Kings New York Simple Agreement for Future Equity (SAFE) is a legal contract widely used in startup financing that allows investors to provide funding to early-stage companies in exchange for potential equity ownership in the future. This financing instrument provides a mutually beneficial agreement between founders and investors, offering simplicity and flexibility. The Kings New York SAFE is designed to eliminate the complexity of traditional investment structures such as convertible notes. It offers key advantages like transparency, ease of use, and a clear valuation framework. This innovative instrument aligns the interests of both parties while minimizing legal complications and negotiation efforts. The Kings New York SAFE comprises different types based on the specific terms and conditions outlined in the agreement. Some notable variations include: 1. pre-Roman SAFE: This type of agreement determines the valuation of the company prior to the investment. It specifies the ownership percentage the investor will receive upon conversion of their investment into equity in the future. 2. Post-Money SAFE: In contrast to the pre-money SAFE, the post-money SAFE includes the total valuation of the company including the new investment. This type clearly outlines the ownership percentage the investor will hold after the investment is made. 3. Discount SAFE: This SAFE type offers investors a discount on the future valuation at the time of conversion into equity. For example, a discount of 20% means the investor will convert their investment into equity at a valuation 20% lower than the valuation of the subsequent financing round. 4. Valuation Cap SAFE: With a valuation cap, this SAFE provides investors with an upper threshold on the valuation while converting their investment into equity. This ensures that the investor's ownership percentage is not diluted excessively, protecting their potential return on investment. 5. Most Favored Nation SAFE: This variation aims to protect the investor by offering them the best terms in the subsequent financing rounds. If the company later offers better terms to subsequent investors, the initial investor automatically receives the updated terms, safeguarding their investment against potential disadvantages. It is important for both founders and investors to thoroughly understand the specific terms and implications of each type of Kings New York SAFE. Consulting with legal and financial experts is advised to ensure compliance and to tailor the agreement to the unique needs and circumstances of the company and its investors.

Kings New York Simple Agreement for Future Equity

Description

How to fill out Kings New York Simple Agreement For Future Equity?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any personal or business purpose utilized in your region, including the Kings Simple Agreement for Future Equity.

Locating templates on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Kings Simple Agreement for Future Equity will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to obtain the Kings Simple Agreement for Future Equity:

- Ensure you have opened the correct page with your regional form.

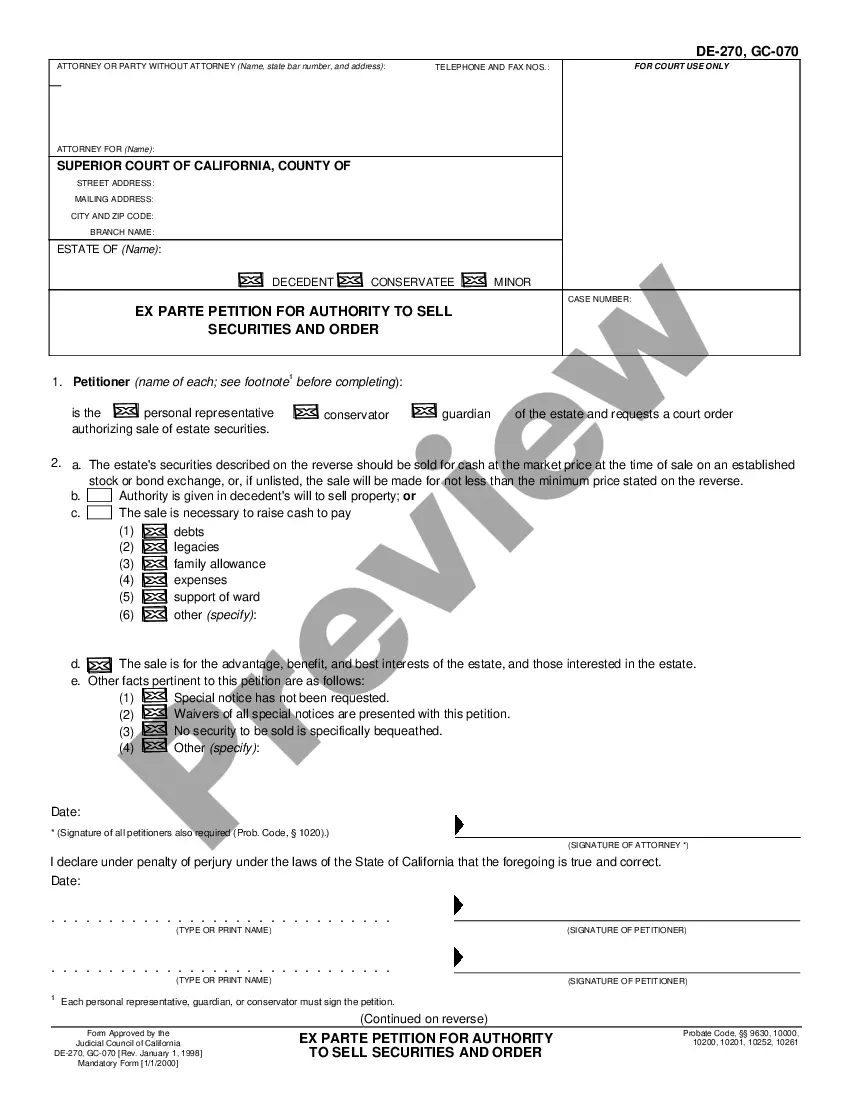

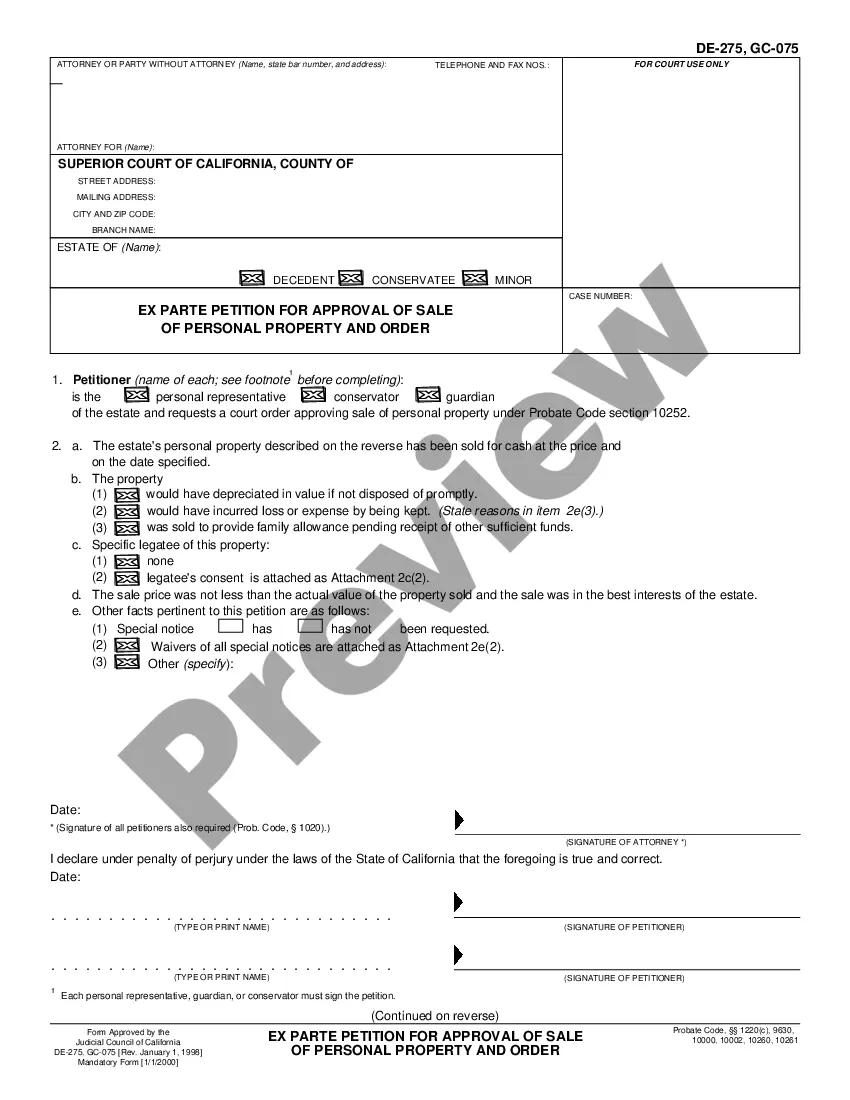

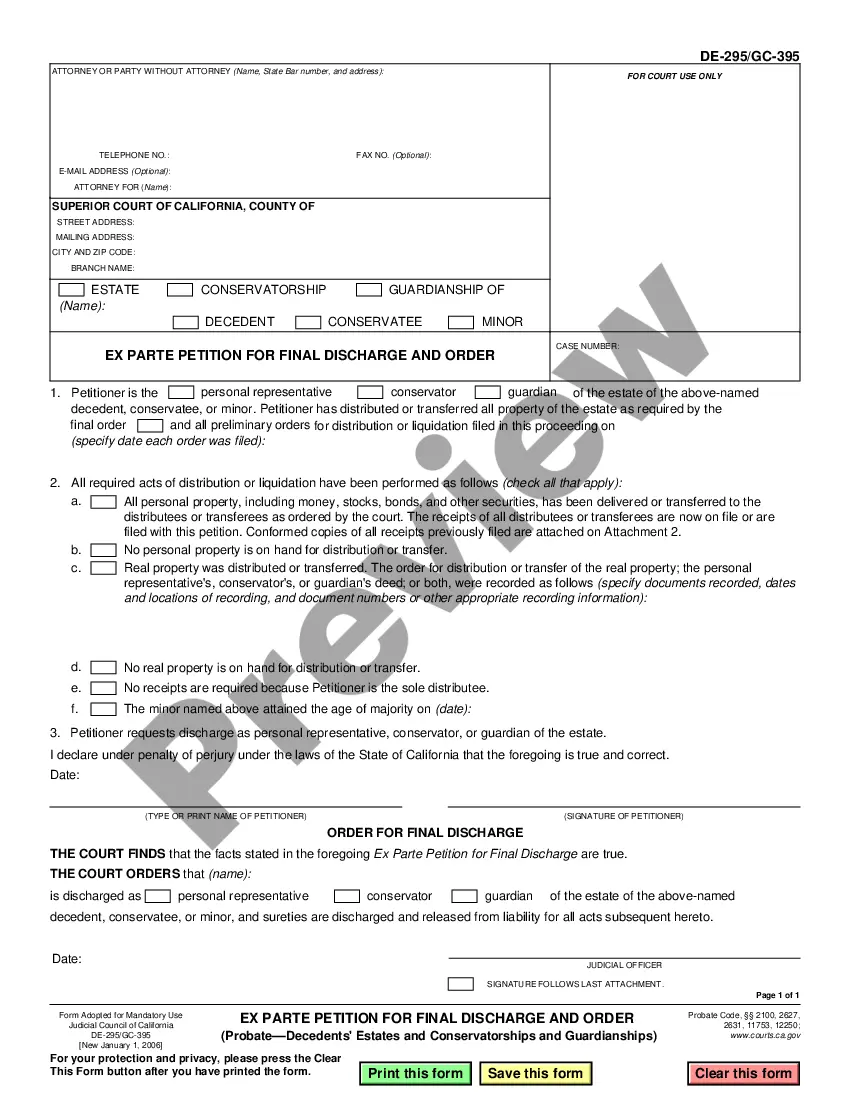

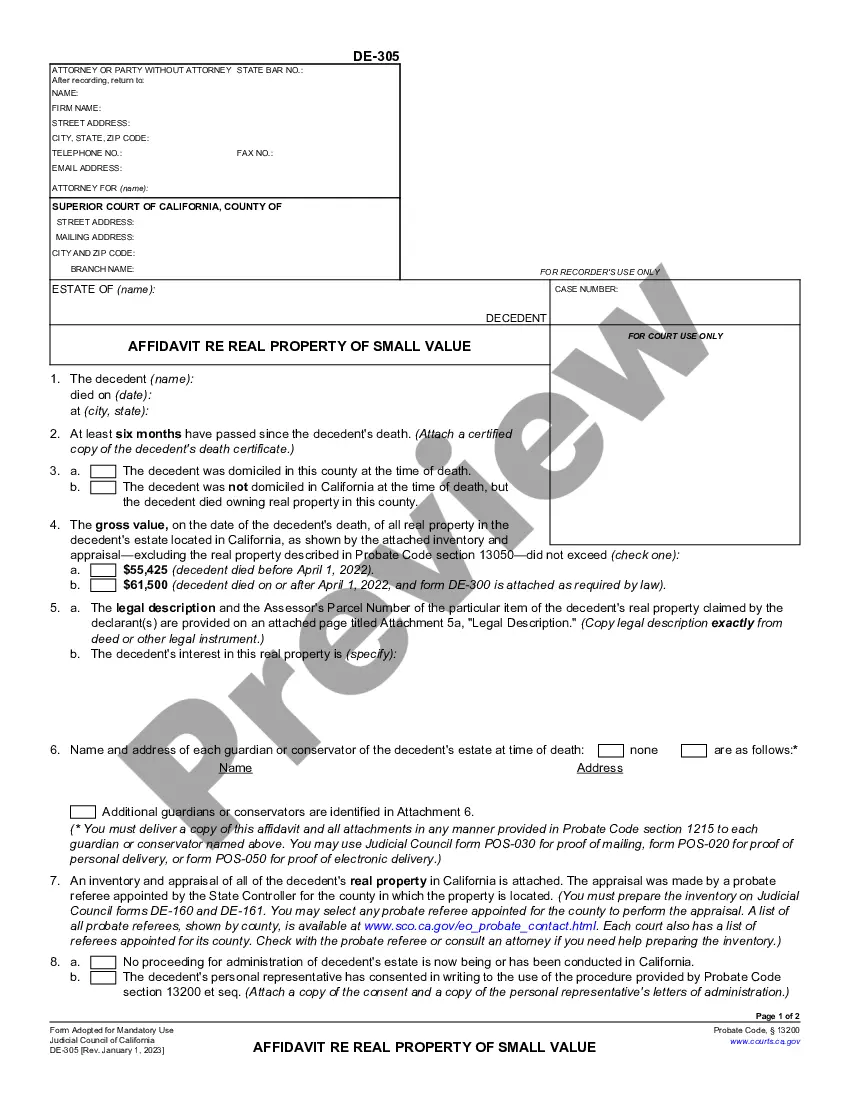

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Kings Simple Agreement for Future Equity on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!