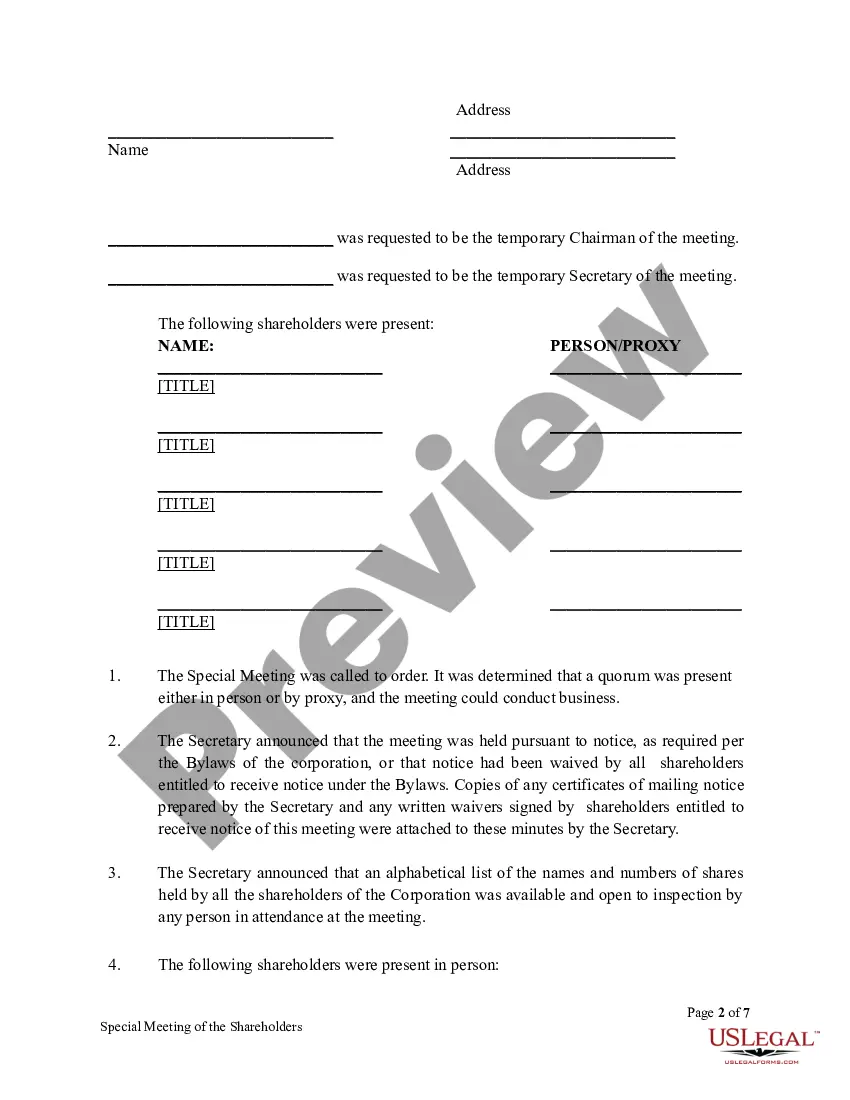

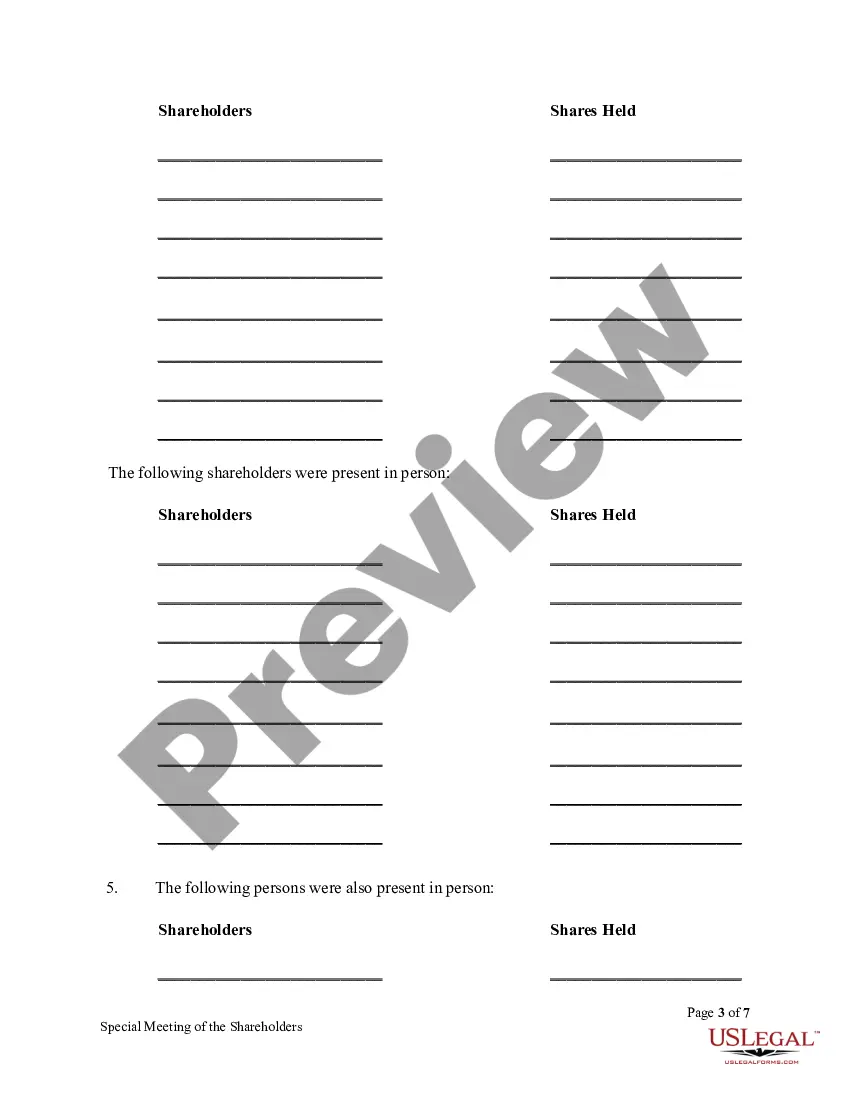

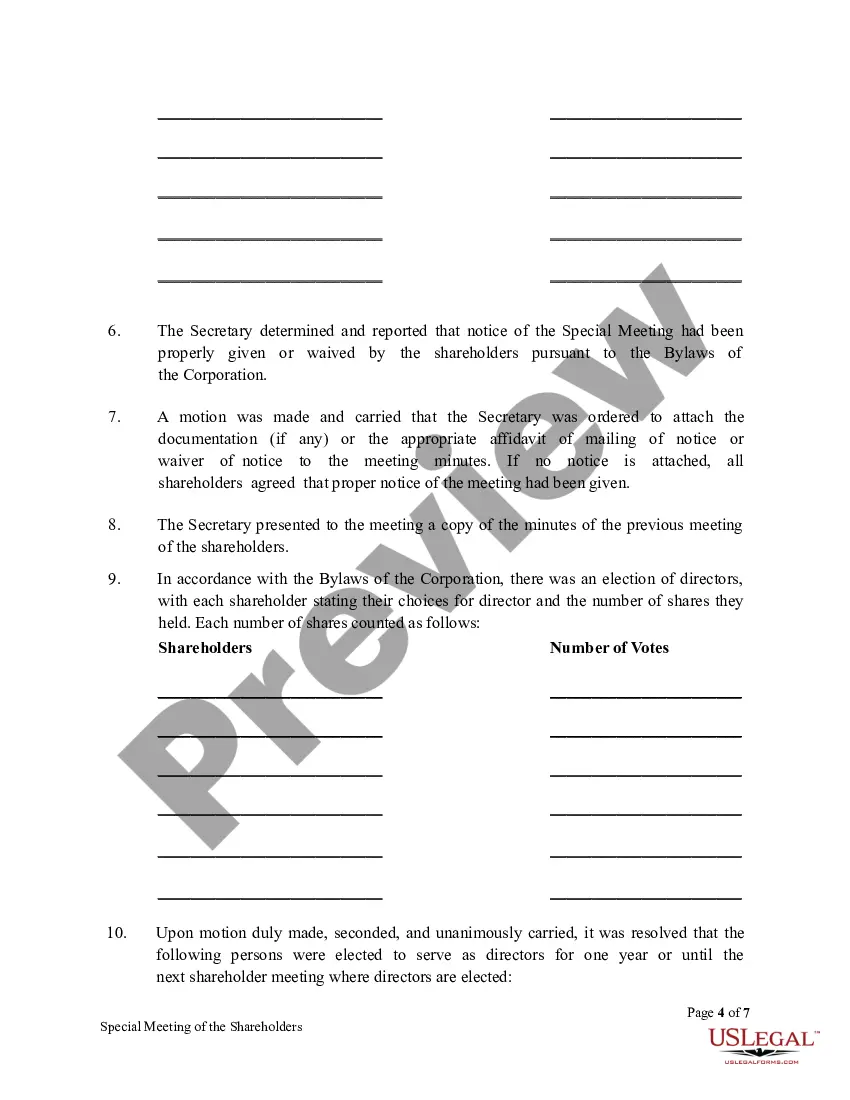

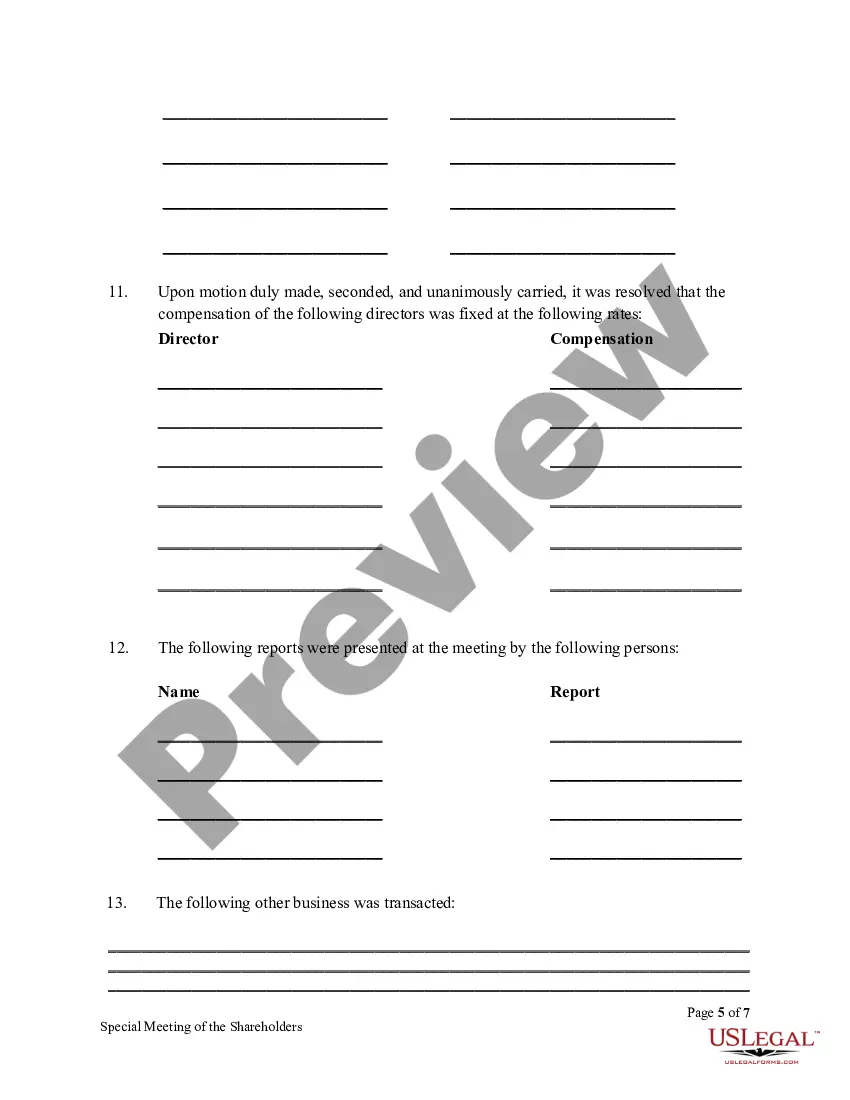

Phoenix Arizona Special Meeting Minutes of Shareholders are written records of important discussions, decisions, and actions taken during a meeting specifically convened for shareholders of a company in Phoenix, Arizona. These documents provide an accurate account of the proceedings and are vital for legal and historical purposes. The minutes typically include the following key elements: 1. Meeting Identification: The date, time, and location of the special meeting are stated to identify when and where the meeting took place. 2. Attendance: Names of shareholders, directors, officers, legal counsel, and other relevant attendees are recorded to establish who participated in the meeting. 3. Call to Order: The meeting is officially opened by the chairman or any designated person, indicating that the meeting has begun. 4. Approval of Minutes: If this is not the first meeting, the minutes of the previous meeting are reviewed, and the attendees vote for their approval or suggest corrections. 5. Purpose of the Meeting: The specific reason for the special meeting is outlined, such as discussing a major corporate decision, a merger or acquisition, leadership changes, or any other significant matter requiring shareholder input. 6. Reports and Presentations: If applicable, reports from officers, committees, or outside consultants can be presented, providing shareholders with updates on financial performance, strategic plans, or any other relevant matters. 7. Shareholder Discussions: Detailed notes are taken on discussions and debates that occur during the meeting. This includes key arguments made by shareholders, questions raised, and responses provided by management or subject-matter experts. 8. Voting Results: The outcome of any formal votes taken by the shareholders is documented, including the specific resolutions and the total number of votes for and against. This ensures transparency and accountability regarding key decisions. 9. Adjournment: The meeting is officially brought to a close by the chairman or designated person, indicating the conclusion of the meeting. Types of Phoenix Arizona Special Meeting Minutes of Shareholders may vary depending on the purpose of the meeting. Examples include: 1. Merger or Acquisition Meeting Minutes: These minutes specifically focus on discussions and decisions related to corporate mergers, acquisitions, or divestitures. 2. Leadership Change Meeting Minutes: These minutes highlight discussions and actions related to changes in the company's board of directors, executives, or other key leadership positions. 3. Financial Performance Meeting Minutes: These minutes primarily document discussions surrounding the company's financial results, including presentations on revenue, expenses, profitability, and future financial projections. 4. Capital Increase or Decrease Meeting Minutes: Minutes for meetings where shareholders decide on increasing or decreasing the company's authorized share capital. 5. Extraordinary Decision Meeting Minutes: These minutes cover special meetings convened for addressing extraordinary matters not covered in regular or annual shareholder meetings. By including relevant keywords such as "Phoenix Arizona," "special meeting minutes," and "shareholders," this content accurately reflects the specific context requested.

Phoenix Arizona Special Meeting Minutes of Shareholders

Description

How to fill out Phoenix Arizona Special Meeting Minutes Of Shareholders?

If you need to find a reliable legal paperwork provider to find the Phoenix Special Meeting Minutes of Shareholders, consider US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed form.

- You can search from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of supporting resources, and dedicated support team make it easy to find and complete different documents.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply select to look for or browse Phoenix Special Meeting Minutes of Shareholders, either by a keyword or by the state/county the form is intended for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Phoenix Special Meeting Minutes of Shareholders template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Create an account and select a subscription option. The template will be instantly ready for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes these tasks less expensive and more affordable. Create your first business, organize your advance care planning, draft a real estate agreement, or complete the Phoenix Special Meeting Minutes of Shareholders - all from the comfort of your home.

Join US Legal Forms now!