Nassau New York Shareholder Agreements — An Overview Nassau County in New York is known for its vibrant business community and thriving economy. For individuals and businesses engaged in the corporate world, shareholder agreements play a crucial role in defining the rights and responsibilities of shareholders within a corporation. In Nassau New York, shareholder agreements are commonly utilized to maintain corporate governance and protect the interests of shareholders. A shareholder agreement in Nassau New York serves as a legally binding contract between the shareholders of a corporation. It outlines the rights, obligations, and expectations of the parties involved, including shareholders' voting rights, share transfer restrictions, dividend policies, dispute resolution mechanisms, and more. This agreement plays a significant role in providing clarity and minimizing conflicts among shareholders, ensuring the smooth operation and long-term success of a corporation. Several types of Nassau New York shareholder agreements cater to specific situations and goals. Some common types include: 1. Voting Agreements: This type of shareholder agreement focuses primarily on the voting rights of shareholders. It outlines how voting for important corporate decisions will be conducted, whether by a majority, super majority, or unanimous consent. 2. Buy-Sell Agreements: Also known as buyout agreements, these contracts establish a framework for shareholders to buy or sell their shares in certain situations, such as death, disability, retirement, or voluntary exit. Buy-sell agreements ensure a fair process for the transfer of ownership and provide mechanisms for valuation and payment terms. 3. Non-Disclosure Agreements (NDAs): While not exclusive to shareholder agreements, NDAs are often included to protect sensitive information shared among shareholders. NDAs help maintain confidentiality regarding trade secrets, proprietary information, or any other confidential aspects of the corporation. 4. Shareholders' Rights Agreements: These agreements focus on documenting and protecting the rights and privileges of shareholders, such as inspection rights, information disclosure, and participation in decision-making processes. 5. Shareholders' Dividend Agreements: This type of agreement defines the policies and procedures related to dividend distributions among shareholders, including timing, amount, frequency, and eligibility criteria. 6. Shareholders' Employment Agreements: In some cases, shareholder agreements may address employment-related matters for shareholders who are also actively involved in managing the corporation. These agreements specify the roles, responsibilities, and compensation arrangements for shareholders who serve as officers or directors. While this overview highlights the common types of shareholder agreements in Nassau New York, it's important to consult an experienced attorney to ensure compliance with state laws and to tailor the agreement to specific needs and circumstances. Shareholder agreements can be complex legal documents, and seeking professional guidance is crucial for creating a comprehensive and effective agreement that protects the interests of all parties involved.

Nassau New York Shareholder Agreements - An Overview

Description

How to fill out Nassau New York Shareholder Agreements - An Overview?

Preparing documents for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to draft Nassau Shareholder Agreements - An Overview without professional assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Nassau Shareholder Agreements - An Overview on your own, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

If you still don't have a subscription, adhere to the step-by-step guide below to get the Nassau Shareholder Agreements - An Overview:

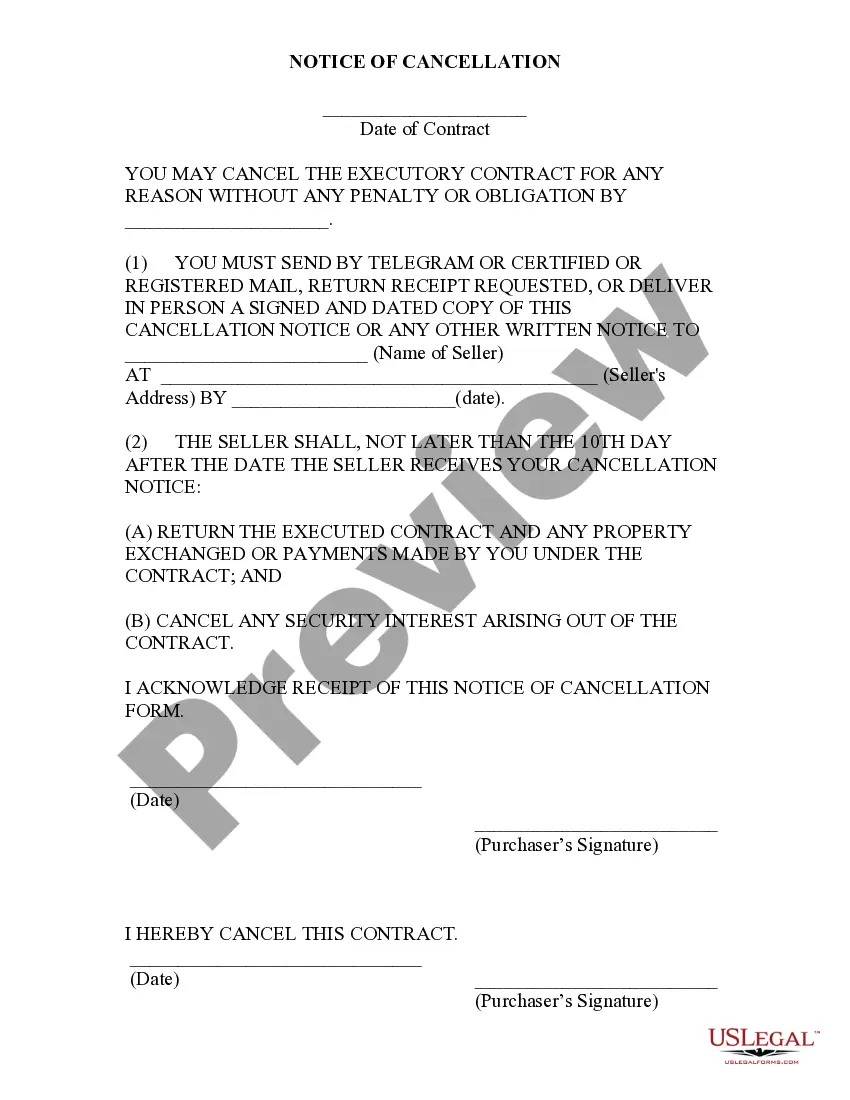

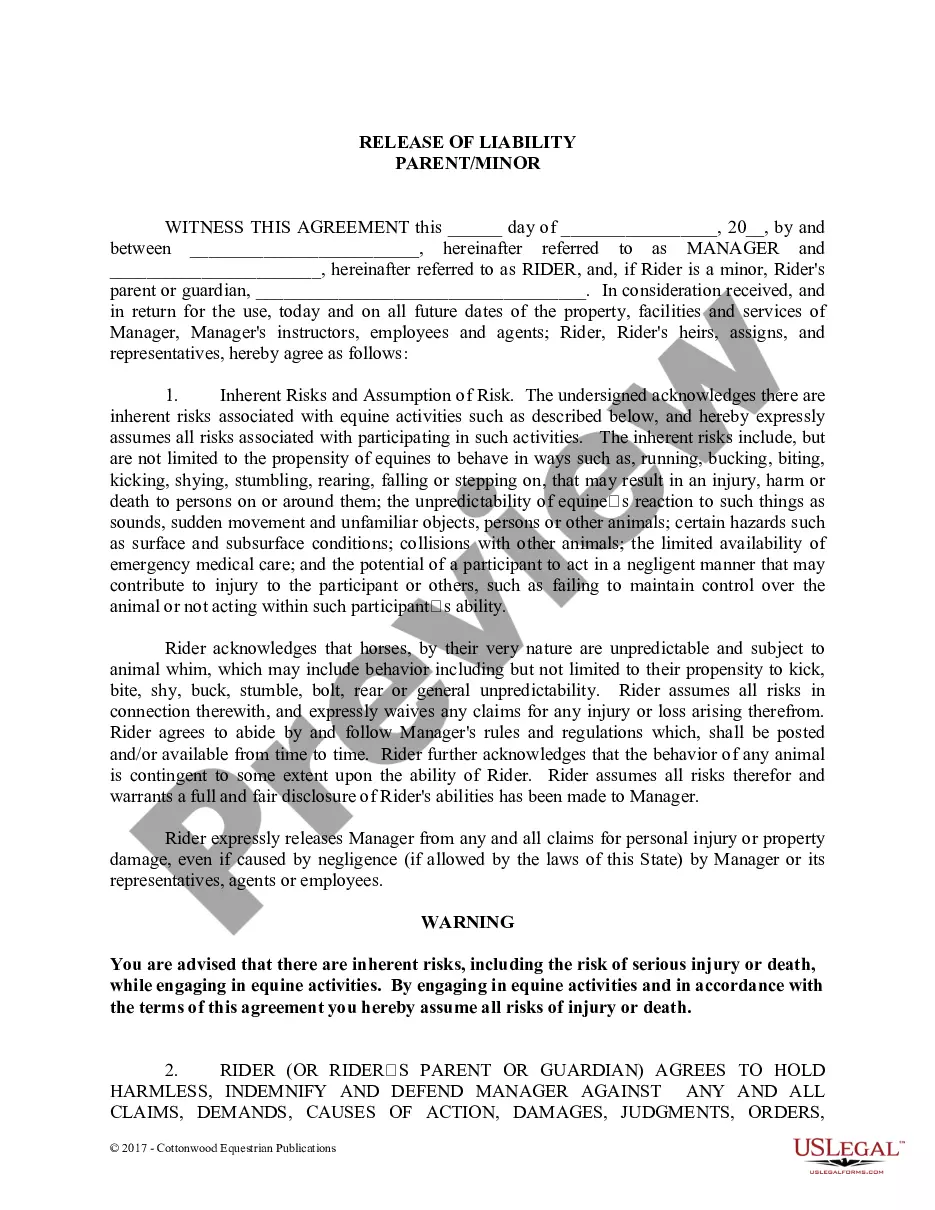

- Look through the page you've opened and check if it has the document you need.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that suits your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any situation with just a couple of clicks!