The Harris Texas PRE Incorporation Agreement is a legal document that outlines the terms and conditions agreed upon by individuals or entities before incorporating a business in Harris County, Texas. This agreement serves as a blueprint for the future corporation's operations and governance. It is a crucial step in the pre-incorporation phase to ensure that all parties involved are on the same page and have a clear understanding of their roles and responsibilities. The Harris Texas PRE Incorporation Agreement typically covers various essential aspects related to the business, such as ownership structure, management, capital contributions, share allocation, decision-making processes, and dispute resolution mechanisms. These agreements aim to establish a framework for the corporation's operations and minimize potential conflicts that may arise in the future. Different types of Harris Texas PRE Incorporation Agreements may exist based on the specific nature of the proposed business. Some common variations include: 1. Shareholder PRE Incorporation Agreement: This agreement is specifically designed for businesses planning to have multiple shareholders. It outlines each shareholder's rights and obligations, including equity ownership, voting rights, dividend distribution, and roles within the company. 2. Director PRE Incorporation Agreement: Suitable for businesses that have a board of directors, this agreement focuses on the responsibilities, appointment process, decision-making authority, and any limitations for directors. 3. Partnership PRE Incorporation Agreement: If the business is structured as a partnership, this agreement will cover the rights and obligations of each partner, profit sharing mechanisms, decision-making processes, and potential exit strategies. 4. LLC PRE Incorporation Agreement: For businesses intending to form a Limited Liability Company (LLC), this agreement outlines the management structure, profit sharing, and members' rights and responsibilities. Including relevant keywords, such as "Harris Texas PRE Incorporation Agreement," "incorporating a business in Harris County," and specific variations like "Shareholder PRE Incorporation Agreement," "Director PRE Incorporation Agreement," "Partnership PRE Incorporation Agreement," and "LLC PRE Incorporation Agreement" in the content will increase its relevance for search engines and those seeking information about these agreements.

Harris Texas Pre Incorporation Agreement

Description

How to fill out Harris Texas Pre Incorporation Agreement?

Laws and regulations in every area differ throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Harris Pre Incorporation Agreement, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Harris Pre Incorporation Agreement from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Harris Pre Incorporation Agreement:

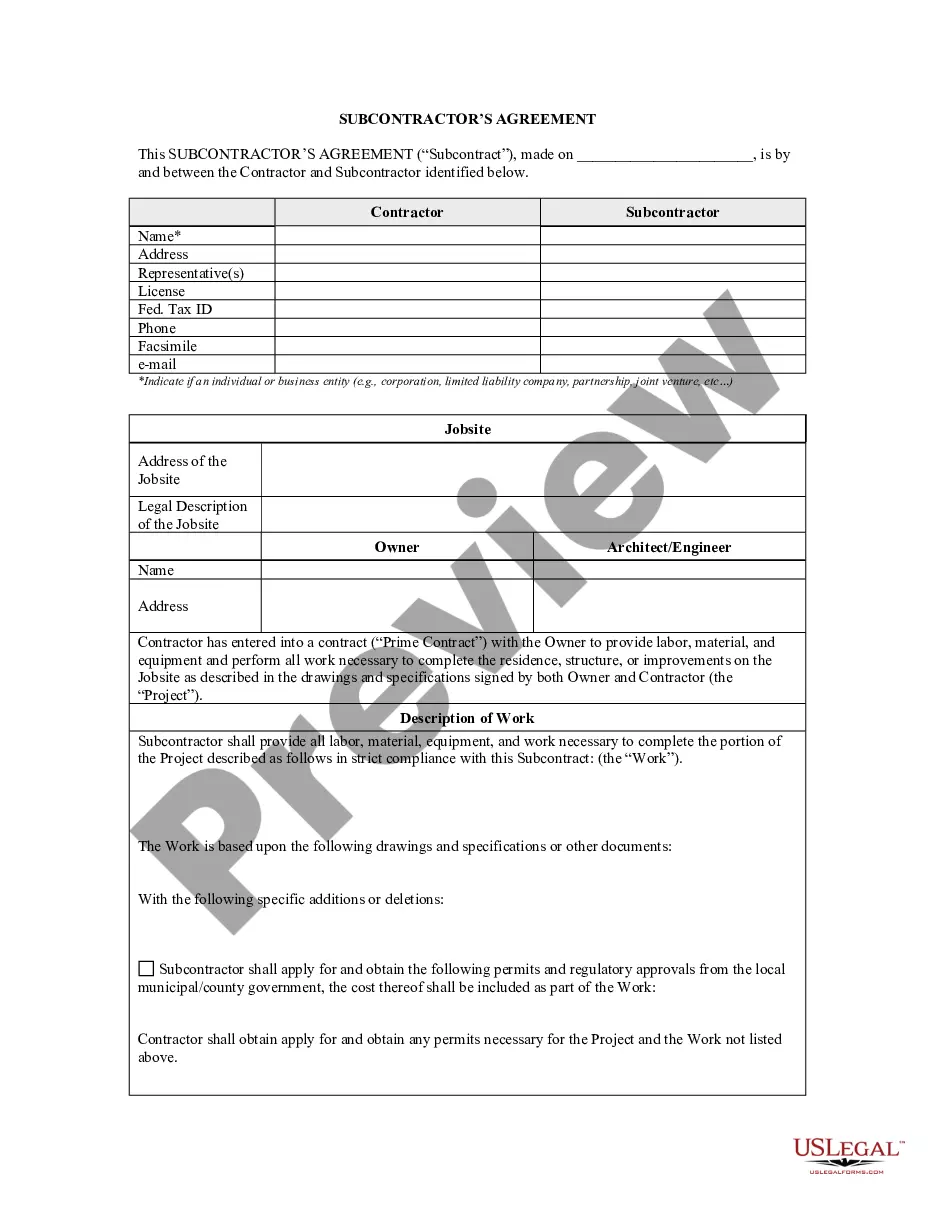

- Analyze the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!