Riverside California is a vibrant city located in Southern California's Inland Empire region. Nestled amidst stunning natural landscapes, Riverside offers residents and visitors a unique blend of urban amenities and outdoor recreational opportunities. Known for its rich history, diverse culture, and thriving economy, Riverside is an ideal place to live, work, and invest. In terms of investment opportunities, there are various private placement offerings available in Riverside California. These offerings provide a way for companies to raise capital from private investors without undergoing the traditional process of a public offering. They offer potential investors the chance to participate in the growth of promising businesses in the region. The Summary of Terms of the Proposed Private Placement Offering outlines the key details of the investment opportunity. It includes crucial information such as the purpose of the offering, the type of securities being offered, the amount of capital sought, and the anticipated return on investment. The summary may also mention the nature of the business or project being funded, highlighting its potential for success and growth. Furthermore, it may outline the terms and conditions of the investment, including any restrictions or eligibility criteria for potential investors. The private placement offering could categorize into various types, depending on the specific securities being offered. Common types include equity offerings, where investors purchase shares of the company, and debt offerings, where investors lend money to the company in exchange for fixed payments over a specified period. Other types of private placement offerings might include convertible securities, which allow investors to convert their investment into equity at a later date, and preferred stock offerings, which offer investors certain privileges compared to common stockholders, such as priority in dividend payments. In conclusion, Riverside California offers a range of private placement investment opportunities that provide potential investors with the chance to support local businesses and contribute to the city's economic growth. The Summary of Terms of the Proposed Private Placement Offering provides a comprehensive overview of these opportunities, outlining the key details and terms for interested investors.

Riverside California Summary of Terms of Proposed Private Placement Offering

Description

How to fill out Riverside California Summary Of Terms Of Proposed Private Placement Offering?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any personal or business objective utilized in your region, including the Riverside Summary of Terms of Proposed Private Placement Offering.

Locating templates on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Riverside Summary of Terms of Proposed Private Placement Offering will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to obtain the Riverside Summary of Terms of Proposed Private Placement Offering:

- Ensure you have opened the proper page with your local form.

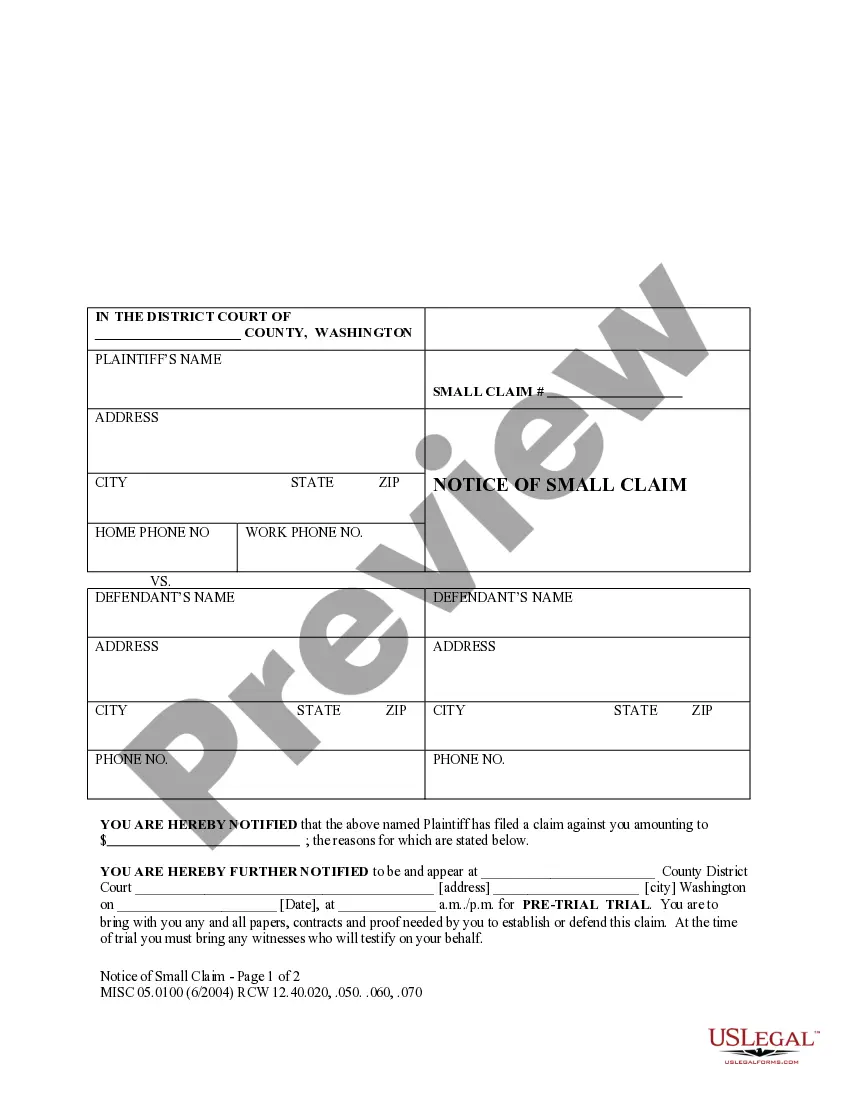

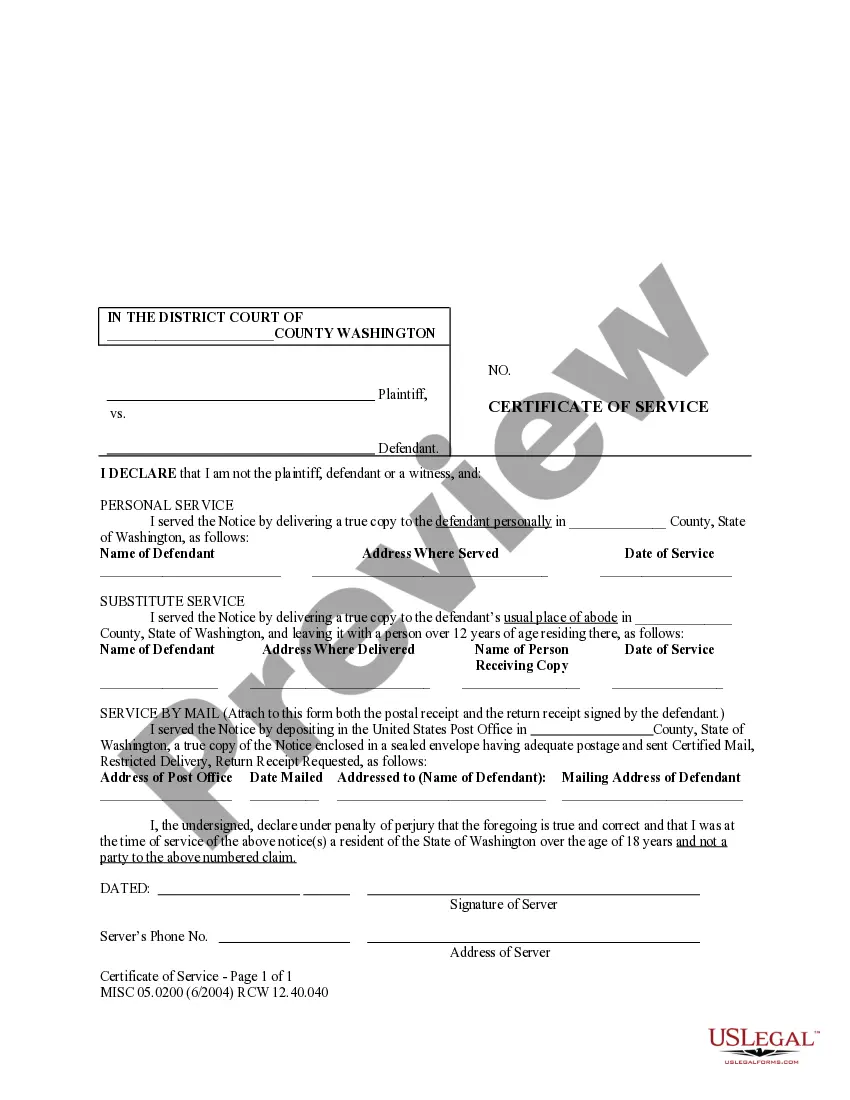

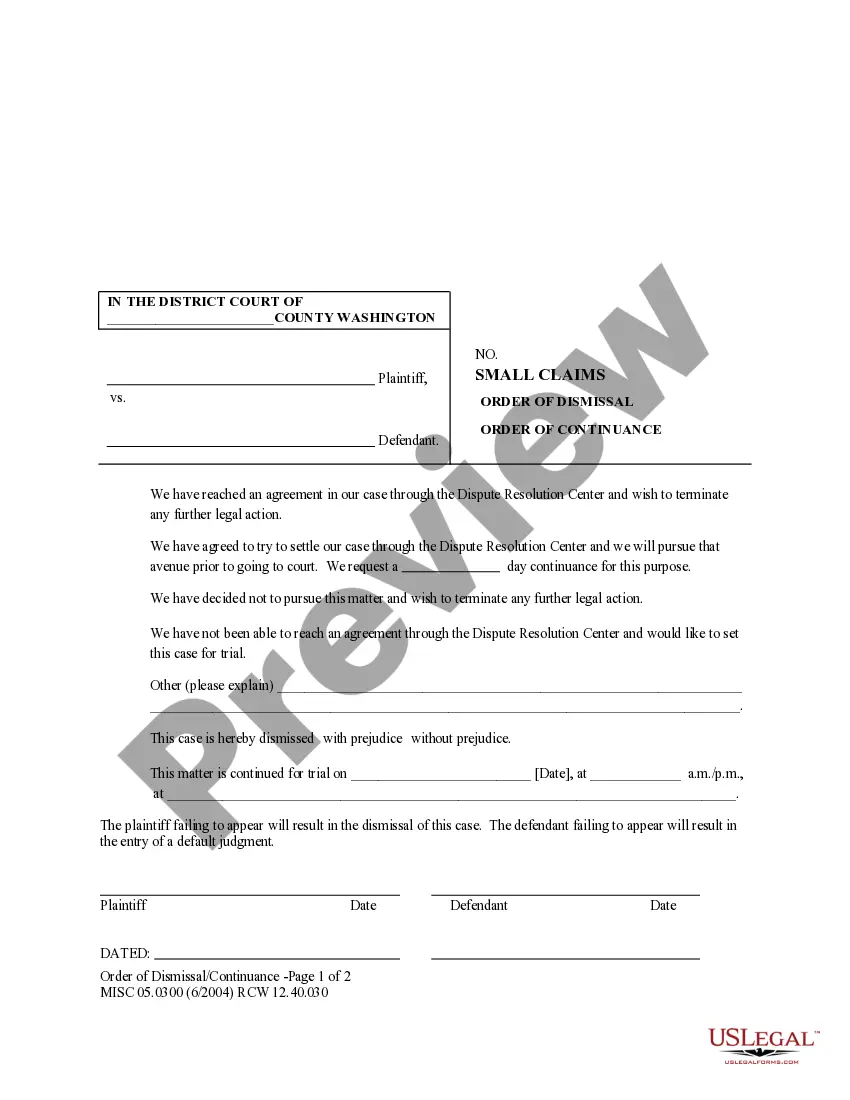

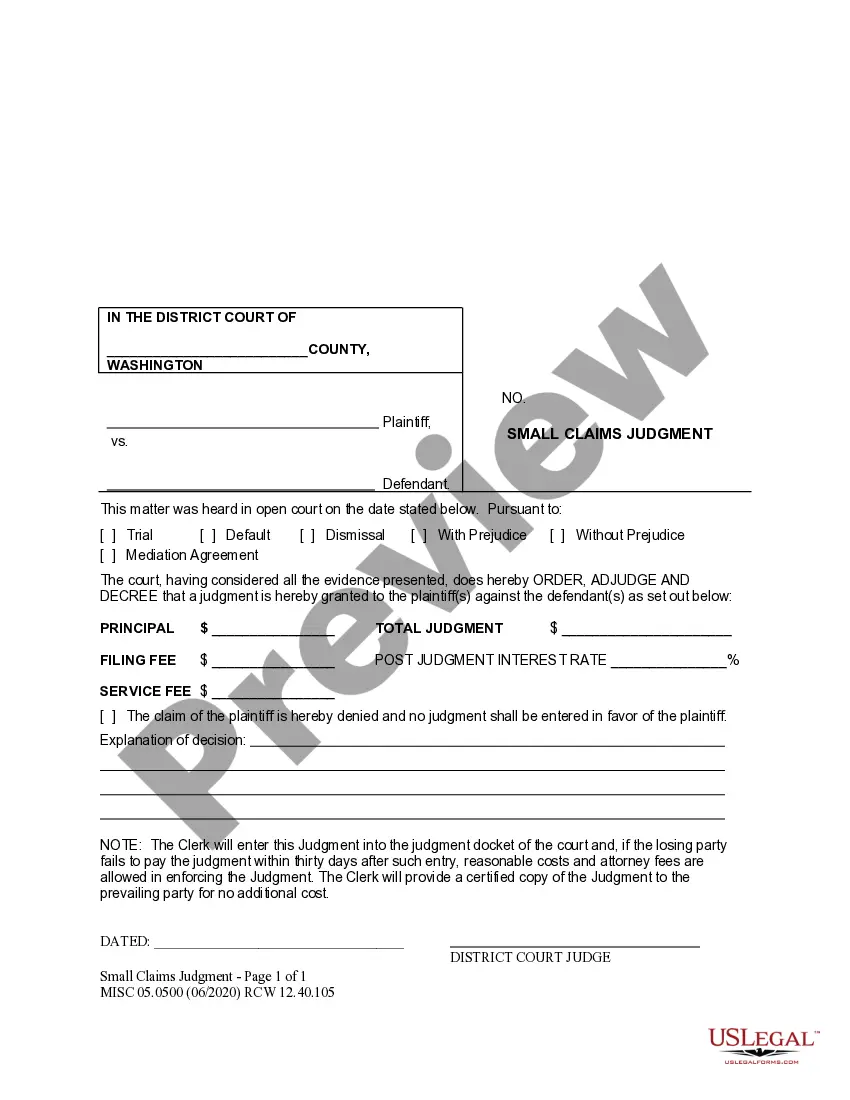

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form meets your needs.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the suitable subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Riverside Summary of Terms of Proposed Private Placement Offering on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!