Title: King Washington's Notice Concerning Introduction of Remuneration Plan for Shares with Restriction On: Comprehensive Overview and Types Explained Introduction: In this detailed description, we will delve into the topic of King Washington's Notice Concerning Introduction of Remuneration Plan for Shares with Restriction On. We will explore what this notice entails, its importance, and provide further information about different types of remuneration plans associated with restricted shares. This article aims to provide clarity and insight into this important aspect of King Washington's business operations. 1. What is King Washington's Notice Concerning Introduction of Remuneration Plan for Shares with Restriction On? The Notice Concerning Introduction of Remuneration Plan for Shares with Restriction On issued by King Washington is a formal announcement outlining the implementation of a new remuneration plan for employees and stakeholders. This plan revolves around granting restricted shares that come with specific limitations or conditions, regulating their ownership, transfer, and selling. 2. Importance of the Notice: This notice signifies King Washington's commitment to aligning employee and shareholder interests with the long-term success and growth of the company. By incorporating a remuneration plan involving restricted shares, King Washington intends to motivate, reward, and retain valuable talent while fostering a sense of ownership and responsibility among participants. 3. Types of Remuneration Plans for Shares with Restriction On: a) Restricted Stock Units (RSS): RSS are a type of remuneration plan where employees receive a promise to receive shares equal to their value at a specified future date. However, until the specified vesting period elapses, employees do not possess actual shares. b) Restricted Stock Awards (SAS): SAS are grants of actual company shares that are subject to specific restrictions. These restrictions may include time-based vesting, performance objectives, or other predetermined conditions. c) Performance Share Units (Plus): Plus are remuneration plans tied to specific performance targets. Upon achieving the set goals, employees receive shares as a reward. Plus incentivize employees to contribute significantly to the company's growth and success. d) Stock Appreciation Rights (SARS): SARS are a form of remuneration where employees are granted the right to receive the appreciation in the company's stock value over a specific period. Employees do not have direct ownership of shares but can benefit from the stock's value growth. Conclusion: The introduction of a Remuneration Plan for Shares with Restriction On clearly demonstrates King Washington's proactive approach towards incentivizing and rewarding its employees and stakeholders. Through various types of remuneration plans, King Washington aims to cultivate a culture of shared success, ultimately driving the company's growth and prosperity. By embracing this transparent and structured approach, King Washington anticipates promoting retention, motivation, and the long-term commitment of its valued workforce and shareholders.

King Washington Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on Transfer

Description

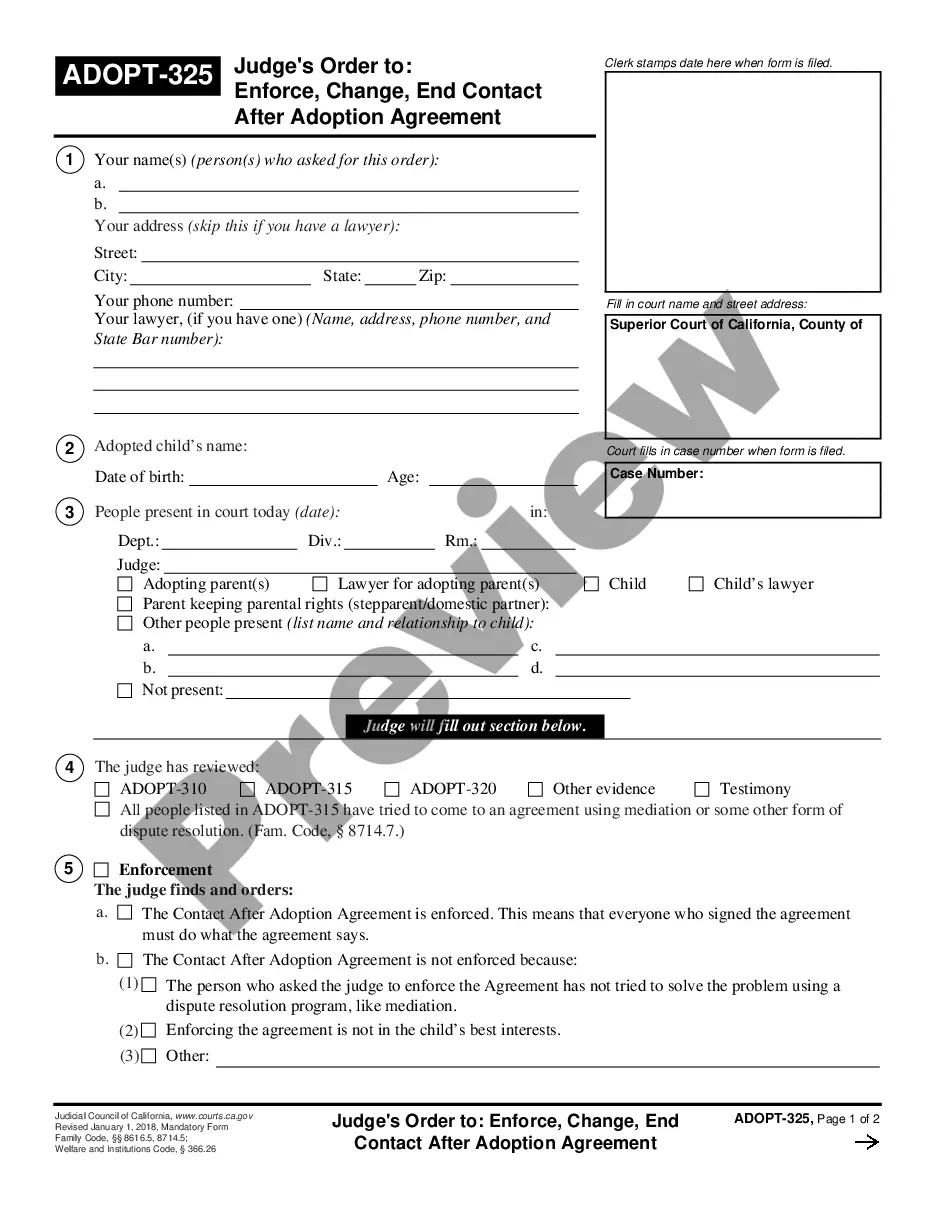

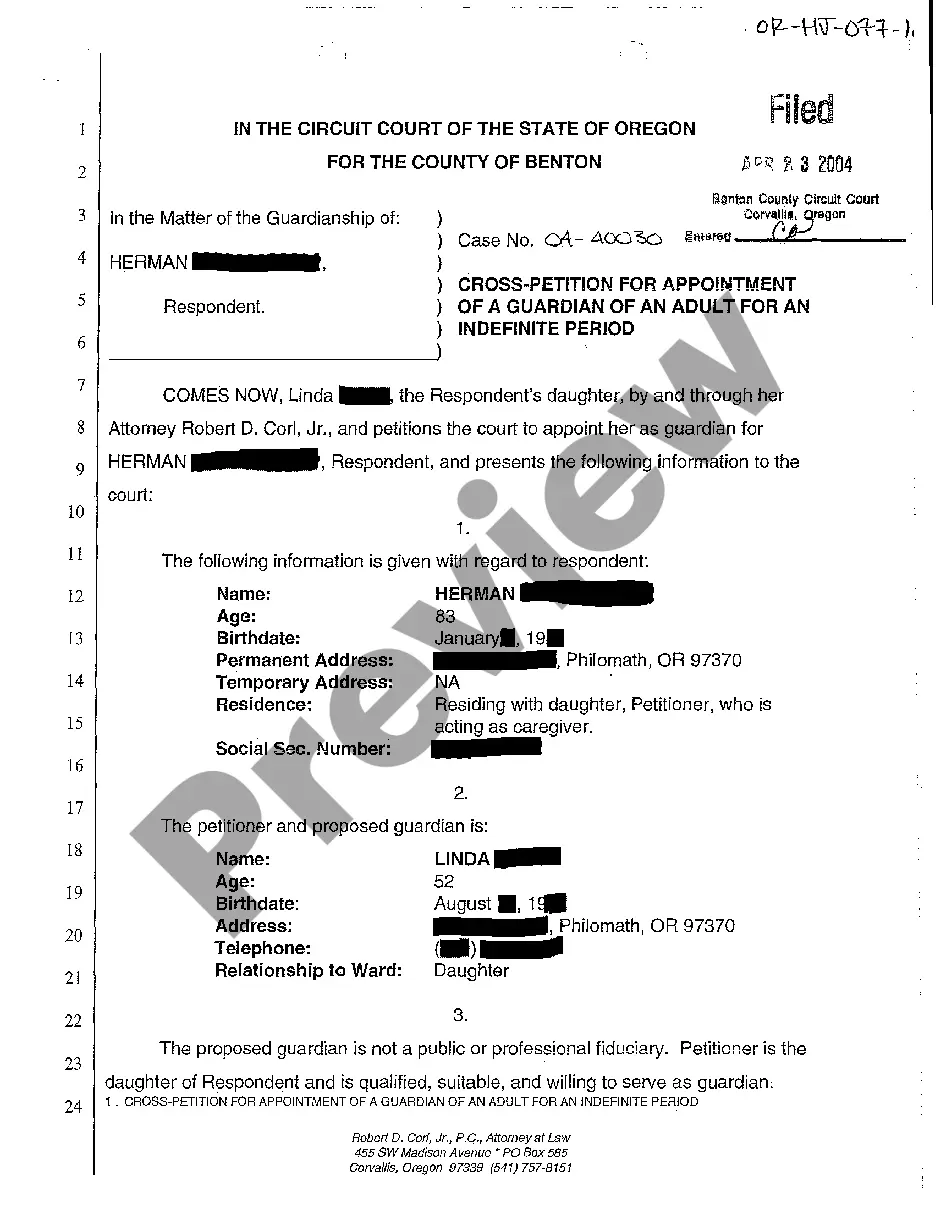

How to fill out King Washington Notice Concerning Introduction Of Remuneration Plan For Shares With Restriction On Transfer?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare formal paperwork that differs throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any personal or business objective utilized in your county, including the King Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on.

Locating samples on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the King Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to obtain the King Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on:

- Ensure you have opened the proper page with your localised form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the King Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!