Cuyahoga County, Ohio is a populous county located in the northeastern part of the state. It is home to the city of Cleveland, which serves as its county seat and the largest city in the region. Cuyahoga County is known for its rich history, vibrant arts scene, and diverse communities. A Cuyahoga Ohio Summary of Terms of Proposed Private Placement Offering refers to a legal document outlining the terms and conditions of a private placement investment opportunity within the county. Private placement offerings are a type of investment opportunity that involves the sale of securities directly to a select group of investors, such as institutional investors, high-net-worth individuals, or private equity firms. The terms of a Cuyahoga Ohio Summary of Terms of Proposed Private Placement Offering typically include details about the type of security being offered, such as equity or debt, the total amount being raised, the minimum investment required, and any potential risks associated with the investment. Additionally, the summary may also outline the proposed use of the funds raised, such as for real estate development, expansion of a business, or acquisition of assets. Different types of Cuyahoga Ohio Summary of Terms of Proposed Private Placement Offerings may include: 1. Equity Offering: This type of private placement involves the sale of shares or ownership interests in a company. Investors, in exchange for their investment, receive a percentage of ownership in the venture and potential dividends or capital appreciation. 2. Debt Offering: In a debt offering, investors provide funds to the issuer in exchange for fixed income securities, such as bonds or promissory notes. The issuer agrees to repay the principal amount with interest over a specified period. 3. Real Estate Offering: This private placement opportunity focuses specifically on real estate projects within Cuyahoga County. Funds raised through this type of offering may be utilized for property acquisition, development, or renovation. 4. Startup or Early-stage Offering: Private placements may also be targeted towards new or early-stage companies seeking capital to support their growth. Investors in such offerings often take on a higher level of risk in exchange for the potential for significant returns. It is important for potential investors to carefully review the terms and risks associated with a Cuyahoga Ohio Summary of Terms of Proposed Private Placement Offering before making any investment decisions. Consulting with a financial advisor or legal professional can provide additional guidance and ensure that the investment aligns with one's financial objectives and risk tolerance.

Cuyahoga Ohio Summary of Terms of Proposed Private Placement Offering

Description

How to fill out Cuyahoga Ohio Summary Of Terms Of Proposed Private Placement Offering?

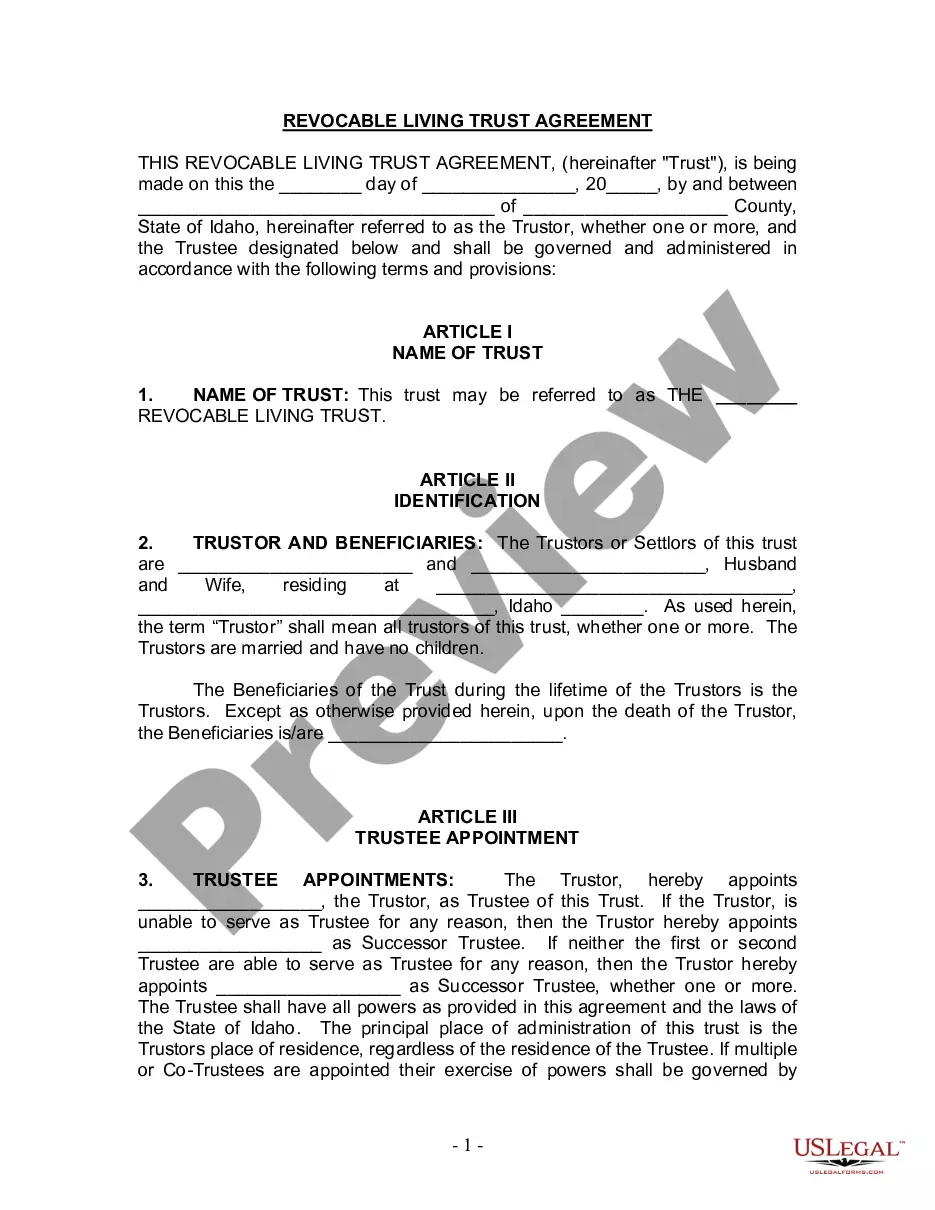

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a lawyer to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Cuyahoga Summary of Terms of Proposed Private Placement Offering, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Therefore, if you need the current version of the Cuyahoga Summary of Terms of Proposed Private Placement Offering, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Cuyahoga Summary of Terms of Proposed Private Placement Offering:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Cuyahoga Summary of Terms of Proposed Private Placement Offering and download it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!