Mecklenburg North Carolina is a county located in the southwestern region of the state. Known for its rich history, vibrant culture, and robust economy, Mecklenburg County is home to the city of Charlotte, the largest city in North Carolina. With an estimated population of over 1 million people, Mecklenburg County serves as a major economic hub, attracting residents and businesses alike. The county's diverse industries span across finance, healthcare, manufacturing, technology, and more, contributing to its strong and thriving economy. In recent developments, Mecklenburg County has introduced a new initiative called the Restricted Share-Based Remuneration Plan. This plan aims to provide eligible employees with a unique compensation structure that includes restricted shares of company stock as a part of their remuneration package. This innovative approach ensures that employees have a vested interest in the success of the company, enhancing motivation, performance, and retention. The Mecklenburg North Carolina Notice Regarding Introduction of Restricted Share-Based Remuneration Plan serves as an official communication, detailing the specifics of this program. It outlines eligibility criteria, the allocation process for restricted shares, vesting schedules, and the overall objectives and benefits of the plan. Different types of Mecklenburg North Carolina Notices Regarding Introduction of Restricted Share-Based Remuneration Plan may include: 1. Employee Eligibility Notice: This notice would outline the specific criteria that employees must meet to be eligible for the restricted share-based remuneration plan. It would clarify the minimum employment duration, position level, and performance requirements necessary for participation. 2. Vesting Schedule Notice: This notice would provide a detailed schedule outlining the time-based milestones at which restricted shares granted under the plan become fully vested. It would explain the implications of changes in employment status, such as retirement or termination, on the vesting process. 3. Tax Implications Notice: This notice would inform employees about the tax consequences associated with participating in the restricted share-based remuneration plan. It would explain the relevant tax laws, withholding requirements, and potential tax benefits or obligations upon stock vesting or sale. 4. Share Allocation Notice: This notice would outline the process by which restricted shares are allocated to eligible employees. It would include information on the calculation of share grants based on performance metrics, sales targets, or other predetermined factors. By implementing the Restricted Share-Based Remuneration Plan in Mecklenburg County, local businesses aim to create a mutually beneficial relationship between employees and employers. Employees receive an opportunity to share in the success of the company, and employers gain a motivated workforce committed to achieving long-term growth and prosperity.

Mecklenburg North Carolina Notice Regarding Introduction of Restricted Share-Based Remuneration Plan

Description

How to fill out Mecklenburg North Carolina Notice Regarding Introduction Of Restricted Share-Based Remuneration Plan?

Drafting documents for the business or personal needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to create Mecklenburg Notice Regarding Introduction of Restricted Share-Based Remuneration Plan without professional assistance.

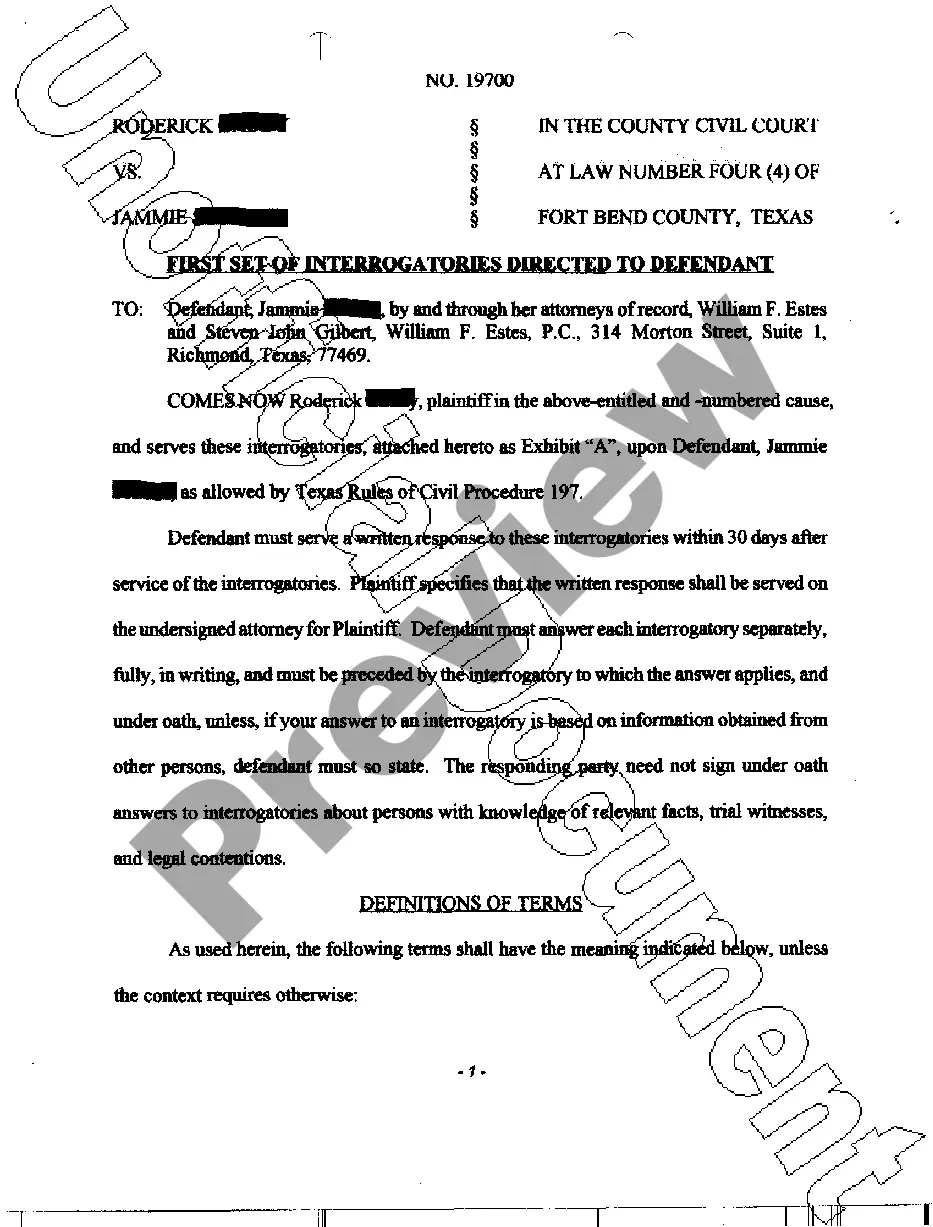

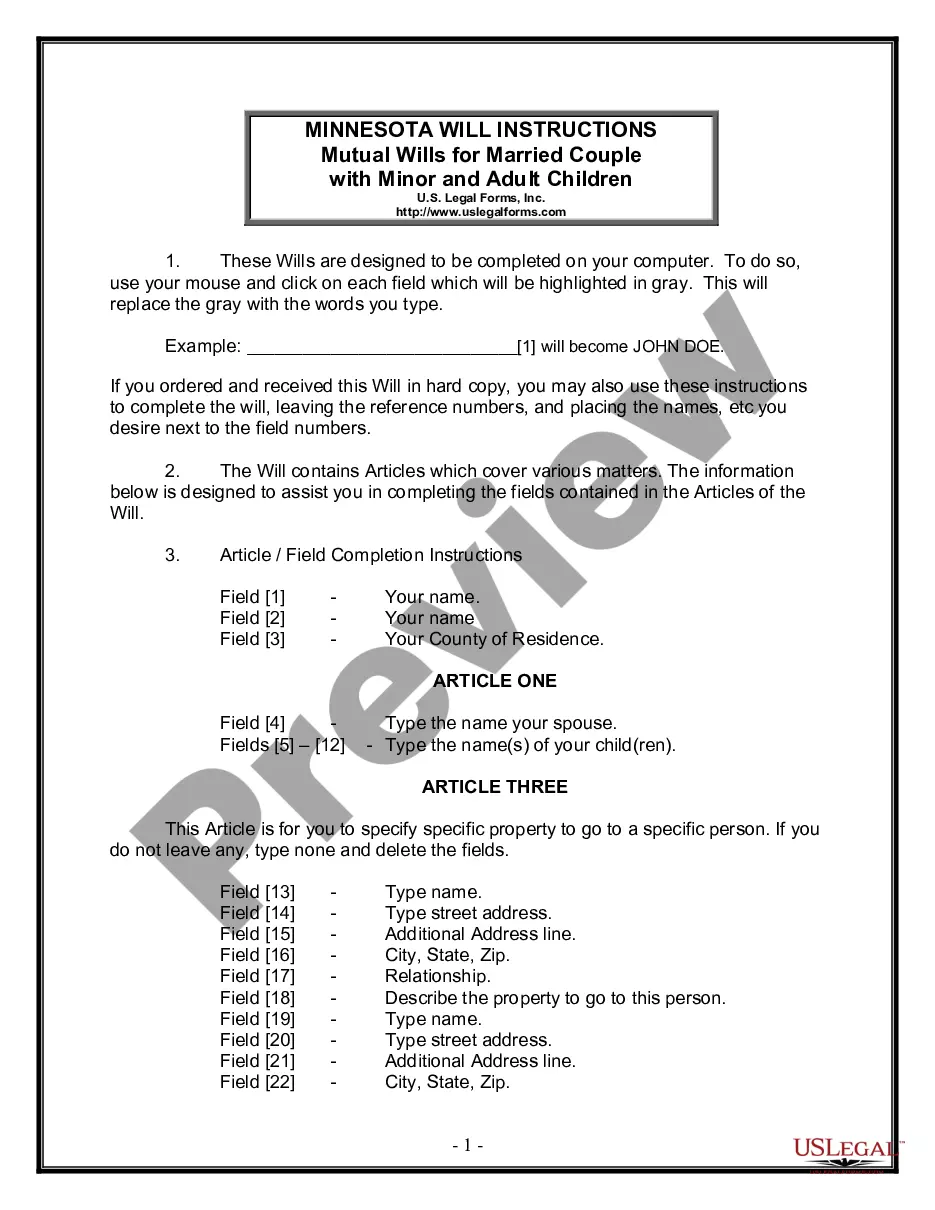

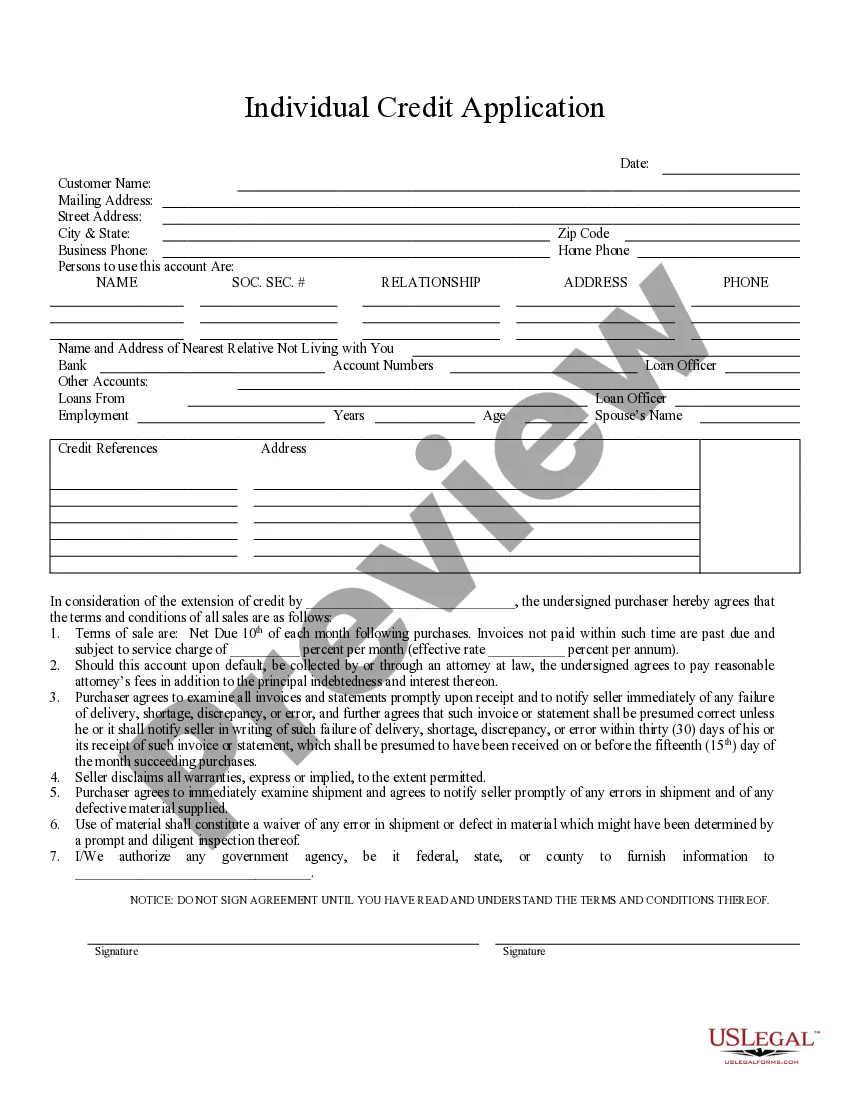

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Mecklenburg Notice Regarding Introduction of Restricted Share-Based Remuneration Plan on your own, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Mecklenburg Notice Regarding Introduction of Restricted Share-Based Remuneration Plan:

- Look through the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that fits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any use case with just a couple of clicks!

Form popularity

FAQ

North Carolina excludes from property taxes a portion of the appraised value of a permanent residence owned and occupied by North Carolina residents aged 65 or older or totally and permanently disabled whose 2022 income does not exceed $33,800 annually.

Emergency Medicine Physicians Of Mecklenburg County is a group practice with 1 location. Currently, Emergency Medicine Physicians Of Mecklenburg County specializes in Psychology with 1 physician.

Single family attached townhome units with a density of 11.93 dwelling units per acre on vacant land. COMMUNITY MEETING Meeting is required and has been held. Report available online.

R6-: High Density Residential District ? The purpose of this district is to provide a location for single family on compact lots, duplex and multifamily dwellings. Multifamily developments are special uses in this district.

The RS Districts are established to provide for orderly suburban residential development and redevelopment. A limited number of nonresidential uses are allowed, subject to the restrictions necessary to preserve the character of the suburban neighborhood.

In North Carolina, there are three types of property tax relief that local governments can offer to property owners: elderly and disabled exclusion, disabled veteran exclusion, and circuit breaker deferment.

North Carolina state law allows property tax relief for low-income seniors and disabled homeowners, as well as disabled veterans or their unmarried surviving spouse.

The purpose of Residential District Three (R3) is to foster orderly growth where the principal use of land is low density residential.

North Carolina allows low-income homestead exclusions for qualifying individuals. Qualifying owners must apply with the Assessor's Office between January 1st and June 1st. If you qualify, you can receive an exclusion of the taxable value of your residence of either $25,000 or 50% (whichever is greater).

RM-5, Residential Multi-family 5 District The RM-5, Residential Multi-family district is primarily intended to accommodate duplexes, twin homes, townhouses, cluster housing, and other residential uses at a density of 5.0 units per acre or less.