Dallas Texas Investment-Grade Bond Optional Redemption (with a Par Call) is a type of bond that offers investors a unique opportunity to redeem their bonds at a specific price (par value) before the maturity date. This type of bond is typically considered low-risk and suitable for investors looking for stable returns. In essence, an optional redemption feature allows the bond issuer, in this case, Dallas Texas, to repurchase the bonds from the bondholders before their maturity date. The redemption is carried out at a predetermined price, known as the par value, which ensures that investors receive the principal amount initially invested. The main advantage of this type of bond is that it provides investors with flexibility and liquidity. If market conditions or the issuer's financial situation changes, Dallas Texas can exercise the option to redeem the bonds, regardless of the original maturity date. Bondholders, on the other hand, have the opportunity to liquidate their investment and reinvest the funds elsewhere (if desired) or simply receive the principal amount invested. Furthermore, Dallas Texas Investment-Grade Bond Optional Redemption (with a Par Call) is categorized as "investment-grade." This classification signifies that the bond is issued by a financially stable, creditworthy entity. Investment-grade bonds typically have lower default risk and offer fixed income returns throughout the bond's tenure. To differentiate among different types of Dallas Texas Investment-Grade Bond Optional Redemption (with a Par Call), it is important to consider factors such as the maturity date, coupon rate, and specific terms and conditions outlined in the bond offering. These factors can vary based on the specific issue of the bond or the series in which it belongs. For example, there may be Dallas Texas Investment-Grade Bond Optional Redemptions (with a Par Call) with different maturity dates, ranging from short-term to long-term options. Investors interested in Dallas Texas Investment-Grade Bond Optional Redemption (with a Par Call) should carefully review the bond's official statement or prospectus, which outlines the specific terms, conditions, and any additional features related to the investment. Additionally, it is essential to conduct due diligence and consult with financial professionals to ensure the investment aligns with individual goals and risk tolerance. In conclusion, Dallas Texas Investment-Grade Bond Optional Redemption (with a Par Call) offers investors the opportunity to invest in a low-risk, fixed income instrument with potential for optional redemption before maturity at a predetermined price. This flexibility, combined with the investment-grade status of the bond, makes it an attractive option for investors seeking stability and liquidity in their portfolio.

Dallas Texas Investment - Grade Bond Optional Redemption (with a Par Call)

Description

How to fill out Dallas Texas Investment - Grade Bond Optional Redemption (with A Par Call)?

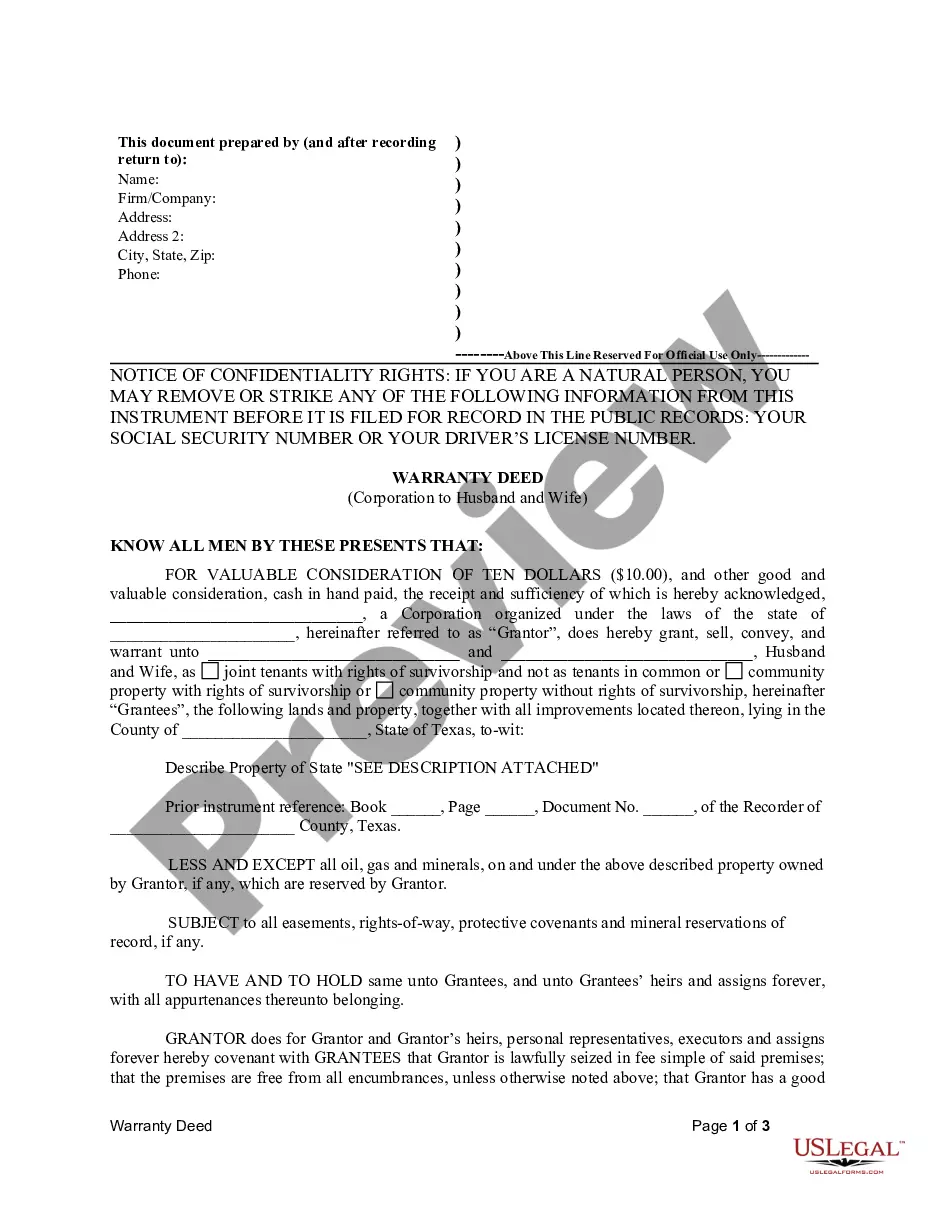

Preparing legal documentation can be difficult. Besides, if you decide to ask a legal professional to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Dallas Investment - Grade Bond Optional Redemption (with a Par Call), it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Consequently, if you need the current version of the Dallas Investment - Grade Bond Optional Redemption (with a Par Call), you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Dallas Investment - Grade Bond Optional Redemption (with a Par Call):

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Dallas Investment - Grade Bond Optional Redemption (with a Par Call) and download it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!