Maricopa, Arizona is a vibrant city located in Pinal County, known for its scenic landscapes, rich cultural heritage, and strategic location. Nestled in the Sonoran Desert, this fast-growing community offers a high quality of life for its residents and attracts visitors from all over the world. One important aspect of Maricopa, Arizona is the introduction of a remuneration plan for shares with a restriction on them. This plan aims to promote a fair and transparent distribution of shares among shareholders, ensuring a balanced and equitable approach towards compensation. The remuneration plan for shares with a restriction on them is designed to provide an incentive for individuals and organizations to invest in the growth and development of Maricopa, Arizona. By imposing certain restrictions on the shares, such as limiting their transferability or imposing holding periods, the plan aims to encourage long-term commitment and loyalty among shareholders. Different types of Maricopa, Arizona Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on can include: 1. Employee Stock Ownership Plan (ESOP): This type of plan is offered to employees of a particular company as a means to increase their ownership stake. It is often used as a tool for employee retention and motivation by granting them shares in the company, subject to certain restrictions. 2. Restricted Stock Units (RSS): RSS are a form of compensation where an employer grants shares of company stock to an employee, usually subject to vesting periods or specific performance-based criteria. This allows employees to become stakeholders in the company while incentivizing them to contribute to its long-term success. 3. Stock Options: Stock options are a type of employee benefit that allows individuals to purchase company shares at a predetermined price, often referred to as the exercise price or strike price. These options typically have a vesting period and expiration date, encouraging employees to stay with the company and contribute to its growth. The introduction of a remuneration plan for shares with a restriction on them in Maricopa, Arizona demonstrates the city's commitment to fostering investment, long-term commitment, and sustainable growth. This innovative approach aims to attract and retain talent while ensuring that shareholders benefit from the city's continued prosperity.

Maricopa Arizona Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on Transfer

Description

How to fill out Maricopa Arizona Notice Concerning Introduction Of Remuneration Plan For Shares With Restriction On Transfer?

Drafting papers for the business or personal demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to draft Maricopa Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on without professional help.

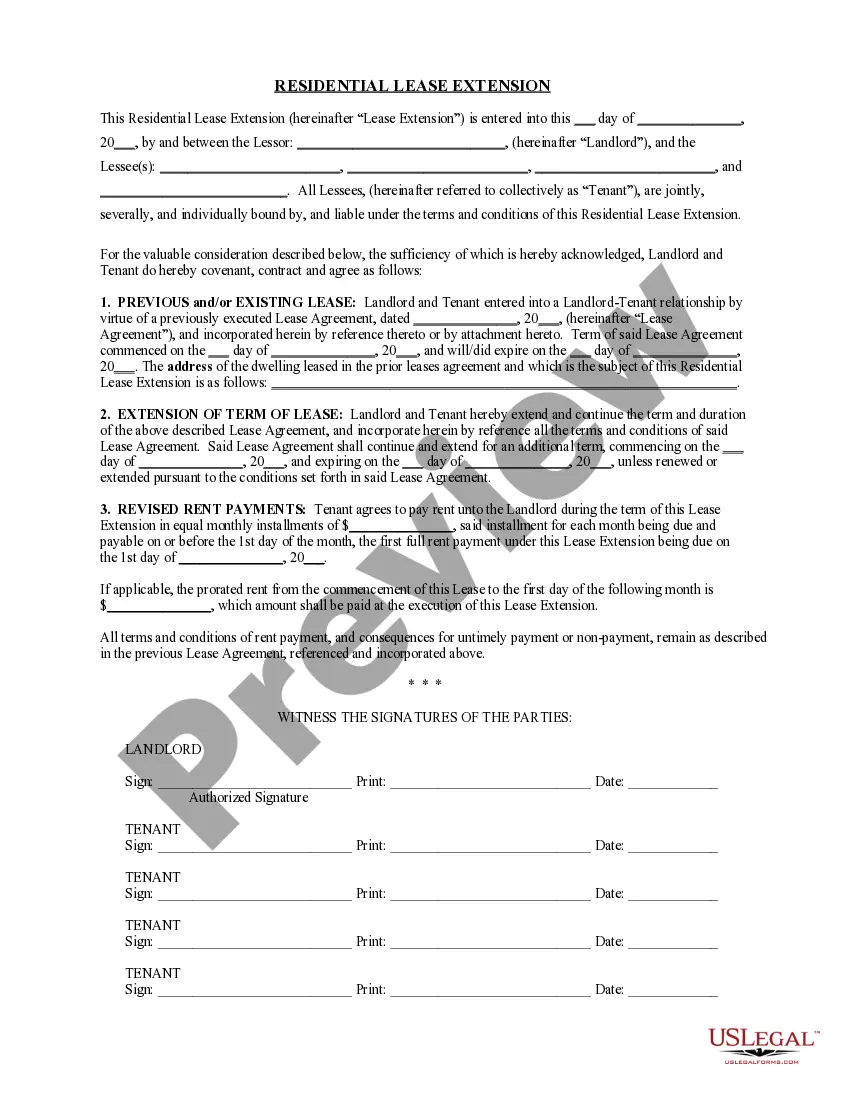

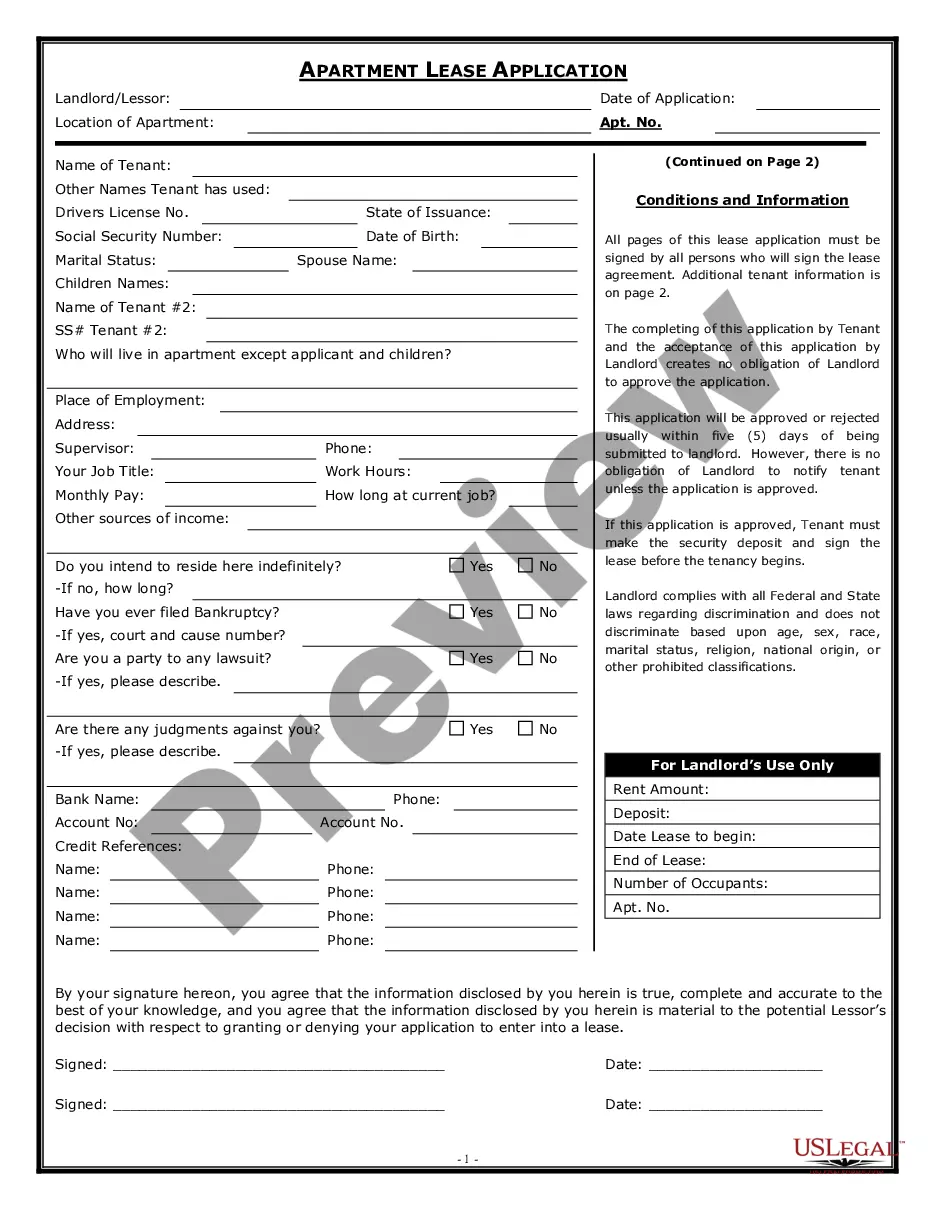

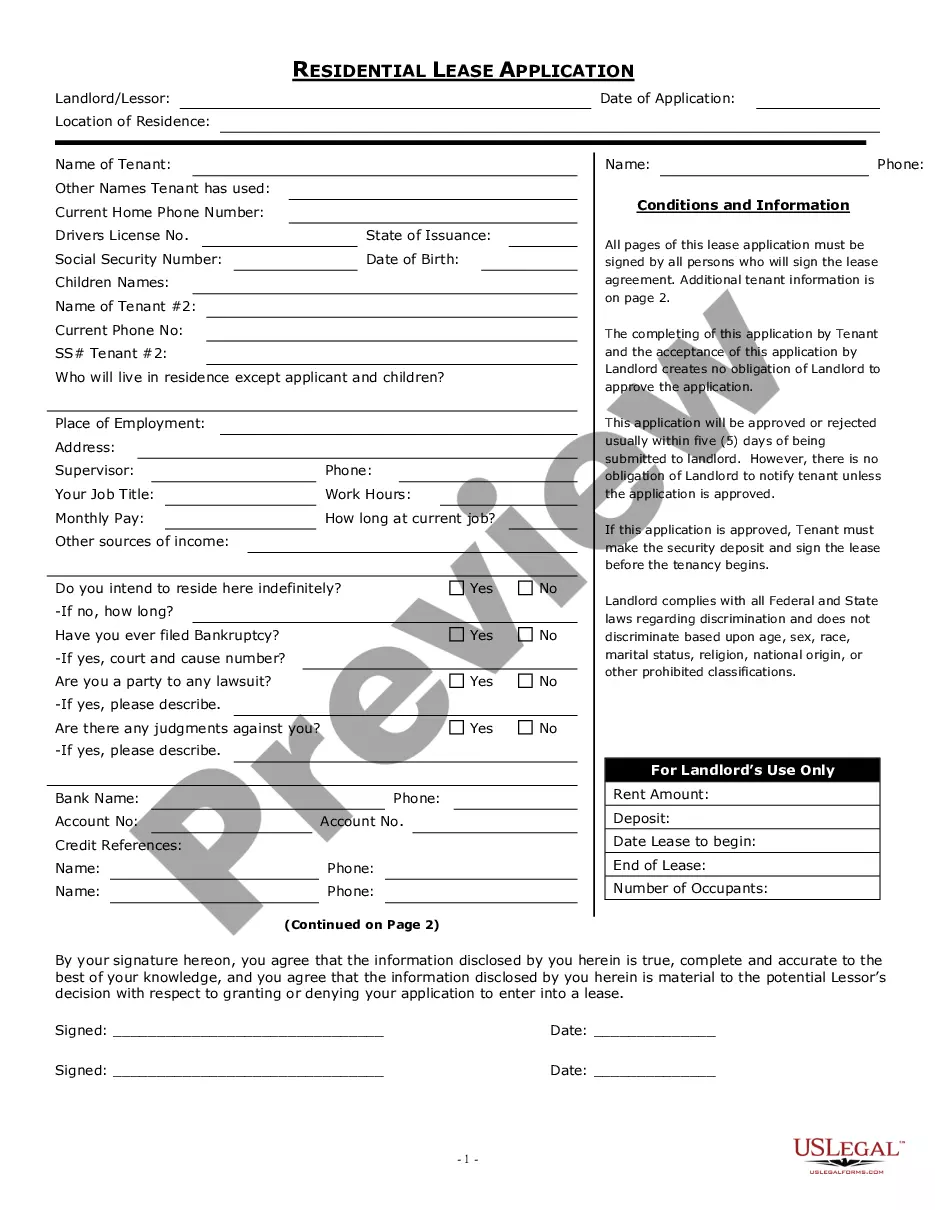

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Maricopa Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on by yourself, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary form.

If you still don't have a subscription, follow the step-by-step guideline below to get the Maricopa Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on:

- Look through the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any use case with just a few clicks!