Franklin Ohio Notice Concerning Introduction of Remuneration Plan for Shares with Restriction On Introduction: The Franklin Ohio Notice Concerning Introduction of Remuneration Plan for Shares with Restriction On provides important information regarding the implementation of a new remuneration plan for company shares that are subject to certain restrictions. This notice aims to outline the details, benefits, and various types of remuneration plans available to shareholders in Franklin, Ohio. Keywords: Franklin, Ohio, Notice, Introduction, Remuneration Plan, Shares, Restriction On 1. Definition of Remuneration Plan: A remuneration plan refers to a comprehensive framework established by a corporation to reward its shareholders by providing them with additional benefits in the form of restricted shares. These remuneration plans are designed to incentivize shareholders and align their interests with the long-term growth and success of the company. 2. Purpose and Benefits of the Remuneration Plan: The primary purpose of the remuneration plan is to motivate and retain key stakeholders within the Franklin, Ohio community by offering them an opportunity to participate in the company's future growth. This plan ensures that shareholders are rewarded for their commitment and loyalty, fostering a stronger relationship between the company and its investors. By implementing a remuneration plan for shares with restrictions, Franklin, Ohio-based companies aim to create a sense of ownership among shareholders and encourage them to actively contribute to the organization's progress. This plan can significantly increase shareholder engagement and align their interests with the company's overall goals. 3. Types of Remuneration Plans with Restrictions: a) Restricted Stock Units (RSS): RSS are a common form of restricted share plan wherein shareholders are granted a specific number of company shares, subject to certain vesting conditions. These restrictions may include a predetermined holding period or achievement of performance goals. Once the restrictions are lifted, shareholders can fully exercise their ownership rights on the allocated shares. b) Performance Share Units (Plus): Plus are similar to RSS; however, their vesting is dependent on specific performance metrics set by the company. To acquire ownership of shares, shareholders must meet or exceed the established performance targets, ensuring alignment of interests between the shareholders and the corporation. c) Stock Option Plans: Stock option plans provide shareholders with the right to purchase company shares at a predetermined price, known as the exercise price or strike price. These plans often have vesting restrictions and expiration dates, offering shareholders the potential to profit when the share price increases. d) Phantom Stock Plans: Phantom stock plans are a type of remuneration plan that provides shareholders with units that track the company's stock performance without actual ownership. This type of plan allows shareholders to benefit from the increase in stock valuation but does not grant voting rights or shareholder privileges. Conclusion: The Franklin Ohio Notice Concerning Introduction of Remuneration Plan for Shares with Restriction On provides shareholders with valuable information about the benefits and types of remuneration plans available to them. By implementing these plans, companies in Franklin, Ohio aim to foster strong relationships with their shareholders, enhance shareholder engagement, and align the interests of the community with the long-term success of the business.

Franklin Ohio Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on Transfer

Description

How to fill out Franklin Ohio Notice Concerning Introduction Of Remuneration Plan For Shares With Restriction On Transfer?

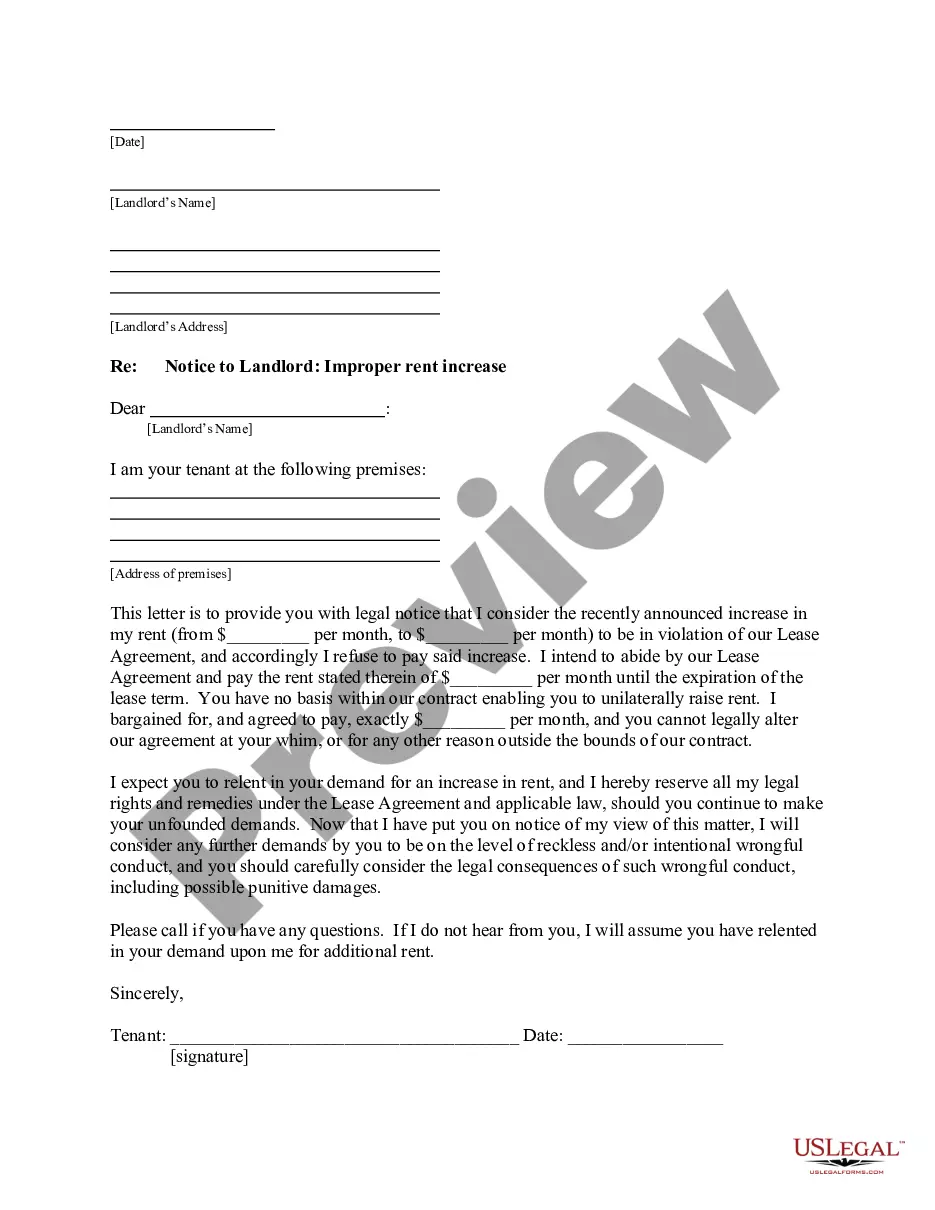

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including Franklin Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different categories varying from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find detailed resources and tutorials on the website to make any activities related to paperwork completion straightforward.

Here's how to find and download Franklin Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on.

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after getting the form.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can impact the validity of some documents.

- Check the related document templates or start the search over to locate the right file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment gateway, and purchase Franklin Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Franklin Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on, log in to your account, and download it. Of course, our website can’t take the place of an attorney entirely. If you have to cope with an exceptionally challenging situation, we recommend getting a lawyer to check your document before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Become one of them today and get your state-specific documents effortlessly!