Broward Florida Investment-Grade Bond Optional Redemption (without a Par Call) Broward Florida Investment-Grade Bond Optional Redemption (without a Par Call) refers to a type of investment-grade bond issued by the government of Broward County, Florida. These bonds offer investors the option to redeem their investment before the scheduled maturity date without requiring the issuer to pay a premium (often referred to as a "par call"). This investment instrument is particularly attractive to investors seeking flexibility in managing their capital as it allows them to potentially exit their investment prior to maturity if certain conditions are met. By removing the requirement to pay a premium, the issuer does not have to compensate bondholders for any potential losses in yield resulting from the early redemption. It is worth noting that Broward Florida Investment-Grade Bond Optional Redemption may come in various forms, depending on the specific terms and conditions established by Broward County. While the exact classifications may differ between issuers, common variations of these bonds include: 1. Callable Bonds with Optional Redemption: These bonds provide the issuer with the right to redeem the bonds before the maturity date. However, bondholders also have the option to redeem their bonds if it becomes economically advantageous for them. 2. Non-Callable Bonds with Optional Redemption: In this type, the issuer does not have the right to redeem the bonds before maturity. However, bondholders are granted the option to redeem their investments early under specific circumstances outlined in the bond agreement. 3. Investment-Grade Bonds vs. Non-Investment Grade Bonds: Investment-grade bonds refer to bonds with high credit ratings assigned by reputable rating agencies. These bonds are considered relatively low-risk investments, making them appealing to conservative investors. Non-investment grade bonds (also known as junk bonds) have lower credit ratings, indicating a higher level of risk for investors. Investors considering Broward Florida Investment-Grade Bond Optional Redemption (without a Par Call) should be aware of the specific terms and conditions associated with these bonds. Additionally, conducting thorough research, assessing the financial health of Broward County, and understanding prevailing market conditions are vital prior to making any investment decisions related to these bonds. Disclaimer: The above information is for informational purposes only and should not be considered as financial advice. Investing in bonds carries risks, and it is crucial to consult with a qualified financial advisor or professional before making any investment decisions.

Broward Florida Investment - Grade Bond Optional Redemption (without a Par Call)

Description

How to fill out Broward Florida Investment - Grade Bond Optional Redemption (without A Par Call)?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Broward Investment - Grade Bond Optional Redemption (without a Par Call), you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Broward Investment - Grade Bond Optional Redemption (without a Par Call) from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Broward Investment - Grade Bond Optional Redemption (without a Par Call):

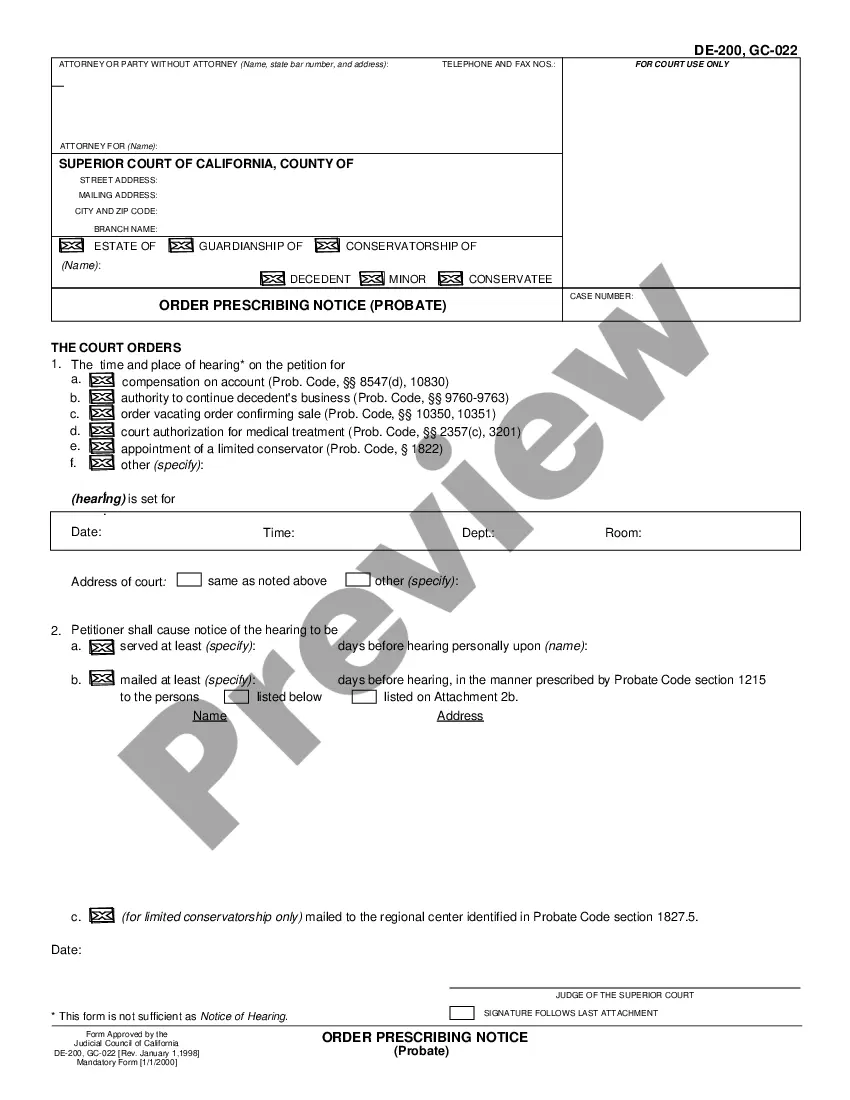

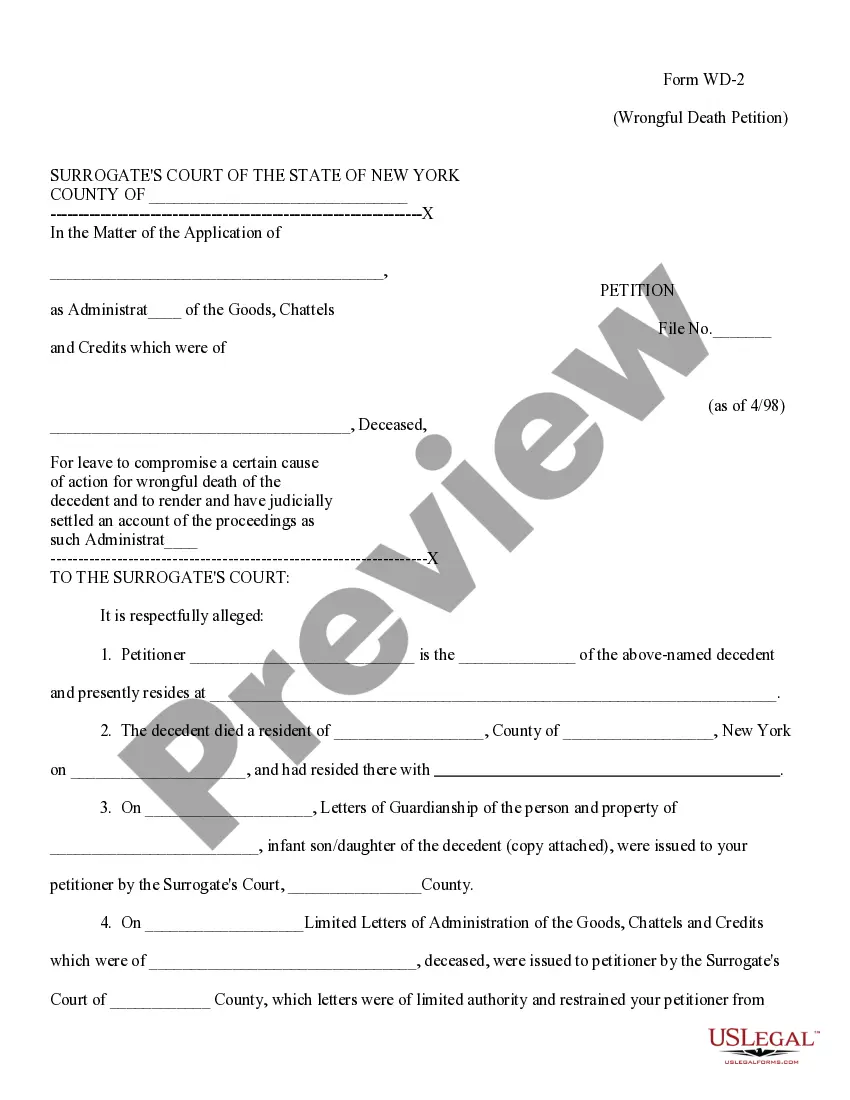

- Take a look at the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the document once you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!