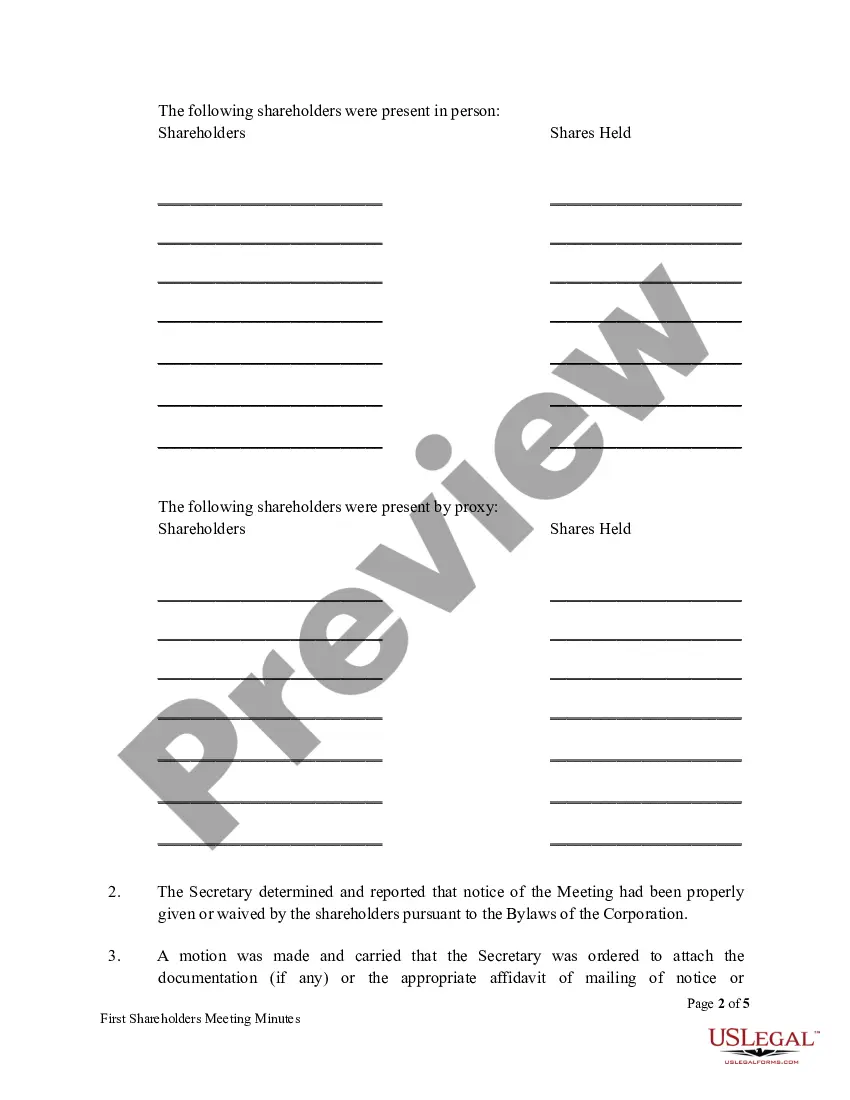

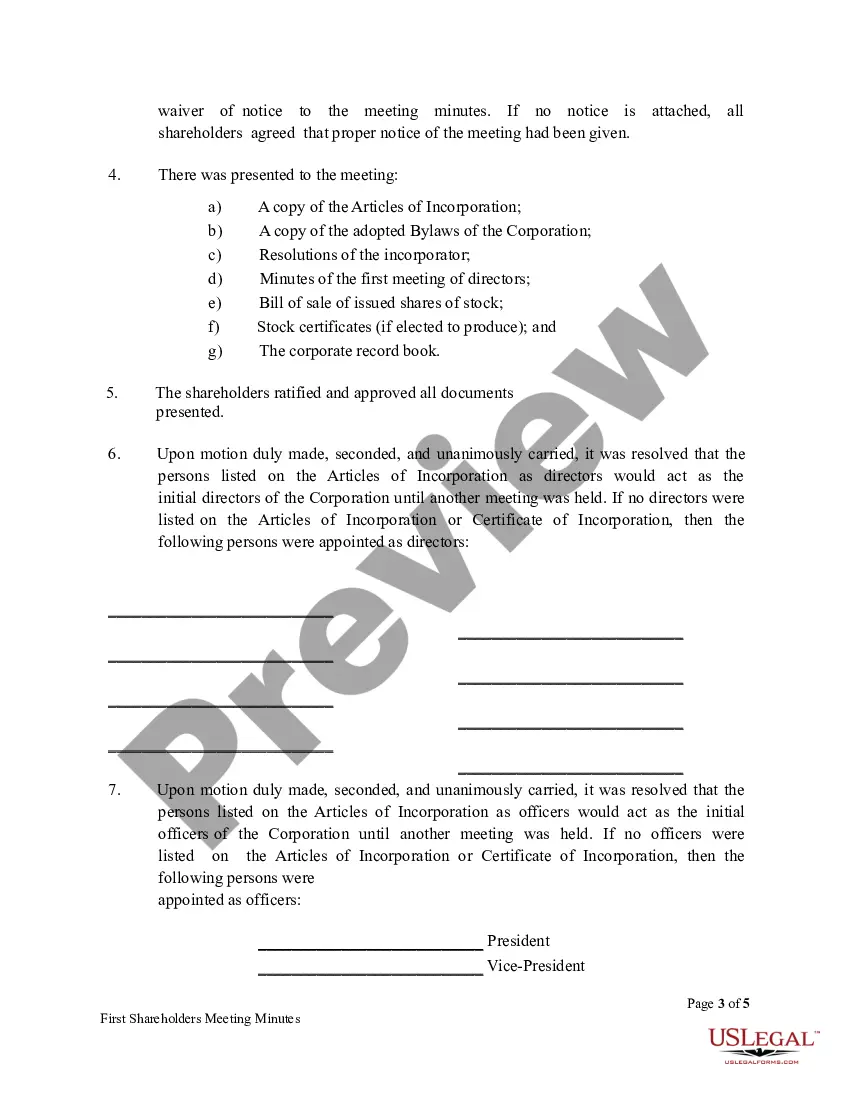

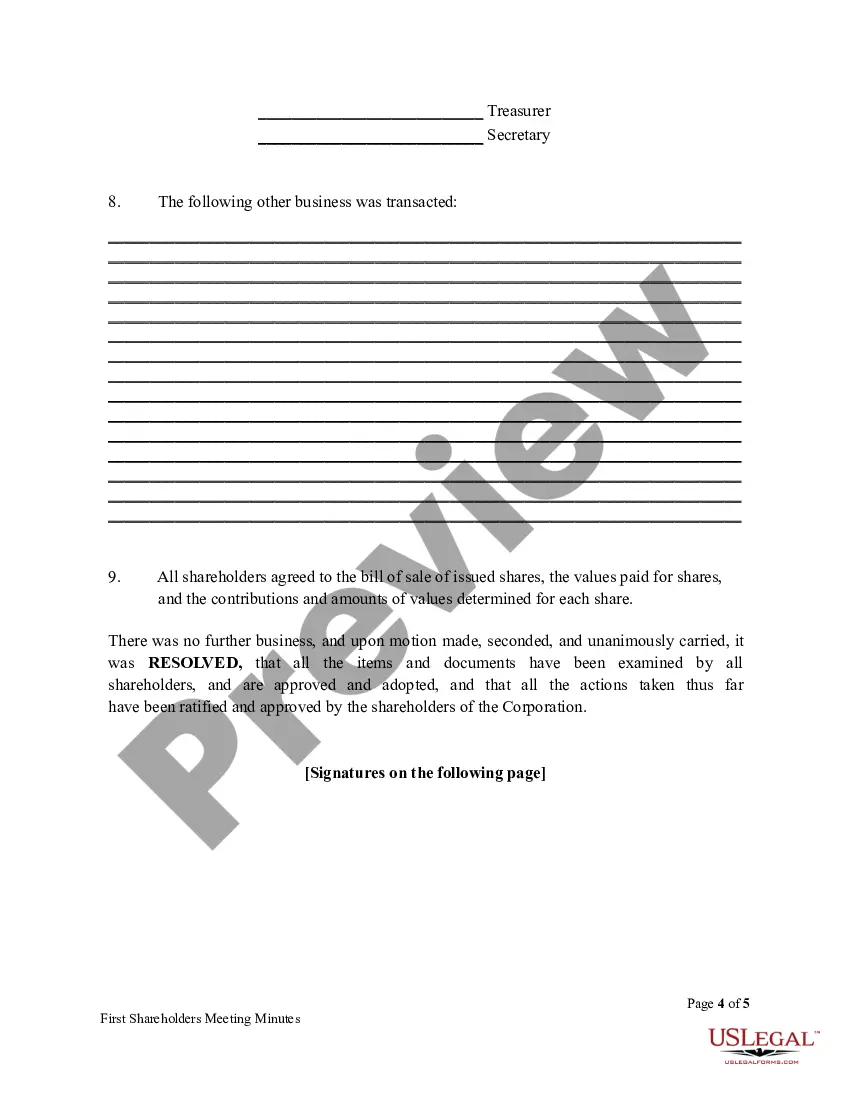

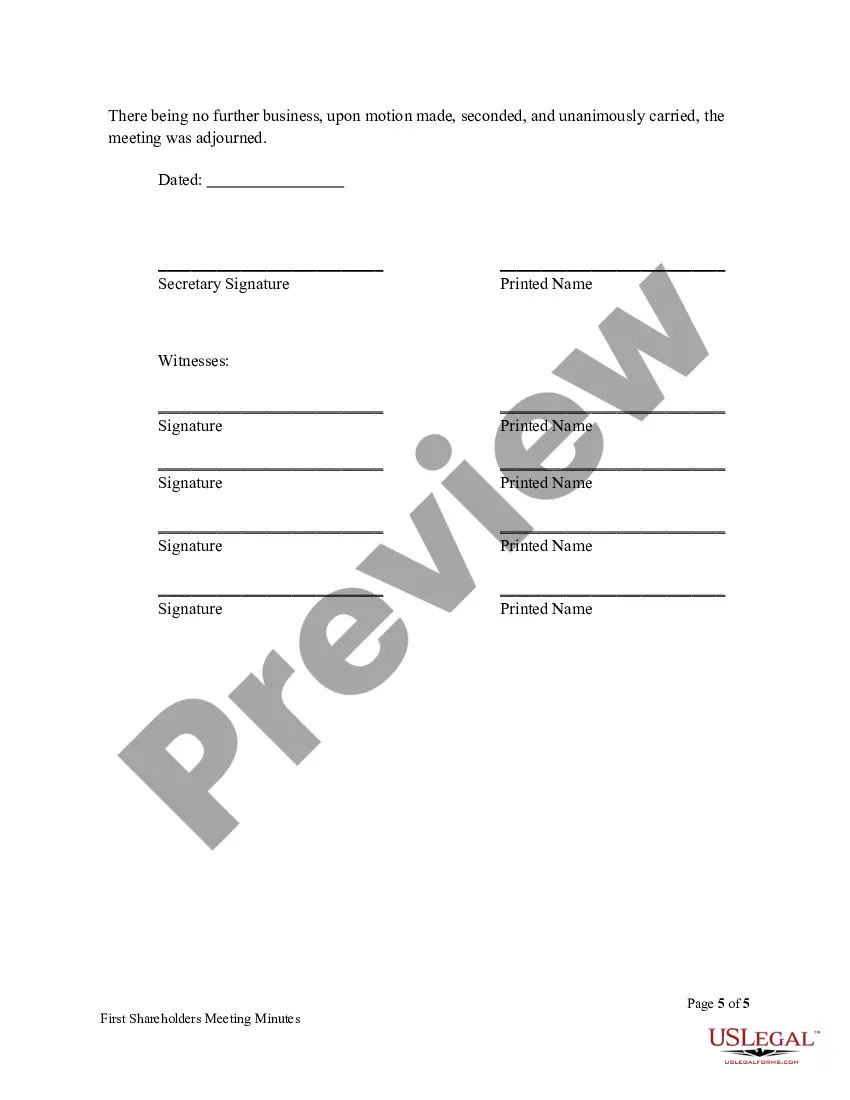

Title: Cook Illinois First Meeting Minutes of Shareholders: A Detailed Description and Key Variations Introduction: The Cook Illinois First Meeting Minutes of Shareholders document outlines the formal record of the proceedings that transpire during the inaugural meeting of shareholders in Cook Illinois Corporation. These minutes play a crucial role in capturing essential information such as resolutions, decision-making, voting results, and other significant matters discussed during the meeting. 1. Purpose and Importance: The Cook Illinois First Meeting Minutes of Shareholders serves as a legal document that illustrates the establishment of the corporation and its governance. It is crucial for maintaining transparency, accountability, and compliance with corporate laws and regulations. These minutes also provide shareholders with a comprehensive overview of the corporation's early operations, objectives, and policies. 2. Key Elements: The minutes typically include essential sections to ensure a comprehensive record of the meeting: — Opening: Details of the meeting's commencement, such as location, date, and time. — Attendance: A list of shareholders present, their positions, and the number of shares held. — Appointment of Officers: Documentation of the appointment and designation of key officers, including the chairperson, secretary, and treasurer. — Ratification of Bylaws: Recording shareholder consensus on approving or modifying the corporation's bylaws. — Resolutions: Detailed records of any decisions, resolutions, or directives adopted during the meeting. — Voting Results: Summarizing the voting outcomes for each proposed motion or resolution. — Next Meeting: Notifying shareholders of the details and agenda of the subsequent meeting. 3. Types of Cook Illinois First Meeting Minutes of Shareholders: There may be variations in the types of minutes prepared based on specific circumstances. Some variants may include: — Ordinary Meeting Minutes: Detailing the standard procedures essential for establishing the company and its initial governance. — Extraordinary Meeting Minutes: Focusing on specific and significant matters not covered in the ordinary meeting, such as major financial decisions or changes in the company structure. — Annual Shareholders Meeting Minutes: Summarizing the proceedings of the yearly gathering of shareholders, which may further include financial reports, election of directors, and dividend declarations. Conclusion: The Cook Illinois First Meeting Minutes of Shareholders are a vital component of corporate governance, providing an official record of the formation, decision-making, and initial operations of Cook Illinois Corporation. These minutes, with their various types, ensure transparency, protect shareholder interests, and contribute to the stability and success of the company.

Cook Illinois First Meeting Minutes of Shareholders

Description

How to fill out Cook Illinois First Meeting Minutes Of Shareholders?

Drafting documents for the business or individual demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Cook First Meeting Minutes of Shareholders without professional assistance.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Cook First Meeting Minutes of Shareholders by yourself, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Cook First Meeting Minutes of Shareholders:

- Examine the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that meets your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any use case with just a few clicks!