The Kings New York Investors Rights Agreement is a legal document that establishes the rights and provisions for investors who acquire shares in Kings New York, a prominent business entity. This agreement outlines the various terms and conditions that safeguard the rights and protect the interests of the investors. One type of Kings New York Investors Rights Agreement is the Preferred Investors Rights Agreement. This specific agreement sets out the rights and privileges granted exclusively to preferred investors who hold a certain class of shares in the company. These investors typically receive preferential treatment in regard to dividends, voting rights, liquidation preferences, and other key areas. Another type is the Common Investors Rights Agreement. This agreement grants rights to common investors who hold ordinary shares in Kings New York. While their rights may be more limited compared to preferred investors, they still benefit from essential provisions such as information rights, anti-dilution protection, and the ability to participate in future financing rounds. The Kings New York Investors Rights Agreement typically includes clauses that cover important aspects such as board representation, transfer restrictions, registration rights, and information rights. Board representation provisions may outline the number of board seats allocated to investors, ensuring their representation and input in decision-making processes. Transfer restrictions clauses restrict the transfer of investor's shares without fulfilling certain conditions, thereby protecting the value and stability of the investment. These restrictions often include rights of first refusal, tag-along rights, and drag-along rights, ensuring that investors have some control over the transfer of shares. Registration rights provisions grant investors the right to request the company to register their shares with appropriate regulatory bodies for public trading purposes. This enables investors to sell their shares on the open market, providing liquidity to their investment. Information rights clauses mandate the company to provide investors with regular financial reports, audit results, and other pertinent information. This transparency helps investors assess the company's financial health and make informed decisions. Overall, the Kings New York Investors Rights Agreement plays a crucial role in establishing a fair and equitable framework for investors, ensuring their protections, rights, and involvement in the company's affairs. Whether it is the Preferred Investors Rights Agreement or the Common Investors Rights Agreement, these agreements define the relationship between the business entity and its investors, fostering transparency, trust, and cooperation.

Kings New York Investors Rights Agreement

Description

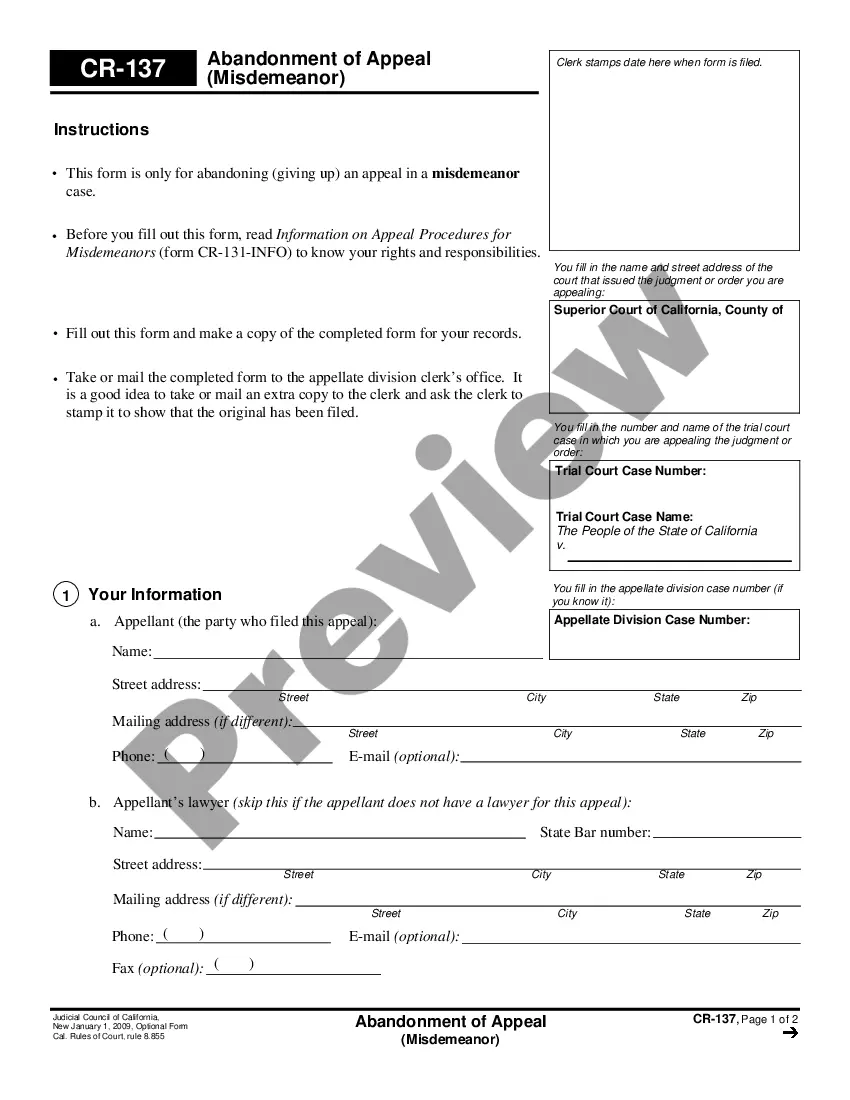

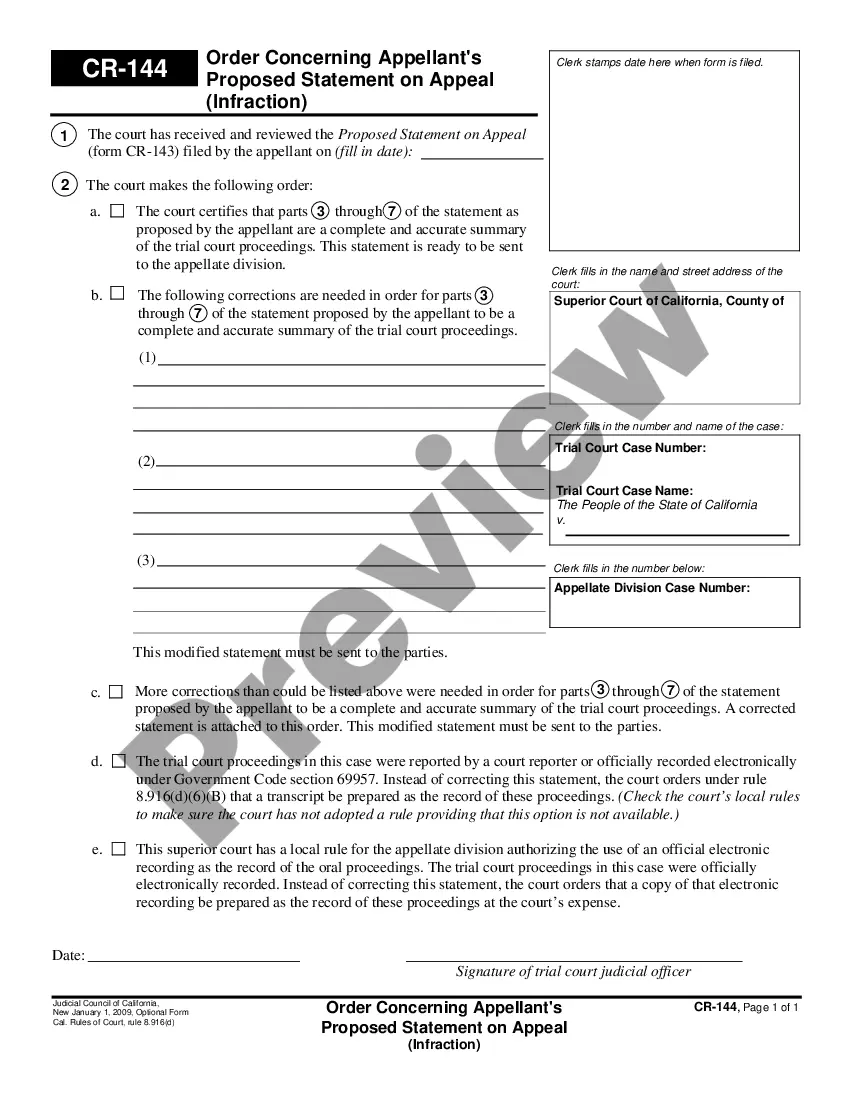

How to fill out Kings New York Investors Rights Agreement?

Do you need to quickly create a legally-binding Kings Investors Rights Agreement or probably any other document to manage your personal or business affairs? You can select one of the two options: contact a professional to write a valid paper for you or draft it entirely on your own. Luckily, there's an alternative option - US Legal Forms. It will help you get neatly written legal papers without having to pay sky-high prices for legal services.

US Legal Forms offers a rich collection of over 85,000 state-compliant document templates, including Kings Investors Rights Agreement and form packages. We provide templates for an array of life circumstances: from divorce papers to real estate documents. We've been out there for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the needed document without extra hassles.

- First and foremost, carefully verify if the Kings Investors Rights Agreement is adapted to your state's or county's regulations.

- If the form has a desciption, make sure to verify what it's intended for.

- Start the searching process over if the template isn’t what you were hoping to find by using the search bar in the header.

- Choose the subscription that best suits your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Kings Investors Rights Agreement template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. Moreover, the templates we offer are updated by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!