Maricopa, Arizona Simple Agreement for Future Equity (SAFE) is a legal instrument commonly used in startup financing, allowing investors to support early-stage companies in exchange for future equity. As an alternative to traditional equity instruments like stocks or shares, the SAFE agreement enables early-stage companies in Maricopa, Arizona, to raise capital without determining the valuation of the company at the time of investment. The Maricopa Arizona Simple Agreement for Future Equity grants investors the right to obtain shares in the company at a later stage when certain predetermined events occur, such as a subsequent funding round or a specific trigger event. This flexible structure allows startups to receive necessary capital without pricing their company early on, and investors can potentially benefit from the future success and increased valuation of the business. There are different types of Maricopa Arizona Simple Agreement for Future Equity that vary in terms and conditions to cater to different investment scenarios: 1. SAFE with a Valuation Cap: This type of SAFE sets a maximum valuation for the company when determining the conversion price into equity. It protects investors from the possibility of excessive dilution if the company achieves a very high valuation in subsequent funding rounds. 2. SAFE with a Discount Rate: In this variant, investors receive a discount when converting their investment into equity in the company's future financing round. This discount allows investors to obtain shares at a lower price compared to other investors in the subsequent round. 3. SAFE with a Valuation Cap and Discount Rate: This type combines both the valuation cap and the discount rate, providing investors with double protection and potentially better terms for converting their investment into equity. Startups in Maricopa, Arizona, often prefer utilizing the Simple Agreement for Future Equity as it simplifies the investment process, reduces negotiation complexity, and avoids the immediate need to establish a valuation. As the popularity of this investment instrument has grown in recent years, it has become a valuable tool for both Maricopa-based startups seeking early-stage capital and investors interested in supporting high-potential ventures.

Maricopa Arizona Simple Agreement for Future Equity

Description

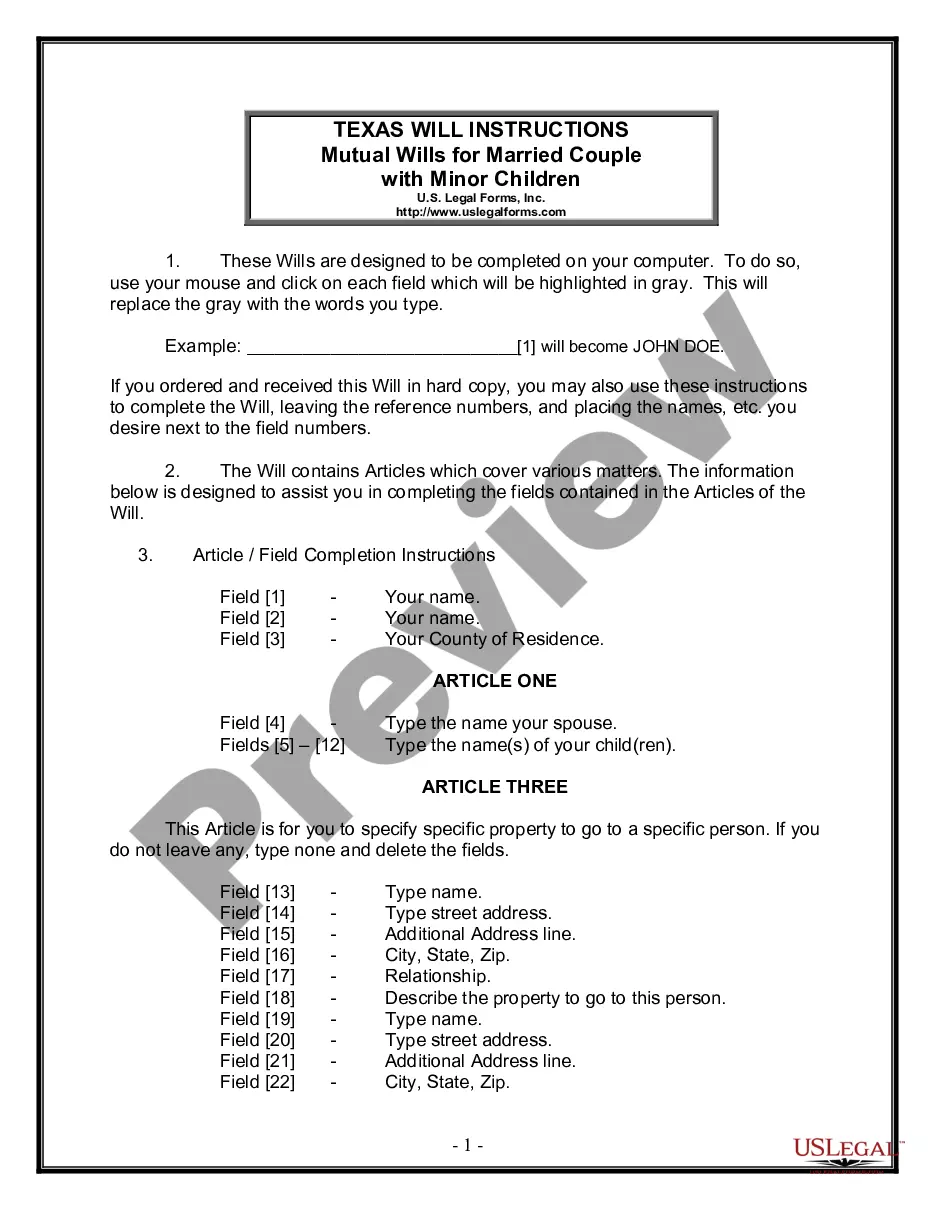

How to fill out Maricopa Arizona Simple Agreement For Future Equity?

If you need to find a trustworthy legal form supplier to find the Maricopa Simple Agreement for Future Equity, consider US Legal Forms. Whether you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed template.

- You can select from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of learning materials, and dedicated support make it simple to find and execute different documents.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply select to search or browse Maricopa Simple Agreement for Future Equity, either by a keyword or by the state/county the document is intended for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Maricopa Simple Agreement for Future Equity template and check the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Create an account and choose a subscription option. The template will be immediately ready for download as soon as the payment is processed. Now you can execute the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes these tasks less pricey and more reasonably priced. Create your first business, organize your advance care planning, create a real estate agreement, or complete the Maricopa Simple Agreement for Future Equity - all from the comfort of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

A simple agreement for future equity (SAFE) is a financing contract that may be used by a startup company to raise capital in its seed financing rounds. The instrument is viewed by some as a more founder-friendly alternative to convertible notes.

These agreements are made between a company and an investor and create potential future equity in the company for the investor in exchange for immediate cash to the company. The SAFE converts to equity at a later round of financing but only if a particular triggering event (outlined in the agreement) takes place.

Yes, there is a simple and safe way to invest in equity. You can invest in equity without the abovementioned problems. You can invest in equity with practically zero possibility of losing your entire capital. The answer isSIP in index funds.

Simple Agreements for Future Equity or SAFEs are investment contracts that allow investors to convert their investments in a company into securities upon the occurrence of a triggering event.

A simple agreement for future equity (SAFE) is an agreement between an investor and a company that provides rights to the investor for future equity in the company similar to a warrant, except without determining a specific price per share at the time of the initial investment.

A KISS agreement (which is a Keep It Simple Security), is a simplified investment structure that is similar to a convertible note, which gets capital into your company much faster than more conventional methods.

Entrepreneurs have a myriad of options for raising capital for their early-stage businesses including bootstrapping, crowdfunding, issuance of common stock, and issuance of convertible notes. Among these options is the Simple Agreement for Future Equity (SAFE).

SAFE stands for Simple Agreement for Future Equity. It was created by the team at Y Combinator and has been a popular method for investing at the earlier stage of a company. At the early stage of a startup, it can be difficult to accurately assign a value to the company because there is usually very little data.

Related Content. A simple agreement for future equity (SAFE) is a financing contract that may be used by a startup company to raise capital in its seed financing rounds. The instrument is viewed by some as a more founder-friendly alternative to convertible notes.