Fairfax Virginia is an idyllic city located in the Commonwealth of Virginia, United States. It is known for its rich history, diverse community, and vibrant economy. In the realm of finance, Fairfax Virginia has witnessed the emergence of a unique financial arrangement known as the Shared Earnings Agreement between Fund & Company. A Shared Earnings Agreement, also referred to as a SEA, is a contractual arrangement between a fund and a company. This type of agreement allows the fund to invest capital into a company in exchange for a share of the company's future earnings. It serves as an alternative approach to traditional equity or debt financing. Under a Fairfax Virginia Shared Earnings Agreement, the fund provides financial support to the company, helping it achieve its growth objectives. In return, the fund receives a predetermined percentage of the company's future earnings over a specified period, typically until a defined financial goal or a specific timeline is reached. The shared earnings percentage can vary based on factors such as the nature of the business, the company's growth potential, and negotiating power. It is designed to offer a fair and mutually beneficial arrangement for both the fund and the company, aligning their interests towards achieving financial success. There are different types of Shared Earnings Agreements between funds and companies in Fairfax Virginia, each tailored to meet specific requirements: 1. Traditional Shared Earnings Agreement: This encompasses a standard structure where the fund invests in the company and receives a pre-agreed percentage of the company's earnings. 2. Risk-Adjusted Shared Earnings Agreement: In this type of agreement, the fund's percentage of earnings can be adjusted based on the performance or risk associated with the company. It allows for a higher percentage of earnings if the company surpasses certain growth targets or vice versa. 3. Participating Shared Earnings Agreement: This type offers additional benefits to the fund. Along with a percentage of earnings, the fund also receives a share of any profits generated from selling the company, an initial public offering, or a merger/acquisition. Regardless of the specific type chosen, a Shared Earnings Agreement provides companies in Fairfax Virginia with an alternative financing option that offers flexibility compared to traditional debt or equity financing. It allows for faster access to capital while minimizing the burden of debt or dilution of ownership. Moreover, it aligns the interests of the fund and the company, fostering a collaborative approach towards achieving shared financial goals in Fairfax Virginia's thriving business ecosystem.

Fairfax Virginia Shared Earnings Agreement between Fund & Company

Description

How to fill out Fairfax Virginia Shared Earnings Agreement Between Fund & Company?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Fairfax Shared Earnings Agreement between Fund & Company, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Fairfax Shared Earnings Agreement between Fund & Company from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Fairfax Shared Earnings Agreement between Fund & Company:

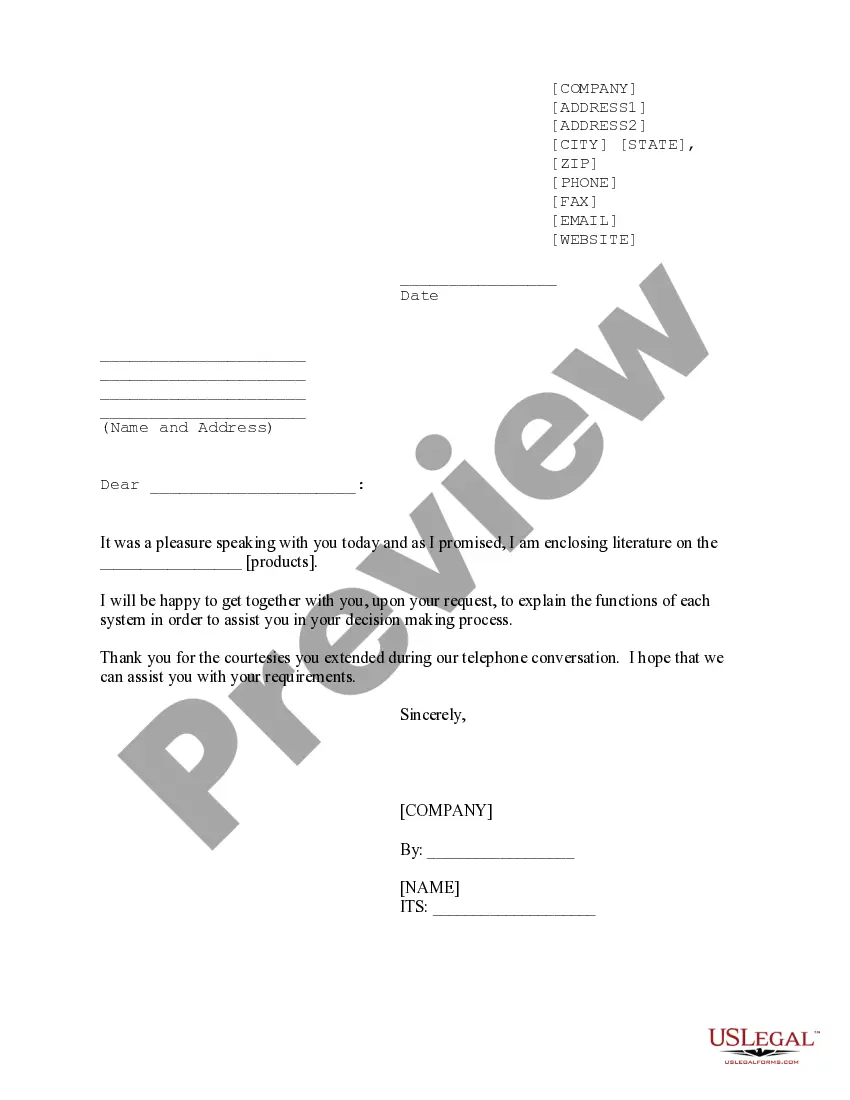

- Examine the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template when you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!