Title: Cuyahoga Ohio Shared Earnings Agreement: An In-depth Overview of Fund & Company Collaboration Introduction: Cuyahoga County, Ohio, offers various types of Shared Earnings Agreements between Funds and Companies. These agreements embody a mutually beneficial collaboration where funds are allocated to eligible companies with the aim of fostering economic growth, job creation, and innovation within the region. In this article, we will explore the details of the Cuyahoga Ohio Shared Earnings Agreement, discuss its benefits, and highlight its different types. I. Understanding Cuyahoga Ohio Shared Earnings Agreement: Cuyahoga Ohio Shared Earnings Agreement is a contractual arrangement between a fund, typically operated by the county or state-level economic development agencies, and qualifying companies based in Cuyahoga County. The purpose of the agreement is to provide financial support to businesses while sharing in the economic rewards derived from the company's growth. II. Key Elements and Benefits of Cuyahoga Ohio Shared Earnings Agreement: 1. Enhanced Access to Capital: Participating companies gain access to funding sources that may not have been previously available, facilitating their ability to expand operations, innovate, and hire more workforce. 2. Collaborative Financial Support: Under this agreement, funds provide financial resources, which could be in the form of grants, loans, or equity investments, depending on the specific agreement and the company's needs. 3. Economic Development Focus: The shared earnings agreement aims to stimulate economic development within Cuyahoga County, encouraging local companies to thrive, contribute to the regional economy, and create job opportunities. 4. Performance-Based Nature: A unique aspect of the agreement is that the return on funds provided is typically tied to the financial success of the participating company. This structure aligns the interests of both parties, as the fund benefits when the company thrives. III. Types of Cuyahoga Ohio Shared Earnings Agreement: 1. Equity-Based Agreement: This type of agreement involves funds investing in a company by purchasing equity shares or convertible debt. The fund becomes a shareholder, sharing in the company's profits or losses based on the agreed terms. 2. Revenue Share Agreement: In this type of agreement, funds provide financial assistance to the company as a loan or grant. However, instead of expecting equity, the fund receives a predetermined portion of the company's revenues or gross profits for a specified period. 3. Royalty Agreement: Under this arrangement, funds provide financial support to the company in exchange for a share of the company's future revenue. The fund receives royalties based on the sales of the company's products or services until a predetermined payback amount is reached. Conclusion: Cuyahoga Ohio Shared Earnings Agreement promotes collaborative growth between funds and businesses, nurturing economic development in the region. Through various agreement types such as equity-based, revenue share, and royalty agreements, funds provide financial resources in exchange for a share in the company's success. This innovative approach fosters local entrepreneurship, stimulates job creation, and positions Cuyahoga County as a thriving hub for economic advancement.

Cuyahoga Ohio Shared Earnings Agreement between Fund & Company

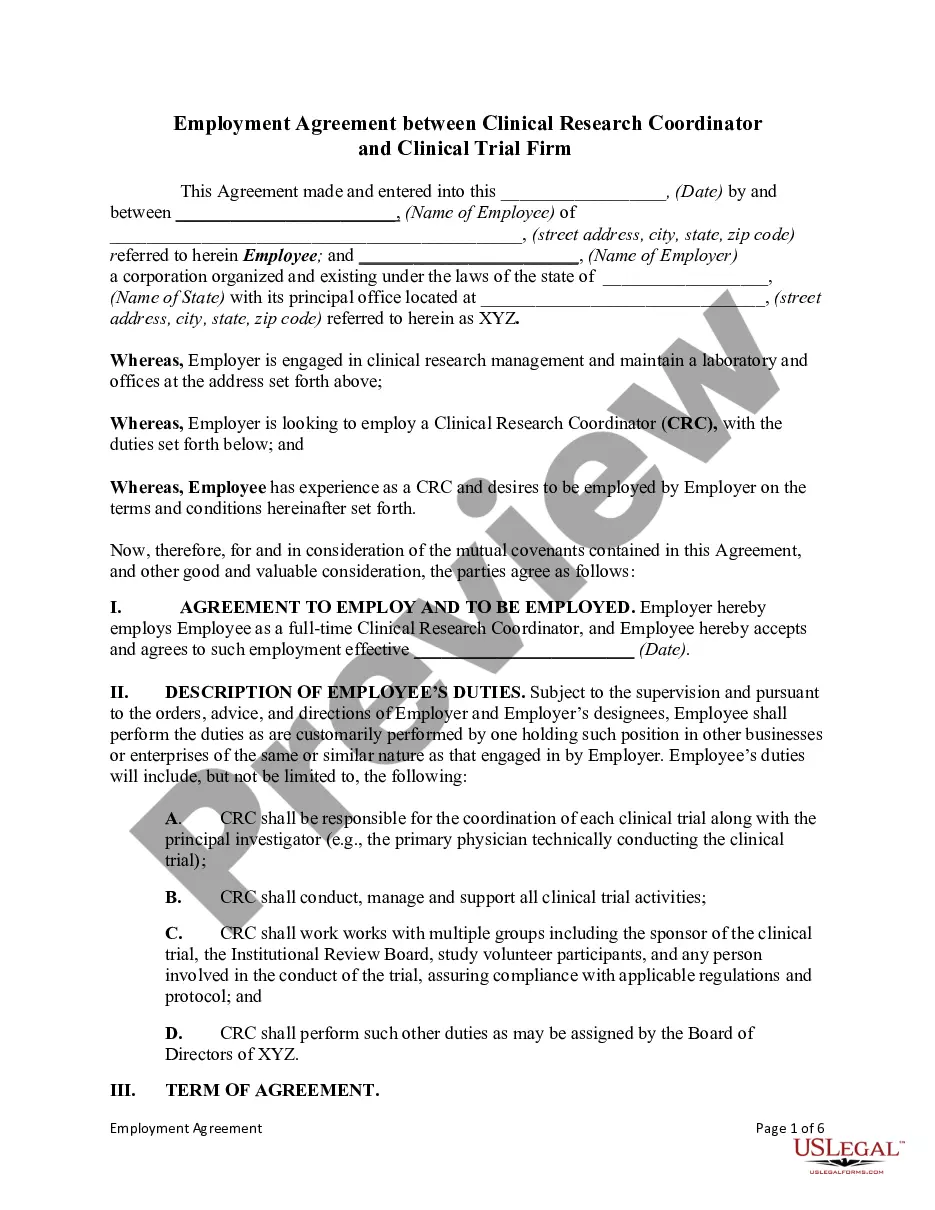

Description

How to fill out Cuyahoga Ohio Shared Earnings Agreement Between Fund & Company?

Drafting documents for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to generate Cuyahoga Shared Earnings Agreement between Fund & Company without expert help.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Cuyahoga Shared Earnings Agreement between Fund & Company by yourself, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Cuyahoga Shared Earnings Agreement between Fund & Company:

- Examine the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that meets your needs, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any situation with just a few clicks!