Kings New York Shared Earnings Agreement between Fund & Company is a financial arrangement that outlines the terms and conditions for profit sharing between a fund and a company based in New York. This agreement provides a framework for the distribution of earnings generated by the fund's investments, ensuring fair and transparent sharing of profits between the two parties. Keywords: Kings New York, Shared Earnings Agreement, Fund & Company, profit sharing, financial arrangement, New York. There can be different types of Kings New York Shared Earnings Agreement between Fund & Company, which include: 1. Fixed Percentage Agreement: This type of agreement specifies a fixed percentage of profits to be shared between the fund and the company. For example, if the agreement states a 70% profit share for the fund and 30% for the company, earnings will be distributed accordingly. 2. Performance-based Agreement: In this type of agreement, the profit sharing ratio is determined based on the fund's performance. The agreement may include benchmarks or performance targets that need to be met for a certain profit sharing ratio to apply. 3. Investor Participation Agreement: This agreement allows investors in the fund to participate in the earnings sharing. The fund may allocate a certain portion of its profits to the investors based on their capital contribution or a predetermined formula. 4. Equity-based Agreement: In some cases, the Kings New York Shared Earnings Agreement may involve the allocation of equity to the company in exchange for sharing profits. This can be in the form of shares or stock options, providing the company with a stake in the fund's success. 5. Hybrid Agreement: This type of agreement combines elements of different profit sharing models. It could include a fixed percentage along with performance-based adjustments or additional provisions depending on the specific needs and objectives of the fund and the company. Overall, Kings New York Shared Earnings Agreement between Fund & Company establishes a fair and mutually beneficial framework for profit sharing, ensuring transparency and aligning the interests of both parties involved.

Kings New York Shared Earnings Agreement between Fund & Company

Description

How to fill out Kings New York Shared Earnings Agreement Between Fund & Company?

How much time does it normally take you to draft a legal document? Since every state has its laws and regulations for every life sphere, finding a Kings Shared Earnings Agreement between Fund & Company meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Apart from the Kings Shared Earnings Agreement between Fund & Company, here you can find any specific form to run your business or personal affairs, complying with your regional requirements. Specialists verify all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can get the document in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Kings Shared Earnings Agreement between Fund & Company:

- Check the content of the page you’re on.

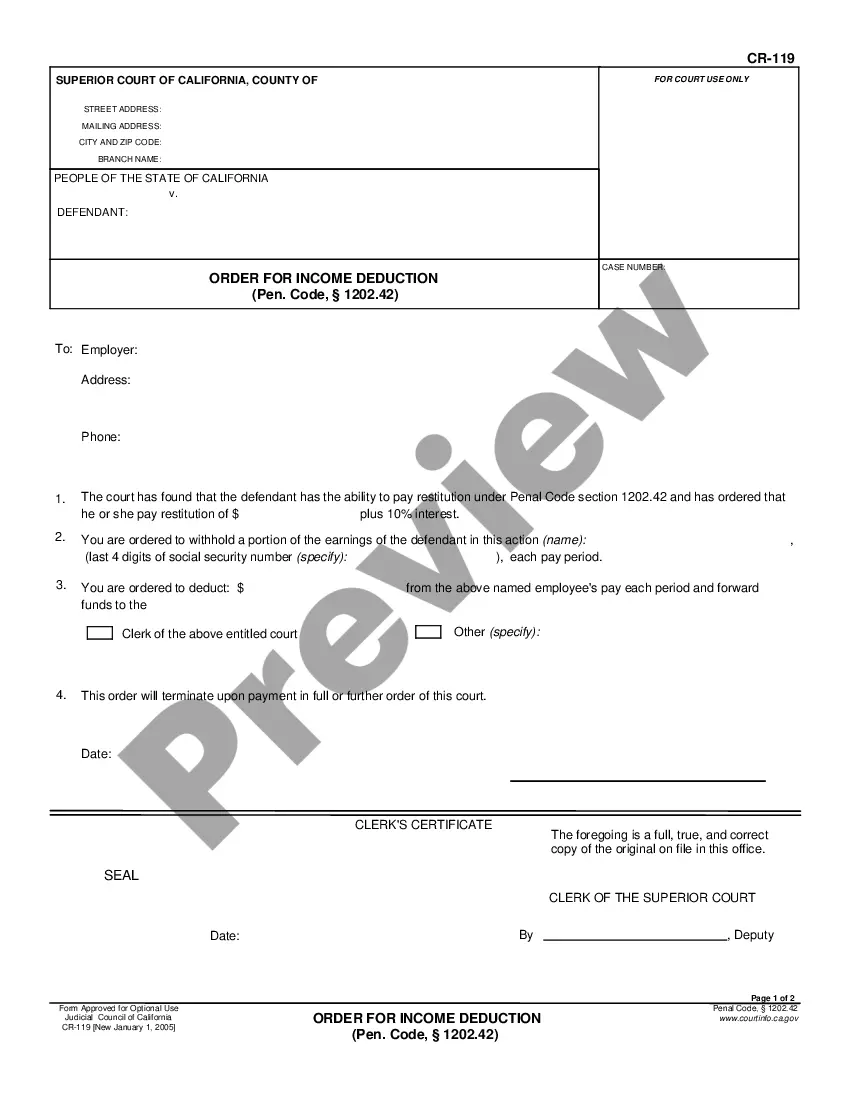

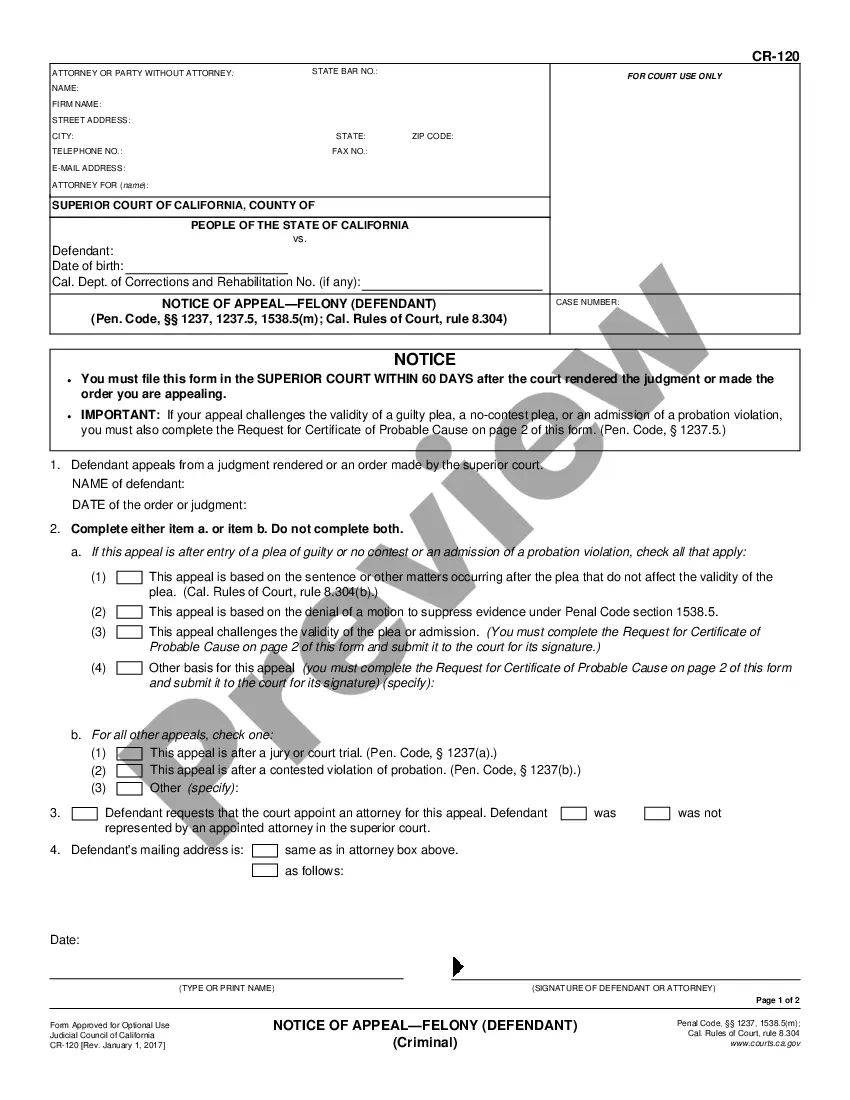

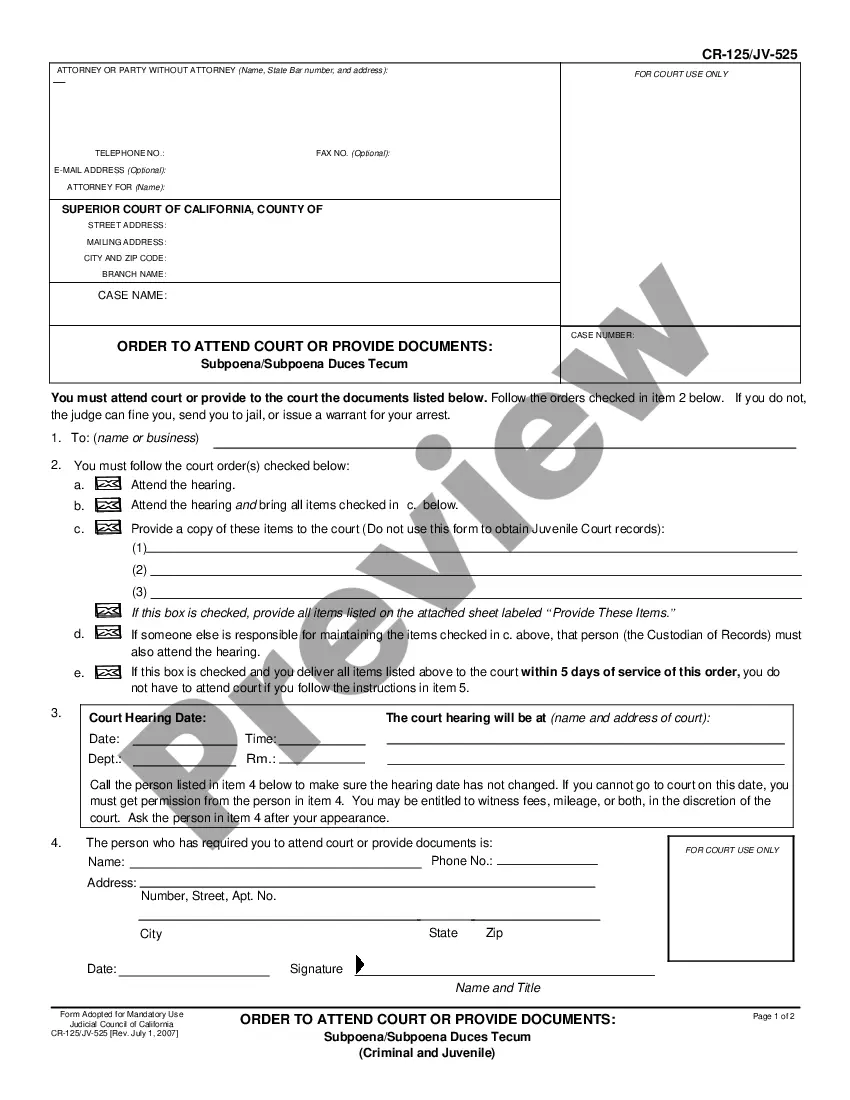

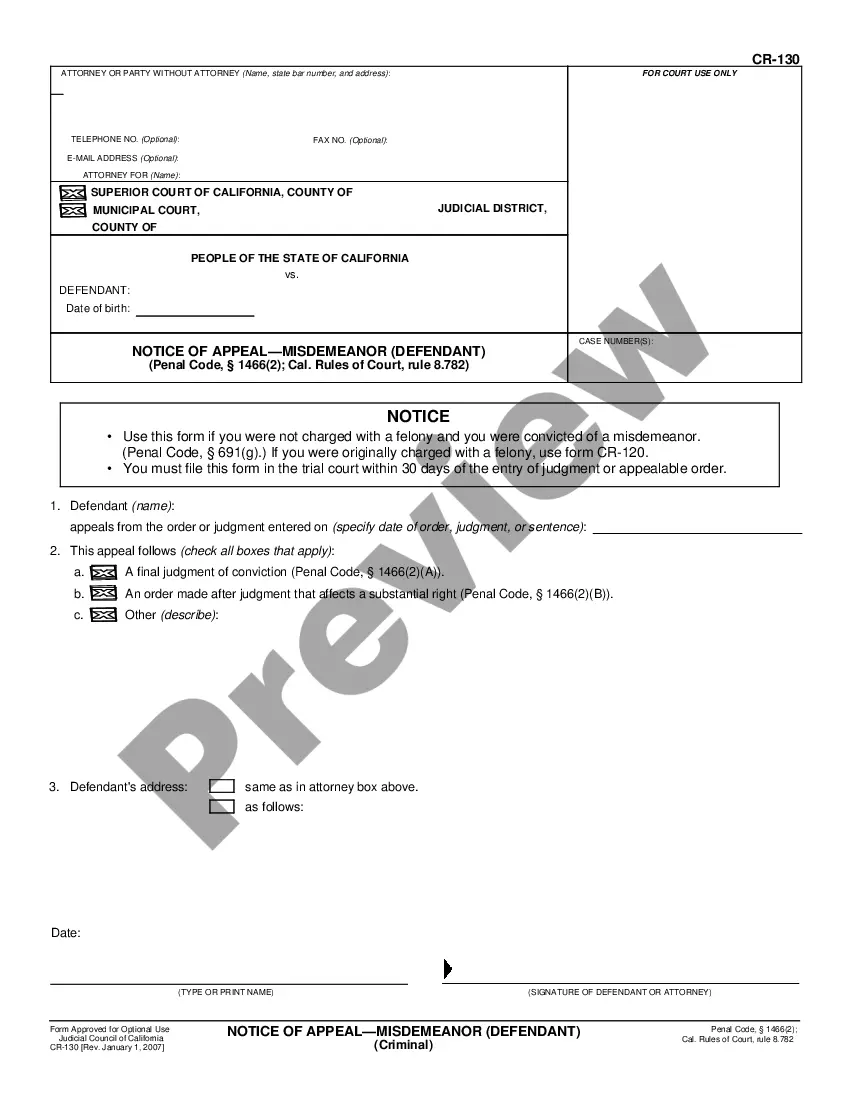

- Read the description of the template or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Kings Shared Earnings Agreement between Fund & Company.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!