Dallas, Texas Simple Agreement for Future Equity, also known as SAFE, is a contractual agreement utilized by startups to raise capital while offering potential investors a future equity stake in the company. This innovative investment tool has gained popularity within the Dallas, Texas startup ecosystem due to its flexibility and simplicity. The Dallas, Texas SAFE operates as a legally binding contract, outlining the terms and conditions under which an investor will potentially convert their investment into equity ownership in the future. This agreement assures investors a streamlined process, eliminating the need to determine the company's valuation at the time of investment. Safes provide various benefits for both startups and investors in Dallas, Texas. Startups can access needed capital without immediately assigning a valuation to their company, circumventing complicated negotiations and potential conflicts. Additionally, SAFE soften contain investor-friendly terms, such as conversion discounts or valuation caps, offering investors additional incentives to participate. In Dallas, Texas, there are various types of Safes tailored to specific investment scenarios. Firstly, the Valuation Cap SAFE offers investors a predetermined maximum valuation at which their investment will convert into equity. This type of SAFE protects investors from potential unfavorable future valuations, ensuring they receive a fair stake in the company. Secondly, the Discount SAFE enables investors to acquire equity at a discounted rate during a future priced equity round. This ensures that early-stage investors are rewarded for taking the risk of investing in the company's earliest stages. Lastly, the most common type of SAFE is the Simple Agreement for Future Equity (Uncapped). This agreement does not include a valuation cap or a discount rate, providing both startups and investors with greater flexibility. However, this type of SAFE might be perceived as more risky for investors, as they have no predetermined protections. In conclusion, the Dallas, Texas Simple Agreement for Future Equity (SAFE) is a popular investment tool utilized by startups in the region to secure funding while offering potential investors a future equity stake. With various types of Safes available, investors can choose the agreement that best aligns with their investment preferences and risk tolerance. Its simplicity and flexibility make it an attractive option for startups and investors in the vibrant Dallas, Texas startup ecosystem.

Simple Agreement For Future Equity Is

Description

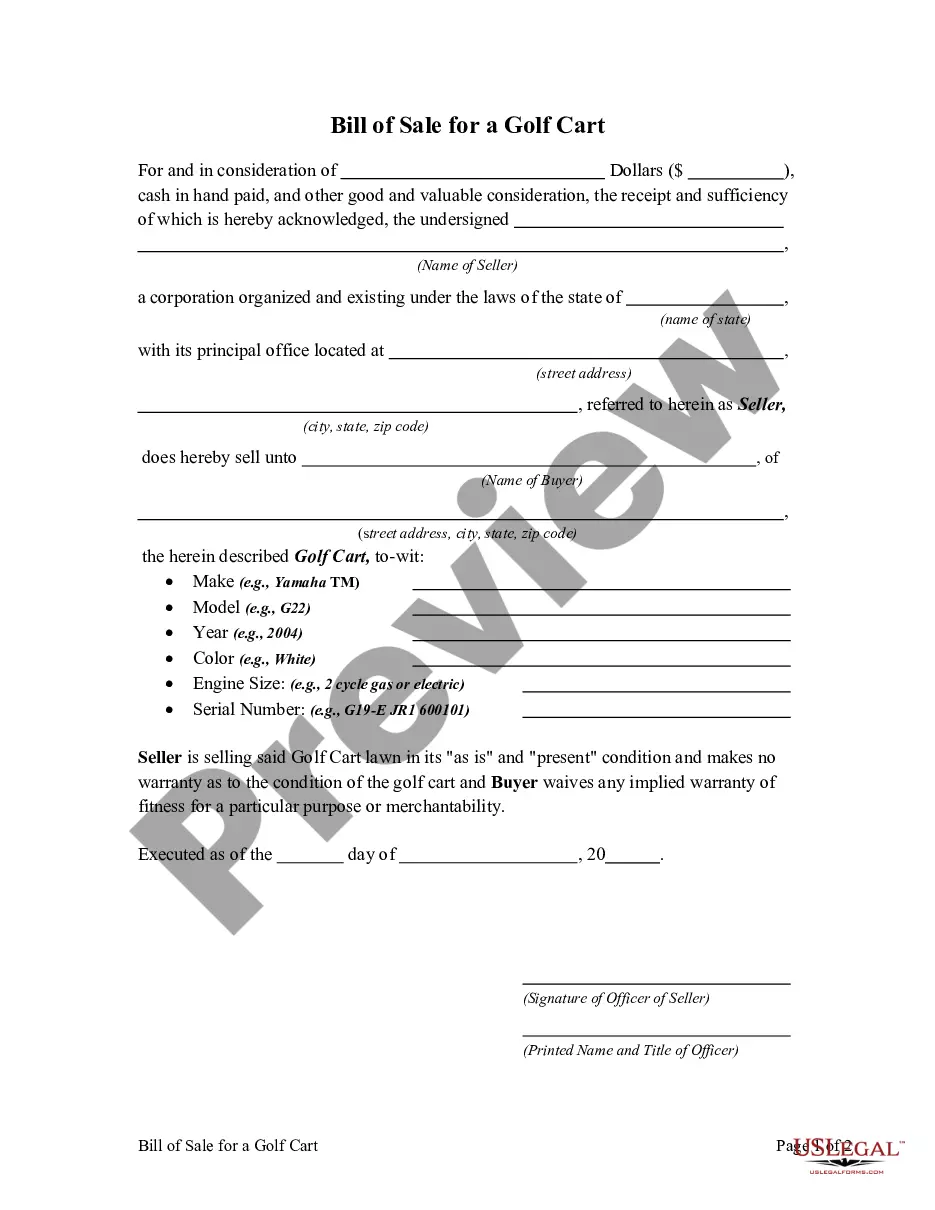

How to fill out Dallas Texas Simple Agreement For Future Equity?

Whether you plan to start your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Dallas Simple Agreement for Future Equity is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to get the Dallas Simple Agreement for Future Equity. Adhere to the guidelines below:

- Make sure the sample fulfills your personal needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to get the file once you find the right one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Dallas Simple Agreement for Future Equity in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

A simple agreement for future equity (SAFE) is an agreement between an investor and a company that provides rights to the investor for future equity in the company similar to a warrant, except without determining a specific price per share at the time of the initial investment.

SAFE agreements are powerful investing tools. However, there are important terms in SAFE Agreements that you must understand. The five terms we'll consider in this article include discounts, valuation caps, pre-money or post-money, pro-rata rights, and the most favored nations provision.

Here are the best low-risk investments in June 2022: High-yield savings accounts. Series I savings bonds. Short-term certificates of deposit. Money market funds. Treasury bills, notes, bonds and TIPS. Corporate bonds. Dividend-paying stocks. Preferred stocks.

Yes, there is a simple and safe way to invest in equity. You can invest in equity without the abovementioned problems. You can invest in equity with practically zero possibility of losing your entire capital. The answer isSIP in index funds.

A KISS agreement (which is a Keep It Simple Security), is a simplified investment structure that is similar to a convertible note, which gets capital into your company much faster than more conventional methods.

SAFEs do not represent a current equity stake in the company in which you are investing. Instead, the terms of the SAFE have to be met for you to receive any shares in the company.

U.S. Treasury bonds are widely considered the safest investments on earth. Because the United States government has never defaulted on its debt, investors see U.S. Treasuries as highly secure investment vehicles.

Equity Mutual Funds as a category are considered 'High Risk' investment products. While all equity funds are exposed to market risks, the degree of risk varies from fund to fund and depends on the type of equity fund.

A convertible note is debt, while a SAFE is a convertible security that is not debt. As a result, a convertible note includes an interest rate and maturity rate, while a SAFE does not. A SAFE is simpler and shorter than most convertible notes.

SAFE agreements are neither debt nor equity. Instead, they're the contractual rights to future equity. These rights are in exchange for early capital contributions invested into the startup. SAFE agreements allow investors to convert investments into equity during a priced round at some future point.