Nassau, New York — Introduction of Remuneration Plan for Shares with Restriction On: Nassau, located in the eastern part of New York State, is a vibrant town known for its rich history, picturesque landscapes, and strong community spirit. It serves as the county seat of Rensselaer County and offers a blend of suburban and rural living, making it an ideal place to call home. Recently, Nassau has introduced an exciting new remuneration plan for shares with restrictions attached. This innovative scheme aims to provide added benefits and incentives to individuals and businesses holding shares within the region. Let's delve deeper into the details of this introduction and its potential impact. The remuneration plan for shares with restrictions on is designed to reward shareholders who hold their investments for a specified period, encouraging long-term commitment and stability within the local economy. By attaching restrictions to these shares, such as limited trading options or minimum retention periods, the plan ensures that investors are aligned with the long-term success of Nassau and its associated businesses. Under this remuneration plan, shareholders who meet the defined criteria can expect various benefits. These may include exclusive access to future investment opportunities, preferential dividend rates, voting rights in important decision-making processes, and potential tax advantages. By offering a range of incentives, Nassau aims to attract more investment, retain current shareholders, and foster a sustainable and thriving environment for businesses and individuals alike. It's important to note that within the realm of the Notice Concerning Introduction of Remuneration Plan for Shares with Restriction On, there might be different types available, each tailored to cater to specific needs and goals. These variations could include: 1. Employee Stock Ownership Plan (ESOP): This type of plan grants employees with restricted shares in the company they work for, providing them with ownership stakes and potential financial rewards tied to the organization's performance. 2. Restricted Stock Units (RSS): Often offered as part of employee compensation packages, RSS grant individuals shares or the potential to receive shares after a specified vesting period. During this period, certain restrictions may be in place on when and how the shares can be sold. 3. Performance Share Units (Plus): Plus are another variant of restricted shares, where individuals are awarded shares based on performance metrics, such as meeting specific financial goals or achieving predetermined targets. The restriction on these shares is typically tied to the achievement of these performance goals. Overall, the introduction of a remuneration plan for shares with restrictions on represents an exciting development for Nassau, New York. By incentivizing long-term commitment and alignment between shareholders and local businesses, this scheme has the potential to bolster the local economy, attract more investments, and foster a prosperous future for Nassau and its residents.

Nassau New York Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on Transfer

Description

How to fill out Nassau New York Notice Concerning Introduction Of Remuneration Plan For Shares With Restriction On Transfer?

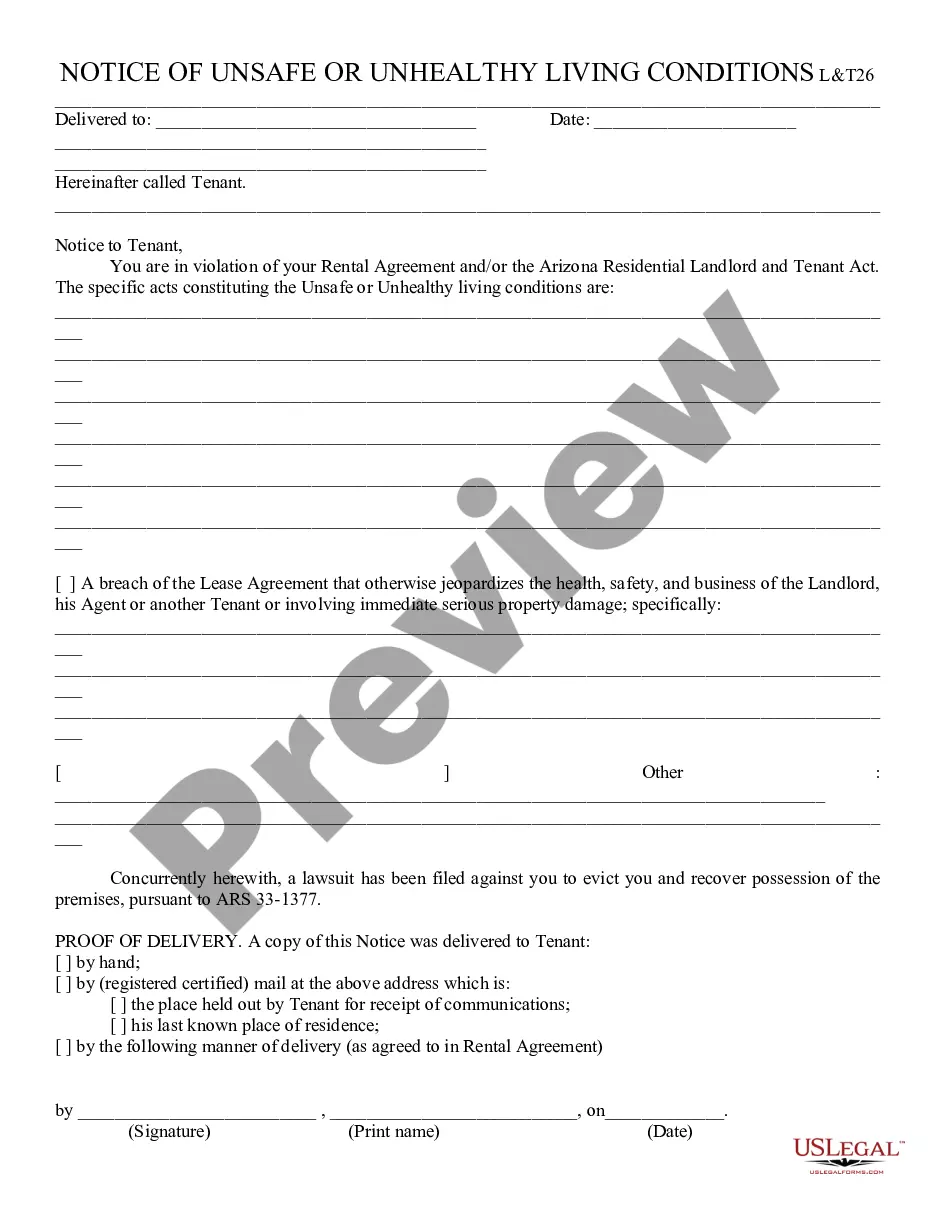

Do you need to quickly create a legally-binding Nassau Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on or probably any other form to take control of your personal or business affairs? You can select one of the two options: hire a professional to draft a legal document for you or draft it entirely on your own. Luckily, there's another option - US Legal Forms. It will help you get professionally written legal papers without paying sky-high prices for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-compliant form templates, including Nassau Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on and form packages. We offer templates for a myriad of life circumstances: from divorce papers to real estate document templates. We've been on the market for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the needed template without extra hassles.

- First and foremost, double-check if the Nassau Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on is adapted to your state's or county's regulations.

- If the document includes a desciption, make sure to check what it's suitable for.

- Start the searching process again if the template isn’t what you were looking for by utilizing the search bar in the header.

- Choose the plan that is best suited for your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Nassau Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Moreover, the documents we offer are updated by industry experts, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!