San Antonio, Texas Shareholders Agreement is a legally binding contract that establishes the rights and responsibilities of shareholders in a corporation based in San Antonio, Texas. This agreement outlines the governance, decision-making process, and ownership structure of the corporation, providing clarity and protection for all parties involved. The San Antonio Shareholders Agreement usually includes several key provisions such as: 1. Shareholder Rights and Obligations: This section defines the privileges and obligations of each shareholder, including the right to attend meetings, vote on important matters, and receive dividends. 2. Ownership and Equity: This clause outlines the distribution and transferability of shares, restrictions on selling shares to external parties, and procedures for executing stock purchases or sales. 3. Board of Directors: In this section, the roles and authority of the board of directors is defined, including the process for appointing and removing directors, as well as their powers and duties. 4. Decision-Making Process: The agreement stipulates how major decisions will be made within the corporation, including matters such as mergers, acquisitions, changes in company structure, and other significant corporate actions. 5. Dispute Resolution: This clause provides guidelines on resolving disputes between shareholders, such as mediation, arbitration, or litigation, in order to maintain fairness and protect the interests of the corporation and its shareholders. 6. Confidentiality and Non-Disclosure: This section establishes the confidentiality obligations of shareholders, safeguarding sensitive corporate information and trade secrets from unauthorized disclosure. 7. Competition and Non-Compete: If applicable, this provision restricts shareholders from engaging in activities that may compete with the corporation, safeguarding its intellectual property and market position. While the general San Antonio Shareholders Agreement is applicable to most corporations, there may be variations or specialized agreements tailored to specific industries or circumstances. Some examples include: 1. Technology Shareholders Agreement: Specifically designed for technology-based corporations, this agreement may include provisions related to intellectual property, patents, licensing, and software development. 2. Real Estate Shareholders Agreement: This agreement caters to companies in the real estate industry, offering clauses that address property acquisition, development, leasing, and joint ventures. 3. Start-up Shareholders Agreement: Designed for early-stage companies, this agreement may focus on equity vesting, founder agreements, investor rights, and exit strategies. 4. Non-Profit Shareholders Agreement: This agreement caters to non-profit organizations and includes specific provisions related to charitable purposes, fundraising, and donor restrictions. In conclusion, a San Antonio, Texas Shareholders Agreement is a comprehensive contract that provides a framework for corporate governance, decision-making, and ownership rights for shareholders in San Antonio-based corporations. It is essential for shareholders to carefully review and understand the terms of the agreement to protect their interests and promote a harmonious business environment.

San Antonio Texas Shareholders Agreement

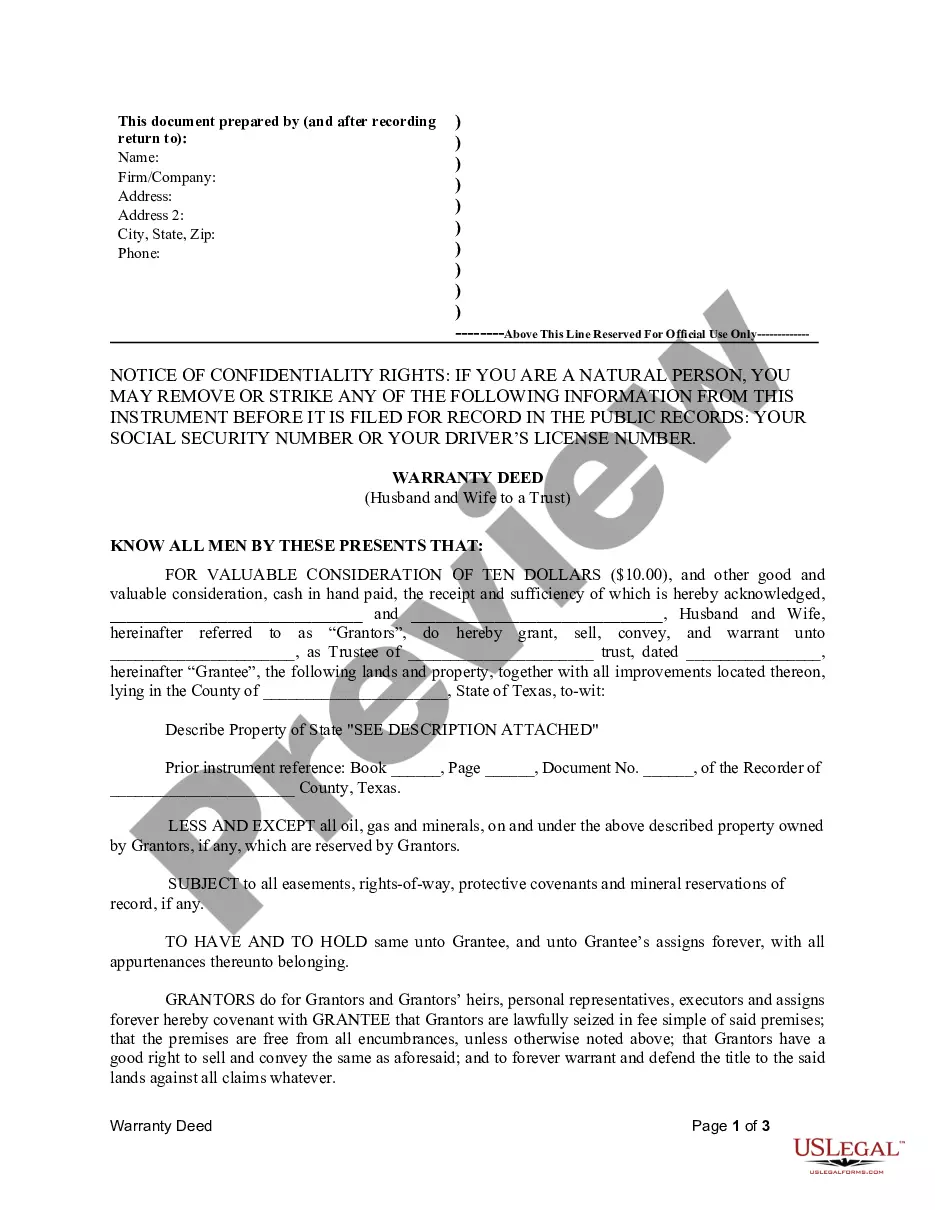

Description

How to fill out San Antonio Texas Shareholders Agreement?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and many other life situations demand you prepare formal paperwork that varies from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any individual or business purpose utilized in your county, including the San Antonio Shareholders Agreement.

Locating templates on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the San Antonio Shareholders Agreement will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to get the San Antonio Shareholders Agreement:

- Make sure you have opened the correct page with your localised form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the San Antonio Shareholders Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!