San Diego California Investment-Grade Bond Optional Redemption (with a Par Call) refers to a type of municipal bond issued by the city of San Diego, California. These bonds are considered investment-grade, meaning they carry a relatively low risk of default and are thus highly attractive to investors seeking stable returns. The optional redemption feature allows the issuer, in this case, the city of San Diego, to redeem or buy back the bonds before their maturity date at a specified price, known as the par value. This provides flexibility to the issuer, enabling them to seize opportunities to refinance the debt or save on interest payments if market conditions are favorable. The par call option ensures that investors receive the full face value of the bonds if an early redemption occurs. San Diego California Investment-Grade Bond Optional Redemption (with a Par Call) is highly regarded in the investment community due to the creditworthiness of the issuer and the added benefits of the optional redemption feature. It provides investors with a reliable source of income and the opportunity for early redemption. Different types of San Diego California Investment-Grade Bond Optional Redemption (with a Par Call) may include variations in maturity dates, interest rates, and other terms and conditions. These variables cater to different investor preferences, such as those seeking shorter-term or longer-term investments. It is important for investors to carefully evaluate the specific terms of each bond offering to align with their investment goals and risk tolerance. Investing in San Diego California Investment-Grade Bond Optional Redemption (with a Par Call) provides individuals and institutions with an opportunity to support and participate in the growth and development of San Diego. These bonds are typically utilized to fund public projects, such as infrastructure improvements, schools, hospitals, and other community initiatives. By investing in these bonds, investors can contribute to the betterment of San Diego while also potentially benefiting from a steady and reliable income stream. In summary, San Diego California Investment-Grade Bond Optional Redemption (with a Par Call) is a secure and attractive investment option that offers the potential for solid returns. Its optional redemption feature allows the city of San Diego to buy back the bonds at a predetermined price before maturity, providing flexibility and potentially favorable market opportunities. Investors should carefully consider the different variations and terms associated with these bonds to align with their investment objectives.

San Diego California Investment - Grade Bond Optional Redemption (with a Par Call)

Description

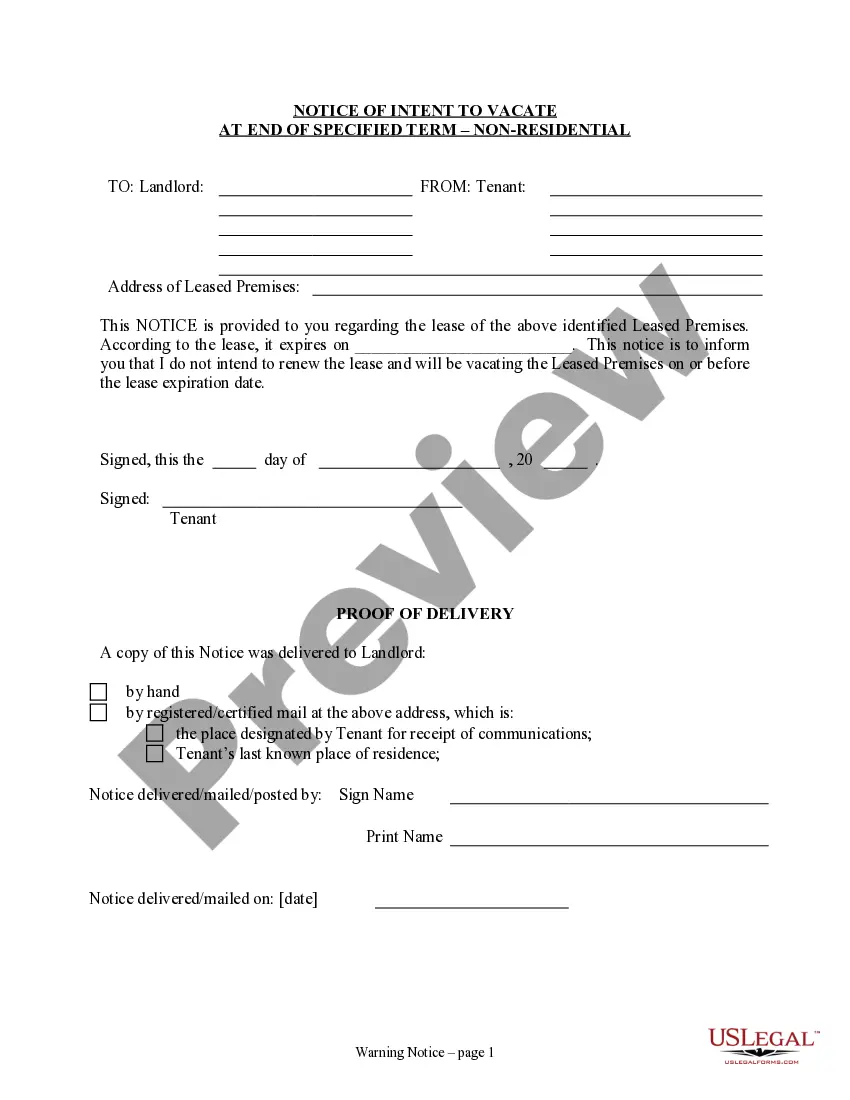

How to fill out San Diego California Investment - Grade Bond Optional Redemption (with A Par Call)?

Do you need to quickly create a legally-binding San Diego Investment - Grade Bond Optional Redemption (with a Par Call) or probably any other document to handle your own or business affairs? You can go with two options: hire a legal advisor to write a valid paper for you or create it entirely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you get neatly written legal documents without paying sky-high fees for legal services.

US Legal Forms offers a huge collection of over 85,000 state-compliant document templates, including San Diego Investment - Grade Bond Optional Redemption (with a Par Call) and form packages. We offer templates for a myriad of life circumstances: from divorce papers to real estate documents. We've been out there for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the needed template without extra hassles.

- To start with, carefully verify if the San Diego Investment - Grade Bond Optional Redemption (with a Par Call) is adapted to your state's or county's regulations.

- In case the form has a desciption, make sure to check what it's intended for.

- Start the search again if the document isn’t what you were seeking by utilizing the search box in the header.

- Choose the plan that is best suited for your needs and move forward to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the San Diego Investment - Grade Bond Optional Redemption (with a Par Call) template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Additionally, the templates we offer are updated by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!