Harris Texas is a renowned financial institution that specializes in offering private placement services for individuals and corporations across various industries. Their Summary of Terms of Proposed Private Placement Offering provides a comprehensive outline of the key details and conditions involved in their private placement investment opportunities. One type of Harris Texas' Summary of Terms of Proposed Private Placement Offering is their Equity Offering. This type of offering involves the sale of ownership interest in a company, typically in the form of stocks or shares. The summary would detail the number of shares available for purchase, the price per share, any voting rights associated with the shares, and other relevant terms and conditions. Another type of offering provided by Harris Texas is their Debt Offering. In this type of offering, investors have the opportunity to invest in a company's debt securities, such as bonds or notes, with the expectation of receiving regular interest payments and the return of the principal amount at maturity. The summary would outline the principal amount being offered, the interest rate, maturity date, and any collateral or security backing the debt. In addition, Harris Texas may also offer Hybrid Offerings, which combine elements of both equity and debt offerings. These offerings provide investors with the option to convert their investment from debt to equity at a later stage or include additional features like convertible bonds or preferred shares. The summary of terms would highlight the conversion terms, conversion ratio, and any other relevant provisions. The Summary of Terms of Proposed Private Placement Offering by Harris Texas typically includes crucial details such as the purpose of the offering, financial projections, use of proceeds, and potential risks associated with the investment. It may also outline the eligibility criteria for investors, minimum investment thresholds, and any required legal or regulatory documentation. Potential investors can find more information about Harris Texas' Summary of Terms of Proposed Private Placement Offering on their official website or by contacting their experienced team of financial advisors who can provide personalized guidance and assistance throughout the investment process.

Harris Texas Summary of Terms of Proposed Private Placement Offering

Description

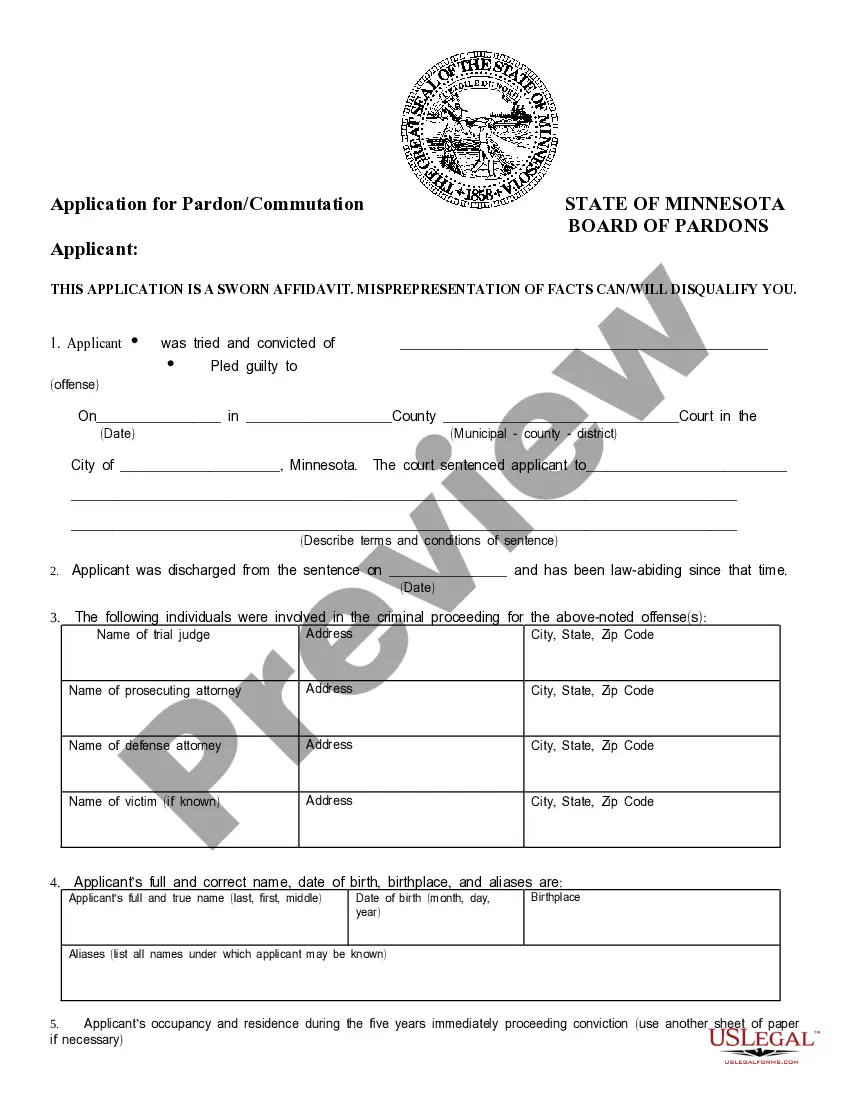

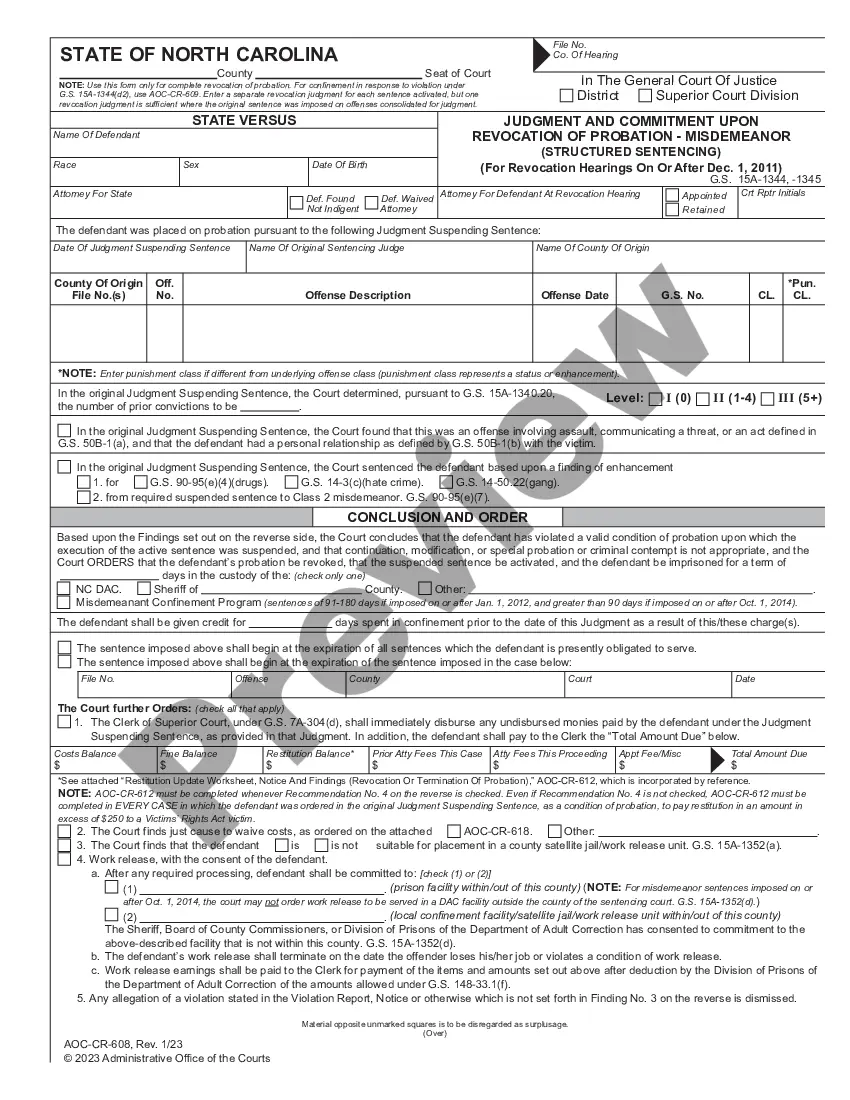

How to fill out Harris Texas Summary Of Terms Of Proposed Private Placement Offering?

Drafting paperwork for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to create Harris Summary of Terms of Proposed Private Placement Offering without expert help.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Harris Summary of Terms of Proposed Private Placement Offering on your own, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, adhere to the step-by-step guide below to obtain the Harris Summary of Terms of Proposed Private Placement Offering:

- Examine the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that suits your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a couple of clicks!

Form popularity

FAQ

A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than on the open market. It is an alternative to an initial public offering (IPO) for a company seeking to raise capital for expansion.

A Private Placement Memorandum (PPM), also known as a private offering document and confidential offering memorandum, is a securities disclosure document used in a private offering of securities by a private placement issuer or an investment fund (collectively, the Issuer).

How to Write a Private Placement Memorandum Choosing a Sample. Look for a sample document dealing with a similar type of offering.Using Multiple Samples. The best tactic to follow if you intend to start by writing your PPM from scratch, is to use multiple samples.Formatting.Disclosures.

How to Complete a Private Placement Deal Launch. The first step, Deal Launch, initiates the window of time from which the issue is offered to investors, to when a decision must be made, typically 1-3 weeks.Negotiations.Information Gathering.Investment Risk Analysis.Pricing.Rate Lock.Closing.

A Checklist for the Main Topics (Information) in a Private Placement Memorandum Notices to Investors. Executive Summary. Company Purpose and Overview. Terms of the Offering and Securities. Risk Factors. Use of Proceeds. Financial Information. Management.

The company can make a private placement of its securities after approval of shareholders of the company for the proposed offer or invitation to subscribe to securities by passing a Special Resolution for every offer or invitation.

A PPM is not technically required for Rule 506(b) offers to only accredited investors and Rule 504 offers to either accredited or non-accredited investors. However, a PPM is usually advisable, even in those cases where it is not technically required.

The PPM is not filed with the SEC. A PPM can be as much for a company's protection from legal liability, as it is for potential investors to be fully informed before they buy the company's stock. The SEC has even warned prospective investors that the absence of a PPM is a red flag to consider before investing.

Rule 506(c) permits issuers to broadly solicit and generally advertise an offering, provided that: all purchasers in the offering are accredited investors. the issuer takes reasonable steps to verify purchasers' accredited investor status and. certain other conditions in Regulation D are satisfied.

The offering memorandum provides disclosures to the investor which is an important concept in investing....Some information that should be disclosed in an offering memorandum includes: Management fees. Investors' voting rights. Indebtedness of the business. How the investment will be repaid.