Kings New York Investment-Grade Bond Optional Redemption (with a Par Call) refers to a specific type of bond offered by the Kings New York Corporation, a well-established financial institution operating in the bond market. This product provides investors with an opportunity to invest in bonds that offer a fixed interest rate and the flexibility of optional redemption with a par call feature. The Kings New York Investment-Grade Bond Optional Redemption (with a Par Call) is designed for investors seeking a stable and reliable source of income while maintaining a degree of flexibility. With an investment-grade bond, investors can expect a relatively low level of risk compared to other investment options, as these bonds are issued by highly rated companies or municipal governments. The optional redemption feature allows the issuer, Kings New York Corporation, to redeem the bond before its maturity date. This feature benefits both the issuer and the investor. The issuer gains the advantage of refinancing the bond at a lower interest rate if market conditions change, while the investor has the opportunity to potentially realize capital gains if the bond is called at a premium. Moreover, the par call provision implies that if the bond is called by the issuer, it will be redeemed at its face value or the par value. This guarantees that investors will receive the principal amount invested, providing them with a sense of security in the event of an early redemption. It's worth noting that there might be different variations or series of the Kings New York Investment-Grade Bond Optional Redemption (with a Par Call) based on specific terms or conditions. These variations may include: 1. Series A: This could represent the initial issuance or a specific offering of the bond. Series A may have unique terms, such as specific interest rates, maturity dates, or restrictions. 2. Callable series: Kings New York may offer different callable series with varying redemption dates and terms. Investors can have options to choose bonds that match their investment preferences. 3. Variable interest rate series: This type of Kings New York bond might offer a floating interest rate tied to an underlying benchmark, such as LIBOR or Treasury rates. This offers investors the potential for higher returns if interest rates rise. In conclusion, Kings New York Investment-Grade Bond Optional Redemption (with a Par Call) provides investors with an opportunity to invest in a stable and flexible bond product. The optional redemption feature, accompanied by a par call provision, adds to its attractiveness, allowing investors to potentially capitalize on changing market conditions. Different variations or series of this bond may exist, such as Series A, callable series, or variable interest rate series, offering investors a range of options to tailor their investments to meet their financial objectives.

Kings New York Investment - Grade Bond Optional Redemption (with a Par Call)

Description

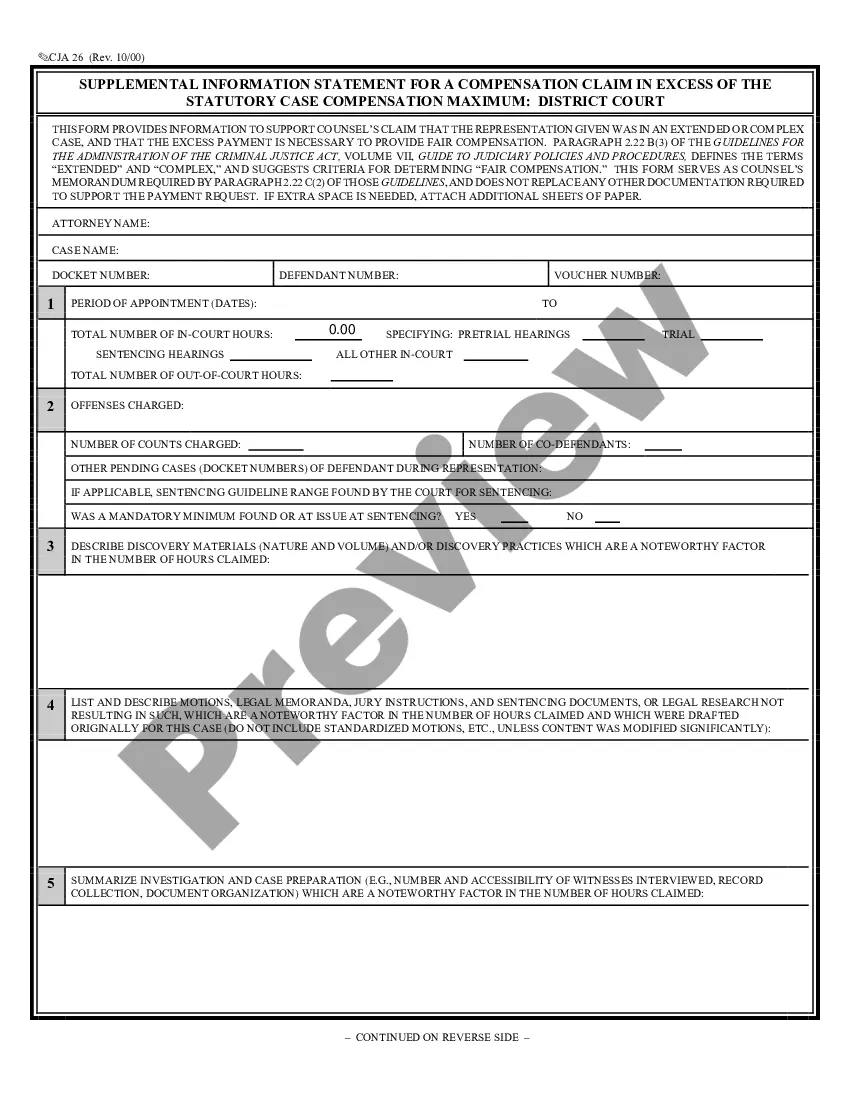

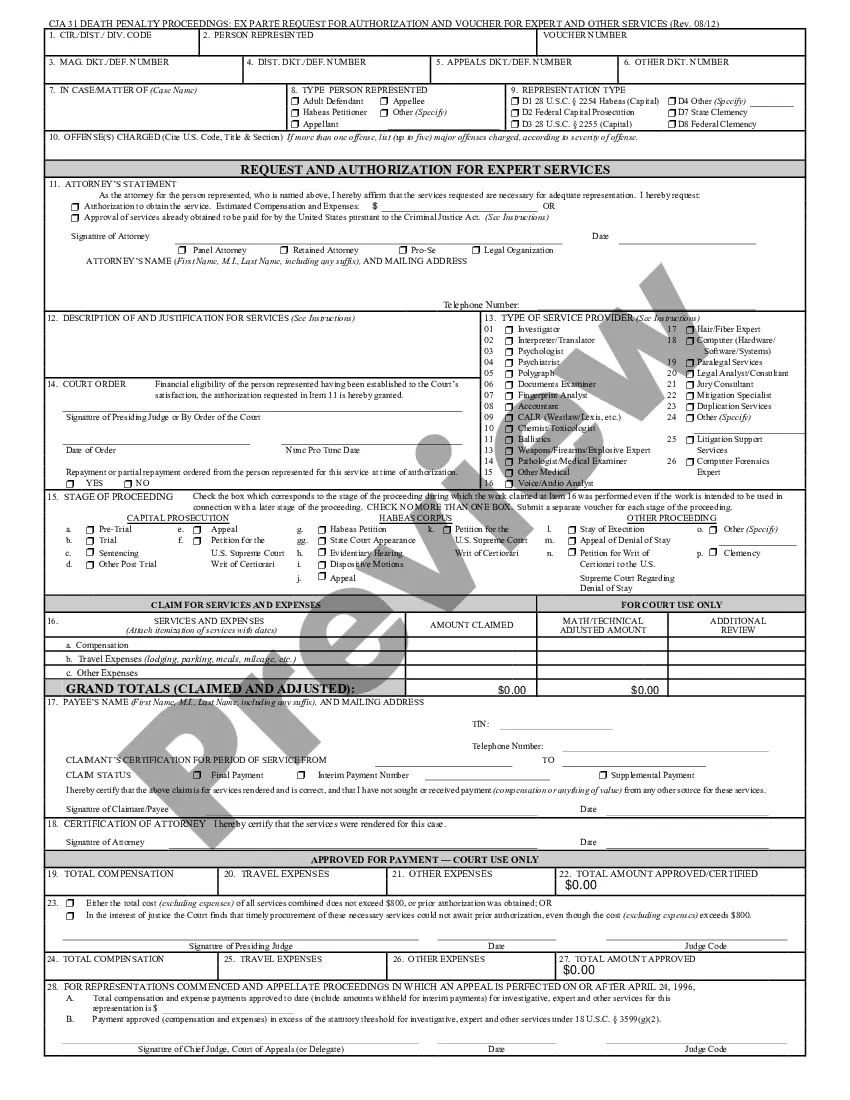

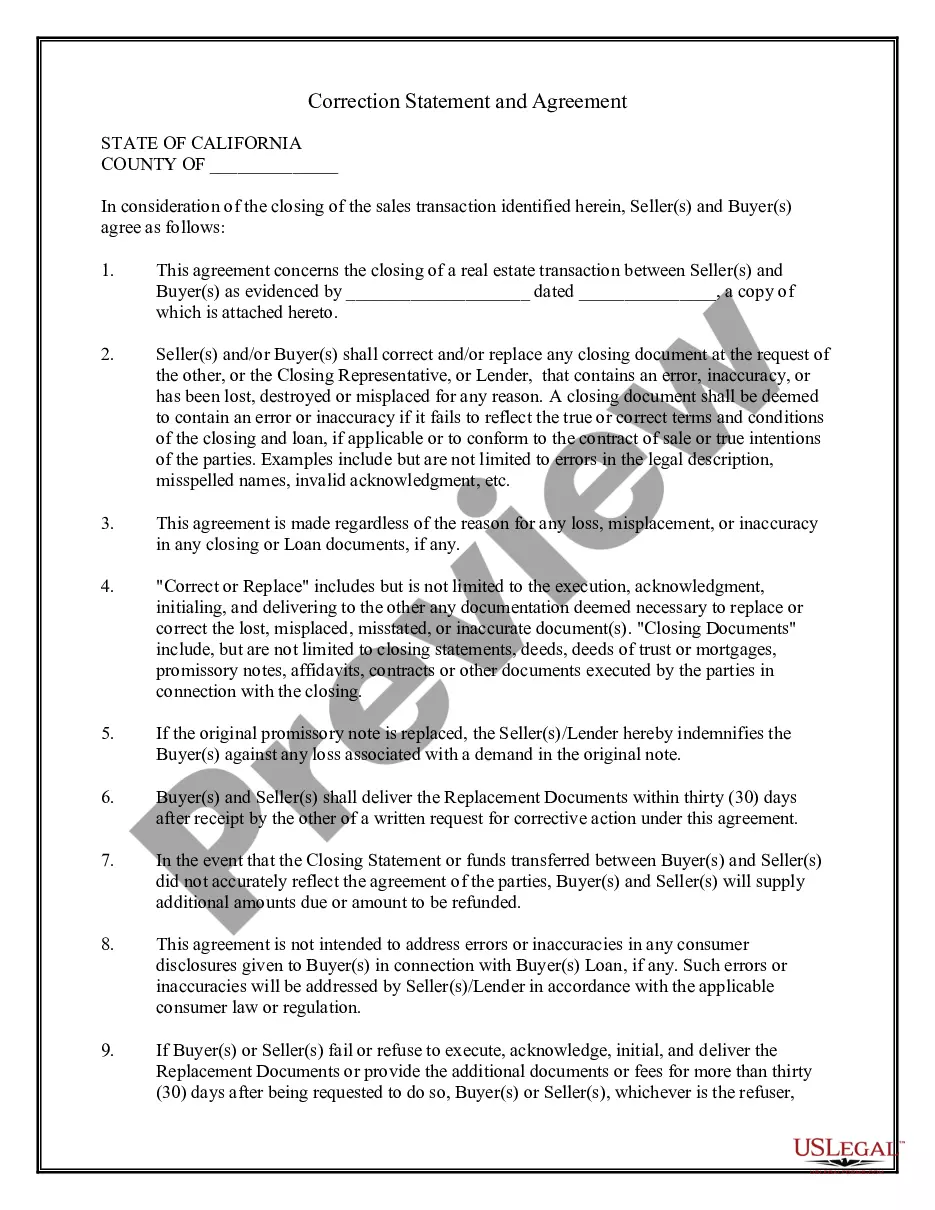

How to fill out Kings New York Investment - Grade Bond Optional Redemption (with A Par Call)?

Preparing documents for the business or personal demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to generate Kings Investment - Grade Bond Optional Redemption (with a Par Call) without expert assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Kings Investment - Grade Bond Optional Redemption (with a Par Call) by yourself, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Kings Investment - Grade Bond Optional Redemption (with a Par Call):

- Examine the page you've opened and check if it has the sample you require.

- To do so, use the form description and preview if these options are available.

- To locate the one that fits your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any situation with just a couple of clicks!