A Broward Florida Construction Loan Agreement is a legal contract between a borrower and a lender, specifically tailored for financing construction projects in Broward County, Florida. This agreement outlines the terms and conditions under which the loan will be provided, including the loan amount, interest rate, repayment terms, and construction-specific clauses. Keywords: Broward Florida, construction loan agreement, financing, construction projects, Broward County, terms and conditions, loan amount, interest rate, repayment terms, construction-specific clauses. Different types of Broward Florida Construction Loan Agreements can include: 1. Fixed-rate Construction Loan Agreement: This type of agreement provides a consistent interest rate throughout the loan term, ensuring predictable monthly payments for the borrower. 2. Adjustable-rate Construction Loan Agreement: Unlike a fixed-rate agreement, an adjustable-rate agreement allows the interest rate to fluctuate over time, potentially resulting in varying monthly payments. 3. Single-closing Construction Loan Agreement: In this type of agreement, the loan agreement combines both the construction loan and permanent financing into a single transaction, simplifying the borrowing process. 4. Two-time close Construction Loan Agreement: This agreement separates the construction loan and permanent financing into two separate transactions, ensuring flexibility in terms of interest rates and repayment terms. 5. Owner-builder Construction Loan Agreement: This agreement is specifically designed for borrowers who act as their own general contractors for the construction project. 6. Renovation Construction Loan Agreement: This type of agreement is suitable for borrowers looking to finance major renovations or remodeling projects rather than new construction. 7. Land Acquisition Construction Loan Agreement: This agreement provides financing for the acquisition of land, with the intention of constructing a new building or development. 8. Bridge Construction Loan Agreement: A bridge loan agreement provides short-term financing to cover the gap between the completion of construction and the securing of a permanent loan. These different types of Broward Florida Construction Loan Agreements cater to the specific needs and circumstances of borrowers, ensuring that their construction projects receive suitable financing options in Broward County, Florida.

Broward Florida Construction Loan Agreement

Description

How to fill out Broward Florida Construction Loan Agreement?

Whether you plan to open your business, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business case. All files are collected by state and area of use, so opting for a copy like Broward Construction Loan Agreement is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to obtain the Broward Construction Loan Agreement. Adhere to the guidelines below:

- Make certain the sample meets your individual needs and state law requirements.

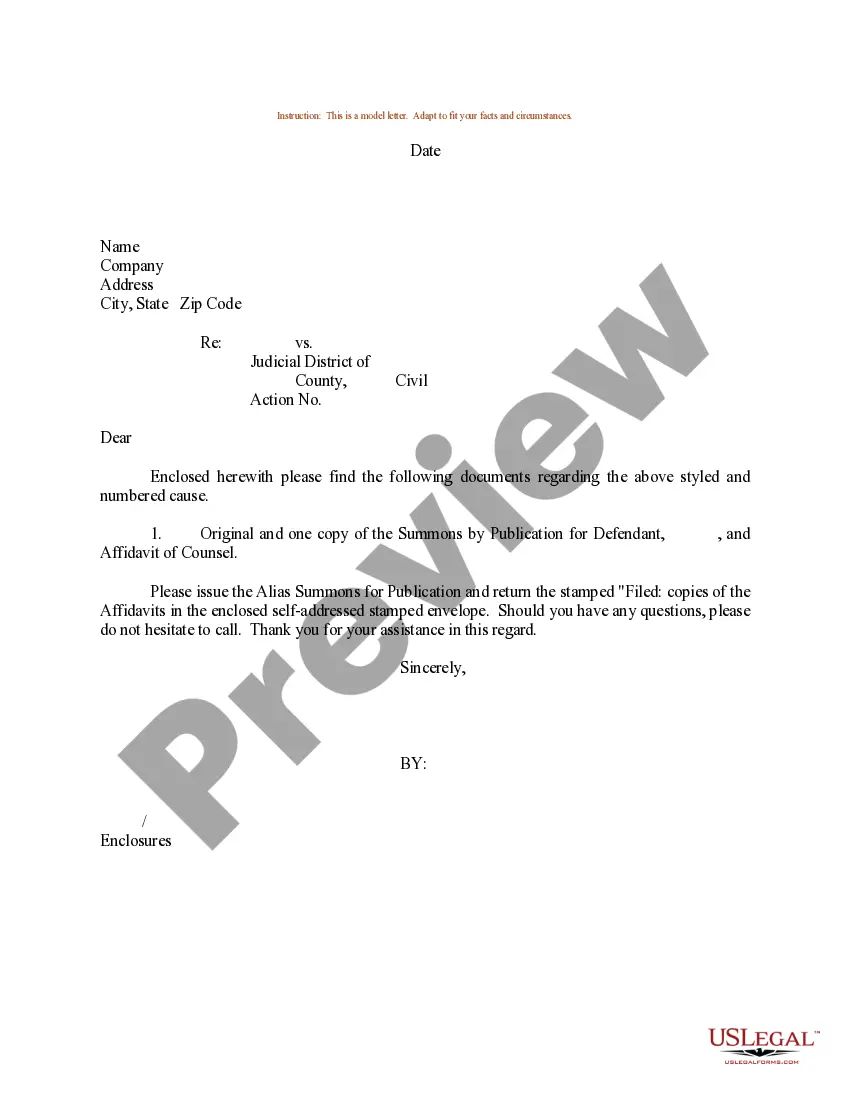

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the file when you find the right one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Broward Construction Loan Agreement in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!