Alameda California Investment-Grade Bond Optional Redemption (without a Par Call) is a financial instrument designed to attract investors looking for stable returns and low-risk investment opportunities. This type of bond issued by the city of Alameda, California, is highly sought after due to its investment-grade rating, indicating a low risk of default. Investors can benefit from regular interest payments, capital appreciation, and the flexibility of optional redemption. An investment-grade bond refers to a bond that has received a credit rating of BBB- or higher from a reputable credit rating agency. This rating determines its creditworthiness and reliability, giving investors confidence in the bond's ability to repay the principal and interest as agreed. Alameda California's investment-grade bond thus assures investors of a safer investment compared to lower-rated bonds. The optional redemption feature allows the issuer, in this case, the city of Alameda, to redeem the bond before its maturity date at their discretion. However, without a Par Call provision, the redemption price may not include a predetermined par value. Instead, it allows the issuer to redeem the bonds at a market price or at a price determined by a certain formula, ensuring fairness to both parties involved. This feature adds a level of flexibility for the issuer but can also offer investors potential advantages. Investors looking for investment-grade bonds without a Par Call feature have a unique opportunity by considering the Alameda California Investment-Grade Bond Optional Redemption. By opting for this type of bond, investors can diversify their portfolios, reduce risk, and potentially enjoy more favorable interest rates compared to alternative low-risk investments. In summary, Alameda California Investment-Grade Bond Optional Redemption (without a Par Call) is an investment opportunity offered by the city of Alameda to investors seeking stable returns and low-risk investments. Different types of investment-grade bonds without a Par Call option may exist in various markets, but the key advantage lies in the creditworthiness of the issuer and the flexibility of potential redemptions. Investors should thoroughly research and evaluate the terms and conditions of such bonds before making any investment decisions.

Alameda California Investment - Grade Bond Optional Redemption (without a Par Call)

Description

How to fill out Alameda California Investment - Grade Bond Optional Redemption (without A Par Call)?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare formal documentation that differs throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Alameda Investment - Grade Bond Optional Redemption (without a Par Call).

Locating templates on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Alameda Investment - Grade Bond Optional Redemption (without a Par Call) will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to obtain the Alameda Investment - Grade Bond Optional Redemption (without a Par Call):

- Make sure you have opened the correct page with your local form.

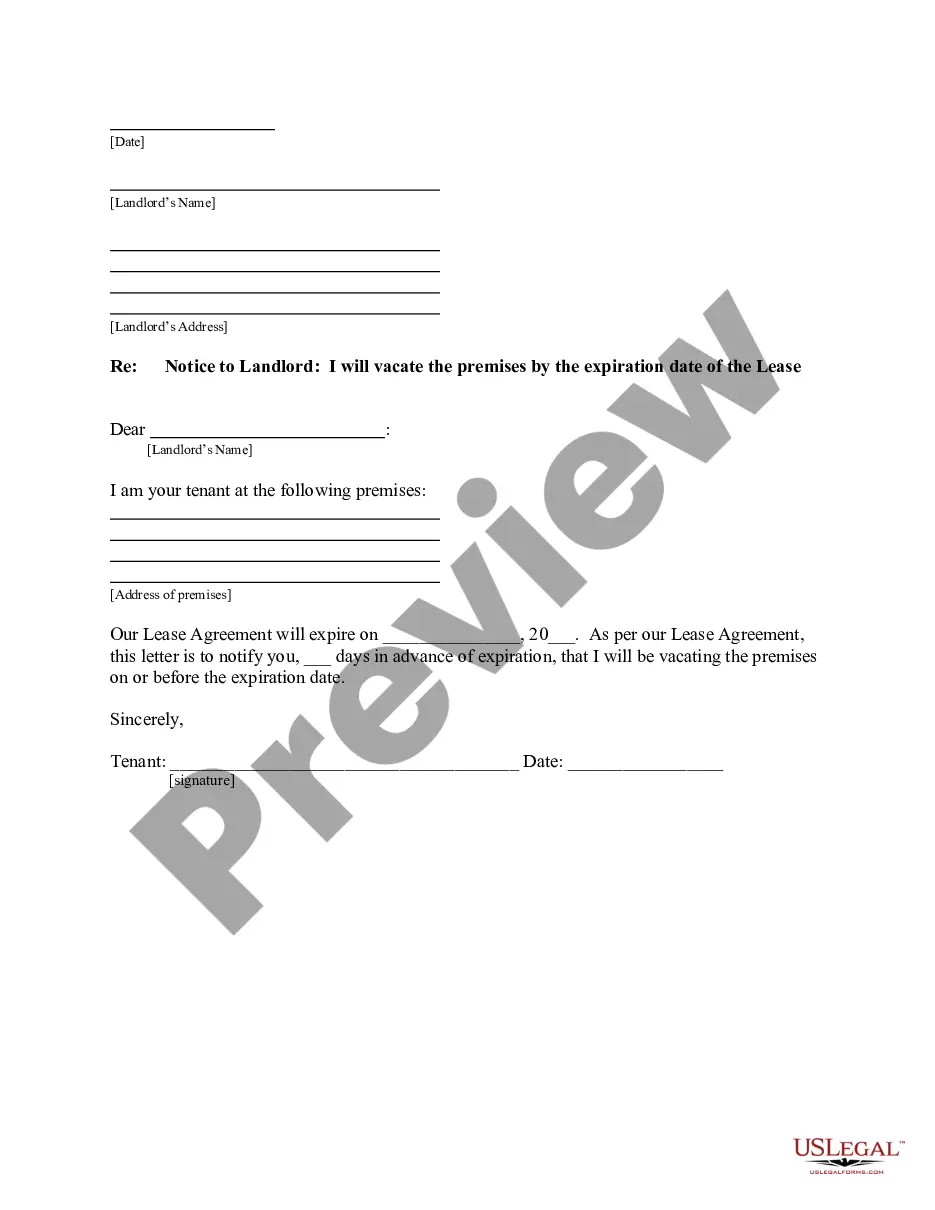

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Alameda Investment - Grade Bond Optional Redemption (without a Par Call) on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!