Nassau County in New York State offers entrepreneurs and startup businesses an innovative financing option known as the Nassau New York Simple Agreement for Future Equity (SAFE). This agreement serves as a legal document that outlines the terms and conditions under which an investor provides funding to a company in exchange for a stake in its future equity. A SAFE agreement is designed to simplify the investment process and provide greater flexibility for both the investor and the startup. It is particularly valuable for early-stage companies that are not yet ready to determine an accurate valuation. With a SAFE, instead of investing in equity directly, the investor receives the right to obtain equity in the future, using predefined terms that are agreed upon at the time of investment. There are two common types of SAFE agreements that can be utilized in Nassau County: 1. SAFE with a Valuation Cap: This type of agreement includes a valuation cap, which sets a maximum limit on the company's valuation at the time of conversion. If the startup's valuation exceeds the cap during subsequent rounds of financing, the investor is entitled to convert their investment into equity at a predetermined discount rate. 2. SAFE with a Discount Rate: In this arrangement, investors receive a discount on the price per share when converting their investment at a future equity financing round. The discount provides an incentive for early investors, as they can purchase shares at a lower price compared to subsequent investors. Both types of SAFE agreements offer advantages to startups, such as providing a simple and efficient method of fundraising, allowing companies to delay the need for setting a valuation, and minimizing the upfront legal costs typically associated with other financing methods. Startups in Nassau County can leverage these agreements to attract investors, spur growth, and secure necessary capital to bring their innovative ideas to fruition. In conclusion, the Nassau New York Simple Agreement for Future Equity (SAFE) is a valuable financing tool available to startups in Nassau County. It simplifies the investment process, allows for flexible terms, and grants investors the right to acquire equity in the future. With options like SAFE with a Valuation Cap or SAFE with a Discount Rate, the agreement provides startups the opportunity to secure funding while postponing the valuation discussion until a later stage.

Nassau New York Simple Agreement for Future Equity

Description

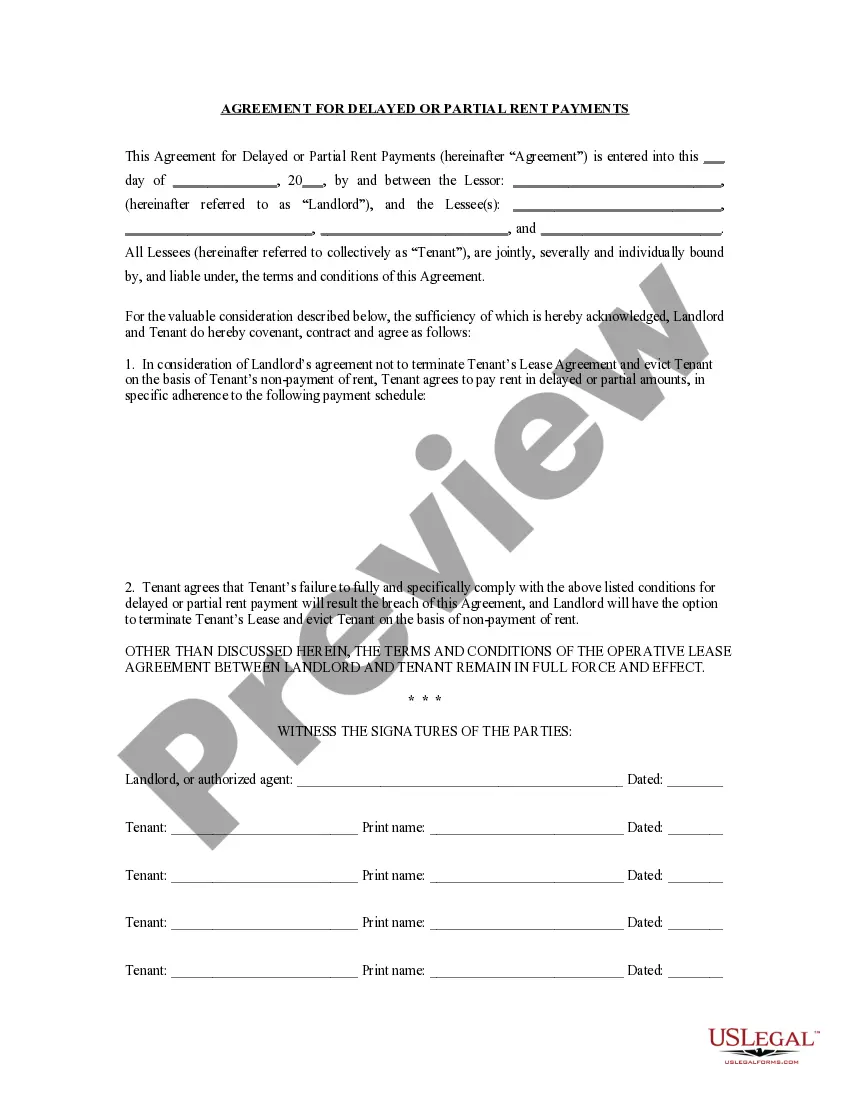

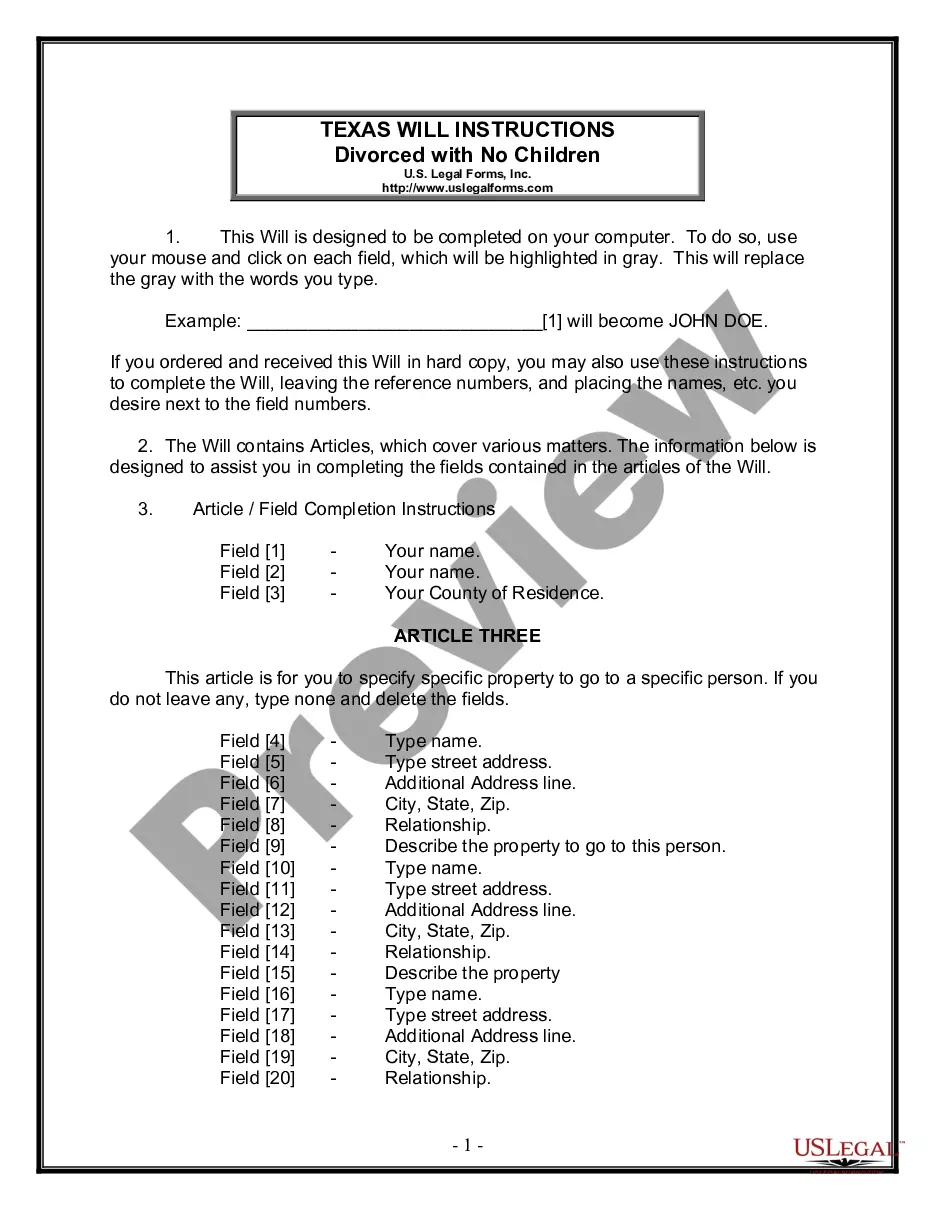

How to fill out Nassau New York Simple Agreement For Future Equity?

Whether you intend to open your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like Nassau Simple Agreement for Future Equity is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several additional steps to obtain the Nassau Simple Agreement for Future Equity. Follow the guidelines below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to obtain the file once you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Simple Agreement for Future Equity in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!