A Tarrant Texas Shared Earnings Agreement between a fund and a company is a legal contract that outlines the terms and conditions of a profit-sharing arrangement between these parties. This agreement is commonly used in the Tarrant County area of Texas, and it establishes the framework for distributing profits based on a specific formula or percentage agreed upon by both the fund and the company. In this shared earnings agreement, the fund (typically an investor or investment fund) provides capital or financial resources to the company (usually a startup or small business) in exchange for a portion of its future profits. This mutually beneficial arrangement allows the company to access funds necessary for growth and development, while the fund has the potential to earn returns on its investment. Keywords: Tarrant Texas, shared earnings agreement, fund, company, profit-sharing arrangement, legal contract, terms and conditions, Tarrant County, Texas, distributing profits, specific formula, percentage, investor, investment fund, capital, financial resources, startup, small business, future profits, mutually beneficial arrangement, growth and development, returns on investment. There can be different types of Tarrant Texas Shared Earnings Agreement between a fund and a company, namely: 1. Fixed Percentage Agreement: This type of agreement states a predetermined percentage of the company's profits that will be shared with the fund. For example, the fund may receive 25% of the company's net profits. 2. Performance-based Agreement: In this type of agreement, the fund's share of profits is determined by the company's performance metrics, such as revenue growth, sales targets, or market share. The better the company performs, the higher the fund's share of earnings. 3. Tiered Agreement: A tiered agreement establishes different levels or tiers of profit-sharing based on predefined milestones or targets. As the company achieves these milestones, the fund's percentage of earnings gradually increases. 4. Time-based Agreement: This agreement structure outlines a specific period during which the fund is entitled to a share of the company's profits. For instance, the fund may receive earnings for a fixed number of years or until it recoups its initial investment. 5. Hybrid Agreement: A hybrid agreement combines elements of different types mentioned above. It may include a fixed percentage of profits combined with performance-based incentives or milestone-based tiers. These various types of Tarrant Texas Shared Earnings Agreements provide flexibility for both the fund and the company to tailor the agreement to their specific needs and circumstances. The choice of the agreement type often depends on factors such as the nature of the business, expected growth trajectory, risk tolerance, and investment objectives of the parties involved. Keywords: fixed percentage agreement, performance-based agreement, tiered agreement, time-based agreement, hybrid agreement, profit-sharing, predefined milestones, targets, revenue growth, sales targets, market share, flexibility, risk tolerance, investment objectives.

Tarrant Texas Shared Earnings Agreement between Fund & Company

Description

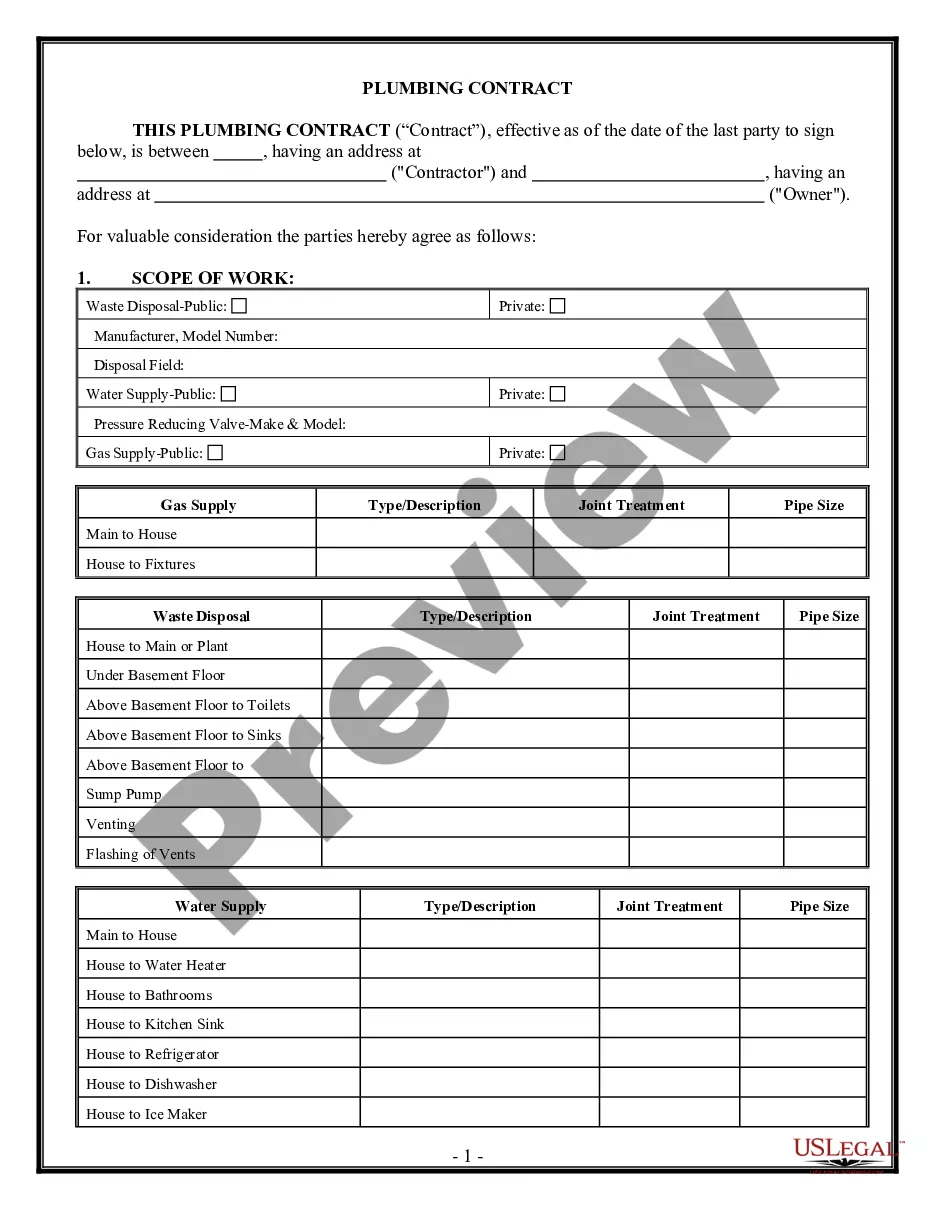

How to fill out Tarrant Texas Shared Earnings Agreement Between Fund & Company?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from scratch, including Tarrant Shared Earnings Agreement between Fund & Company, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in different categories varying from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching process less challenging. You can also find detailed resources and guides on the website to make any tasks associated with document completion simple.

Here's how you can find and download Tarrant Shared Earnings Agreement between Fund & Company.

- Take a look at the document's preview and outline (if provided) to get a general information on what you’ll get after downloading the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can affect the legality of some records.

- Check the related forms or start the search over to locate the appropriate document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and purchase Tarrant Shared Earnings Agreement between Fund & Company.

- Choose to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Tarrant Shared Earnings Agreement between Fund & Company, log in to your account, and download it. Of course, our website can’t replace an attorney completely. If you have to cope with an extremely challenging case, we advise using the services of a lawyer to examine your form before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Become one of them today and purchase your state-compliant documents with ease!