Chicago, Illinois Simple Agreement for Future Equity, also commonly known as SAFE, is a legal contract that governs the investment in early-stage startups in Chicago, Illinois. It is a financial agreement where an investor provides capital to a startup in exchange for the right to obtain shares in the company at a future date, usually upon a specific milestone or event. This financing tool has gained significant popularity in the Chicago startup ecosystem due to its simplicity, flexibility, and investor-friendly terms. The Chicago Illinois SAFE is designed to facilitate fundraising for startups by mitigating the complexities associated with traditional equity financing. There are several types of Chicago Illinois Simple Agreement for Future Equity that cater to different investment scenarios: 1. Conversion SAFE: This type of SAFE includes a conversion feature that allows the investor's initial investment to convert into equity shares in the event of a subsequent financing round or specific trigger event, such as a sale or IPO. The conversion terms are typically determined based on the terms negotiated in the subsequent financing round. 2. Valuation Cap SAFE: In this type of SAFE, the investor agrees to a valuation cap, which sets a maximum pre-money valuation at which their investment will convert into equity. This ensures that the investor receives a certain percentage of ownership in the company, even if the subsequent financing round values the startup at a higher valuation. 3. Discount SAFE: A Discount SAFE grants the investor the right to purchase equity shares at a predetermined discounted price compared to the valuation of the subsequent financing round. This provides investors with an advantage by enabling them to acquire more shares for their initial investment, encouraging early investments in startups. 4. MFN SAFE: The Most Favored Nation (MFN) SAFE includes a provision that ensures the investor receives the most favorable terms available in subsequent financing rounds. This protects the investor from receiving less favorable terms compared to other investors in the future, ensuring they are treated equally. 5. Post-Money SAFE: Unlike traditional Safes, the Post-Money SAFE values the startup based on its post-money valuation. This means that the investor's ownership percentage is determined after the successful completion of a subsequent financing round, taking into account the influx of capital from that round. Overall, the Chicago Illinois Simple Agreement for Future Equity serves as a valuable tool for early-stage startups in Chicago to attract investments and secure funding for their growth. The different types of Safes enable startups and investors to negotiate terms that best align with their respective interests, fostering innovation and entrepreneurship in the vibrant Chicago startup ecosystem.

Chicago Illinois Simple Agreement for Future Equity

Description

How to fill out Chicago Illinois Simple Agreement For Future Equity?

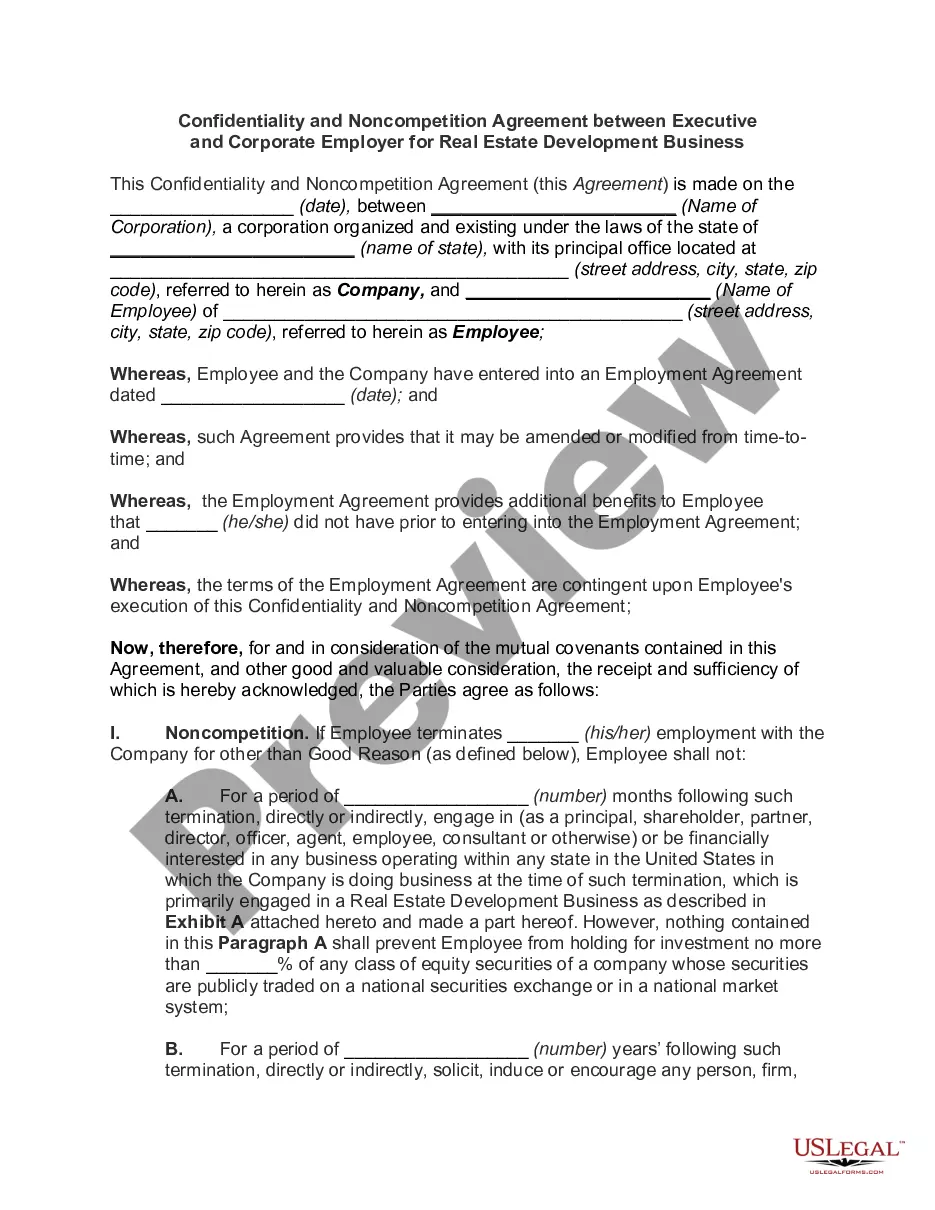

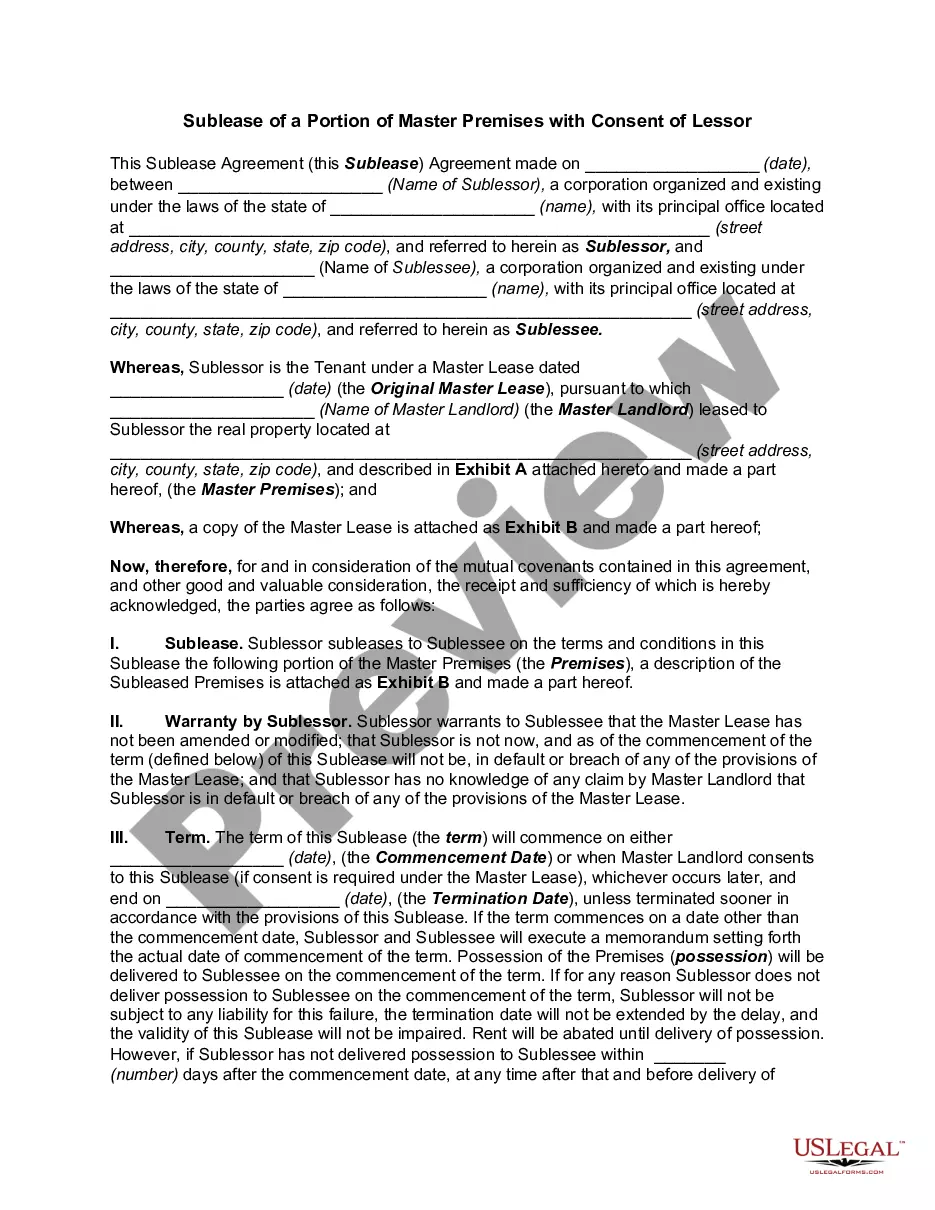

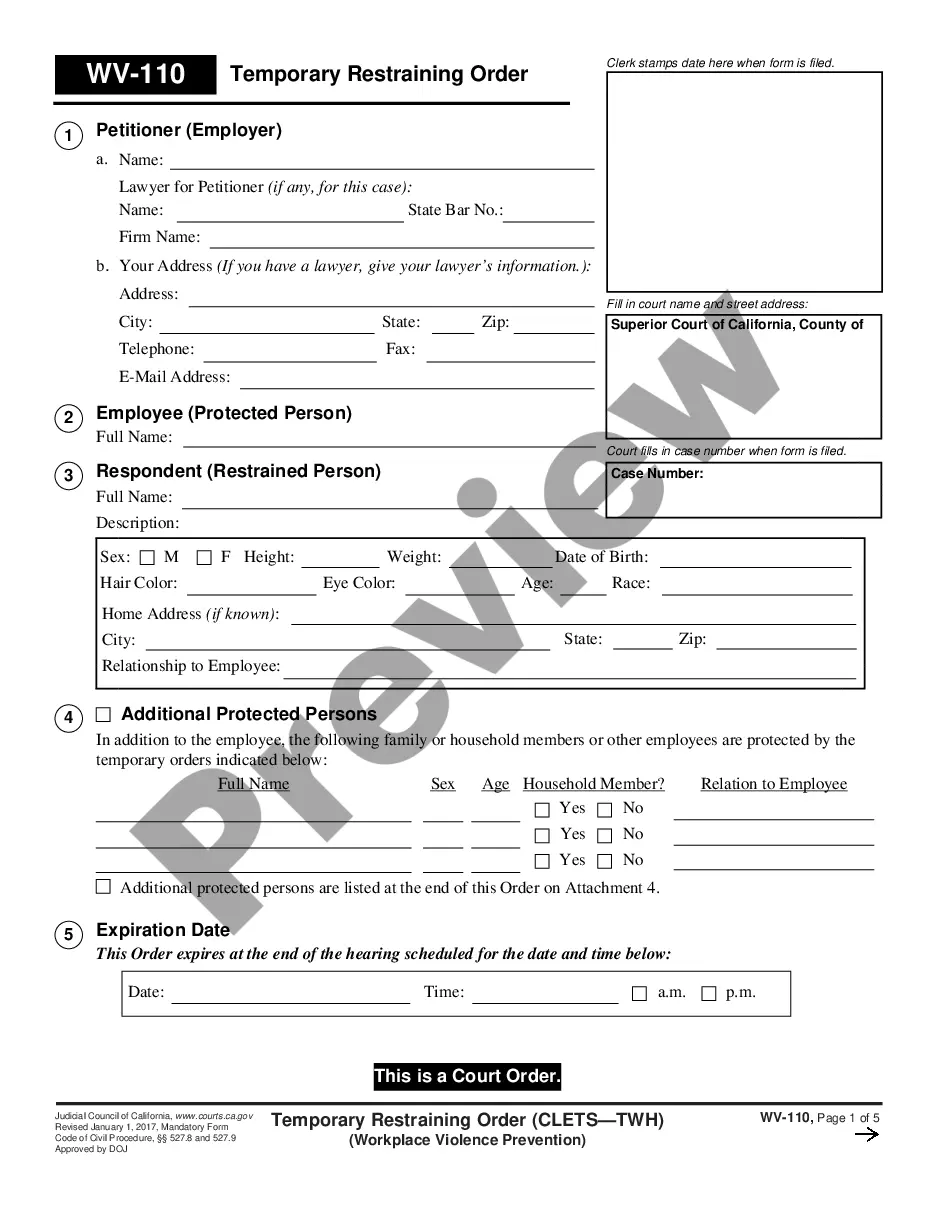

Preparing papers for the business or individual needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to generate Chicago Simple Agreement for Future Equity without professional assistance.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Chicago Simple Agreement for Future Equity by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Chicago Simple Agreement for Future Equity:

- Examine the page you've opened and check if it has the document you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that meets your needs, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any use case with just a couple of clicks!

Form popularity

FAQ

SAFEs serve as a placeholder for an equity investment in the company's next equity financing. For startup founders, SAFEs are beneficial because they do not act like debt instrument ? they do not accrue interest and do not have a maturity date.

The convertible note and the SAFE work very similarly. The difference is that the convertible note is a debt instrument (or loan) that converts to equity. The SAFE simply provides the right to purchase equity at a capped price (possibly with a discount) during a future equity funding event.

Some issuers have been offering a new type of security as part of some crowdfunding offerings?which they have called a SAFE. The acronym stands for Simple Agreement for Future Equity. These securities come with risks, and are very different from traditional common stock.

Investors using the SAFE get a financial stake in the company, but are not immediately holders of stock. Investments are converted to equity if certain ?trigger events? occur, such as the company's future financing, acquisition, IPO or another event pre-determined by the SAFE.

ISAFE stands for India Simple Agreement For Future Equity. 100X.VC, an early-stage investment firm in India was the first to introduce the iSAFE in India. It is an agreement to purchase equity shares of the company at a future date.

A simple agreement for future equity (SAFE) is a financing contract that may be used by a startup company to raise capital in its seed financing rounds. The instrument is viewed by some as a more founder-friendly alternative to convertible notes.

Interesting Questions

More info

A contract must be of a level adequate to achieve the objectives of its issuer. In this way, brokers and hedge funds make loans, and you, as a trader, make the trades using your position, and not your own account. The trading of these contracts is conducted through the use of a derivatives exchange, and the results of the trades are passed on to your brokerage account, which then deposits or pays you. Trading has more than one way. You and your broker or exchange are involved in the trading, not just the customer, because the brokerage is also the money market clearing agent. Your broker can set you and the contract in order to place and cancel orders, or you can set them to enter or exit trading sessions. Your trading position will vary with the price of the futures (i.e. the spread) between the price of the futures and the price of the underlying; if your order was placed to sell, it would bid at the market rate and sell its contract at the price of the underlying.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.