Maricopa Arizona Shareholders Agreement is a legally binding contract that outlines the rights and obligations of the shareholders within a corporation or company based in Maricopa, Arizona. This agreement serves as a crucial tool in providing clarity and structure to the relationships among shareholders, protecting their interests and ensuring effective governance. The Maricopa Arizona Shareholders Agreement typically encompasses various essential aspects, including the distribution of shares, voting rights, decision-making procedures, transfer restrictions, dividend policies, and dispute resolution mechanisms. By defining these terms, it helps to establish a fair and harmonious environment for shareholders’ involvement in the company's affairs and decision-making processes. Additionally, this agreement emphasizes the shareholders' roles and responsibilities, making it easier to manage and regulate conflicts, minimize potential risks, and protect the company's long-term interests. It is essential to tailor the agreement to the specific needs and goals of the shareholders, considering the nature of their business, industry regulations, and the desired level of control. Types of Maricopa Arizona Shareholders Agreements may include: 1. Basic Shareholders Agreement: This agreement outlines fundamental terms related to share ownership, voting rights, and profit distribution among shareholders in a Maricopa, Arizona-based corporation. It serves as a foundational document for shareholders' relationship management within the company. 2. Voting Agreement: This specific agreement focuses on regulating the voting rights and procedures for shareholders' decision-making. It outlines how voting power is distributed and exercised, ensuring fair and transparent corporate governance practices. 3. Buy-Sell Agreement: A buy-sell agreement sets the terms for the potential sale or transfer of shares between shareholders, providing a mechanism to handle situations such as voluntary or involuntary exit of a shareholder. It helps to maintain stability within the organization and governs the process of buying or selling shares. 4. Drag-Along Agreement: This type of agreement allows majority shareholders to compel minority shareholders to sell their shares in the event of a substantial corporate transaction or sale. It ensures smooth and efficient transactions by preventing minority shareholders from obstructing deals. 5. Tag-Along Agreement: On the contrary, this agreement safeguards minority shareholders by granting them the right to join in a share sale initiated by the majority shareholders. It ensures that minority shareholders are not unfairly left out when opportunities for a beneficial transaction arise. In conclusion, the Maricopa Arizona Shareholders Agreement is a comprehensive and crucial legal document that defines the rights, obligations, and relationships among shareholders in a Maricopa, Arizona-based corporation. Through its various types and provisions, this agreement aims to establish a fair, transparent, and well-regulated environment for corporate governance and decision-making processes.

Maricopa Arizona Shareholders Agreement

Description

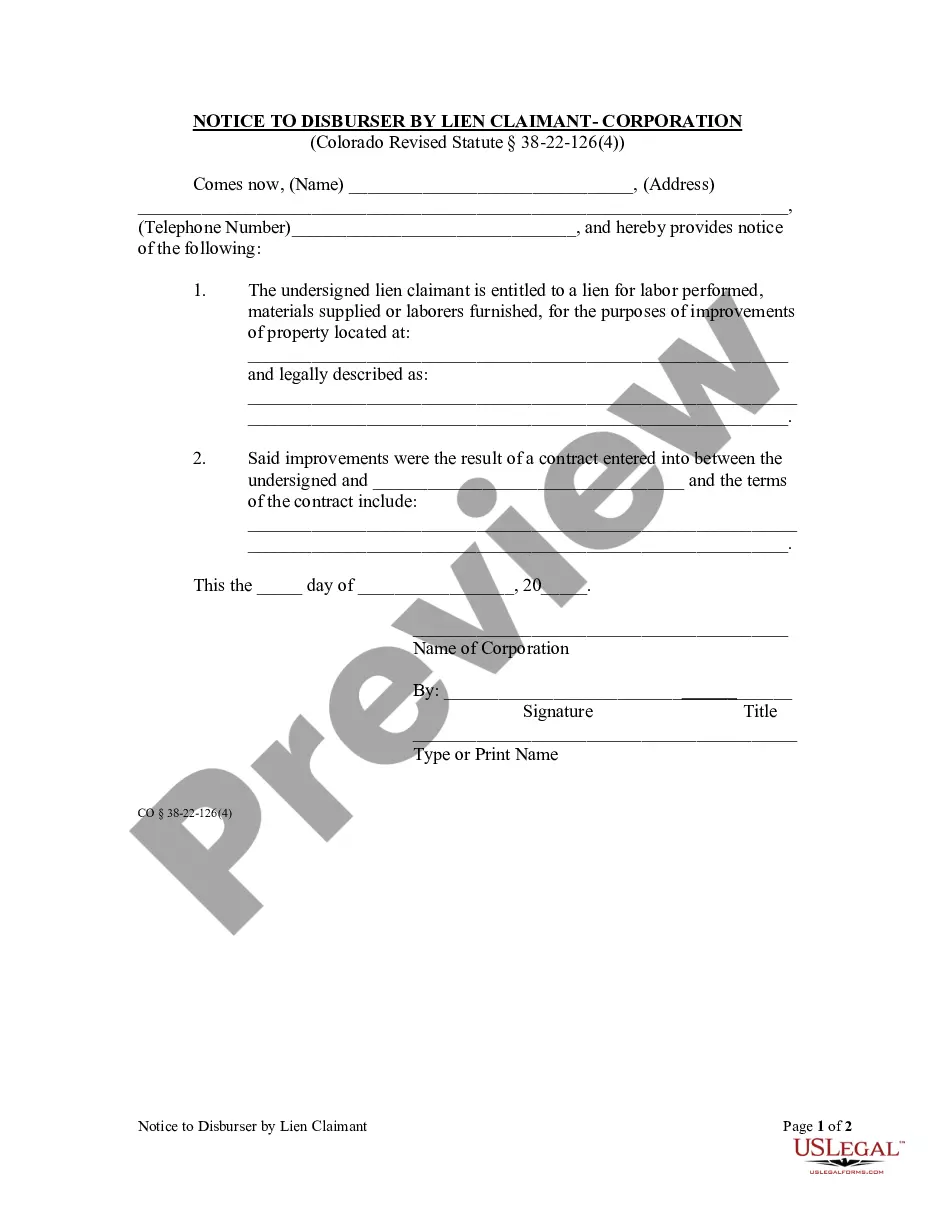

How to fill out Maricopa Arizona Shareholders Agreement?

Draftwing documents, like Maricopa Shareholders Agreement, to manage your legal affairs is a tough and time-consumming task. Many situations require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can get your legal affairs into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents intended for different scenarios and life situations. We ensure each form is compliant with the laws of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Maricopa Shareholders Agreement template. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before downloading Maricopa Shareholders Agreement:

- Make sure that your template is compliant with your state/county since the rules for creating legal paperwork may vary from one state another.

- Find out more about the form by previewing it or going through a brief description. If the Maricopa Shareholders Agreement isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to begin utilizing our service and get the document.

- Everything looks good on your side? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your template is all set. You can go ahead and download it.

It’s an easy task to find and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

Building permits are required for all structures with the exception of a structure that is less than 200 square feet with no electrical, plumbing or mechanical.

In most residentially, zoning districts, accessory structures can be located in the rear of your property, can be as close as 3 feet to the rear and side property lines, with a maximum height of 15 feet. The building must be 6 feet away from other structures.

Building permits are required for all structures with the exception of a structure that is less than 200 square feet with no electrical, plumbing or mechanical.

There are two ways to submit your plans for a building permit with Maricopa County. Electronic submittals are completed online. For questions regarding Building Permits submittals, call 602-506-3301.

Your city office or the Maricopa County Planning and Development department can tell you where you should submit the site plan. Most major cities in the county have a planning and development department including Phoenix, Tempe, Chandler, Mesa, Scottsdale and Glendale.

The transfer fee is $50 per parcel, regardless of the number of treatment facilities on the parcel. When submitting an Onsite Wastewater Septic Treatment Facility Notice of Transfer (NOT) by mail, please complete the entire NOT form.

In addition to the regular location standards, detached accessory buildings are permitted to be constructed/placed at a minimum 3 foot setback in any location other than the required front yard. Accessory buildings cannot occupy more than 30 percent of the required rear yard or side yard.

The exact amount a building needs to be set back from the property line will vary from one location to another. However, the required setback on the side is typically between 5 ? 10 feet, while the front and back require around 10 ? 20 feet at a minimum.

For Building: 1. One-story detached accessory structures used as tool and storage sheds, playhouses and similar uses provided the floor area does not exceed 200 square feet. (These would still require a zoning permit) 2. Fences not over 7 feet high, but these do require a zoning permit.

The Arizona Department of Environmental Quality (?ADEQ?) rules require a pre-transfer inspection by Seller. Facility Inspection: Seller shall have the Facility inspected at Seller's expense within six (6) months prior to Close of Escrow, but no later than twenty (20) days or days after Contract acceptance.