Wayne Michigan Shared Earnings Agreement between Fund & Company is a legal contract that outlines the terms and conditions for profit sharing between a fund and a company located in Wayne, Michigan. This type of agreement is commonly used in various investment scenarios, where a fund provides financial backing to a company in exchange for a share of the company's future profits. Key elements of a Wayne Michigan Shared Earnings Agreement include the specific percentage of earnings the fund is entitled to, the duration of the agreement, and any conditions for termination or modification. This agreement also typically covers the process for distributing the shared earnings and may include provisions for dispute resolution and confidentiality. There can be several variations of Wayne Michigan Shared Earnings Agreements between Fund & Company, each tailored to the specific needs and objectives of the parties involved. Some common types include: 1. Equity-Based Shared Earnings Agreement: This type of agreement involves the fund receiving a percentage of the company's equity ownership instead of immediate cash profits. The fund becomes a shareholder in the company and benefits from any increase in the value of the equity over time. 2. Revenue or Sales-Based Shared Earnings Agreement: In this agreement, the fund receives a predetermined percentage of the company's total revenue or sales. The fund's share is directly linked to the company's performance in generating income, incentivizing both parties to focus on driving revenue growth. 3. Project-Based Shared Earnings Agreement: In certain situations, funds may enter into an agreement with a company to fund a specific project or initiative. In this case, the fund's earnings may be directly tied to the success and profitability of that particular project, rather than overall company profits. 4. Hybrid Shared Earnings Agreement: This type of agreement combines elements of different earning models, allowing funds and companies to customize the profit-sharing structure based on their specific business goals and risk appetite. It may include a combination of equity, revenue, or project-based earnings sharing. It is important for both parties involved in a Wayne Michigan Shared Earnings Agreement to consult with legal counsel or financial advisors to ensure that the terms and conditions of the agreement are fair, clear, and legally enforceable.

Wayne Michigan Shared Earnings Agreement between Fund & Company

Description

How to fill out Wayne Michigan Shared Earnings Agreement Between Fund & Company?

How much time does it normally take you to create a legal document? Since every state has its laws and regulations for every life scenario, locating a Wayne Shared Earnings Agreement between Fund & Company meeting all local requirements can be tiring, and ordering it from a professional lawyer is often pricey. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. In addition to the Wayne Shared Earnings Agreement between Fund & Company, here you can get any specific document to run your business or individual affairs, complying with your regional requirements. Experts verify all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can get the file in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Wayne Shared Earnings Agreement between Fund & Company:

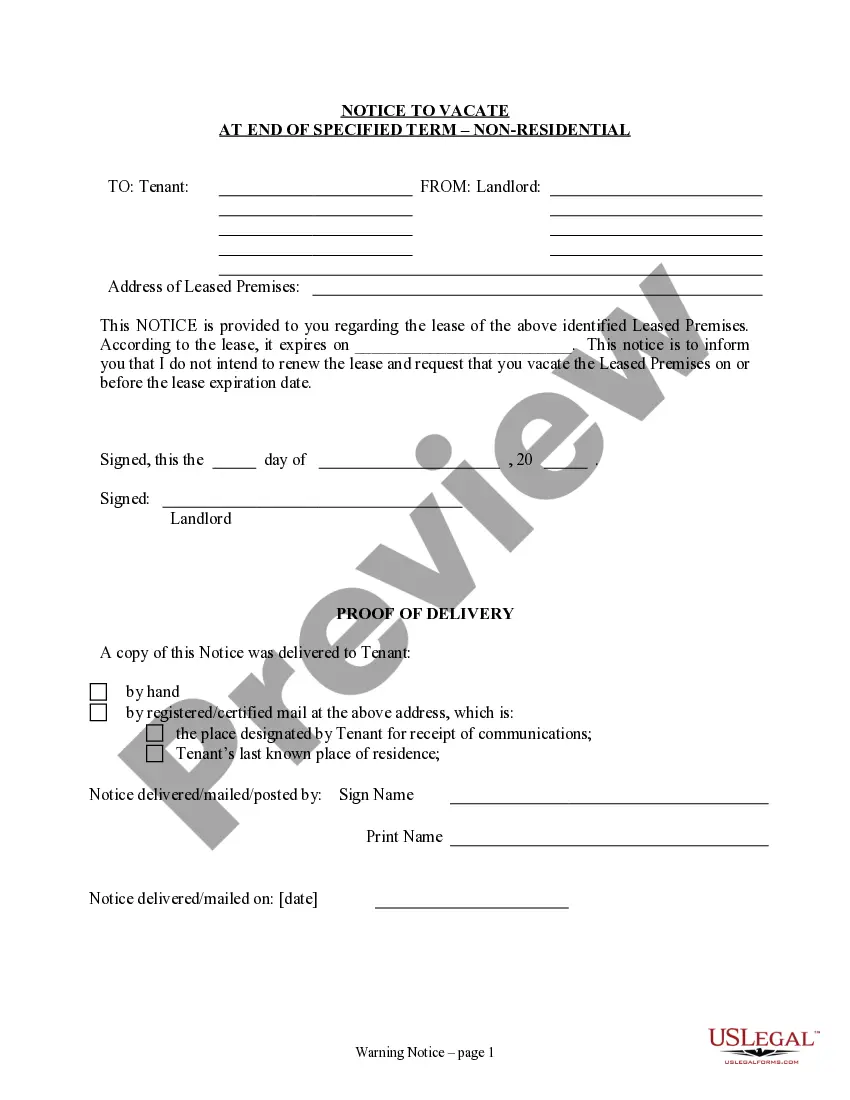

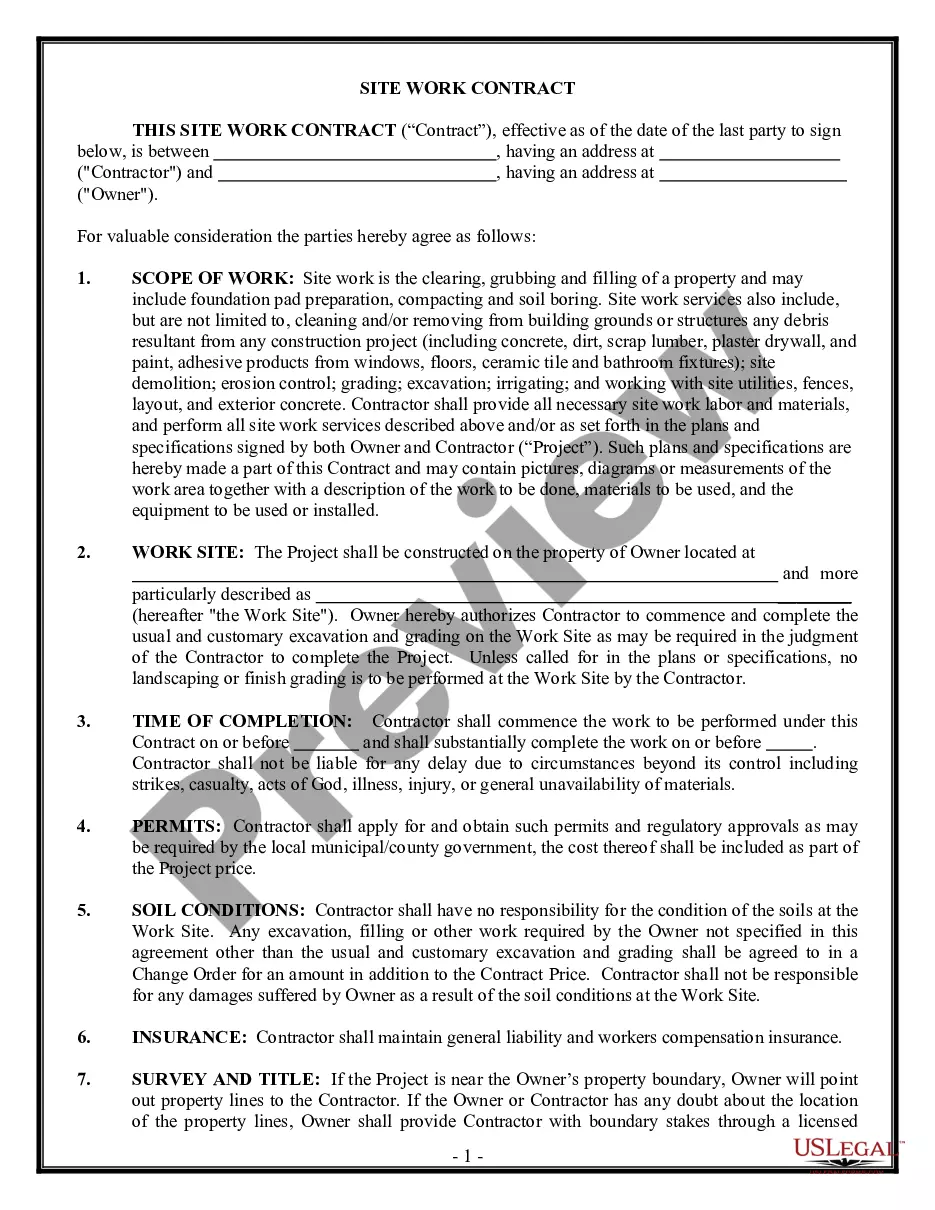

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Wayne Shared Earnings Agreement between Fund & Company.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!