Orange California Investors Rights Agreement refers to a legally binding document that outlines the rights and protections offered to investors in Orange, California. It serves as a crucial agreement between the investors and the company, ensuring the equitable treatment and safeguarding the interests of investors. The Investors Right Agreement specifies the various rights and privileges granted to investors, including the disclosure of reliable financial information, access to key company records, voting rights, anti-dilution provisions, preemptive rights, and liquidation preferences. It aims to balance the interests of both the company and investors, fostering transparency and trust in the investment process. In Orange, California, there may be different types of Investors Rights Agreements based on the specific needs and characteristics of the investments. Some notable variations include: 1. Preferred Stock Investors Rights Agreement: This agreement caters to investors who hold preferred stock in the company, offering them specific rights and protections unique to this class of shareholders. 2. Common Stock Investors Rights Agreement: This type of agreement is designed for investors who hold common stock in the company. It outlines the rights and protections granted to this category of investors. 3. Convertible Note Investors Rights Agreement: In the case of investors who have acquired convertible notes, this agreement provides them with specific rights and protections associated with their investment instrument. These different types of Investors Rights Agreements maintain the core principles of investor protection, while adapting to the specific characteristics of the investment structure. It is crucial for both investors and the company to carefully review and negotiate the terms of the agreement to ensure a fair and transparent investment process. In conclusion, the Orange California Investors Rights Agreement is a comprehensive legal document that safeguards the rights and interests of investors in Orange, California. It ensures transparency, disclosure, and equitable treatment for investors, while fostering mutual trust between companies and their investors.

Orange California Investors Rights Agreement

Description

How to fill out Orange California Investors Rights Agreement?

Laws and regulations in every area vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Orange Investors Rights Agreement, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Orange Investors Rights Agreement from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Orange Investors Rights Agreement:

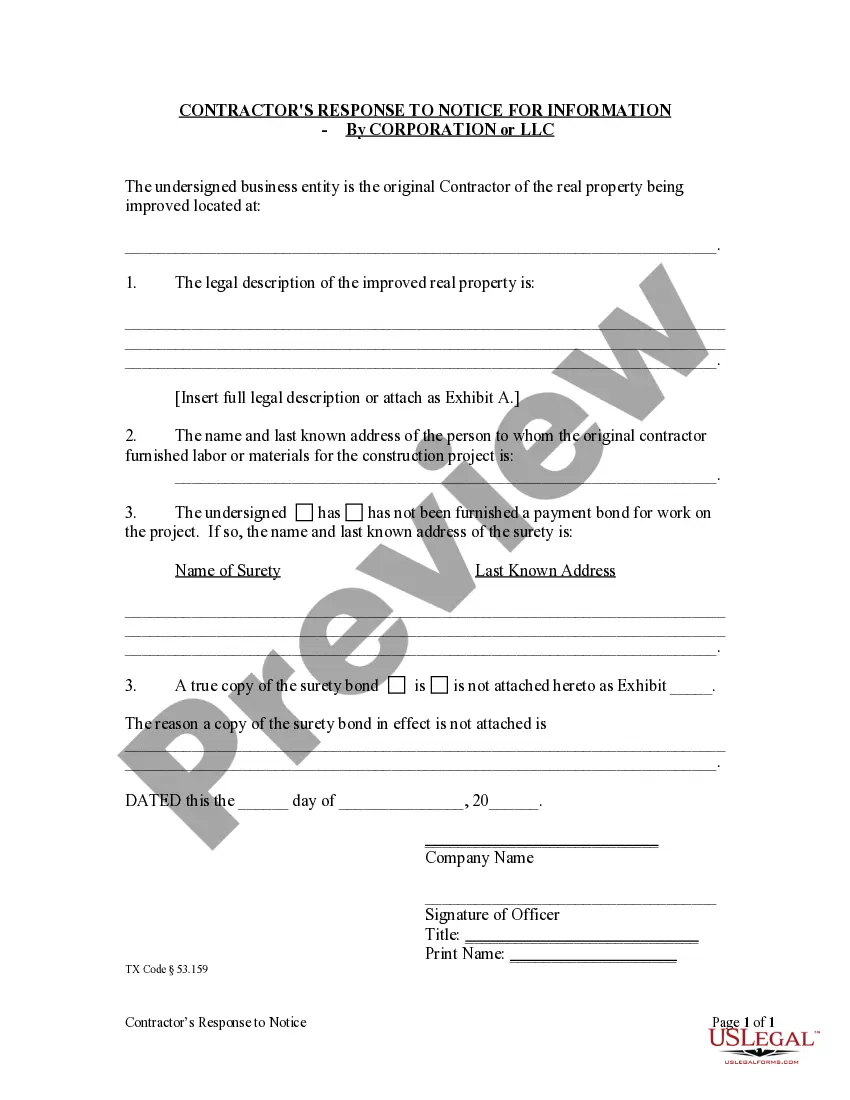

- Take a look at the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document when you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Piggyback registration rights, where the investor is entitled to register its securities when either the company or another investor initiates the registration. Holders of piggyback rights are allowed to include their securities in a registration initiated by the company or another investor.

Piggyback registration rights are a form of registration rights that grants the investor the right to register their unregistered stock when either the company or another investor initiates a registration.

The right of first refusal and co-sale (ROFR/Co-sale) work together to prevent a founder or major common shareholder for selling shares without the company and the investors being allowed to purchase the shares or participate in the sale of the shares.

Investors that own restricted shares of a privately-held company need access to a broader market to eventually sell those shares. Such investors need to have the right or ability to require the company to list the shares publicly.

The right to vote on all major business decisions; The right to be informed about all significant business decisions; The right to sue you or the company if they feel their rights aren't be respected.

An Investor Rights Agreement (IRA) is an agreement between an investor and a company that contractually guarantees the investor certain rights including, but not limited to, voting rights, inspection rights, rights of first refusal, and observer rights.

An equity investment agreement occurs when investors agree to give money to a company in exchange for the possibility of a future return on their investment. Equity is one of the most attractive types of capital for entrepreneurs, thanks to wealthy investor partners and no repayment schedule.

Tag-along rights also referred to as "co-sale rights," are contractual obligations used to protect a minority shareholder, usually in a venture capital deal. If a majority shareholder sells his stake, it gives the minority shareholder the right to join the transaction and sell their minority stake in the company.

In an unregistered securities offering, an agreement between the issuer and the purchasers of the security that creates an obligation for the issuer to register the re-offer and resale of the securities being offered at some time in the future (usually within six months).