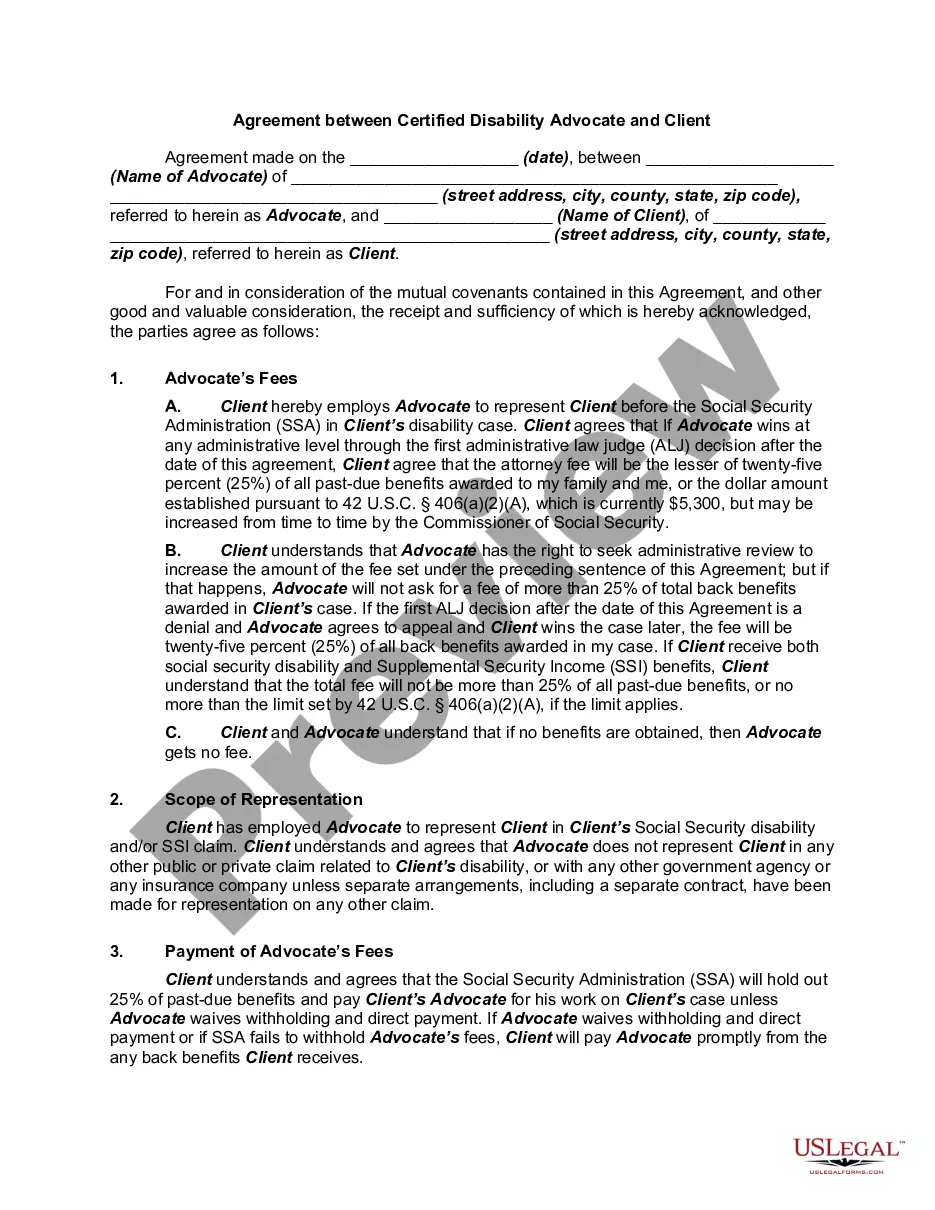

Chicago, Illinois Simple Agreement for Future Equity (SAFE): A Detailed Description Chicago, Illinois is a vibrant and bustling city known for its rich cultural heritage, stunning architecture, and thriving business ecosystem. This dynamic environment has given rise to innovative investment opportunities, including the Simple Agreement for Future Equity (SAFE) framework. The Chicago, Illinois Simple Agreement for Future Equity is a legal contract employed by companies to raise capital from investors while deferring the valuation and pricing of their equity until a future equity financing round occurs. This innovative agreement is an alternative to traditional convertible debt financing and provides an efficient mechanism for startups and early-stage companies in Chicago to attract investors while mitigating certain risks. A SAFE is a versatile investment instrument that serves both company and investor interests. By participating in a SAFE arrangement, Chicago-based startups can obtain much-needed financing for growth, product development, or expanding their operations. At the same time, investors gain exposure to potential equity appreciation in the future without immediately determining the valuation, making it an attractive option for those seeking early-stage investment opportunities. While the core principles of the Chicago, Illinois SAFE generally remain the same, there can be variations in terms and conditions depending on individual situations and the parties involved. Different types of Safes include: 1. Valuation Cap SAFE: This type of SAFE agreement establishes a maximum company valuation at which the investor can convert their investment into equity during a subsequent financing round. The valuation cap provides investors with a potential maximum return on their investment. 2. Discount SAFE: Under this variation, the investor receives a predetermined discount when converting their investment into equity during a future financing round. The discount serves as a reward for early-stage investors who take on more risk. 3. Most Favored Nation SAFE: The Most Favored Nation clause ensures that if the company later offers a SAFER (Simple Agreement for Equity Rights), the SAFE investor will receive the same or better terms as those offered to investors participating in the SAFER round, protecting the initial investor's interest. 4. Capped Safe: This type of SAFE includes both a valuation cap and a discount, combining the benefits of the Valuation Cap SAFE and Discount SAFE. It provides downside protection for investors by imposing a cap on the company's valuation while also offering them a discount during future financing rounds. Chicago's startup ecosystem embraces the versatile nature of the SAFE framework, allowing companies and investors to structure agreements tailored to their specific needs and expectations. By leveraging this innovative investment instrument, budding entrepreneurs in Chicago can access capital while maintaining the flexibility required for growth, and investors can enjoy potential returns dictated by the city's vibrant business landscape. In conclusion, the Chicago, Illinois Simple Agreement for Future Equity presents a compelling investment option for both startups and investors in the city's dynamic ecosystem. Whether through a Valuation Cap SAFE, Discount SAFE, Most Favored Nation SAFE, or Capped SAFE, this flexible framework empowers entrepreneurs and financiers to forge mutually beneficial partnerships while contributing to the growth of Chicago's entrepreneurial landscape.

Chicago Illinois Simple Agreement for Future Equity

Description

How to fill out Chicago Illinois Simple Agreement For Future Equity?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Chicago Simple Agreement for Future Equity, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Chicago Simple Agreement for Future Equity from the My Forms tab.

For new users, it's necessary to make some more steps to get the Chicago Simple Agreement for Future Equity:

- Examine the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template when you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!