Title: Nassau New York First Meeting Minutes of Shareholders: A Comprehensive Overview and Types Explained Introduction: The Nassau New York First Meeting Minutes of Shareholders holds paramount importance in documenting the initial discussions, decisions, and actions taken during the first shareholders' meeting of a company incorporated in Nassau, New York. This document essentially serves as a written record that reflects the organization's establishment, sets a framework for future operations, and outlines key corporate governance procedures. Within Nassau, New York, there are various types of first meeting minutes of shareholders, including the organizational meeting minutes, annual meeting minutes, and special meeting minutes. 1. Organizational Meeting Minutes: The Organizational Meeting Minutes capture the key discussions and decisions made during the first shareholders' meeting. This type of meeting is held shortly after the company's incorporation and aims to establish the groundwork for the corporation's governance through the adoption of bylaws, appointment of officers and directors, and consideration of other essential matters. 2. Annual Meeting Minutes: The Annual Meeting Minutes refer to the minutes documented during the yearly general shareholders' meeting. This meeting is held to discuss and address various corporate matters such as reviewing the financial statements, election of directors, appointment of auditors, and any other crucial business matters. These minutes reflect the consistent compliance with legal requirements and facilitate transparency within the company's operations. 3. Special Meeting Minutes: Special Meeting Minutes encompass the minutes captured during extraordinary or unscheduled meetings, which are convened to address specific urgent matters. These meetings might be called to discuss mergers and acquisitions, changes in the company's strategy, major investments, or other critical decisions that cannot be adequately addressed during the regular annual meetings. These minutes outline the reasons for the special meeting and document any resolutions or actions taken. Content Keywords: Nassau, New York, First Meeting Minutes, Shareholders, Organizational Meeting, Annual Meeting, Special Meeting, Corporate Governance, Incorporation, Bylaws, Officers, Directors, Compliance, Transparency, Financial Statements, Election, Auditors, Mergers and Acquisitions, Strategies, Investments, Resolutions. Conclusion: Nassau New York First Meeting Minutes of Shareholders play a pivotal role in recording and preserving the foundational discussions and actions conducted in a company's initial shareholder meetings. These minutes are classified into organizational, annual, and special meeting minutes, each serving a specific purpose within the broader context of corporate governance and decision-making. By employing accurate and detailed minutes, companies ensure compliance with legal requirements, promote transparency, and establish a solid framework for future operations.

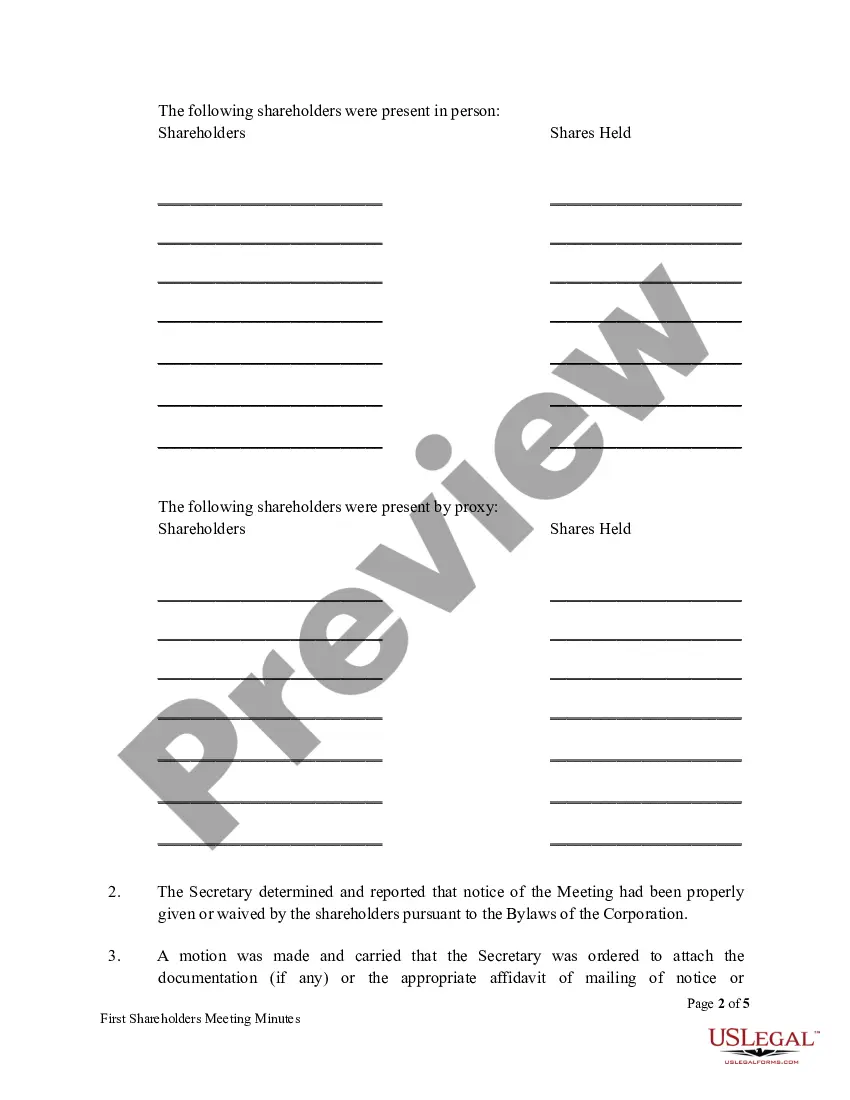

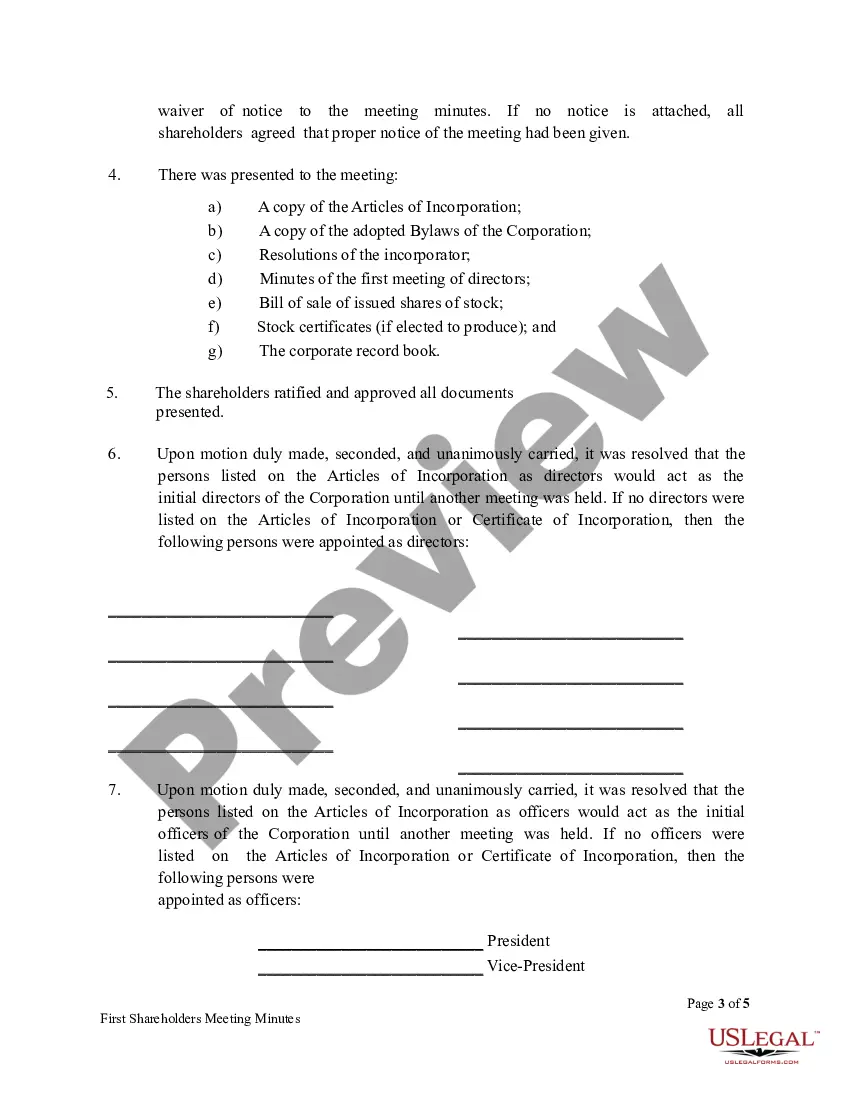

Nassau New York First Meeting Minutes of Shareholders

Description

How to fill out Nassau New York First Meeting Minutes Of Shareholders?

Draftwing documents, like Nassau First Meeting Minutes of Shareholders, to take care of your legal matters is a challenging and time-consumming task. Many situations require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can acquire your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms crafted for various cases and life circumstances. We ensure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Nassau First Meeting Minutes of Shareholders form. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as simple! Here’s what you need to do before downloading Nassau First Meeting Minutes of Shareholders:

- Ensure that your template is compliant with your state/county since the rules for creating legal papers may vary from one state another.

- Learn more about the form by previewing it or reading a quick intro. If the Nassau First Meeting Minutes of Shareholders isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to start using our service and get the document.

- Everything looks great on your side? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment information.

- Your form is good to go. You can go ahead and download it.

It’s easy to find and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!