Montgomery Maryland PRE Incorporation Agreement is a legally binding document that outlines the terms and conditions agreed upon by the founders of a company before its official incorporation in Montgomery County, Maryland. This agreement serves as a guiding framework, defining the roles, responsibilities, and rights of the founders during the pre-incorporation phase. The Montgomery Maryland PRE Incorporation Agreement typically includes important details such as the purpose of the business, the identities of the founders, the contribution of each founder (capital, assets, or intellectual property), the division of ownership and shares, the initial business plan, and the distribution of profits and losses. It ensures that all founders are on the same page and have a clear understanding of their obligations and expectations. Different types of Montgomery Maryland PRE Incorporation Agreements may exist based on the specific circumstances of the business and the preferences of the founders. Some variations may include: 1. General Montgomery Maryland PRE Incorporation Agreement: This is the most common type of agreement that covers all the necessary aspects of the pre-incorporation phase for any type of business. 2. Tech Startup Montgomery Maryland PRE Incorporation Agreement: This specific agreement may address additional provisions relevant to technology startups, such as intellectual property ownership, software development, licensing, and protection. 3. Partnership Montgomery Maryland PRE Incorporation Agreement: If the founders intend to form a partnership rather than a corporation, this agreement would include provisions related to the partnership structure, profit sharing, and decision-making processes. 4. Non-Profit Montgomery Maryland PRE Incorporation Agreement: If the founders are establishing a non-profit organization, this agreement may include clauses pertaining to the organization's charitable purpose, board structure, fundraising, and compliance with tax-exempt regulations. It is important for the founders to consult with legal professionals specialized in business law during the drafting and execution of the Montgomery Maryland PRE Incorporation Agreement to ensure its accuracy, enforceability, and compliance with local laws. Creating a comprehensive and well-defined agreement helps establish a solid foundation for the future success and operations of the company.

Montgomery Maryland Pre Incorporation Agreement

Description

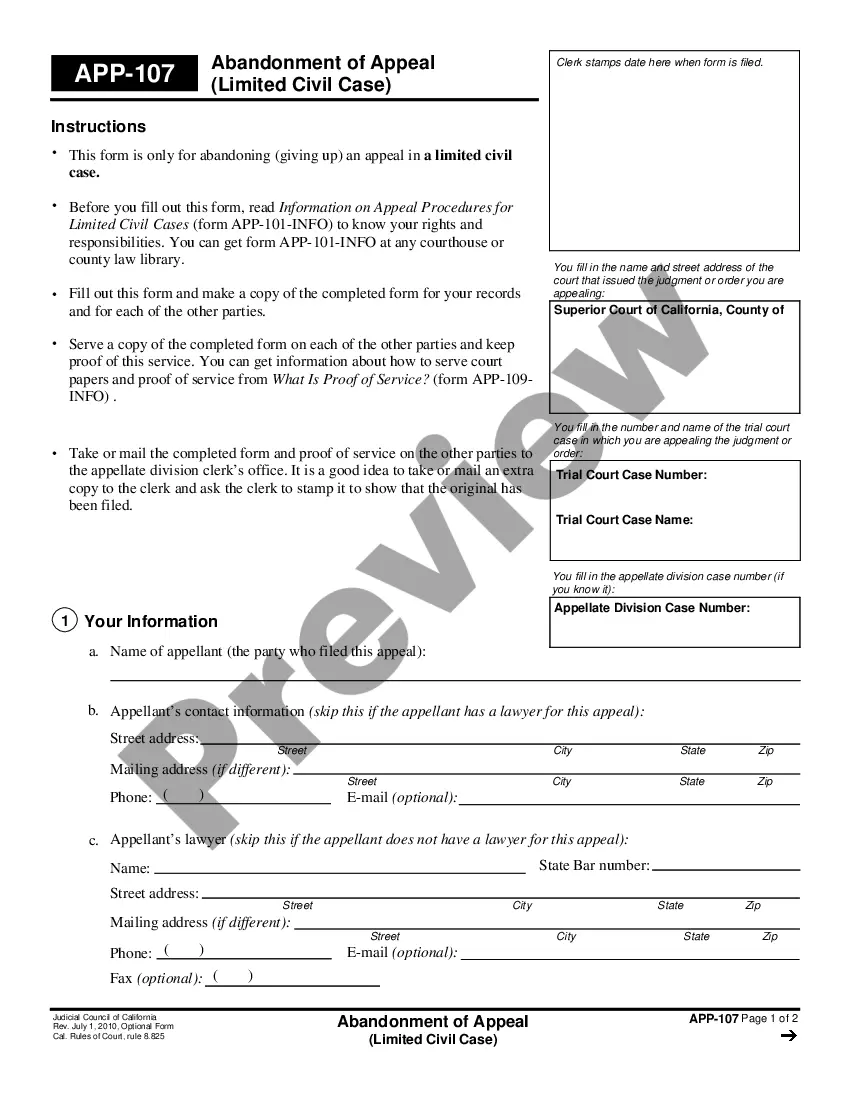

How to fill out Montgomery Maryland Pre Incorporation Agreement?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a lawyer to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Montgomery Pre Incorporation Agreement, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Consequently, if you need the current version of the Montgomery Pre Incorporation Agreement, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Montgomery Pre Incorporation Agreement:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Montgomery Pre Incorporation Agreement and download it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Incorporation contract is a contract that is entered into by a person who is acting on behalf of a company that does not exist. The person entering into the agreement has the intention that once the company comes into existence the company is to be bound by the provisions of the preincorporation contract.

incorporation contract is an agreement entered into by a person at the request of a corporation or corporation that did not exist at the time such an agreement was signed. These agreements are entered into because preliminary contracts and expenses are incurred before an organization takes shape.

6 Steps to Incorporating Your Business Step 1: Choose a business name. Get the one tech tool your startup really needs2026 for free.Step 2: Pick a location. Step 3: Decide on a corporate entity.Step 4: Obtain a tax ID number.Step 5: Manage the money.Step 6: State finalization and securing permits and licenses.

A promoter undertakes to bring about the incorporation of a business, procures for for it the rights and capital by which it is to carry out its purposes, and establishes it as able to do business.

Definition of preincorporation : existing or occurring before the formation of a corporation the preincorporation period/process preincorporation expenses a preincorporation contract.

Legal status of Pre-incorporation contract The legal status of a pre-incorporation contract is not easy to define. Going by the definition of the contract, there have to be at least two parties/persons who enter into contract with each other.

Any pre-incorporation contract must have the following items: Shareholders' name: The shareholders' names including the names of the promoters in the future company must be mentioned. Incorporation: The State in which the company would be incorporated must be mentioned.

Pre incorporation contracts are those contracts that are necessary to run a business or incorporation. When promoters make pre-incorporation contracts, the company is just an artificial entity which means at that time, the company does not exist. So basically, it cannot be executed at the time of incorporation.

Definition of preincorporation : existing or occurring before the formation of a corporation the preincorporation period/process preincorporation expenses a preincorporation contract.

Means an agreement entered into before the incorporation of a company by a person who purports to act in the name of, or on behalf of, the company, with the intention or understanding that the company will be incorporated, and will thereafter be bound by the agreement; Sample 1Sample 2Sample 3.