Santa Clara, California is a vibrant city located in the heart of Silicon Valley. Known for its technological innovations, it is home to numerous high-tech companies, renowned universities, and an abundance of employment opportunities. In terms of its thriving private placement offering market, Santa Clara, California has witnessed several types of offerings, each with its unique characteristics. Some of these offerings include: 1. Equity Private Placement: This type of offering involves the sale of company shares, allowing investors to become partial owners of the business. It is a popular way for companies to raise capital without going public. 2. Debt Private Placement: In this type of offering, companies issue debt securities to investors, promising to repay the principal amount with interest over a specified period. This method allows businesses to borrow funds without going through traditional bank loans. 3. Convertible Private Placement: This offering involves the sale of securities that can be converted into equity shares in the future. It provides an option for investors to convert their investment into company ownership if certain conditions are met. 4. Preferred Stock Private Placement: This offering involves selling preferred shares to investors, which carry additional advantages over common shares. Preferred stockholders usually have a priority claim on company assets and may receive fixed dividends. When considering a private placement offering in Santa Clara, California, it is crucial to familiarize oneself with the terms and conditions set forth in the summary of terms. The summary typically outlines key details such as: 1. Offering Size: The total amount of securities being offered to potential investors. 2. Securities Type: Whether it is equity, debt, convertible securities, or preferred stock. 3. Pricing Structure: How the securities are priced, including the purchase price per share or the interest rate for debt securities. 4. Use of Proceeds: Describes how the raised capital will be utilized by the company, whether it's for expansion, research and development, debt repayment, or other purposes. 5. Rights and Protections: Any additional rights and protections granted to investors, such as anti-dilution provisions or voting rights. 6. Lock-up Period: The duration during which investors are restricted from selling or transferring their securities. 7. Investor Eligibility: Specifies the criteria that investors must meet to participate in the offering, such as accredited investor status. Understanding the terms of a proposed private placement offering is crucial for both issuers and investors alike. It ensures transparency, mitigates risks, and helps foster mutually beneficial partnerships that drive economic growth in Santa Clara, California's dynamic business environment.

Santa Clara California Summary of Terms of Proposed Private Placement Offering

Description

How to fill out Santa Clara California Summary Of Terms Of Proposed Private Placement Offering?

If you need to get a reliable legal form supplier to obtain the Santa Clara Summary of Terms of Proposed Private Placement Offering, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can browse from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of supporting resources, and dedicated support make it simple to locate and complete various papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply type to look for or browse Santa Clara Summary of Terms of Proposed Private Placement Offering, either by a keyword or by the state/county the document is created for. After finding the needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Santa Clara Summary of Terms of Proposed Private Placement Offering template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Create an account and choose a subscription plan. The template will be instantly ready for download once the payment is processed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes these tasks less costly and more reasonably priced. Set up your first business, organize your advance care planning, draft a real estate contract, or execute the Santa Clara Summary of Terms of Proposed Private Placement Offering - all from the convenience of your sofa.

Sign up for US Legal Forms now!

Form popularity

FAQ

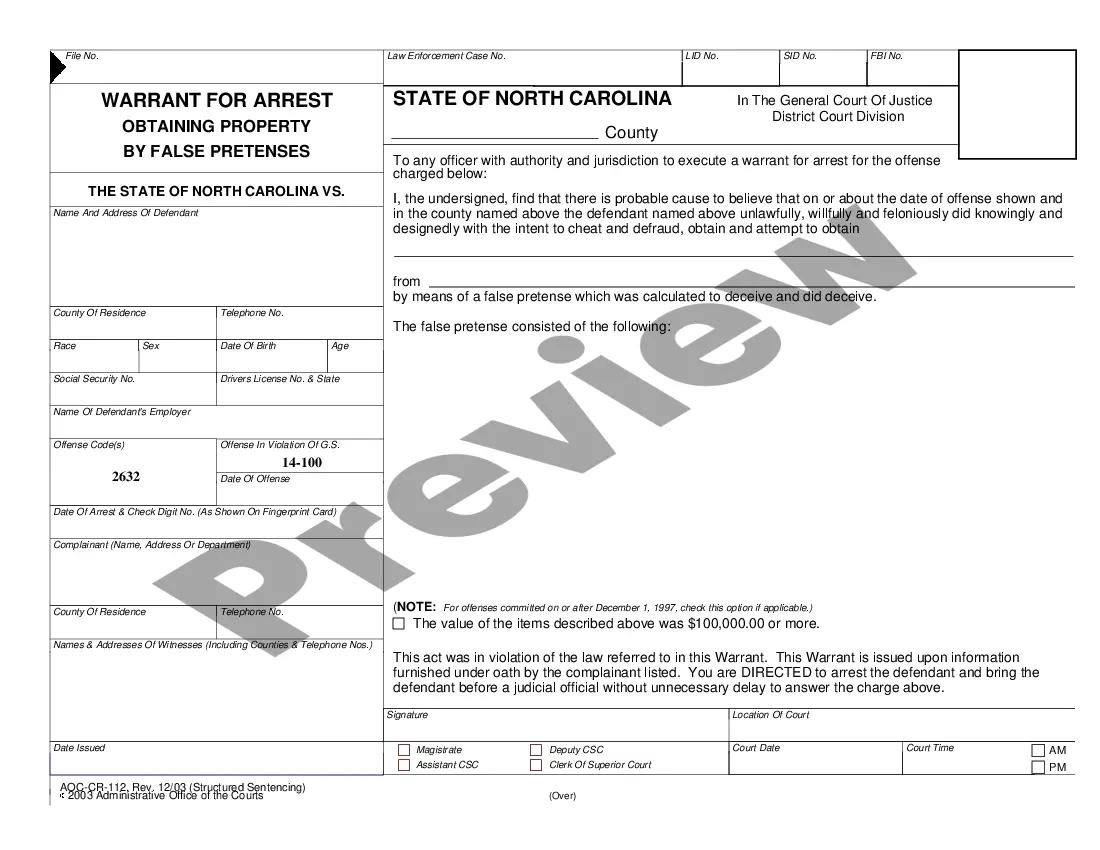

FINRA Rule 5123 (Private Placements of Securities) requires firms to file with FINRA's Corporate Financing Department within 15 calendar days of the date of first sale of a private placement, a private placement memorandum, term sheet or other offering document, or indicate that no such offerings documents were used.

Offering memorandums are similar to prospectuses but are for private placements, while prospectuses are for publicly traded issues.

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.

Under the Securities Act of 1933, any offer to sell securities must either be registered with the SEC or meet an exemption. Issuers and broker-dealers most commonly conduct private placements under Regulation D of the Securities Act of 1933, which provides three exemptions from registration.

An offering memorandum is a legal document that states the objectives, risks, and terms of an investment involved with a private placement. This document includes items such as a company's financial statements, management biographies, a detailed description of the business operations, and more.

Outline of a PPM Introduction.Summary of Offering Terms.Risk Factors.Description of the Company and the Management.Use of Proceeds.Description of Securities.Subscription Procedures.Exhibits.

The PPM is a self-contained disclosure document consisting of everything that an investor will need to fund your business. The PPM also operates as legal protection that allows you to raise capital from investors while closing the loop on legal exposure and regulatory issues.

The PPM describes the company selling the securities, the terms of the offering, and the risks of the investment, amongst other things. The disclosures included in the PPM vary depending on which exemption from registration is being used, the target investors, and the complexity of the terms of the offering.

How to Write a Private Placement Memorandum Choosing a Sample. Look for a sample document dealing with a similar type of offering.Using Multiple Samples. The best tactic to follow if you intend to start by writing your PPM from scratch, is to use multiple samples.Formatting.Disclosures.