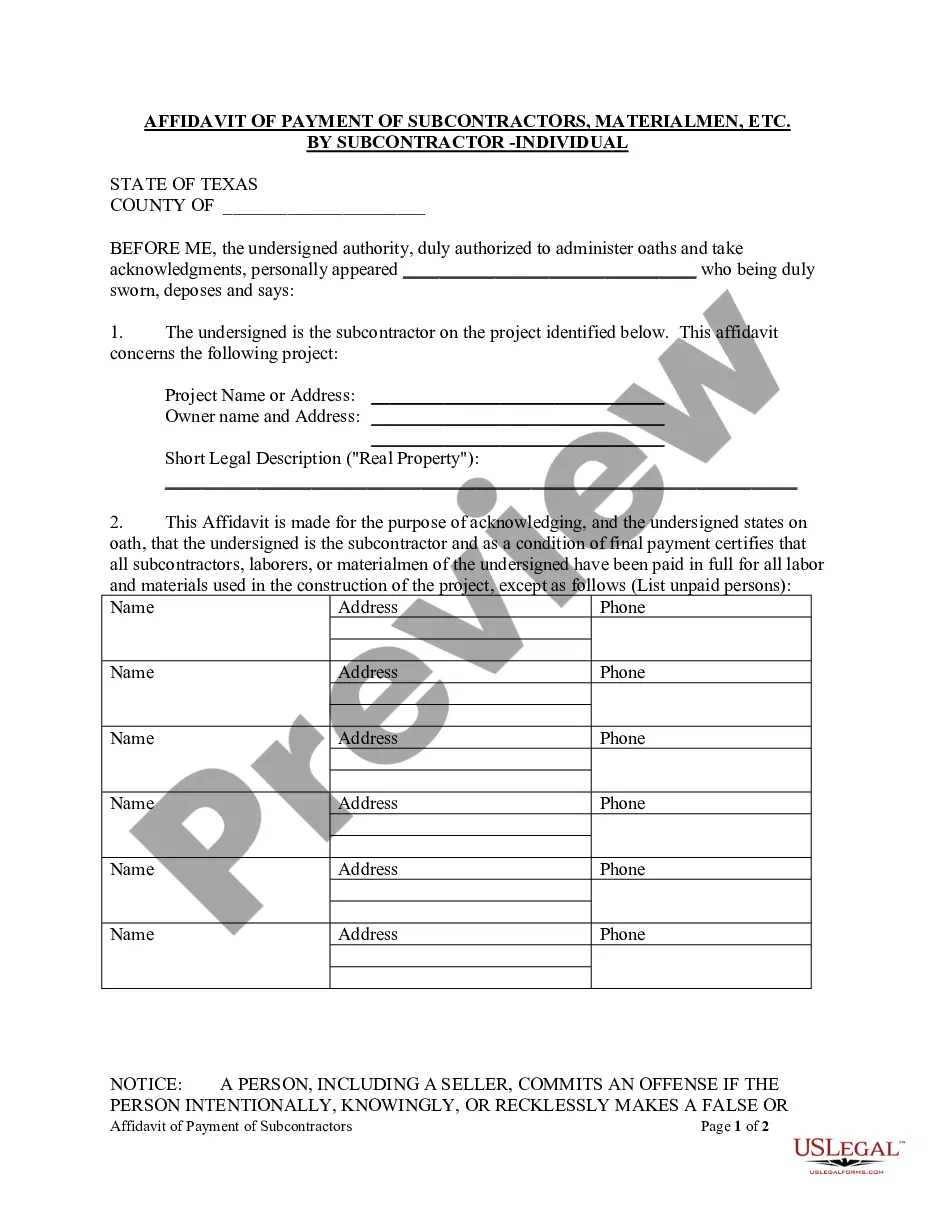

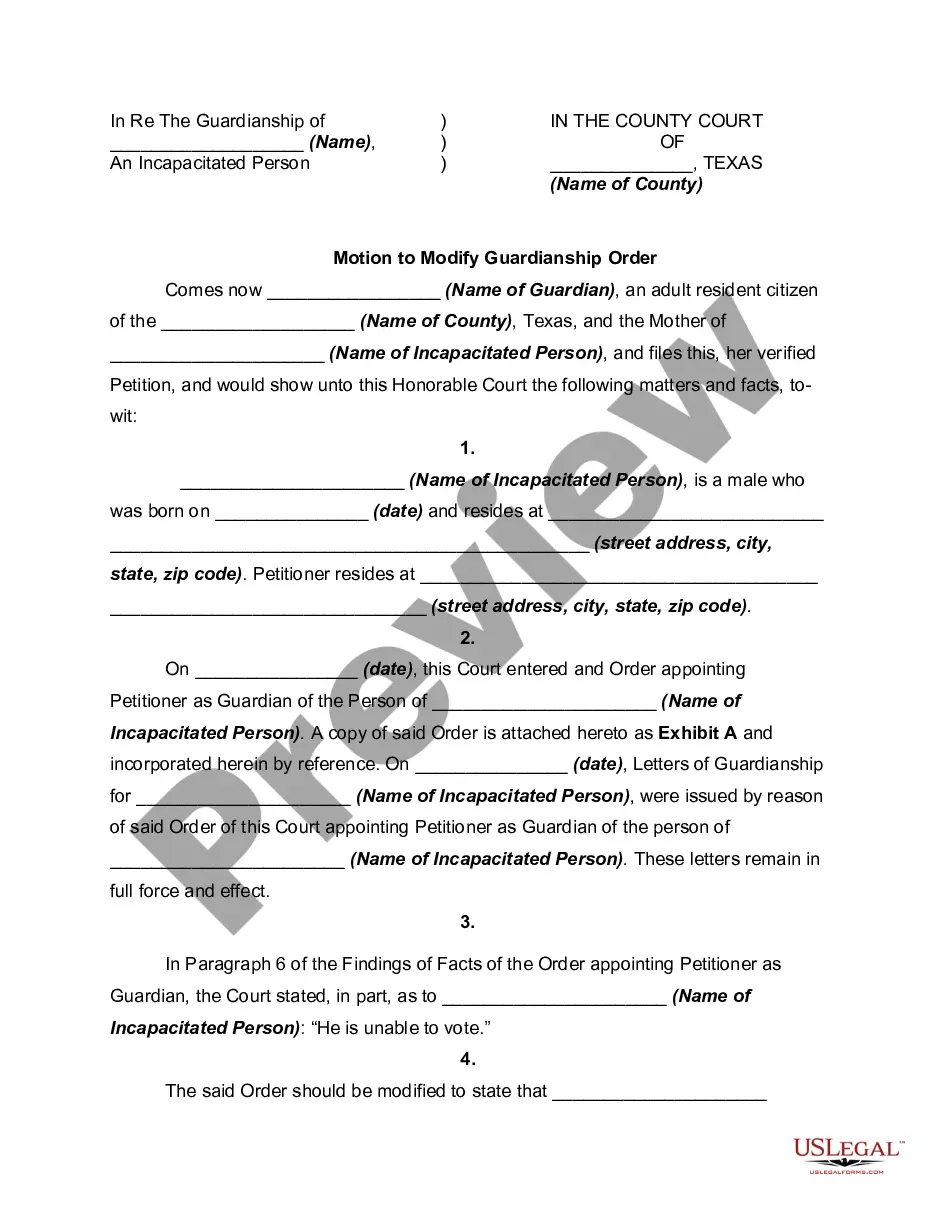

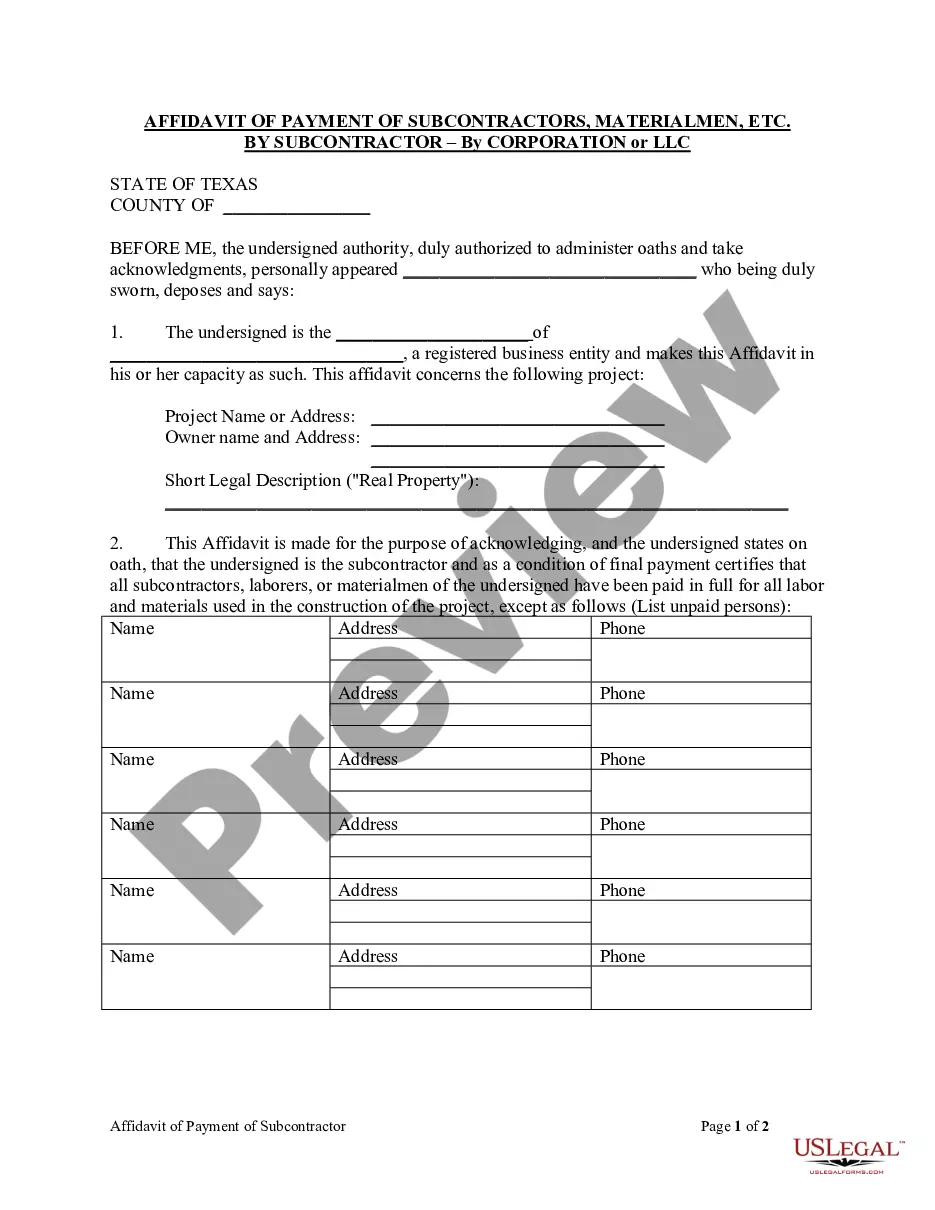

How to fill out Orange California Executive Summary Investment-Grade Bond Optional Redemption?

Draftwing paperwork, like Orange Executive Summary Investment-Grade Bond Optional Redemption, to manage your legal affairs is a tough and time-consumming task. A lot of circumstances require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can acquire your legal affairs into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents crafted for different scenarios and life situations. We make sure each form is compliant with the laws of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Orange Executive Summary Investment-Grade Bond Optional Redemption template. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly easy! Here’s what you need to do before getting Orange Executive Summary Investment-Grade Bond Optional Redemption:

- Make sure that your form is compliant with your state/county since the rules for writing legal paperwork may vary from one state another.

- Find out more about the form by previewing it or going through a quick description. If the Orange Executive Summary Investment-Grade Bond Optional Redemption isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start utilizing our service and get the document.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment information.

- Your form is ready to go. You can try and download it.

It’s an easy task to find and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!