Hennepin County, located in Minnesota, offers investment-grade bonds with an optional redemption provision without a par call. These bonds are an attractive option for investors seeking stability, security, and predictable returns. Let's delve deeper into what Hennepin Minnesota Investment — Grade Bond Optional Redemption (without a Par Call) entails and explore its various types. Investment-grade bonds are debt securities issued by entities with a strong credit rating, indicating a low risk of default. Hennepin County, being an established and stable government entity, offers investment-grade bonds that are highly sought after by investors ranging from individuals to institutions. One key feature of Hennepin Minnesota Investment — Grade Bond Optional Redemption (without a Par Call) is the absence of a par call provision. A par call typically allows the issuer to redeem the entire bond issue at par value before its maturity date. However, with Hennepin County's optional redemption provision, bondholders have the choice to redeem their bonds early without facing a par call. This flexibility provides investors with the opportunity to exit their investment if needed or take advantage of better investment opportunities without being tied to the original maturity date. Hennepin Minnesota Investment — Grade Bond Optional Redemption (without a Par Call) comes in different types, providing investors with options that cater to their specific needs: 1. General Obligation Bonds: These bonds are backed by the full faith and credit of Hennepin County, ensuring their repayment through the county's taxing authority. General Obligation Bonds are seen as the most secure type of bonds, providing investors with a high level of certainty in terms of principal and interest payments. 2. Revenue Bonds: These bonds are backed by the revenue generated from specific projects or services. In Hennepin County, revenue bonds might be issued to finance infrastructure projects, such as bridges, roads, or public facilities. The revenue generated from these projects helps service the bond's interest and principal payments. 3. Tax Increment Financing (TIF) Bonds: TIF bonds are issued to finance development projects within a designated Tax Increment Financing District. These bonds are repaid using the increased property tax revenue generated by the development projects in the district. Hennepin County might issue TIF bonds to fund the revitalization of certain areas or support economic growth initiatives. Investors interested in Hennepin Minnesota Investment — Grade Bond Optional Redemption (without a Par Call) can consult with their financial advisors or brokerage firms to explore the available options. By investing in these bonds, investors can support Hennepin County's development initiatives, enjoy predictable income streams, and contribute to the growth of their local community.

Hennepin Minnesota Investment - Grade Bond Optional Redemption (without a Par Call)

Description

How to fill out Hennepin Minnesota Investment - Grade Bond Optional Redemption (without A Par Call)?

How much time does it normally take you to create a legal document? Because every state has its laws and regulations for every life scenario, finding a Hennepin Investment - Grade Bond Optional Redemption (without a Par Call) suiting all regional requirements can be tiring, and ordering it from a professional attorney is often expensive. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. In addition to the Hennepin Investment - Grade Bond Optional Redemption (without a Par Call), here you can find any specific document to run your business or personal affairs, complying with your regional requirements. Professionals check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can retain the document in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Hennepin Investment - Grade Bond Optional Redemption (without a Par Call):

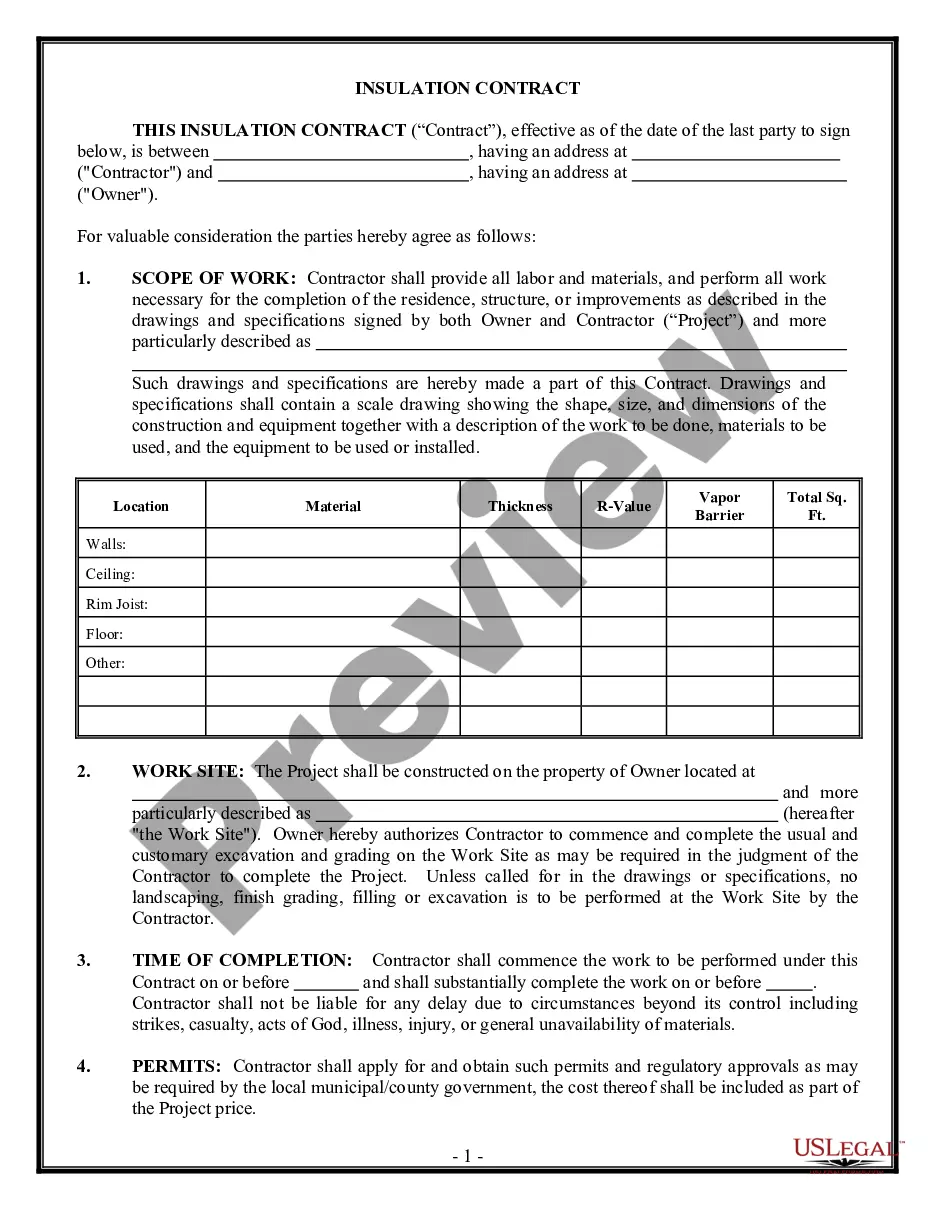

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Hennepin Investment - Grade Bond Optional Redemption (without a Par Call).

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!