Title: Understanding Queens, New York Shared Earnings Agreement Between Fund & Company Description: In Queens, New York, a Shared Earnings Agreement between a fund and a company establishes a legal framework that outlines the rights and obligations of both parties as they collaborate on a business venture. This detailed description provides an overview of the purpose, key components, and potential variations of Queens, New York Shared Earnings Agreements between funds and companies. Keywords: Queens, New York, Shared Earnings Agreement, fund, company, legal framework, rights, obligations, collaboration, business venture 1. Purpose of a Shared Earnings Agreement: A Shared Earnings Agreement in Queens, New York outlines how the funds and companies cooperate, manage risks, and share profits in joint ventures or investment partnerships. It serves as a foundational document, guiding negotiations and expectations. 2. Key Components: a. Profit Sharing: The agreement defines the percentage split of profits between the fund and company, serving as a fair and transparent mechanism for allocating earnings. b. Capital Contributions: The agreement outlines the financial contributions made by the fund and company, including initial investments, additional funding, or other resources. c. Management and Decision-making: Roles and responsibilities pertaining to the operation, decision-making, and fulfillment of operational obligations are detailed, ensuring effective coordination and cooperation. d. Risk Allocation: The agreement addresses the distribution of risks, liabilities, and potential losses between the fund and company, ensuring a balanced arrangement. e. Termination and Dispute Resolution: Provisions for terminating the agreement, mediation, or arbitration in case of disputes are included, providing a structured approach to resolving conflicts. 3. Types of Queens, New York Shared Earnings Agreements: a. Joint Venture Partnership: Where a fund and a company collaborate on a specific project, sharing risks, costs, and rewards. b. Investment Partnership: Where a fund provides capital to a company in exchange for a share of future profits, without direct operational involvement. c. Revenue Sharing Agreement: A variation where the fund receives a share of the company's revenue instead of profits, often used in arrangements involving licensing, franchising, or intellectual property rights. d. Equity Sharing Agreement: In this type of agreement, the fund receives equity ownership in the company and participates in both profits and losses. e. Performance-Based Agreement: A framework where the fund's earnings are based on predetermined performance metrics, incentivizing the company to achieve specific goals or milestones. In conclusion, a Queens, New York Shared Earnings Agreement between a fund and a company establishes the terms, rights, and obligations for working together in various business arrangements. By understanding the purpose, key components, and different variations, parties can draft comprehensive and effective agreements to ensure a mutually beneficial partnership.

Queens New York Shared Earnings Agreement between Fund & Company

Description

How to fill out Queens New York Shared Earnings Agreement Between Fund & Company?

Preparing paperwork for the business or personal needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to draft Queens Shared Earnings Agreement between Fund & Company without expert assistance.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Queens Shared Earnings Agreement between Fund & Company by yourself, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, follow the step-by-step guide below to get the Queens Shared Earnings Agreement between Fund & Company:

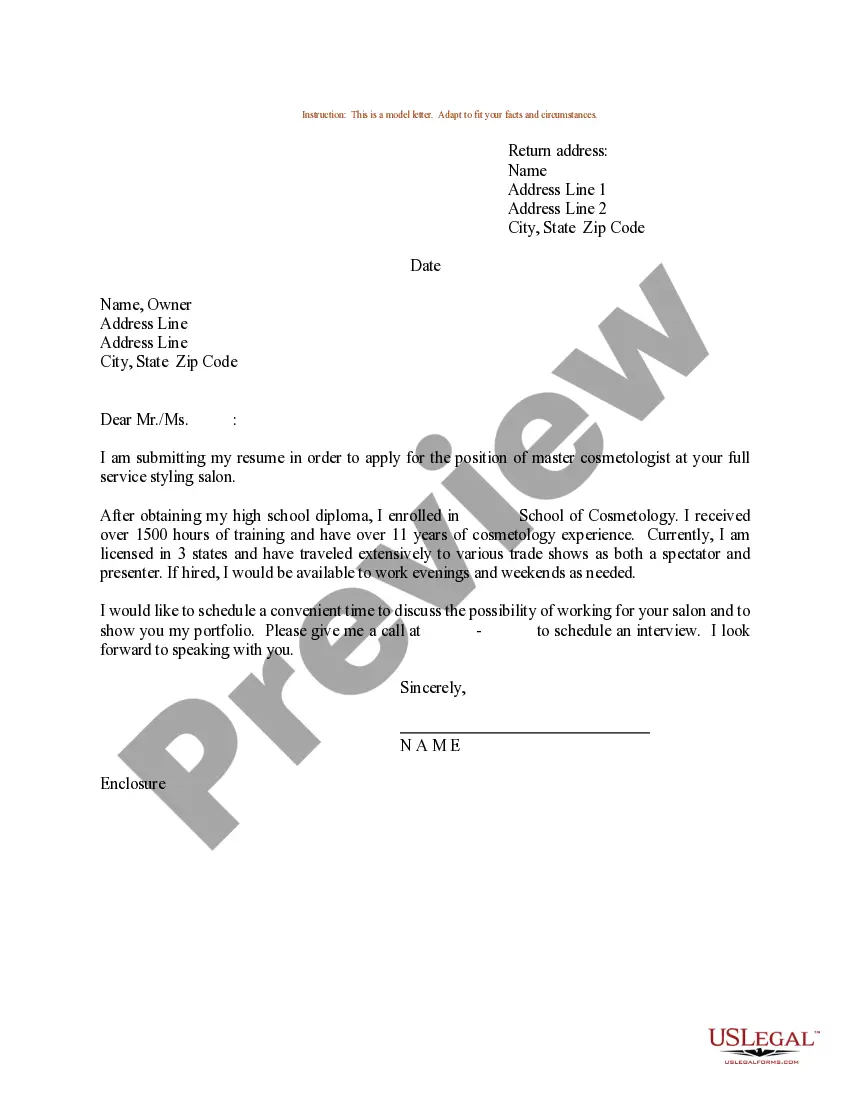

- Examine the page you've opened and verify if it has the sample you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that suits your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any scenario with just a few clicks!