The Wake North Carolina Simple Agreement for Future Equity (SAFE) is a legal contract that outlines the terms and conditions of an investment in a startup or early-stage company located in Wake, North Carolina. It is a popular framework used by entrepreneurs and investors to secure funding without determining the valuation of the company at the time of investment. The Wake North Carolina SAFE is designed to provide a simplified and standardized method for startup financing. It helps streamline the investment process by focusing on the future issuance of shares to investors instead of setting a specific valuation upfront. This allows startups to attract funding without the need for costly and time-consuming negotiations over company valuation. By utilizing a Wake North Carolina SAFE, both startups and investors benefit from flexibility and clarity. Startups can secure funding without worrying about immediate valuation, while investors get a stake in the company and potential future returns. This agreement establishes the terms for the conversion of the invested amount into equity shares or provides rights to alternative forms of compensation in future financing rounds. There are several types of Wake North Carolina SAFE agreements: 1. Valuation Cap SAFE: This type of SAFE establishes a maximum valuation for the startup when the investment converts into equity. It ensures that investors receive equity based on a predetermined cap, protecting their interests should the company's valuation skyrocket in future financing rounds. 2. Discount SAFE: In a Discount SAFE, investors are offered a discount on the future valuation when converting their investment into equity. This enables investors to secure a larger stake in the company for their investment, recognizing their early support. 3. MFN (Most-Favored Nation) SAFE: The MFN SAFE ensures that investors receive the best terms offered by the startup in future financing rounds. If the company provides more favorable terms to subsequent investors, the MFN SAFE investors are entitled to those same terms, preventing them from being disadvantaged. 4. Pro Rata Rights SAFE: This type of SAFE gives investors the right to maintain their ownership percentage in future financing rounds. It allows them to participate and invest more funds to preserve their proportional ownership as the company raises additional capital. Overall, the Wake North Carolina Simple Agreement for Future Equity presents an innovative and standardized approach to startup financing, offering a clear framework for both startups and investors to navigate their investment journey and nurture successful ventures in the thriving entrepreneurial ecosystem of Wake, North Carolina.

Wake North Carolina Simple Agreement for Future Equity

Description

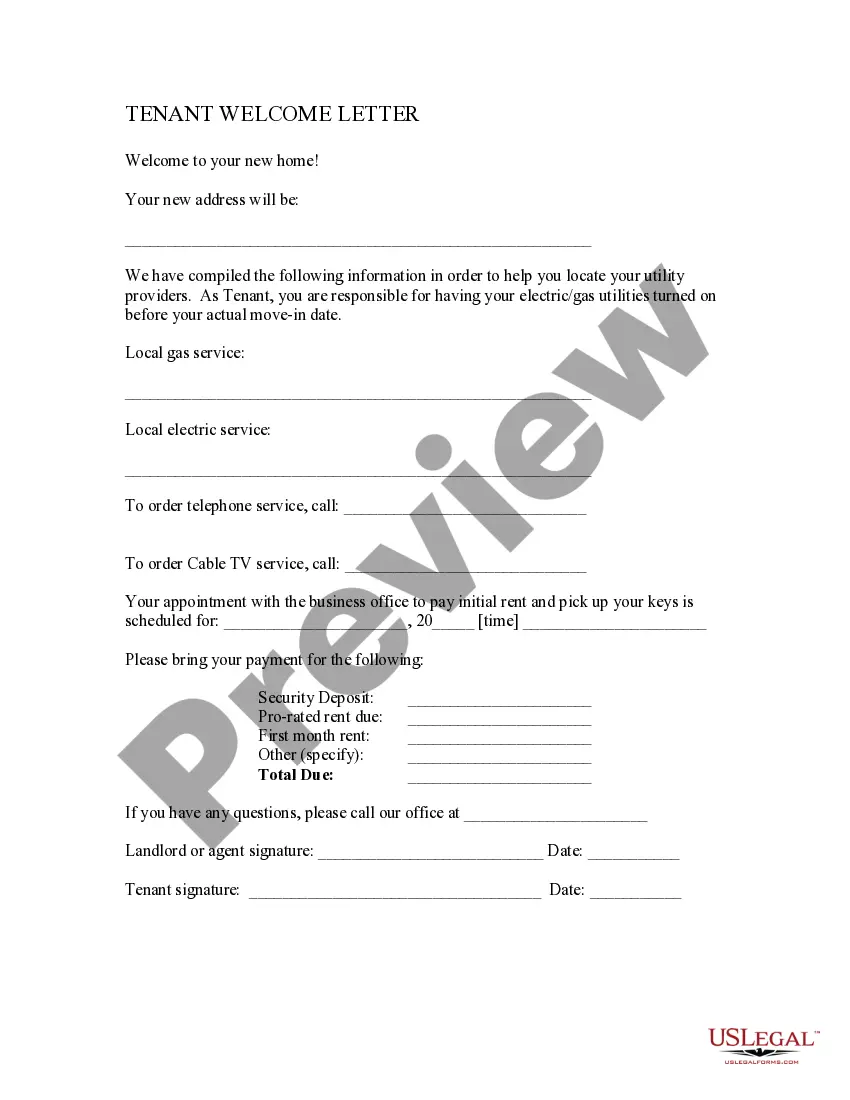

How to fill out Wake North Carolina Simple Agreement For Future Equity?

If you need to get a trustworthy legal form supplier to find the Wake Simple Agreement for Future Equity, consider US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can select from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of learning materials, and dedicated support make it easy to get and complete various documents.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

You can simply type to search or browse Wake Simple Agreement for Future Equity, either by a keyword or by the state/county the form is created for. After finding the necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the Wake Simple Agreement for Future Equity template and check the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and choose a subscription option. The template will be instantly ready for download once the payment is completed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes these tasks less expensive and more affordable. Set up your first business, organize your advance care planning, draft a real estate contract, or execute the Wake Simple Agreement for Future Equity - all from the convenience of your home.

Sign up for US Legal Forms now!