A Suffolk New York Shareholders Agreement is a legally binding contract that outlines the rights, responsibilities, and obligations of shareholders in a company based in Suffolk County, New York. This agreement is crucial for maintaining a harmonious relationship between shareholders and protecting their interests. The Suffolk New York Shareholders Agreement typically covers various important aspects such as voting rights, decision-making processes, ownership percentages, transfer of shares, and dispute resolution mechanisms. It sets out clear guidelines for shareholders to follow, ensuring the smooth functioning of the company and preventing potential conflicts among stakeholders. One of the different types of Suffolk New York Shareholders Agreements is the Majority Shareholders Agreement. This type of agreement is designed to protect the interests of majority shareholders who hold a controlling stake in the company. It may include provisions that grant the majority shareholders additional voting rights or impose restrictions on minority shareholders. Another type is the Minority Shareholders Agreement, which is aimed at safeguarding the rights of minority shareholders who do not hold a controlling interest in the company. This agreement may offer specific protections to minority shareholders, such as special voting rights, guaranteed seats on the board of directors, or preemptive rights in case of share issuance or sale. Additionally, some Suffolk New York Shareholders Agreements can be categorized as Founders' Agreements. These agreements are typically utilized by startup companies and cover specific terms related to company formation, initial share ownership distribution, and outlining the roles and responsibilities of the founders. Furthermore, a Suffolk New York Shareholders Agreement might include provisions related to non-compete agreements, confidentiality, intellectual property rights, and restrictions on the transfer of shares to third parties. In summary, a Suffolk New York Shareholders Agreement is a comprehensive legal document that protects both majority and minority shareholders' interests in a company. These agreements can vary in their specifications, with some tailored specifically for majority or minority shareholders, while others focus on founding members of a startup. Ultimately, these agreements play a crucial role in maintaining transparency, clarifying shareholder rights, and resolving disputes within the context of a Suffolk County-based company.

Suffolk New York Shareholders Agreement

Description

How to fill out Suffolk New York Shareholders Agreement?

Preparing legal paperwork can be difficult. In addition, if you decide to ask an attorney to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Suffolk Shareholders Agreement, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Therefore, if you need the latest version of the Suffolk Shareholders Agreement, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Suffolk Shareholders Agreement:

- Glance through the page and verify there is a sample for your area.

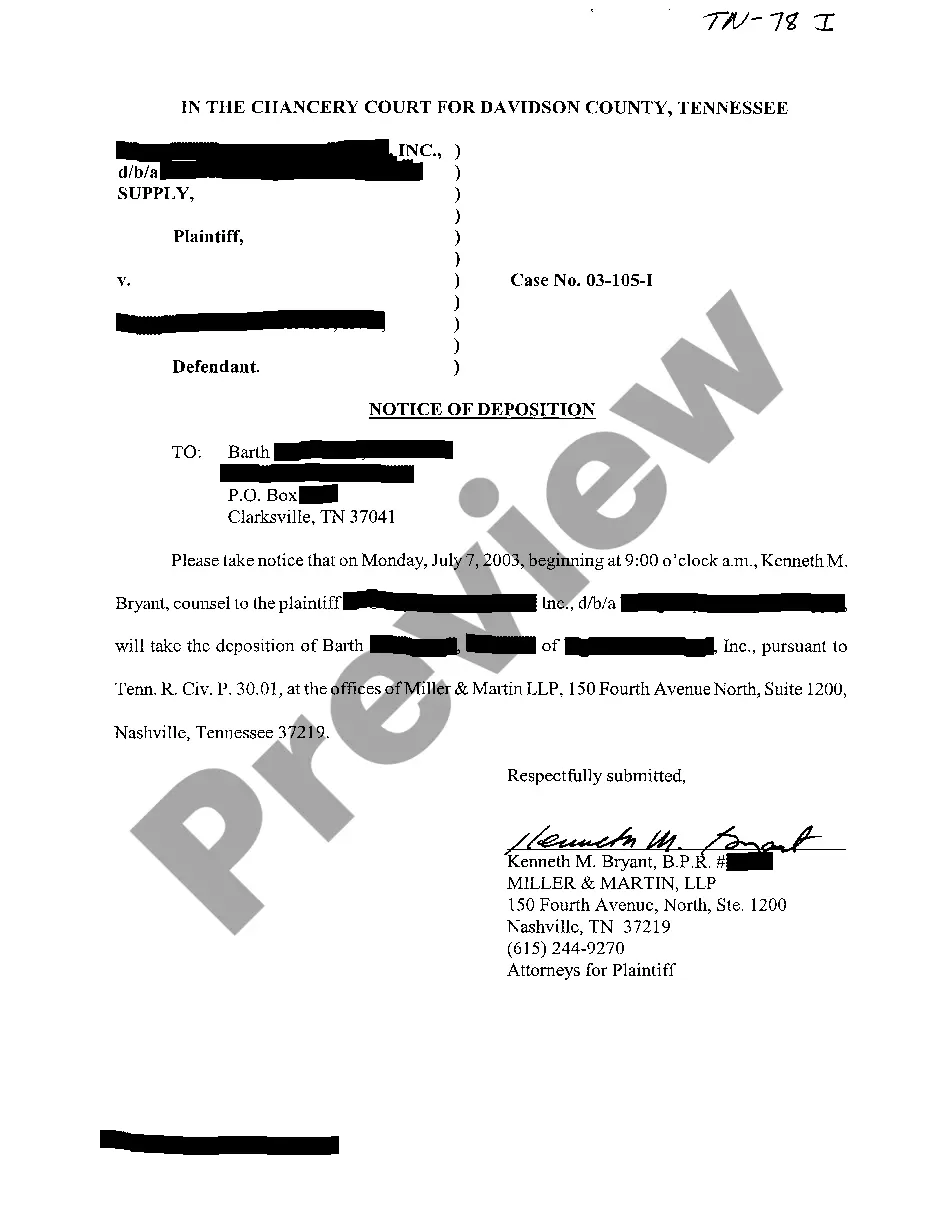

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Suffolk Shareholders Agreement and save it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!