Hennepin Minnesota Shared Earnings Agreement between Fund & Company is a legal contract that outlines the terms and conditions for the profit-sharing arrangement between a fund and a company based in Hennepin County, Minnesota. This agreement is commonly used to establish a mutual understanding regarding the distribution of earnings and profits generated through joint ventures or collaborative business activities. The key components of the Hennepin Minnesota Shared Earnings Agreement between Fund & Company typically include the following: 1. Parties Involved: The contract identifies the participating fund and company, including their legal names, addresses, and contact details. It ensures that both entities are legally bound to the terms stated within the agreement. 2. Purpose and Scope: This section outlines the purpose of the shared earnings agreement, which may involve various business activities such as investments, acquisitions, partnerships, or other collaborative projects. It delineates the specific projects or initiatives covered under the agreement. 3. Equity Distribution: The agreement sets forth the agreed-upon method for distributing earnings and profits generated from the collaborative activities. It typically defines the ratio or percentage of profits shared between the fund and company, ensuring a fair and equitable distribution. 4. Reporting and Accounting: The contract includes provisions for regular reporting and accounting of the financial transactions related to the shared earnings. It outlines the frequency and format of financial statements that both the fund and company must provide to each other for transparency and tracking purposes. 5. Dispute Resolution: To address potential conflicts that may arise during the course of the agreement, a section on dispute resolution is included. It defines the methods for resolving disagreements, such as through mediation, arbitration, or litigation, with the intention of safeguarding the interests of both parties. 6. Termination and Amendments: In case either party wishes to terminate the agreement or make amendments to its terms, this section outlines the procedure for doing so. It may state the notice period required or specify conditions under which the agreement can be terminated. Different types of Hennepin Minnesota Shared Earnings Agreements between Fund & Company can exist based on the specific nature of the collaboration or partnership. For example: 1. Joint Venture Agreement: This type of agreement is formed when two or more entities enter into a business partnership to undertake a specific project or venture. The earnings and profits generated from this joint venture are then shared between the fund and company according to the terms outlined in the agreement. 2. Acquisition Agreement: In cases where a fund acquires a company, a shared earnings agreement may be established to determine the distribution of profits between the acquiring fund and the acquired company. The agreement ensures that both parties benefit from the financial success of the venture. 3. Partnership Agreement: When a fund and a company enter into a formal partnership to collaborate on multiple projects, a shared earnings agreement can be created to govern the profit-sharing arrangement. This type of agreement enables both entities to share the risks and rewards associated with their joint efforts. In conclusion, the Hennepin Minnesota Shared Earnings Agreement between Fund & Company forms the basis for a fair and transparent distribution of profits between a fund and a company engaging in collaborative business activities within Hennepin County, Minnesota.

Hennepin Minnesota Shared Earnings Agreement between Fund & Company

Description

How to fill out Hennepin Minnesota Shared Earnings Agreement Between Fund & Company?

How much time does it normally take you to draw up a legal document? Since every state has its laws and regulations for every life situation, finding a Hennepin Shared Earnings Agreement between Fund & Company suiting all local requirements can be tiring, and ordering it from a professional attorney is often expensive. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, gathered by states and areas of use. Aside from the Hennepin Shared Earnings Agreement between Fund & Company, here you can get any specific form to run your business or individual deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can get the file in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Hennepin Shared Earnings Agreement between Fund & Company:

- Examine the content of the page you’re on.

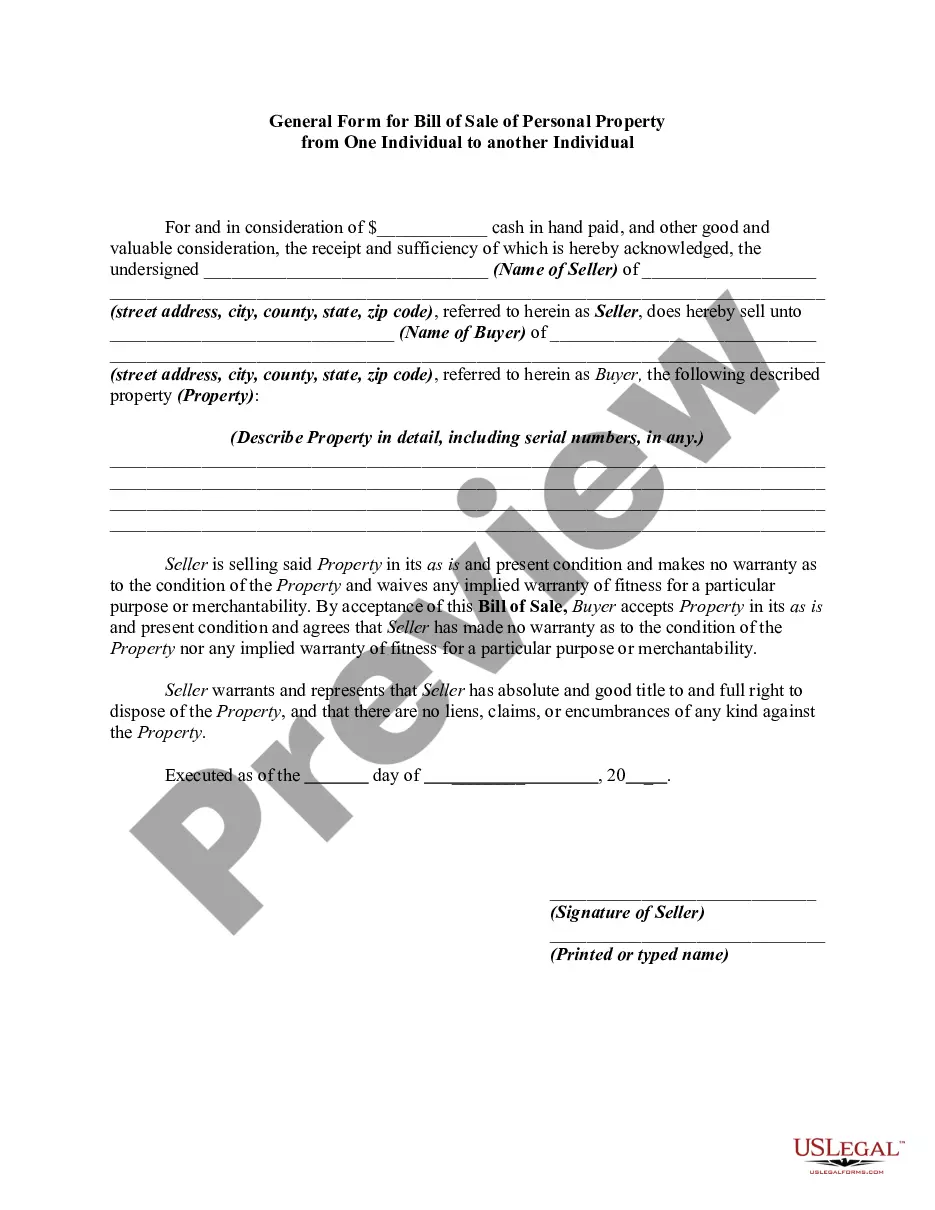

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Hennepin Shared Earnings Agreement between Fund & Company.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!