Orange, California is a vibrant city located in Orange County, renowned for its rich historical heritage and thriving community. Home to several prominent landmarks, educational institutions, and a flourishing business environment, Orange has become a desirable location for residents and entrepreneurs alike. One important aspect of the Orange California business landscape is the Simple Agreement for Future Equity (SAFE). SAFE is a legal contract commonly used by startups and early-stage companies to raise investment capital. It provides a flexible and streamlined approach to fundraising by offering an agreement between the company and the investor, without determining the specific valuation of the company at the time of investment. Orange California offers various types of Simple Agreement for Future Equity suited to the different requirements of entrepreneurs seeking funding. Some common variations of SAFE include: 1. pre-Roman SAFE: This type of SAFE determines the valuation of the company before any investment is made. It outlines the agreed-upon percentage of equity that the investor will receive in return for their investment. 2. Post-Money SAFE: In contrast to the pre-Roman SAFE, this type of agreement determines the valuation of the company after the investment has been made. It reflects the dilution of existing shareholders' ownership due to the new investment. 3. Valuation Cap SAFE: This variation includes a valuation cap, providing a maximum valuation that determines the investor's equity stake, regardless of the actual valuation in future financing rounds. It offers investors protection against potential future dilution. 4. Discount Rate SAFE: This type of agreement provides investors with a discount on the valuation of the company during future financing rounds. It ensures that the investor receives more equity for their investment compared to later investors. When utilizing a Simple Agreement for Future Equity in Orange California, it is crucial for both entrepreneurs and investors to seek legal counsel to ensure compliance with local regulations and to protect their interests. The agreements entered into through SAFE play a vital role in fostering a healthy investment ecosystem and driving innovation within the business community in Orange, California.

Orange California Simple Agreement for Future Equity

Description

How to fill out Orange California Simple Agreement For Future Equity?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Orange Simple Agreement for Future Equity, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you pick a sample, it remains available in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Orange Simple Agreement for Future Equity from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Orange Simple Agreement for Future Equity:

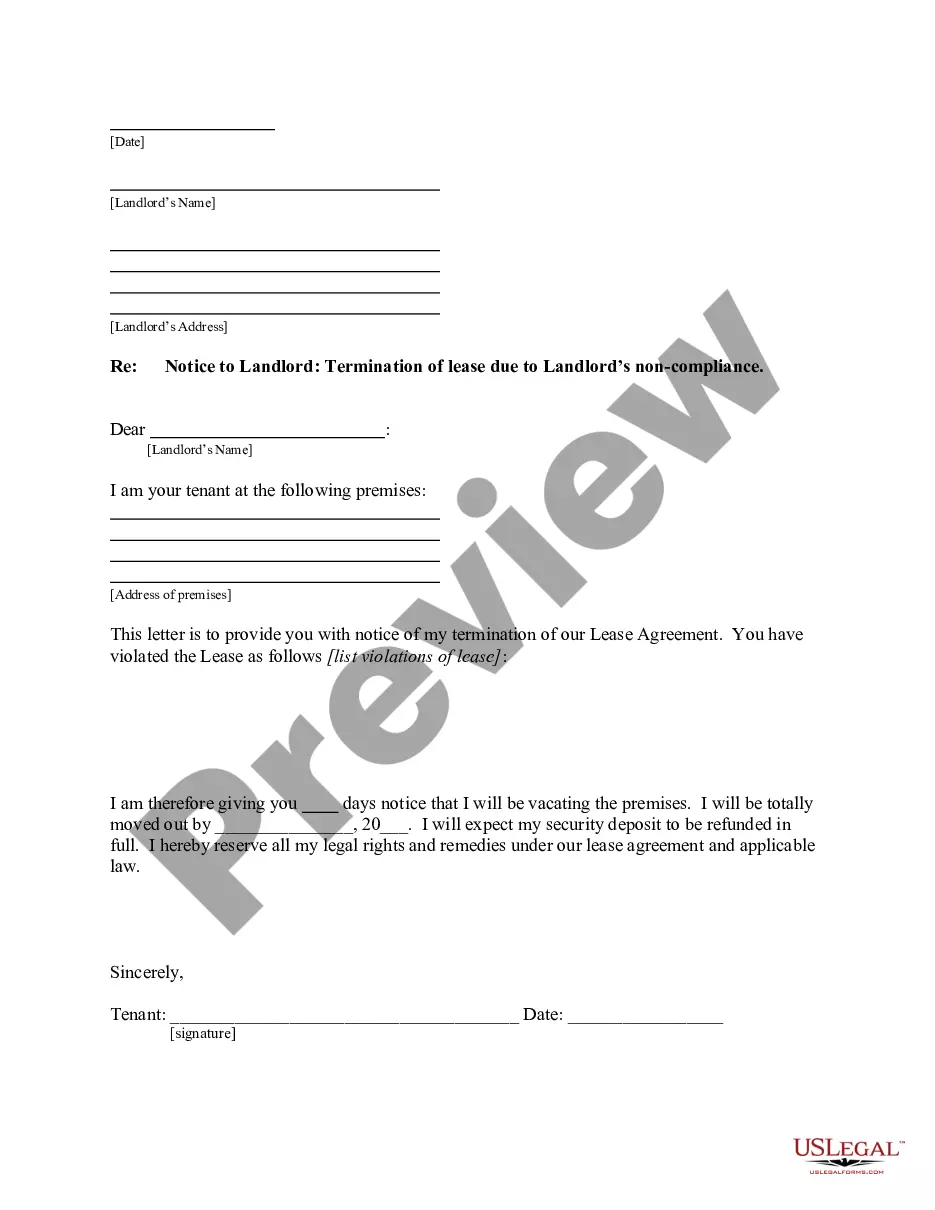

- Analyze the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document when you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!