Orange California Investment-Grade Bond Optional Redemption (with a Par Call) refers to a specific type of bond investment available in Orange County, California. These bonds are categorized as investment-grade, indicating a relatively low risk of default and a higher credit rating. The term "optional redemption" means that the issuer of the bond has the option to redeem or buy back the bond before its maturity. In this case, the optional redemption is coupled with a "par call" provision. The par call provision allows the issuer to redeem the bonds at their face value (par value) plus any accrued interest. This type of bond offers investors a level of flexibility and potential for early redemption. It is particularly appealing to issuers when interest rates have decreased since the bond's issuance, as they can refinance at a lower rate. Orange California Investment-Grade Bond Optional Redemption (with a Par Call) can be further classified into various types, including: 1. General Obligation Bonds: These bonds are backed by the full faith and credit of the issuer, usually a municipality or county government. They are typically used to finance public projects like schools, parks, and infrastructure developments. 2. Revenue Bonds: These bonds are secured by specific revenue streams generated by the projects or facilities they finance. Examples include toll-road or airport revenue bonds, where the funds to repay bondholders come from user fees or charges. 3. Municipal Bonds: These bonds are issued by a municipality or local government to raise capital for public infrastructure projects. Municipal bonds are often exempt from federal taxes, making them attractive to investors seeking tax advantages. 4. Corporate Bonds: These are issued by corporations to raise capital for various purposes, such as expansion, acquisitions, or debt refinancing. Corporate bonds typically have higher yields than government bonds, reflecting their higher risk. Investors in Orange California Investment-Grade Bond Optional Redemption (with a Par Call) can benefit from regular interest payments and the knowledge that their investment has a relatively low risk of default. However, potential investors should carefully assess their individual risk tolerance and consider consulting with a financial advisor before making any investment decisions.

Orange California Investment - Grade Bond Optional Redemption (with a Par Call)

Description

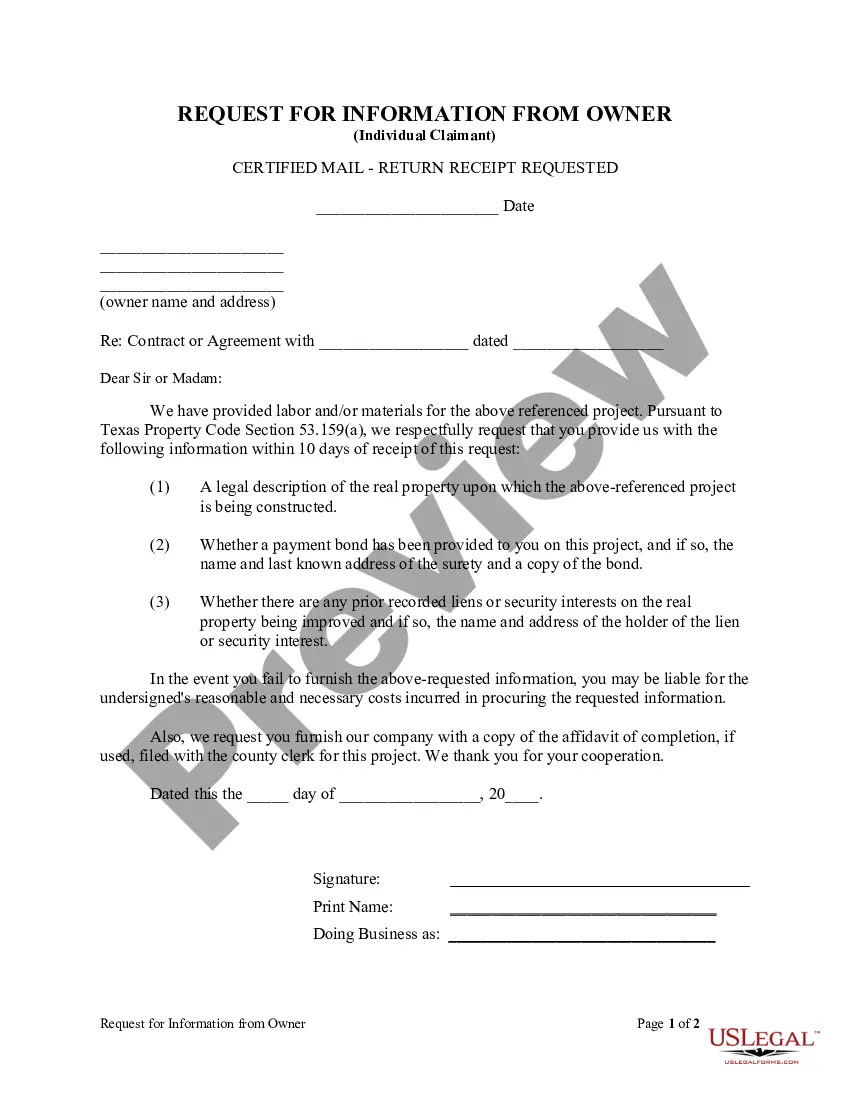

How to fill out Orange California Investment - Grade Bond Optional Redemption (with A Par Call)?

Are you looking to quickly create a legally-binding Orange Investment - Grade Bond Optional Redemption (with a Par Call) or maybe any other document to handle your own or business matters? You can select one of the two options: contact a professional to draft a legal paper for you or draft it completely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay sky-high prices for legal services.

US Legal Forms provides a huge collection of over 85,000 state-compliant document templates, including Orange Investment - Grade Bond Optional Redemption (with a Par Call) and form packages. We provide templates for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra troubles.

- First and foremost, carefully verify if the Orange Investment - Grade Bond Optional Redemption (with a Par Call) is adapted to your state's or county's laws.

- If the document includes a desciption, make sure to verify what it's intended for.

- Start the searching process again if the document isn’t what you were looking for by utilizing the search box in the header.

- Choose the plan that best suits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Orange Investment - Grade Bond Optional Redemption (with a Par Call) template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to find and download legal forms if you use our services. In addition, the templates we offer are reviewed by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!