Wayne Michigan Investors Rights Agreement is a legal document that outlines the rights and protections granted to investors in Wayne, Michigan. This agreement serves as a safeguard for the interests of investors and ensures that they have certain privileges, control, and information access regarding their investments in the region. It establishes a transparent and fair framework for investors, ensuring their confidence and protection. The Wayne Michigan Investors Rights Agreement covers various important aspects, such as ownership rights, financial transparency, governance, and exit strategies. By clearly defining these key areas, the agreement aims to establish a balance between the interests of investors and the business or project in which they are investing. The agreement typically grants investors certain rights and privileges. These can include the right to review financial documents and receive regular updates on the performance of the investment. Investors may also have the right to participate in the decision-making process, such as voting on major business decisions or electing board members. The agreement may also outline the rights and procedures for investors to exit their investment, whether through an initial public offering (IPO), acquisition, or other means. Within the realm of Wayne Michigan Investors Rights Agreement, there might be variations or different types of agreements tailored to specific circumstances. These may include: 1. Early-stage Investors Rights Agreement: This type of agreement is specifically designed for early-stage investments, such as seed funding or venture capital. It may focus on providing additional protections to investors who are taking a higher risk by investing in new or established businesses. 2. Minority Investors Rights Agreement: In cases where investors hold a minority stake in a company, this agreement may provide specific rights to protect their interests, ensuring they have a say and are not ignored in major decision-making. 3. Preferred Stock Investors Rights Agreement: When investors hold preferred stock to common stock, this type of agreement outlines the specific rights conferred upon them, such as priority in dividend distributions or liquidation proceedings. In conclusion, the Wayne Michigan Investors Rights Agreement is a vital legal tool that safeguards the interests of investors in the region. It provides a framework for transparency, control, and protection, allowing investors to have a voice in their investments and ensuring their rights are respected. Different types of agreements may exist depending on the circumstances, such as early-stage, minority, or preferred stock investors' rights agreements.

Wayne Michigan Investors Rights Agreement

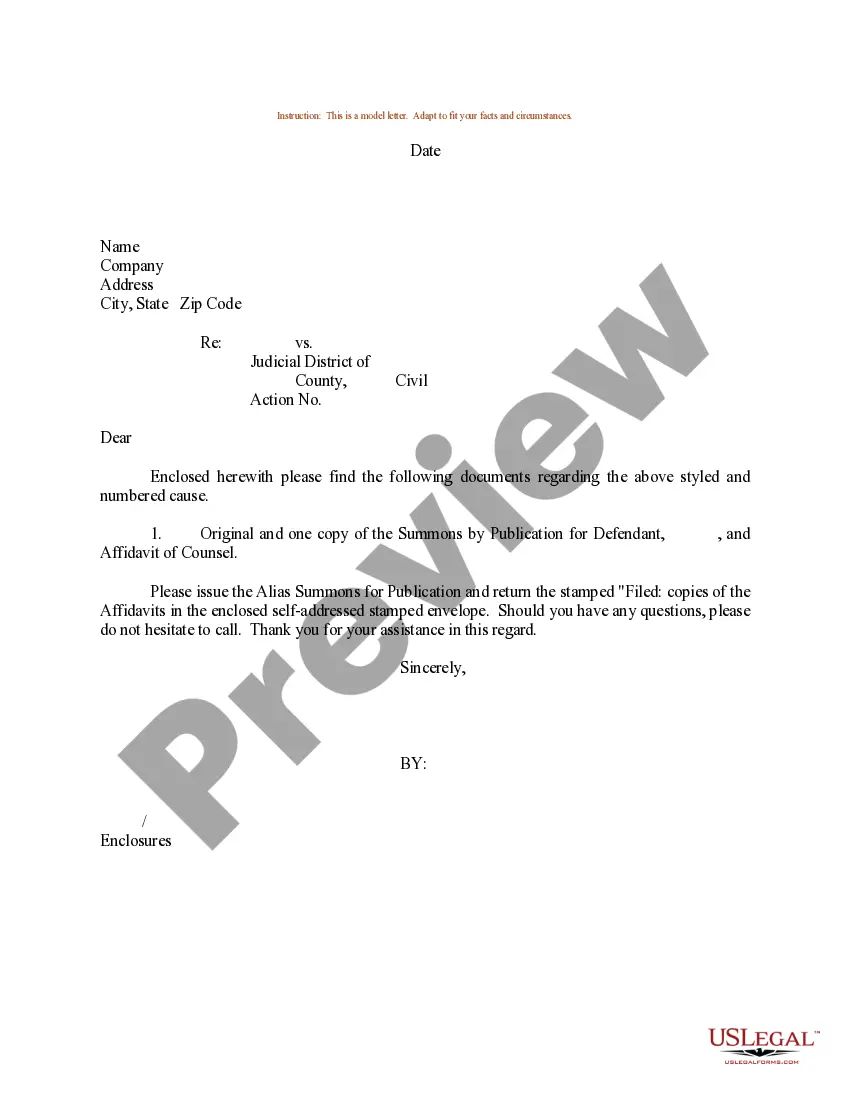

Description

How to fill out Wayne Michigan Investors Rights Agreement?

Draftwing paperwork, like Wayne Investors Rights Agreement, to manage your legal matters is a difficult and time-consumming process. Many circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can acquire your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents created for various scenarios and life circumstances. We ensure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Wayne Investors Rights Agreement template. Simply log in to your account, download the template, and customize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before downloading Wayne Investors Rights Agreement:

- Make sure that your form is specific to your state/county since the rules for writing legal papers may vary from one state another.

- Find out more about the form by previewing it or going through a brief description. If the Wayne Investors Rights Agreement isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin utilizing our website and get the form.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is ready to go. You can try and download it.

It’s easy to locate and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!