The Kings New York Summary of Terms of Proposed Private Placement Offering is a comprehensive document outlining the key provisions and conditions of a private placement investment opportunity provided by Kings New York. This summary serves as a detailed description of the offering and provides potential investors with essential information needed to assess the investment's viability and potential returns. The term "Kings New York" refers to the entity offering the private placement investment opportunity. It is vital to understand that multiple types of Kings New York Summary of Terms of Proposed Private Placement Offering could exist, tailored to different investment opportunities. However, without further context or specific information, it is difficult to name or classify such variations. Below are some relevant keywords to consider when discussing the Kings New York Summary of Terms of Proposed Private Placement Offering: 1. Private Placement: Refers to a capital-raising method where securities are offered exclusively to a select group of investors, typically institutions or high-net-worth individuals, bypassing public offerings. 2. Investment Opportunity: Describes the chance for potential investors to allocate capital into a project or venture, with the expectation of generating financial returns. 3. Proposed Offering: Indicates that the private placement investment opportunity is still in the initial stages and subject to approval and finalization. 4. Terms and Conditions: Encompasses the detailed provisions, requirements, and terms that govern the private placement investment, including minimum investment amounts, expected returns, duration, and any associated risks. 5. Viability Analysis: Involves a comprehensive evaluation of the investment opportunity's potential profitability and sustainability, considering factors such as market conditions, financial projections, and competition. 6. Due Diligence: Signifies the process of conducting an in-depth investigation and research to verify the accuracy of the information provided in the private placement offering, ensuring prospective investors have access to reliable and transparent data. 7. Regulatory Compliance: Refers to adherence to applicable laws, regulations, and guidelines governing private placements and securities offerings to protect investors' interests. 8. Risk Assessment: Involves the identification and evaluation of potential risks associated with the proposed private placement offering, enabling investors to make informed decisions based on their risk appetite. It is important to note that the specific details and variations within the Kings New York Summary of Terms of Proposed Private Placement Offering will depend on the nature of the investment opportunity and the particular objectives of the issuer.

Kings New York Summary of Terms of Proposed Private Placement Offering

Description

How to fill out Kings New York Summary Of Terms Of Proposed Private Placement Offering?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a lawyer to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Kings Summary of Terms of Proposed Private Placement Offering, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

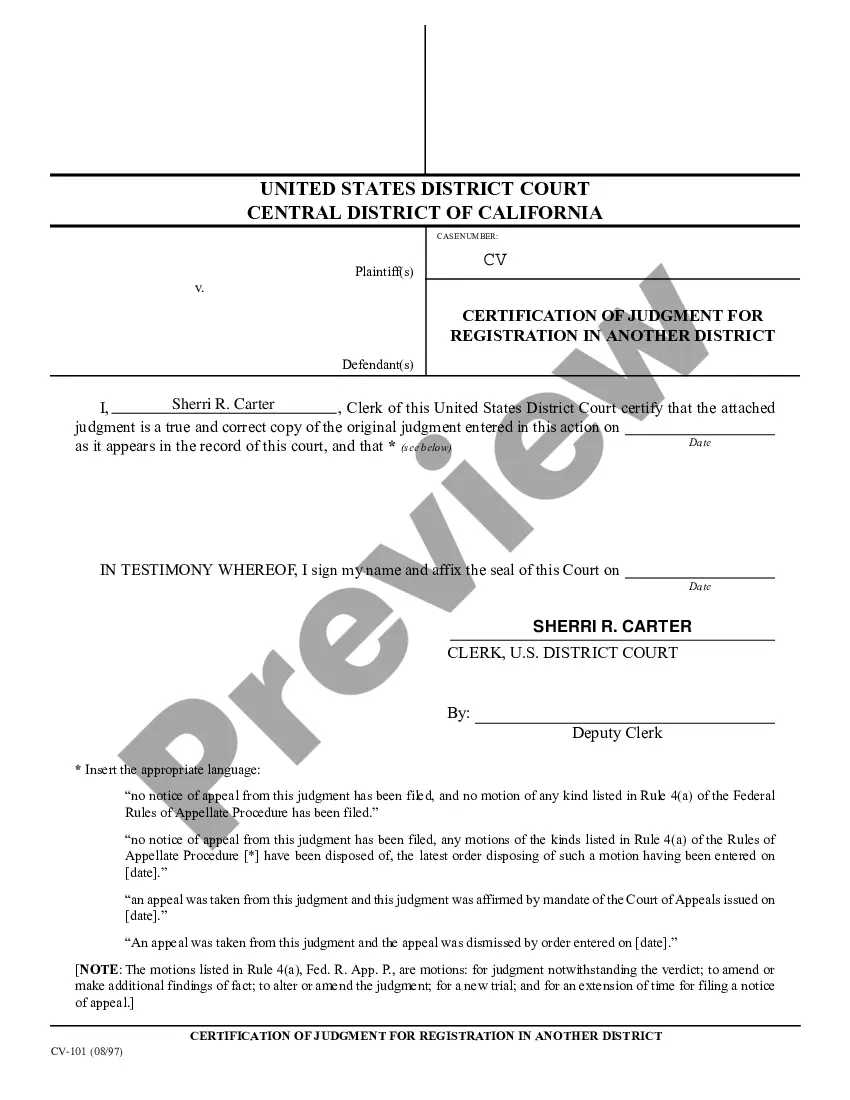

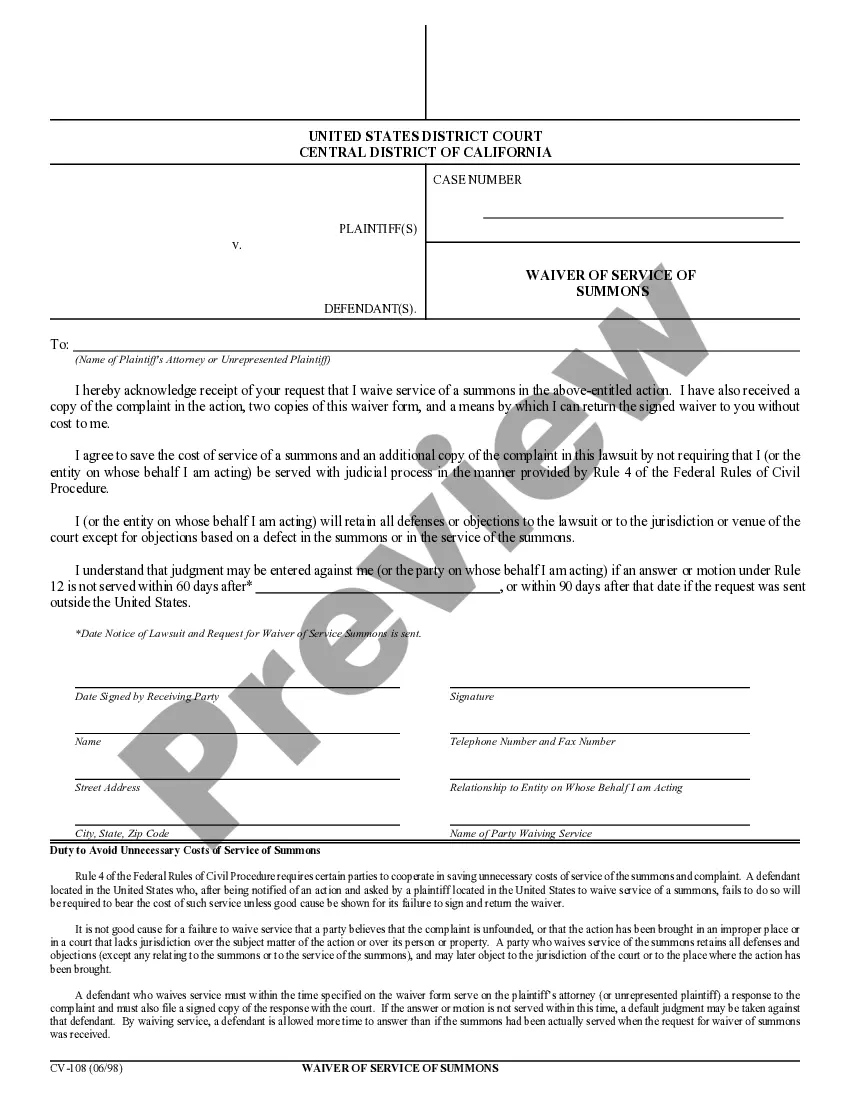

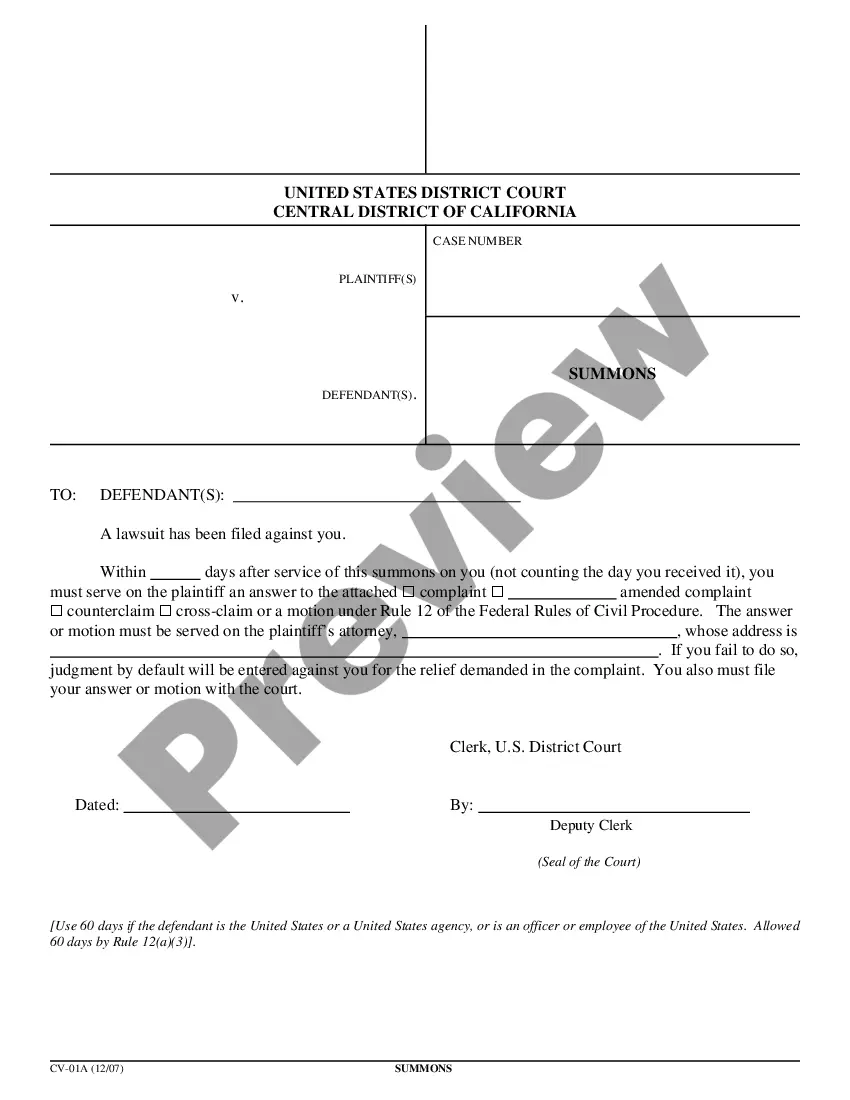

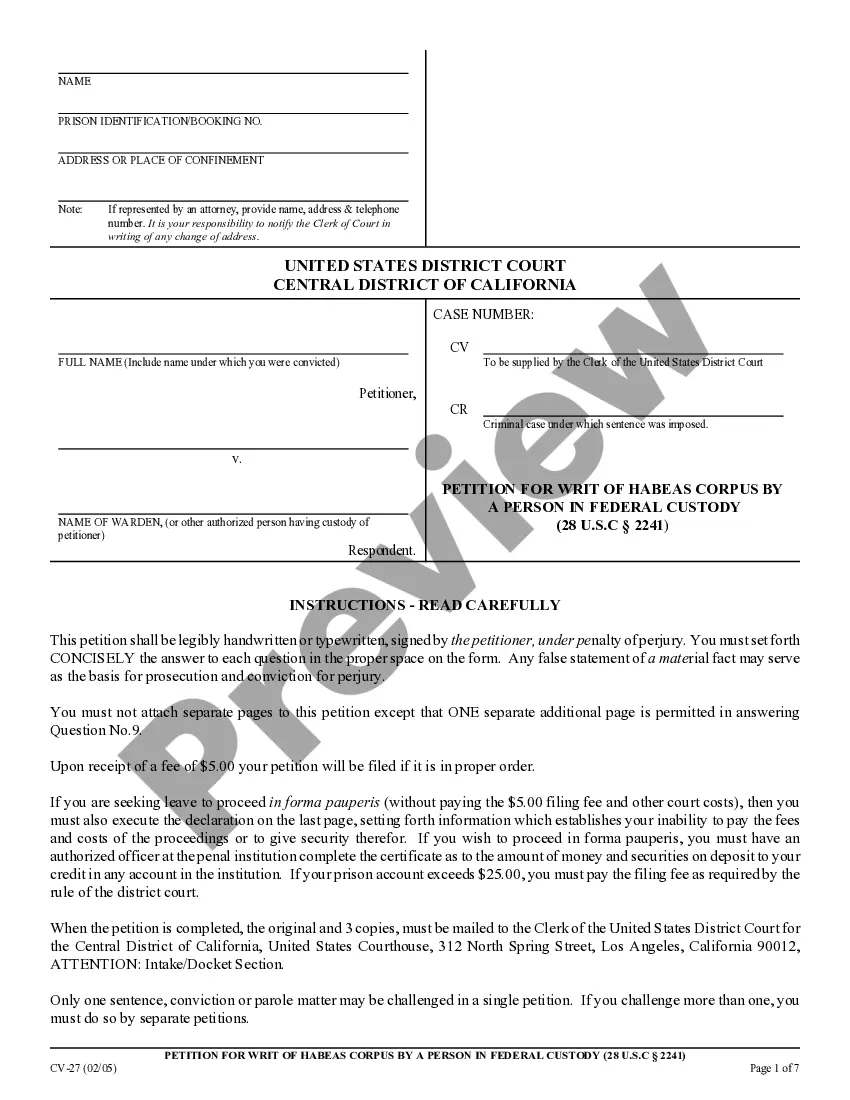

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Consequently, if you need the latest version of the Kings Summary of Terms of Proposed Private Placement Offering, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Kings Summary of Terms of Proposed Private Placement Offering:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Kings Summary of Terms of Proposed Private Placement Offering and save it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

How to Complete a Private Placement Deal Launch. The first step, Deal Launch, initiates the window of time from which the issue is offered to investors, to when a decision must be made, typically 1-3 weeks.Negotiations.Information Gathering.Investment Risk Analysis.Pricing.Rate Lock.Closing.

Rule 5123 requires firms to file offering documents that were used to sell the private placement, which can include the private placement memorandum, term sheet or other offering documents.

FINRA Will Require Broker-Dealers to File Private Placement Retail Communications. More than a year ago, the Financial Industry Regulatory Authority (FINRA) said that it would make reviewing the rules for private placement retail communications by broker-dealers a special priority.

Section 4(a)(2) of the Securities Act exempts from registration transactions by an issuer not involving any public offering.

It must address external and internal risks facing the company. A PPM may indirectly serve a marketing purpose if it is professional looking and thorough. A well drafted PPM will balance disclosure requirements with marketing elements designed to sell the deal.

SEC enforcement is not just a public company concern: What private companies need to know. Private companies are subject to SEC oversight too, and this has implications for your D&O policy. Private companies are subject to SEC oversight too, and this has implications for your D&O policy.

Placement Agents- If you sell private securities for a commission, but do not advise on investment banking or finance-related matters, you need to pass the SIE and Series 63 exams and either the Series 7 (broader) or the Series 82 exam (more limited).

For debt investments in private placements the required closing documents include the private placement memorandum, sensitive information release form, subscription agreement, investor questionnaire, loan and security agreement, and promissory note.

Under the Securities Act of 1933, any offer to sell securities must either be registered with the SEC or meet an exemption. Issuers and broker-dealers most commonly conduct private placements under Regulation D of the Securities Act of 1933, which provides three exemptions from registration.